frtb bcbs 239

|

Basel Committee on Banking Supervision Principles for effective risk

Australia. Ms Heidi Richards (APRA). Canada. Mr James Dennison (OSFI). China. Ms Zhangjun Wu (CBRC). (from October 2012). Mr Xianqiu Zhang (CBRC). |

|

Progress in adopting the Principles for effective risk data

effective risk data aggregation and risk reporting (“the Principles” or “BCBS 239”)1 based on supervisors' assessments conducted in 2019. |

|

Living with BCBS 239

and technology including BCBS 239 |

|

BCBS 239 – Raising the standard - November 2017

Since it was issued in January 2013 |

|

Accenture

FRTB compliance: The BCBS 239 framework (“Principles for effective risk data aggregation and risk reporting”) was issued in 2013 and focuses. |

|

EDM Council Advances Industry Standard to Harmonize Financial

Oct 26 2017 ... management mandates – including Dodd Frank |

|

BCBS 239: A Path to Good Risk Taking - Title

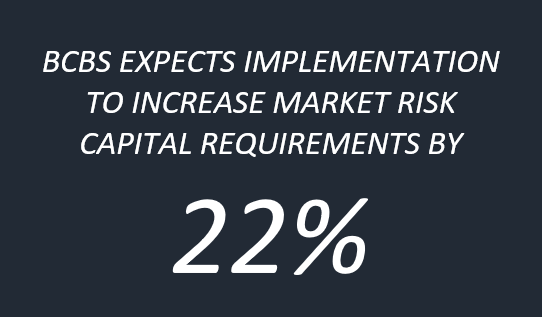

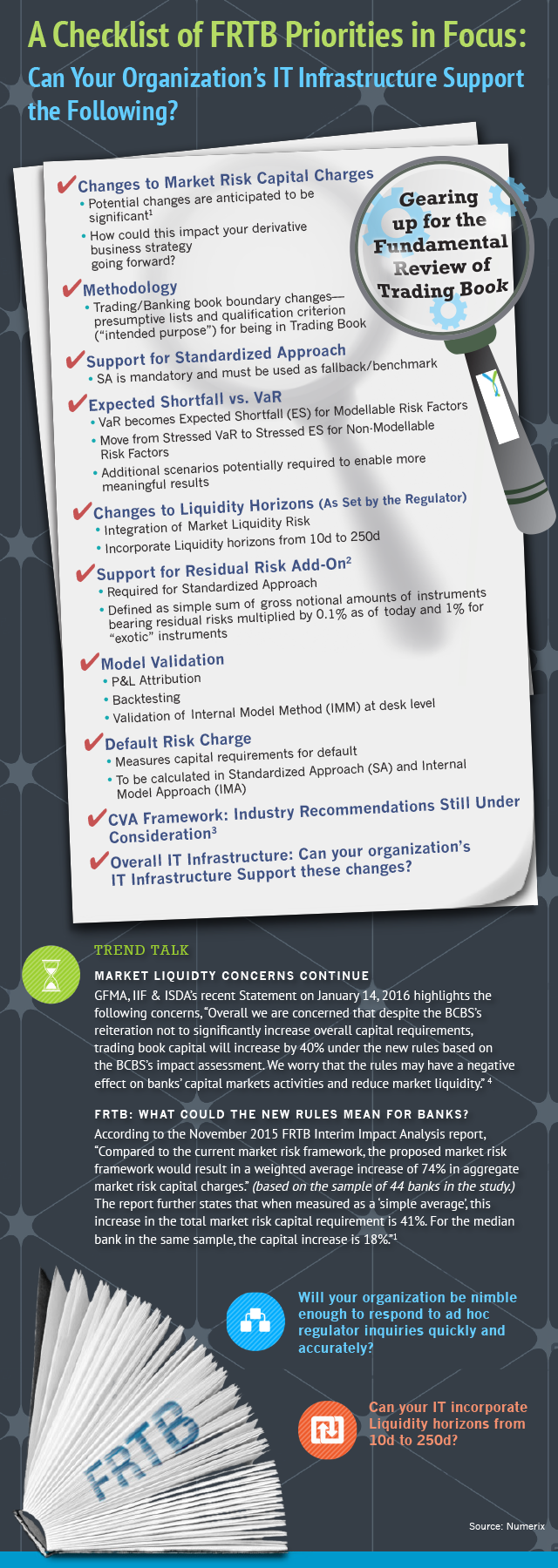

For example estimates of the impact of FRTB (fundamental review of the trading book) alone point to a 40 percent increase1 in capital reserves. IFRS 9 |

|

BCBS #239: the transformation towards the compliance Based on

How the Banking Sector is approaching BCBS #239 09 BCBS #239 |

|

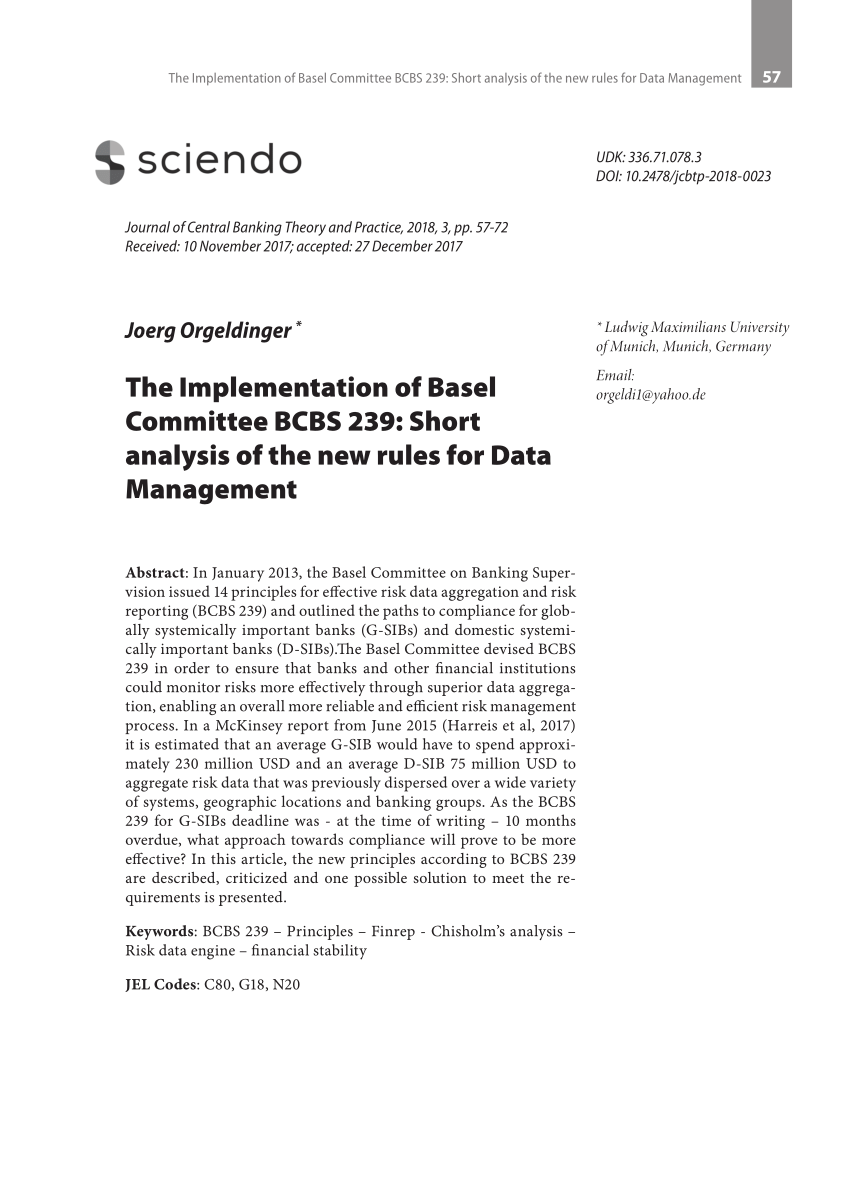

The Implementation of Basel Committee BCBS 239: Short analysis

reporting (BCBS 239) and outlined the paths to compliance for glob- ally systemically important banks FRTB. Fundamental review of the trading book. |

|

Progress report on adoption of the Basel regulatory framework

Oct 1 2021 The Basel Committee on Banking Supervision (BCBS) and its oversight body |

|

Principles for effective risk data aggregation and risk reporting

Basel Committee Enhancements to the Basel II framework (July 2009) at www bis org/publ/bcbs158 pdf 2 MIS in this context refers to risk management |

|

Progress in adopting the Principles for effective risk data

Supervisors' discussions with banks revealed that many banks have expanded their scope of implementation of BCBS 239 beyond risk management aligning their BCBS |

|

Living with BCBS 239 - McKinsey

regulatory framework introduced by the US Federal Reserve; FRTB: Fundamental Review of the Trading Book introduced by the Basel Committee; GDPR: General Data |

|

(PDF) The Implementation of Basel Committee BCBS 239

PDF In January 2013 the Basel Committee on Banking Supervision issued 14 principles for effective risk data aggregation and risk reporting (BCBS 239) |

|

The Implementation of Basel Committee BCBS 239: Short analysis

25 oct 2019 · It is a global regulation that presents a challenge for globally systemically important banks and a wide range of other financial services |

|

BCBS ï - Deloitte

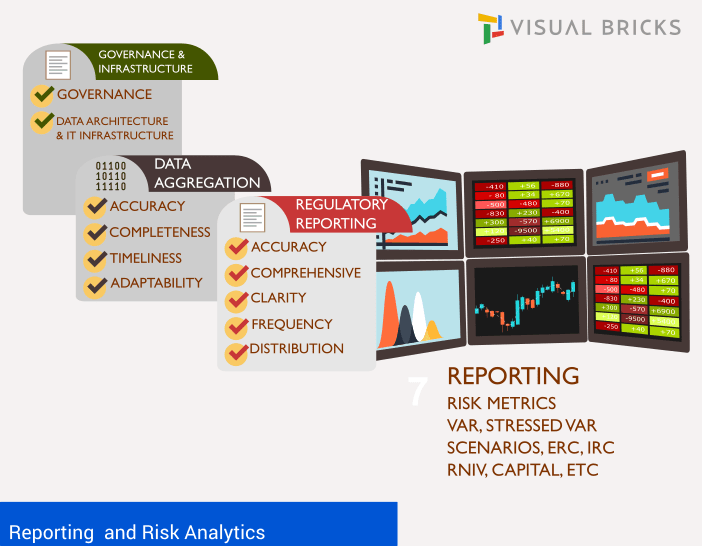

Difficulties in removing manual intervention in the generation of risk reports; BCBS #239 Monitoring Risk Reporting Data Governance Processes |

|

BCBS 239 - Wikipedia

BCBS 239 is the Basel Committee on Banking Supervision's standard number 239 The subject title of the standard is: "Principles for effective risk data |

|

FRTB Market Data Demands Accenture

3 oct 2019 · FRTB compliance: The BCBS 239 framework (“Principles for effective risk data aggregation and risk reporting”) was issued in 2013 and focuses |

|

Regulatory Data Handbook 2020/21 - SmartStream Technologies

28 déc 2020 · Fundamental Review of the Trading Book (FRTB) regulation which has Full Text: www bis org/publ/bcbs239 pdf |

|

Report on the Thematic Review on effective risk data aggregation

global systemically important banks – have fully implemented the BCBS 239 principles 2 Weaknesses stem mainly from a lack of clarity regarding |

What is BCBS Principle 239?

The overall objective of the standard is to strengthen banks' risk data aggregation capabilities and internal risk reporting practices, in turn, enhancing the risk management and decision making processes at banks.Is BCBS 239 mandatory?

While initially aimed at institutions designated as G-SIBs2, BCBS 239 has become a de facto standard across the banking industry and several national supervisors are now formally requiring D-SIBs3 under their jurisdiction to be compliant.Is BCBS 239 part of Basel III?

BCBS 239 essentially equips financial institutions with the tools to maximise the potential of their data produced for disclosure purposes under the Basel III standards.- The Group Independent Validation unit is a second line control function within NLB Group whose objective is to ensure that data management's controls are designed and operating effectively to mitigate significant risks.

|

From Theory to Action Fundamental Review of the - Accenture

31 déc 2019 · 2 FUNDAMENTAL REVIEW OF THE TRADING BOOK (FRTB) In January 2016, the (BCBS) published final rules for the market risk framework for capital requirements for FRTB BCBS 239 regulations propose the use of |

|

BCBS 239 Compliance: A Comprehensive Approach - Cognizant

BCBS 239 principles, most domestic systematically important banks tions, OTC derivative clearing, Fundamental Review of Trading Book (FRTB), and Basel |

|

BCBS ï - Deloitte

How the Banking Sector is approaching BCBS #239 09 Links with the new regulatory requirements 10 The last mile towards compliance 11 Contacts 13 |

|

Living with BCBS 239 - McKinsey & Company

and technology, including BCBS 239, CCAR, FRTB, GDPR, and RRP, posing capability challenges for the largest banks 3 While no one expects to see global |

|

Progress in adopting the Principles for effective risk data

Going forward, banks should continue to closely monitor their BCBS 239 implementation programmes, adapting them as necessary to take into account changes in |

|

The Implementation of Basel Committee BCBS 239 - CORE

reporting (BCBS 239) and outlined the paths to compliance for glob- FRTB Fundamental review of the trading book The Committee's goal is to improve |

|

BCBS 239: A Path to Good Risk Taking - SAS

For example, estimates of the impact of FRTB (fundamental review of the trading book) alone point to a 40 percent increase1 in capital reserves IFRS 9, with its |

|

Bcbs 239 progress report 2019 - f-static

While the BCBS 239 principles aim to strengthen banks' data governance FRTB, whether BCBS 239 compliance projects can help banks meet FRTB risk data |

|

BCBS 239 - CeFPro

BCBS 239 • Data governance framework • Consistent set of data standards • Improved data aggregation and reporting • MIFID II • Real observation data |

![PDF] Critical Analysis of the New Basel Minimum Capital PDF] Critical Analysis of the New Basel Minimum Capital](https://www.pwc.com/gx/en/advisory-services/basel-iv/basel-iv-chart-english.jpg)