elimination of intercompany sale of fixed assets

|

82 Intercompany transactions

ASC 810 establishes basic consolidation principles which include (1) any intercompany income on assets remaining within the consolidated group of companies should be eliminated and (2) the amount of intercompany income to be eliminated is not affected by the existence of an NCI ASC 810-10-45-1 |

Should intercompany profits or losses be eliminated?

However, intercompany profits or losses should not be eliminated for arm’s-length transactions that do not result in an asset that remains on the books of either party. For example, an investee may provide outsourcing services to the investor for a fee. Intercompany profits or losses for this transaction would not be eliminated.

What is intercompany income elimination in consolidated financial statements?

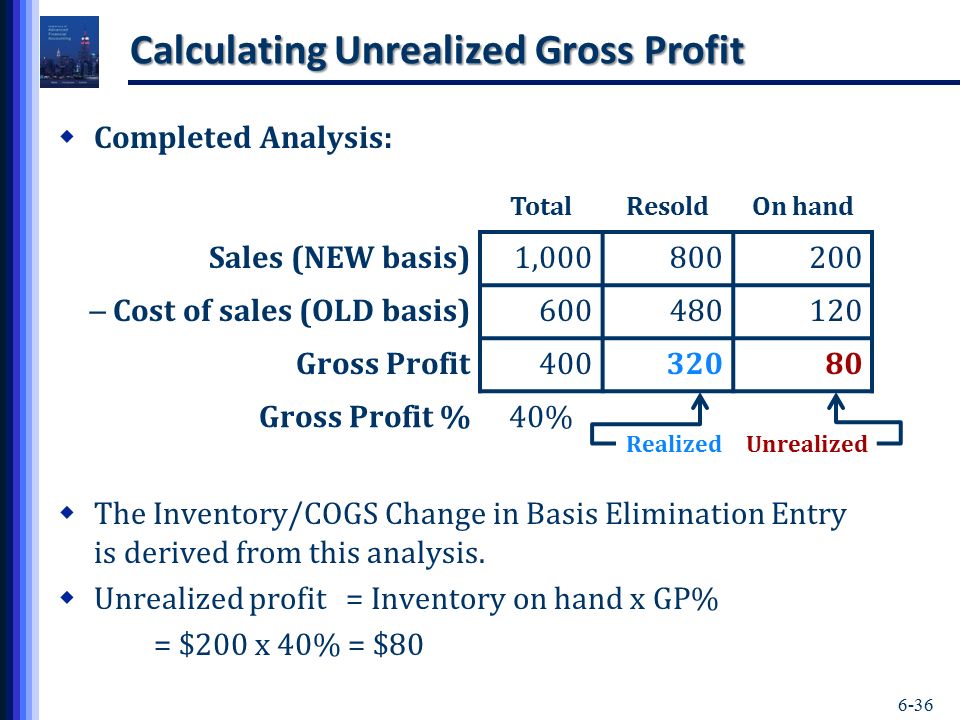

The general objective of intercompany income elimination in consolidated financial statements is to exclude from consolidated shareholders’ equity the profit or loss arising from transactions within the consolidated entity and to correspondingly adjust the carrying amount of assets remaining in the consolidated entity.

Does the equity method eliminate intercompany transactions?

An investor applying the equity method may need to make adjustments to eliminate the effects of certain intercompany transactions. While ASC 323 refers to the consolidation guidance under ASC 810 for guidance on eliminations, the extent of the eliminations under the equity method are more limited than those required when consolidating a subsidiary.

What are intercompany eliminations?

Intercompany eliminations improve the accuracy of consolidated financial statements by preventing the double-counting of intercompany sales, expenses, and other business dealings. However, using manual methods to perform this process can lead to issues like data errors, compliance problems, and scalability issues.

What Are Intercompany Transactions?

Before we dive into intercompany eliminations, it's important to understand how intercompany transactions work because they are the basis of intercompany eliminations. So what is an intercompany transaction? It's a transaction that occurs across affiliates (the parent or subsidiaries of the parent company) within a parent company. As intercompany t

What Are Intercompany Eliminations?

Intercompany eliminations cancel intercompany transactions that don't impact the parent company's net assets. This ensures that the parent company's financial statements can be accurately consolidated. Otherwise, the parent company's balance sheet might become inflated (we'll discuss specific scenarios below). However, not every single intercompany

Types of Intercompany Eliminations

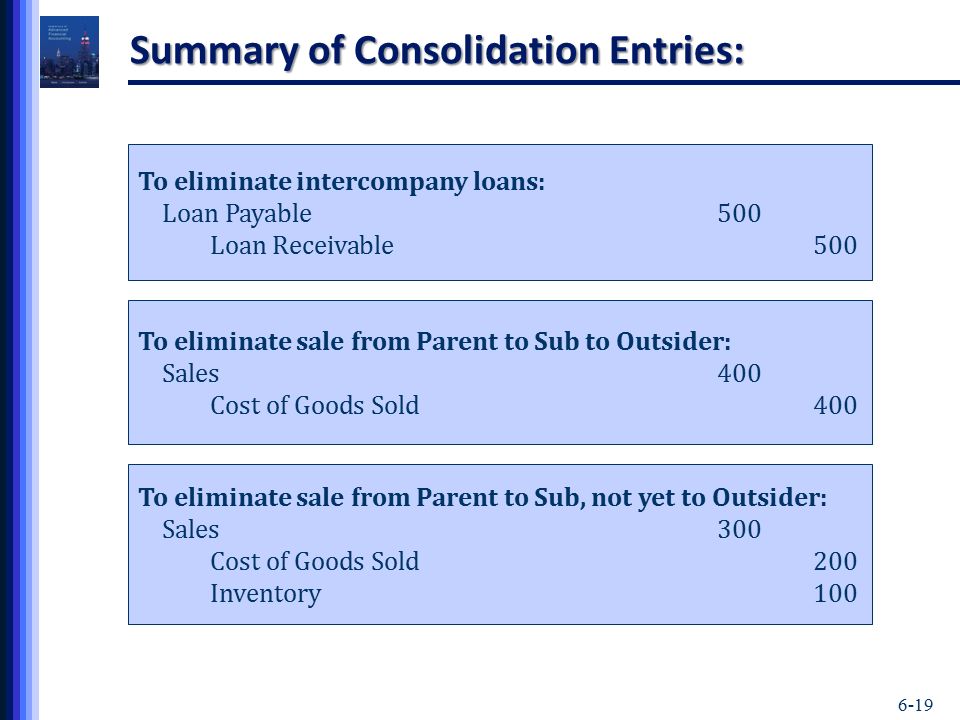

The three main types of intercompany eliminations are: 1. Intercompany debt 2. Intercompany revenue and expenses 3. Intercompany stock ownership Below, we'll discuss the three main types of intercompany eliminations. softledger.com

Intercompany Debt

Intercompany debt is when there is a loan between a subsidiary and another subsidiary or the parent company. An example of intercompany debt is if the parent company pays for a warehouse that several subsidiaries use. In this case, each subsidiary has an expense, but because the parent company paid it, an intercompany elimination would have to occu

Intercompany Revenue and Expenses

When goods or services are bought and sold within the parent company and its subsidiaries, the revenue and expenses associated with each intercompany sale should be eliminated. This is because the parent company's consolidated net assets remain unchanged. So, in addition to eliminating the sales recorded, you should also eliminate interest or reven

Intercompany Stock Ownership

Finally, each parent company needs to eliminate assets and stockholders' equity accounts for each subsidiary. Otherwise, it can inflate the parent company's financial data. softledger.com

Example of Executing Intercompany Eliminations

To help you visualize the process, here’s a quick walkthrough of an example of executing intercompany eliminations. In this example, the parent company pays a vendor bill on behalf of the subsidiary. softledger.com

Automating Intercompany Eliminations

Traditionally, most intercompany accounting processes were performed in Excel, and the elimination and consolidation process was highly manual. The problem with manual financial consolidation and elimination is that it's time-consuming and exposes your data to manual errors. To solve these problems, we built SoftLedger, which streamlines the entire

|

Chapter 7 Intercompany Inventory Transactions Intercompany

fixed assets. 7-3. Intercompany Inventory When an intercorporate sale includes no profit ... intercorporate transfer prices the elimination. |

|

Intercorporate Transfers: Noncurrent Assets

(e.g. consulting) and sales of fixed assets |

|

IFRS 9 impairment practical guide: intercompany loans in separate

expected credit losses on all financial assets including intercompany loans within the positions eliminate in consolidated financial statements. |

|

Financial reporting developments: Income taxes

1 May 2021 Intercompany sale or transfer of assets other than inventory . ... A franchise tax to the extent it is based on capital and there is no ... |

|

Letter to IFRS IC- Elimination of intercompany profits between an

tor records a gain from the sale of the fixed assets in its separate financial statements. 5. The joint venture entity accounts for a leasehold asset and a |

|

Chapter 14 Intercompany Transactions

which applied the federal deferred intercompany transaction system for. “fixed assets and capitalized items.” The elimination of income and. |

|

The Adjunct Method in Consolidations

inventory or fixed assets cost to be released as expense in the terest be eliminated |

|

Financial Results for the Second Quarter Ended September 30 2013

1 Nov 2013 Gain on sales of fixed assets ... Loss on disposal of fixed assets ... represent the amount eliminated for intercompany transactions related ... |

|

Untitled

2 Jan 2012 Elimination of Realized Profit on Intercompany Sales of Inventory . ... Distiguish between an asset and a stock acquisition. |

|

Eliminating Intercompany Gain or Loss on Sale of Fixed Assets - IBM

Eliminating Intercompany Gain or Loss on Sale of Fixed Assets in manual group journals Product(s): IBM Cognos Controller 10 Area of Interest: Financial |

|

Intercompany transactions in relation to consolidated - CORE

inventories and fixed assets when 100 per cent is eliminated from a subsidiary elimination of intercompany sales has the effectof leaving as a remainder a |

|

Transfer Pricing Intercompany Sales Of Fixed Assets

31 déc 2020 · assets intercompany accounts the capital accounts and the general, to eliminate the 150 000 gain from the intercompany sale of land the parent company is |

|

Elimination of intercompany profits between an - ESMA - europaeu

tor records a gain from the sale of the fixed assets in its separate financial statements 5 The joint venture entity accounts for a leasehold asset and a lease |

|

Intercompany Profits and ARB 51 - JSTOR

profit to eliminate or how it should be Retained Earnings (Company B's) 1,000 eliminated profit was 100 owned from the con- Intercompany Fixed Asset Transactions solidated tions, when fixed assets are sold by one profit should be |

|

Technical Line: A closer look at the new guidance on - EY Japan

9 fév 2017 · intercompany sale or transfer of assets is eliminated from earnings applied to transfers of other assets, including tangible (e g , fixed assets) |

|

INTRA-ENTITY TRANSFERS OF ASSETS OTHER - BDO USA

31 déc 2016 · The FASB issued ASU 2016-161 in October 2016 eliminating the existing exception in entity asset transfers (other than those of inventory) when the transfer occurs Also called intercompany ” This view is premised on the fact that for U S income purposes, the U S tax liability is not considered “fixed |