france u.s. tax treaty dividend withholding

|

Convention between the government of the united states of america

However certain provisions concerning the availability of the French dividend tax credit and the application of the copyright royalty exemption will apply for |

|

Protocol to France-U.S. Tax Treaty

13.01.2009 The Protocol generally eliminates withholding tax on dividends paid to shareholders holding at least 80% of the distributing company and ... |

|

Technical Explanation - US-France Tax Treaty Protocol of 13 Jan 2009

13.01.2009 dividend then the U.S. rate of withholding tax is limited to 5 percent of the gross amount of the dividend. Shares are considered voting ... |

|

TREASURY DEPARTMENT TECHNICAL EXPLANATION OF THE

U.S. income tax treaties in referring only to the avoidance of income tax and of France the U.S. paying agent would withhold on that dividend at the ... |

|

Investing in the US: Tax Considerations for French Investors

Dividends earned by the partnership are taxable to non-US partners (possibly at reduced rates under a treaty) and subject to withholding by the partnership. ?. |

|

5000NOT-EN EXPLANATORY NOTICE

Under the provisions of international tax treaties signed by France these tax Form 5001: calculation of withholding tax on dividends – repayment of ... |

|

Extending Taxation of Interest and Royalty Income at Source – an

only on net balances in royalty income flows but also on withholding tax and credit Some countries such as France |

|

Protocol amending U.S.-France Income Tax Treaty signed January

13.01.2009 1. Dividends paid by a company that is a resident of a Contracting State to a resident of the other Contracting State may be taxed in that other ... |

|

Table 1. Tax Rates on Income Other Than Personal Service Income

generally the treaty rates of tax are the same. Interest ccc. Dividends. Pensions and Annuities. Income Code Number. 1. 6. 7. 15. Name. Code. Paid by U.S.. |

|

Worldwide Real Estate Investment Trust (REIT) Regimes

08.10.2019 The withholding tax on Belgian dividends received by a RREC is no ... Based on article 4 of the OECD Model Tax Treaty a RREC should be ... |

|

Convention between the government of the united states of america

The new Convention preserves the special French tax benefits for U S However certain provisions concerning the availability of the French dividend tax |

|

France - Tax Treaty Documents Internal Revenue Service

24 mar 2023 · The complete texts of the following tax treaty documents are available in Adobe PDF format If you have problems opening the pdf document or |

|

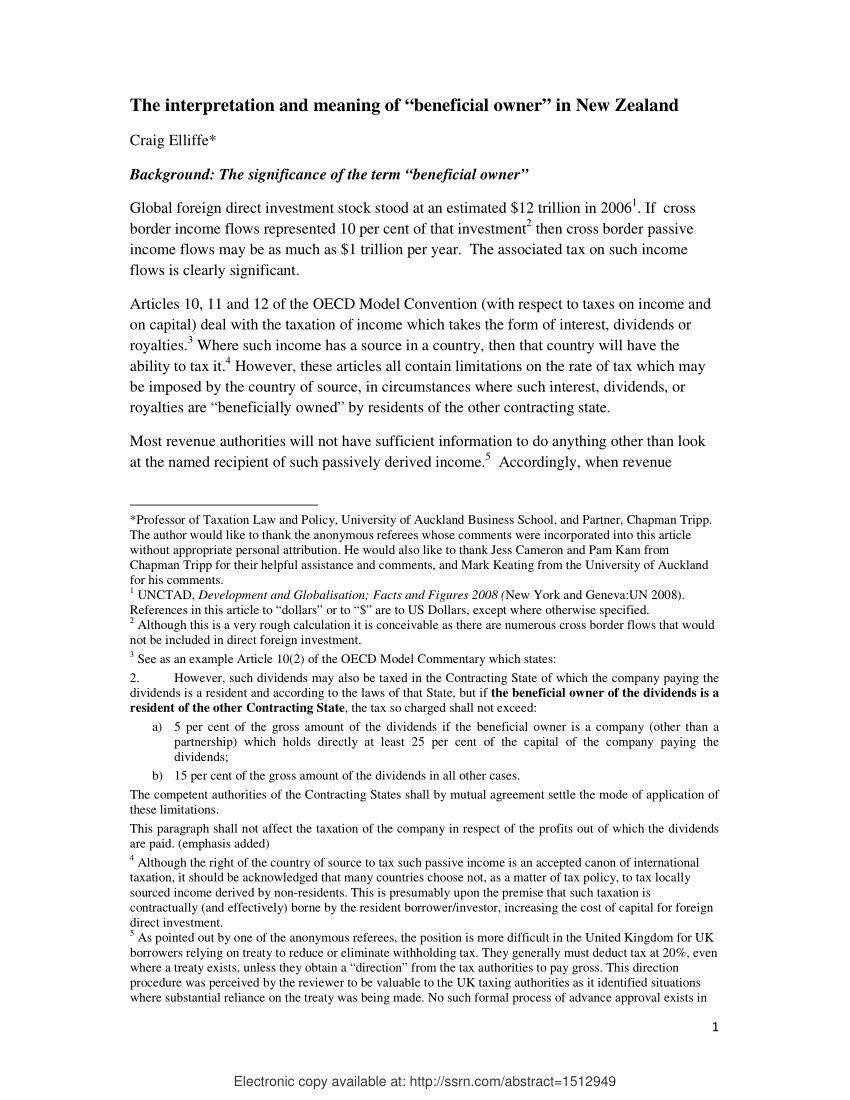

5001-EN

CALCULATION OF WITHHOLDING TAX ON DIVIDENDS Attachment to Form 5000 12816*01 in Article of the tax treaty between France and |

|

5003-EN

II) Precise description of the goods or rights giving rise to royalty payments from the withholding tax on royalties collected from French sources |

|

Technical Explanation - US-France Tax Treaty Protocol of 13 Jan 2009

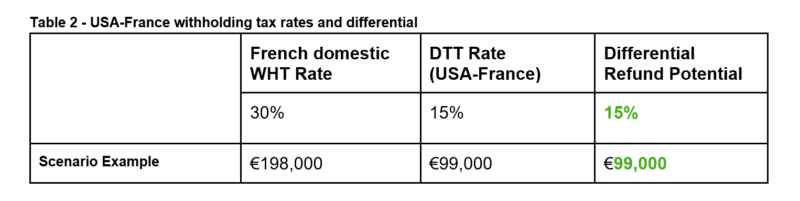

13 jan 2009 · Paragraph 2 generally limits the rate of withholding tax in the State of source on dividends paid by a company resident in that State to 15 |

|

Protocol amending US-France Income Tax Treaty signed January

13 jan 2009 · Dividends paid by a company that is a resident of a Contracting State to a resident of the other Contracting State may be taxed in that other |

|

Protocol to the France-US Tax Treaty Enters Into Force

20 jan 2010 · The Protocol eliminates withholding tax on cross-border royalty payments Formerly the rate was 5 LIMITATION ON BENEFITS The Protocol |

|

The United States - French Income Tax Convention - Fordham Law

It has been argued that many tax conventions implicitly include these taxes by indirection when they exempt from United States tax dividends and interest paid |

|

5000NOT-EN 2022 Vdéfinitiveodt - Impotsgouv

Under the provisions of international tax treaties signed by France these tax Form 5 001 : calculation and refund of withholding tax on dividends ; |

|

FRANCE Taxand

Dividends not subject to the parent-subsidiary regime will no longer be fully tax-exempt but a 1 lump sum will remain taxable if the dividend is received by a |

How are US dividends taxed in France?

Dividends are taxable in the source state and in the state of residence, but taxation in the source state is in principle limited to 15% for individuals.Is there a tax treaty between France and USA?

The double taxation treaty also establishes the taxation method for interest, royalties, business profits or director's fees as well as income derived from real property in France or the U.S (including income from agriculture or forestry).How much is French withholding tax on dividends?

To this tax are added the social security contributions of 17.2% in force. The withholding tax on dividends from French sources paid to natural persons who are not tax residents of France is set at 12.8%.- Article 24 of the U.S./French Income Tax Treaty provides a substantial tax benefit for U.S. citizens in France by granting a French tax credit equal to any French tax liability on U.S. investment income, effectively excluding U.S. investment income and gains from French taxation.

|

Income Tax Treaty PDF - Internal Revenue Service

The new Convention preserves the special French tax benefits for U S citizens However, certain provisions concerning the availability of the French dividend tax (ii) in the case of France, is included in the base of the French withholding |

|

Technical Explanation PDF - Internal Revenue Service

the Model Double Taxation Convention on Income and on Capital published by a resident of France, the U S paying agent would withhold on that dividend at |

|

Technical Explanation - US-France Tax Treaty Protocol of 13 Jan 2009

13 jan 2009 · If the beneficial owner of the dividends is a company resident in the United States that owns, directly or indirectly at least 10 percent of the capital of the French company paying the dividends, then the French rate of withholding tax is limited to 5 percent of the gross amount of the dividend |

|

The United States - French Income Tax Convention - CORE

June 13, 1957) The 1945 Convention can also be found at I CCH Tax Treaties U 2803 when they exempt from United States tax, dividends and interest paid by foreign corporations French and United States withholding taxes Even in the |

|

France - Deloitte

Dividends Dividends paid by a French corporation to a nonresident shareholder are subject to a 30 withholding tax, unless a tax treaty provides for a lower rate |

|

EXPLANATORY NOTICE 5000NOT-EN - Impotsgouv

Under the provisions of international tax treaties signed by France, these tax Form 5001: calculation of withholding tax on dividends – repayment of equalisation tax and tax credits, US financial institution) for certification purposes (Box IV) |

|

New Tax Treaty Between France and Luxembourg - BMH Avocats

France and Luxembourg signed a new double tax treaty on income and New D T T provides a full exemption from withholding tax on dividends paid by a United States, which expressly grants treaty-resident status to both S I I C 's and |