how to report canadian pension on u.s. tax return

|

Information on the United States-Canada Income Tax Treaty

07-Oct-2015 Pensions Annuities |

|

Agreement Between The United States And Canada

Coverage and Social Security taxes. 2. Certificate of coverage. 4. Monthly benefits. 5. A CPP/QPP pension may affect your U.S. benefit. |

|

UNITED STATES - CANADA INCOME TAX CONVENTION

Under Canadian law the credit for foreign taxes on dividends |

|

Global planning for wealth straddling US – Canada border

under the Canada-U.S. Treaty and this tax can be used as a foreign tax credit against any. U.S. taxes payable. Are there any foreign reporting requirements? |

|

2021 Instructions for Form 1040-NR

18-Jan-2022 U.S. Nonresident Alien Income Tax Return ... and Schedule OI (Form 1040-NR) you may not need to file the numbered ... Only report pensions. |

|

Publication 597 (Rev. May 1998)

The United States—Canada income tax of any pension included in income for U.S. tax ... have to file U.S. income tax returns for those. |

|

Rev. Proc. 2014-55

United States-Canada Income Tax Convention). Election Procedures and Information Reporting with Respect to Interests in Certain. Canadian Retirement Plans. |

|

IMPLICATIONS OF FATCA PROVISIONS TO CANADIAN PENSION

regardless of where they reside in the world and therefore requires Americans living abroad to file U.S. income tax returns annually. |

|

Instructions for Form 8938 (Rev. November 2021)

exclusively to provide pension or retirement benefits or to provide must file Form 8938 if the total value ... alien for U.S. tax purposes under the. |

|

12945: 1040 - Canadian Retirement Income - Drake Software KB

are reported on Form 1040 U S Individual Income Tax Return (or Form 1040A) on the line on which U S social security benefits would be reported If the |

|

Publication 597 (10/2015) Information on the United States - IRS

Canadian pensions and annuities paid to U S residents may be taxed by the United States but the amount of any pension included in income for U S tax purposes |

|

Canadian Retirement Income - TaxAct

Canadian benefits that are treated as U S social security benefits are reported on Lines 6a and 6b on Form 1040 To enter this information in the TaxAct |

|

Learn About the Canadian Pension Table in the US

28 avr 2022 · If you receive Canadian retirement or pension benefits while living in the US you should report them on form 1040 or a 1040A (depending on |

|

Is a Canadian Pension Plan Taxable in US?

If a resident of the United States receives Social Security from Canada it will only be taxable in the United States as if it was being received as U S Social |

|

Agreement Between The United States And Canada - SSA

A CPP/QPP pension may affect your U S benefit Social Security taxes to both countries on the how to get a form from the country where you |

|

Desktop: Canadian Retirement Income – Support

3 avr 2023 · Canadian retirement benefits are similar to the US in that there are CRA Form T4A(P) Box 20 and should be reported in the individual tax |

|

How do you report pension received from Canada by a US citizen

29 sept 2020 · are reported on Form 1040 U S Individual Income Tax Return (or Form 1040A) on the line on which U S social security benefits would be |

|

Line 11500 – Other pensions and superannuation - Canadaca

24 jan 2023 · Do not subtract the taxes from your income when you report it Two common types of foreign pension are: United States individual retuirement |

|

Canada Pension Plan - After youve applied

8 mar 2023 · completing the Request for voluntary Federal Income tax Deductions CPP/OAS (ISP3520CPP) form and mailing it to us or dropping it off at a |

How do I report Canadian pensions plans on US taxes?

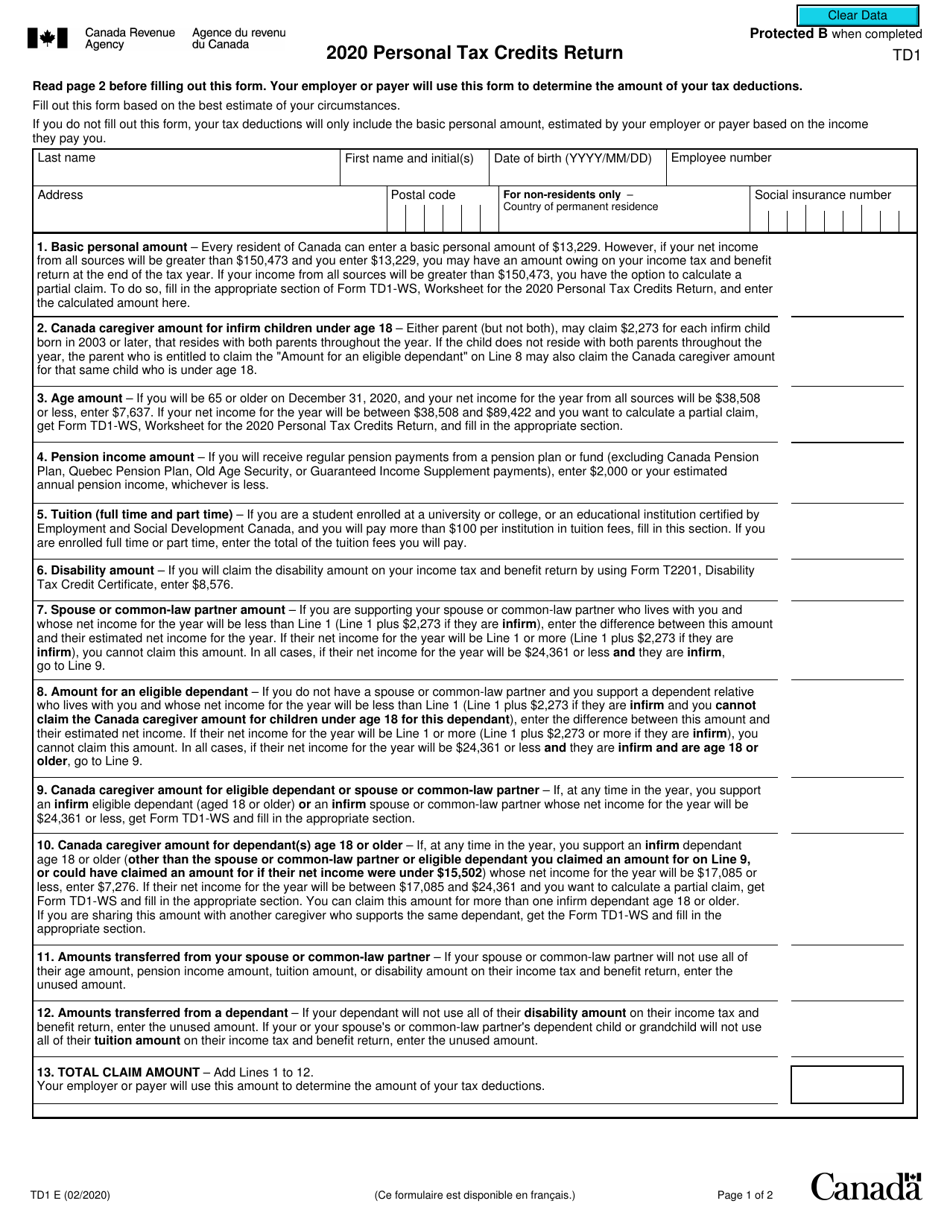

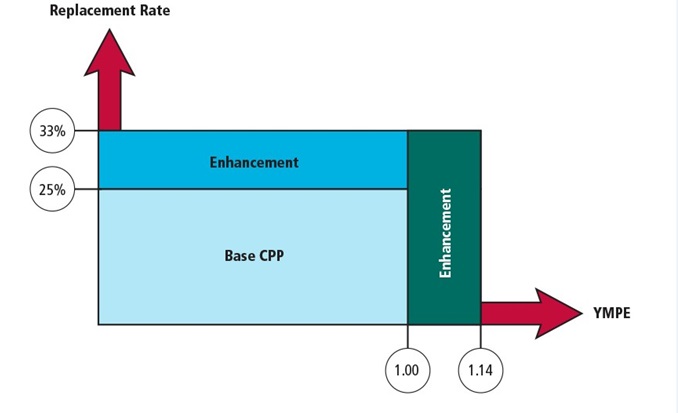

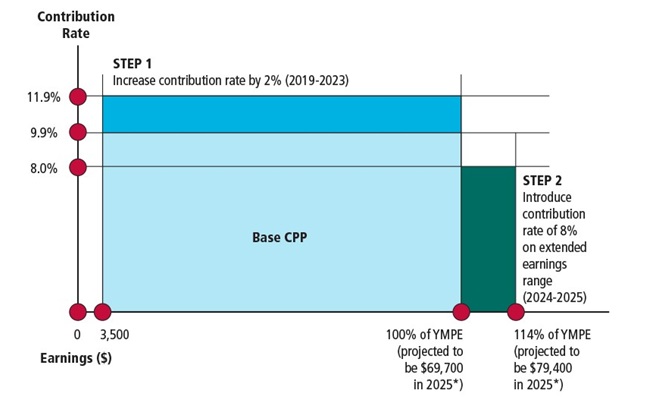

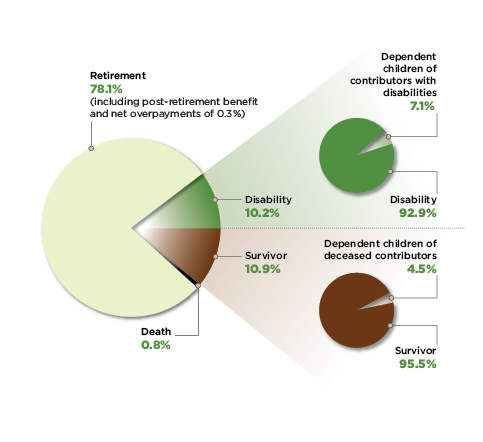

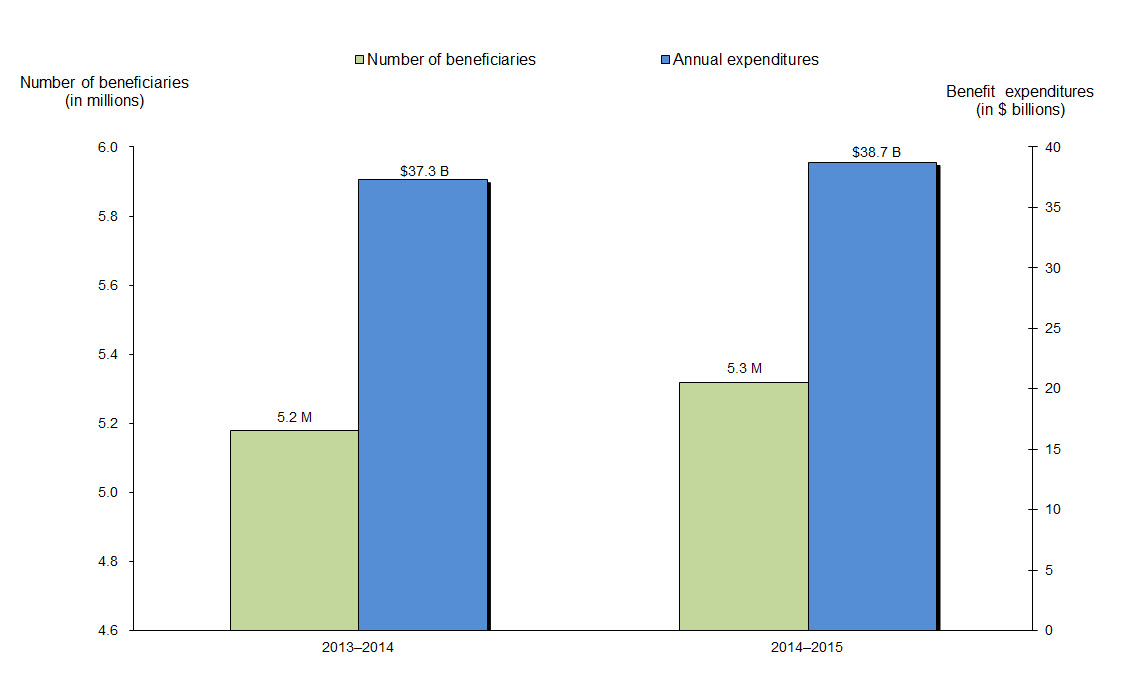

If you are a resident of the United States, these retirement benefits are treated as US social security payments for tax purposes. The benefits are taxed only in the US—not Canada. Essentially, the IRS ignores the fact that these are Canadian retirement benefits and treats them like regular US social security benefits.28 avr. 2022Is my Canadian pension taxable in the US?

Retirement benefits are reported on several Canada Revenue Agency (CRA) forms, including several flavors of Forms T4 and T4A along with Form NR4. Any amount entered in the tax return needs to be converted to US Dollars.3 avr. 2023Where do I report Canadian pension?

Because CPP is a "member contributed plan" it will always be yours, regardless of where you live in the world. If you paid in at least 1 CPP contribution, you are entitled to a benefit.

|

Administrative, Procedural, and Miscellaneous Taxation of Social

States of America and Canada With Respect to Taxes on Income and on Capital Old Age Security (OAS) pensions and Canada/Quebec Pension Plan (CPP/ QPP) file Canadian tax returns and pay tax at regular graduated rates on their |

|

IRS Introduces Two Unique Remedies for US Persons with

holders of certain Canadian retirement accounts and expatriates first requires an understanding of the nor- mal U S tax and information reporting duties Entire |

|

US Tax Filing Obligations

✴File IRS form 8840 (Closer connection statement) Present in Canada more than 183 days - resident Pensions (401k) from work done in the US (15 ) |

|

Strategies for Canadians with US retirement plans - Sun Life of

Therefore, Canadians who own Roth IRAs must file a one-time election to defer tax on their plan balances The CRA does not provide a form for making the |

|

Agreement Between The United States And Canada - Social Security

A CPP/QPP pension may affect your U S benefit 10 What you 3121(l) of the Internal Revenue Code to pay Social Security taxes for U S citizens and residents employed by the responsibility to present the certificate to the Canadian or |

|

Retiring right: Understanding the taxation of retirement income - CIBC

expected to receive Canada Pension Plan (CPP) and Old Age Security (OAS) Income Tax Act and comply with federal and/or provincial benefits standards legislation or receive a refund, when you file your tax return and report the income |

|

Tax Consequences for US Citizens and Other US - BDO Canada

1 mar 2019 · Normally, you must file your U S income tax return for a particular year no Registered Retirement Savings Plans (RRSPs) and Registered |

|

Moving from Canada to the US - RBC Wealth Management

U S , including enticing employment prospects, retirement destinations, potentially lower taxes and sunny weather Canadian income tax return to report |

/payrollfiles-57a621f05f9b58974a262cf8.jpg)

:max_bytes(150000):strip_icc()/T3_Form_2018-5bf57ac446e0fb0026a0018f.jpg)