global debt market

|

Global Debt Markets: Dollar Volume by New Issue Category

information on the global rated debt markets in the United. States EMEA |

|

2021 SIFMA Capital Markets Fact Book

Global Bond Market Outstanding and Global Equity Market Capitalization - Charts . The use of debt capital markets to fuel economic growth is more. |

|

Global Debt Markets - Dollar Volume by New-Issue Category

the global rated debt markets in the United States EMEA |

|

The Future of Global Debt Issuance: 2025 Outlook

The Future of Global Debt Issuance: 2025 Outlook. SEPTEMBER 2017 Many particpants are active in the wider (emerging) Asian bond market. |

|

Green-Bond-Principles-June-2021-140621.pdf

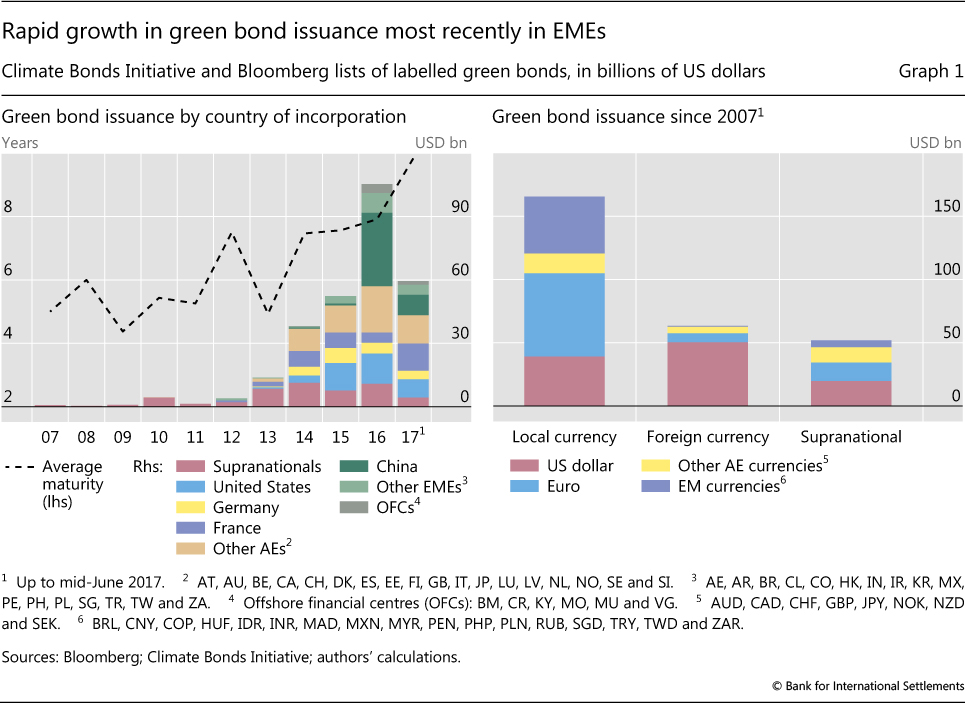

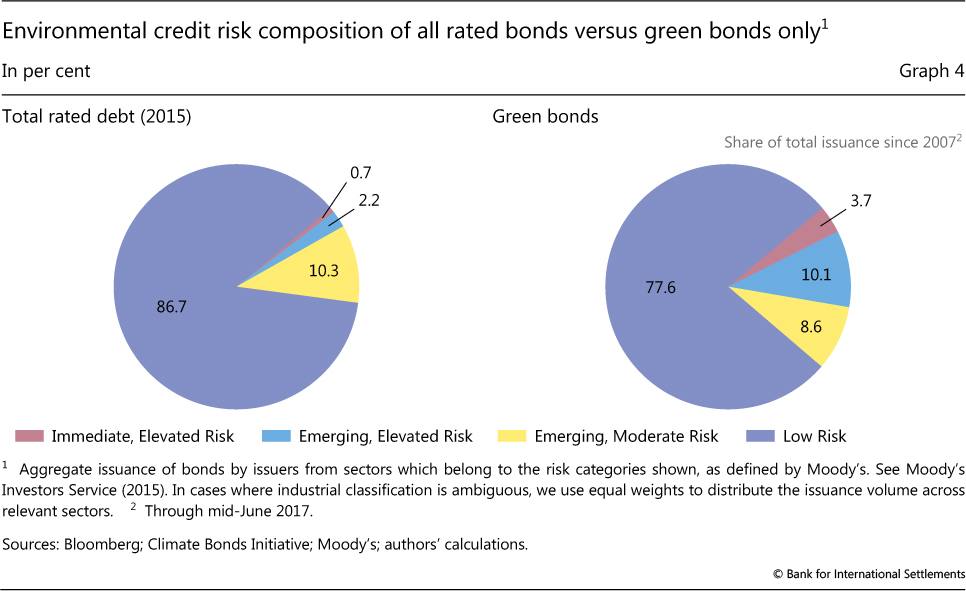

the role that global debt capital markets can play in financing progress towards environmental and social sustainability. The Principles outline best |

|

Global Debt Markets

The rated debt market is a component of the total debt market and includes only the debt securities issued with a rating. The rated U.S. debt market. |

|

Global Debt Markets

Global Debt Markets. 875. 1750. 2 |

|

Tracking Global Demand for Emerging Market Sovereign Debt; by

different markets within a global benchmark portfolio. government debt securities in the secondary market (World Bank and IMF 2001). Markets may. |

|

SIFMA Capital Markets Fact Book 2019

Global Equity Market. Capitalization. $74.7. TRILLION. 2018. Global Bond Market. Outstanding. $102.8. TRILLION. 6.4%. The U.S. household savings rate. |

|

Global Debt Markets

The rated U S debt market chart (shown below) is primarily comprised of five new-issue categories: (1) Corporates; (2) Municipals; (3) Mortgage-Backed |

|

Global Debt Markets: Dollar Volume by New Issue Category

The rated U S debt market chart (shown below) is primarily comprised of six new-issue categories: (1) Corporates (Industrials and Financial Services); (2) |

|

The international debt securities market

Main features of net issuance in international debt securities markets1 The return of emerging market borrowers to international markets continues |

|

The future of debt markets OECD

Discussions at the 12th OECD-WBG-IMF Global Bond Market Forum focused on three key areas related to the future of debt markets: (i) the challenges facing |

|

Debt Markets: Policy Challenges in the Post- Crisis Landscape

Discussions at the 11th OECD-WBG-IMF Global Bond Market Forum focused on four key areas: i) the impact of crisis-related measures and the potential implications |

|

Global Debt Market Growth Security Structure and Bond Pricing

Global bonds represent a relatively new and innovative financing structure allowing a variety of public and private debtors to raise |

|

Global Financial Stability Report - International Monetary Fund

Akey policy prescription to prevent or ameliorate financial crises in emerging markets has been the development of local bond markets and this strategy |

|

Research Institute Assessing Global Debt Credit Suisse

Foreign currency debt in of GDP The significant decline in interest rates in the major bond markets also made it attractive for emerging market borrowers to |

|

Government bond markets - CEMLA

I Government bond market is the world's largest bond market I Government bond markets play a crucial role in financing government |

|

How firms borrow in international bond markets - Banco de España

Foreign and global bond markets are strictly regulated The regulation of the US 144A bond market is much lighter and the Eurobond market is an offshore market |

How debt markets operate?

What Is Debt Market? The debt market is a platform where debt securities are traded by investors. These securities are issued by companies and the government authorities to raise capital for business operations, infrastructure development, and other projects.What is the debt market?

The debt market, or bond market, is the arena in which investment in loans are bought and sold. There is no single physical exchange for bonds. Transactions are mostly made between brokers or large institutions, or by individual investors.How big is the global bond market?

In 2022, the global bond market totaled $133 trillion. As one of the world's largest capital markets, debt securities have grown sevenfold over the last 40 years. Fueling this growth are government and corporate debt sales across major economies and emerging markets.- The debt market is the market where debt instruments are traded. Debt instruments are assets that require a fixed payment to the holder, usually with interest. Examples of debt instruments include bonds (government or corporate) and mortgages.

|

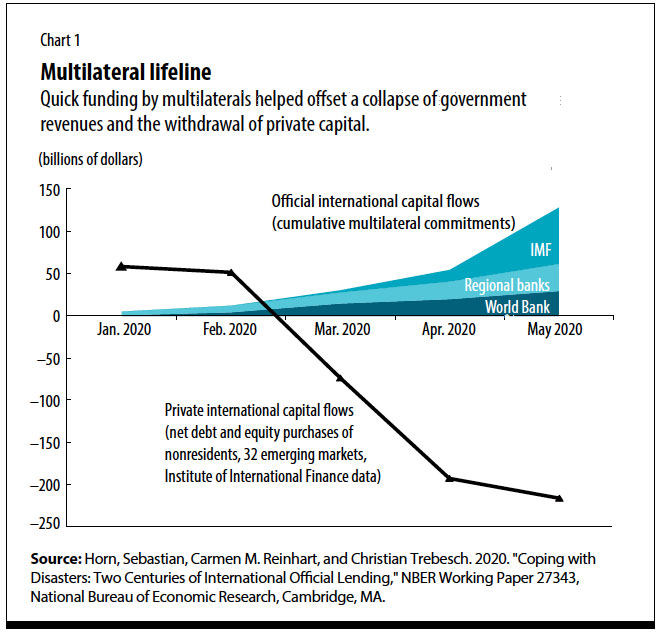

Global Debt Monitor Sharp spike in debt ratios - Institute of

16 juil 2020 · in emerging markets—the global debt-to-GDP ratio surged by over 10 percentage points in Q1 (Chart 1) While this marks the largest quarterly |

|

Global Debt Monitor COVID Drives Debt Surge—Stabilization Ahead?

17 fév 2021 · Unsurprisingly, mature markets saw the biggest increase in government debt (+$ 10 7 trillion) as the fiscal response to the pandemic was |

|

The Future of debt Markets - OECD

The OECD, the International Monetary Fund, and the World Bank Group hosted on 5-6 May 2011 the Twelfth OECD-World Bank Group-IMF Global Bond Market |

|

Growth of Global Corporate Debt - World Bank Document

Because capital markets have a larger role in firm financing, policy makers have limited tools to mitigate the risks of growing firm debt This paper is a product of the |

|

The Future of Global Debt Issuance: 2025 Outlook - Clearstream

Issuers access the market when they are raising capital through debt capital markets In this white paper, the market is defined as the space limited by legal, |

|

The role of debt securities markets - Bank for International Settlements

As a result, bonds overtook loans in international financing flows after the financial crisis – the so-called “second phase” of global liquidity (Shin (2013)) This |

|

Research Institute - Assessing Global Debt - Credit Suisse

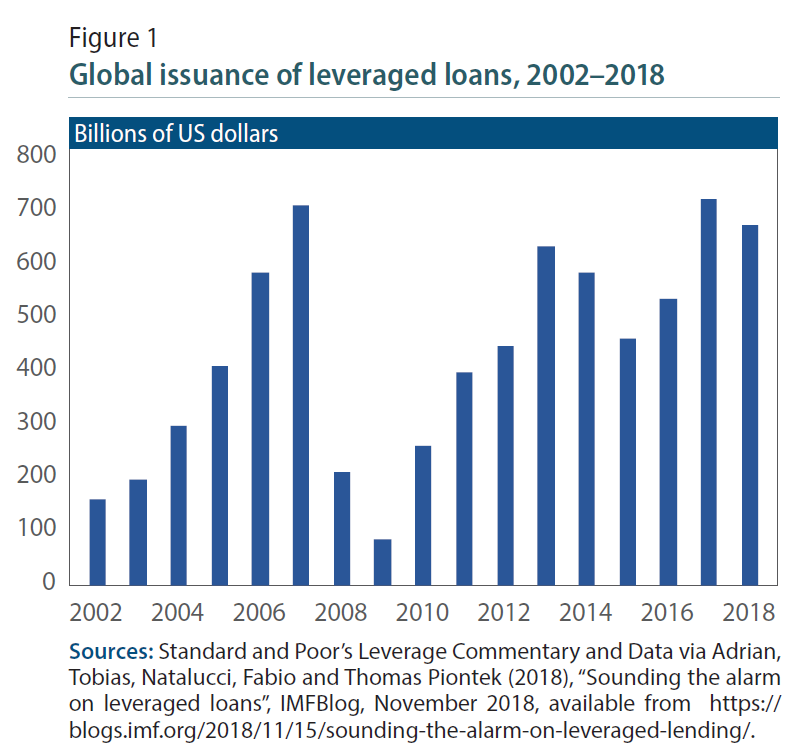

Assessing Global Debt 7 New financial stability risks beyond bank balance sheets During the financial crisis, runs on “shadow banks,” including money market |

|

Spotlight on Global and GCC Debt Markets Activity - PwC

Global debt markets activity is gaining momentum US high-yield bonds are amongst the best performers - driven by companies seeking to refinance and an |

|

RISING CORPORATE DEBT PERIL OR PROMISE? - McKinsey

Will the growth of global corporate bond markets continue after the credit cycle turns and interest rates rise? While there are risks, there is also significant |