Certificate for tax-Exempt non-profit making entities - France

|

501(c)(3) and Issues Related

1 mar 2015 · Before seeking tax-exempt status from the IRS a prospective entity must first pursue this process and form a state nonprofit corporation The |

|

FISCAL GUIDE

1 4 4 Special rules for tax-exempt entities – Exemption subject to agreement A reduced withholding tax rate of 15 may be granted to non-profit making |

|

A statute for European cross-border associations and non

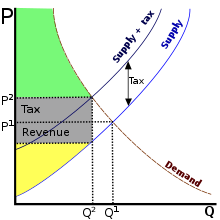

NPOs are exempt from corporate income tax and are subject to the (more favourable) “tax of the legal entities” if they do not carry out profit-making operations |

|

Advantages of establishing an Association Loi 1901 (non-profit

- It provides major advantages: reduced paperwork basic accounting a presumed commercial and VAT tax exemption (as long as the program does not earn profits |

|

Overview of the french tax system

31 déc 2016 · This means that profits made by a French company in enterprises operated in countries other than France are not liable to French corporation tax |

|

The tax regime for non-profit making organisations: no need to be

• obtain tax documents such as the taxpayer's registration certificate non-profit making entities carry out activities that compete with the commercial |

|

not-for-profit organizations a legal guide

Organizations which are registered charities are exempt from income tax An organization which is not considered to be a charity still may qualify for tax- |

|

REPORT ON ABUSE OF CHARITIES FOR MONEY-LAUNDERING

The registered charity is exempt from paying tax on its revenue and it can issue donation receipts for gifts that it receives Donors are rewarded with a tax |

Are 501c3 exempt from sales tax in California?

Although many nonprofit and religious organizations are exempt from federal and state income tax, there is no similar broad exemption from California sales and use tax.

How do I incorporate a not-for-profit in New Brunswick?

To incorporate a non-profit or not-for-profit company, an application for incorporation must be filed under the Act along with the appropriate fee payment.

Provisions exist under the Act detailing the incorporation process.What is a not-for-profit organization in France?

French law recognizes two primary legal forms of not-for-profit, non-governmental organizations: associations and foundations.

Associations may serve either a private or public benefit purpose.

Public benefit associations fall into one of two categories: (1) general interest and (2) public utility."All revenues and assets of non-stock, non- profit educational institutions used actually, directly and exclusively for educational purposes shall be exempt from taxes and duties." This constitutional exemption is reiterated in Section 30 (H) of the 1997 Tax Code, as amended, which provides as follows: "Sec.

|

501C3 and issues related -mars 2015

1 mars 2015 Applying to the IRS for Tax-Exempt Status. Once a nonprofit entity has received a state certificate of incorporation and an EIN it may. |

|

A statute for European cross-border associations and non-profit

NPOs are exempt from corporate income tax and are subject to the (more favourable) “tax of the legal entities” if they do not carry out profit-making |

|

Form W-8BEN-E (Rev. October 2021)

Certificate of Status of Beneficial Owner for. United States Tax Withholding and Reporting (Entities). ? For use by entities. Nonprofit organization. |

|

FISCAL GUIDE

1.4.4 Special rules for tax-exempt entities – Exemption subject to agreement . A reduced withholding tax rate of 15% may be granted to non-profit making. |

|

Microsoft Nonprofit Eligibility Requirements

organizations of public interest; (2) certified beneficent social assistance entities; Organizations must be: (1) charities; (2) tax exempt non-profit ... |

|

Aircall-Nonprofit-Program.pdf

Tax Exempt Registration from Registrar General;. NPO Certificate of Registration; Articles and. Memorandum of Association. ARGENTINA. AUSTRALIA. AUSTRIA. |

|

Best Practices: Combating the Abuse of Non-Profit Organisations

While it is possible that NPOs like their for-profit counterparts |

|

FISCAL GUIDE

1.4.4 Special rules for tax-exempt entities – Exemption subject to agreement . A reduced withholding tax rate of 15% may be granted to non-profit making. |

|

Instructions for Form W-8BEN-E (Rev. October 2021)

30 nov. 2020 tax-exempt organization foreign private foundation |

|

REPORT ON ABUSE OF CHARITIES FOR MONEY-LAUNDERING

Non commercial entities are liable to corporate income tax but may be entitled to tax benefits. In order to be tax exempt on the income derived from the social |

| Form 202 - Certificate of Formation - Nonprofit Corporation |

| Sales and Use Tax Notice Nonprofit Exemption - TNgov |

| REG-1-090 Nonprofit Organizations |

| Tax Registration form for Voluntary non-profit making organisations |

| Nonprofit Organizations & Government Entities - NJgov |

| 302-739-3073 Certificate of Incorporation for Exempt Corporation |

| NONPROFITS AND SALES TAX - Pro Bono Partnership |

| 206 Sales Tax Exemptions for Nonprofit Organizations - April 2022 |

| Form ST16 Application for Nonprofit Exempt Status-Sales Tax |

| Publication 18 Nonprofit Organizations - CDTFA |

|

Certificate for tax-Exempt non-profit making entities - Standard

Certificate for tax-Exempt non-profit making entities - Standard Refund (version A ) (French version) Mesure à prendre Sujet Certificat Précompte mobilier |

|

501C3 and issues related -mars 2015 - Ambassade de France aux

1 mar 2015 · Revenue Service (IRS) must grant the organization tax-exempt status Once a nonprofit entity has received a state certificate of incorporation |

|

Eligible nonprofit organizations - Aircall

Tax Exempt Registration from Registrar General; NPO Certificate of Registration; Articles and Memorandum of Association ARGENTINA AUSTRALIA AUSTRIA |

|

Money-laundering and tax evasion - OECD

In France, non-profit organizations are associations subject to the law of 1901, religious Ireland has for many years operated a Tax Exemption Scheme for Charities Finally, donations from certified charities to charitable purposes are also |

|

EU registration options for NGOs - A4ID

We are a charity that believes the law can, and should, be used more effectively to Europe to help organisations decide which may be most suitable for them to NGOs in a broad sense – that is, non-profit entities of any legal form, as well can be found in German tax laws offering tax exemptions to charitable NGOs |

|

K FOREIGN ACTIVITIES OF DOMESTIC CHARITIES AND - IRS

an international conference concerning the development of the law of charity in that country Eastern Europe are moving most rapidly but with an attendant degree of How many of these foreign charities will apply for recognition of exemption tax issues in the context of foreign organizations, and the filing of returns An |

|

France FATCA - Treasury

Institutions may not be able to comply with certain aspects of FATCA due to domestic trading in money market instruments (cheques, bills, certificates of deposit, derivatives issues, or is obligated to make payments with respect to, a Cash Value the U S Internal Revenue Code; (x) any trust that is exempt from tax under |