income tax arrears

|

FORM NO. 10E

Particulars of income referred to in rule 21A of the Income tax Rules 1962 |

|

Part 42-04-24b - PAYE Regulation 16 - Arrears of pay being paid to

if a Revenue Payroll Notification (RPN) has been sent to or made available to the employer the amount of tax to be deducted is calculated by reference to the. |

|

Chapter VI: Write-off of Arrears of tax demand 6.1 Introduction In the

(TRO) to monitor and recovery of arrears of tax demand by allocating one Income Tax (CsIT) has powers to write-off irrecoverable tax demands subject. |

|

Circular No. 4/2020

16 janv. 2020 3.2.1 Computation of Average Income Tax. 4. 3.3 Salary From More Than One Employer. 4. 3.4 Relief When Salary Paid in Arrear or Advance. |

|

Income tax arrears

21 juil. 2014 If you have arrears of income tax you should contact HM Revenue and Customs. (HMRC) as soon as possible. If you don't pay your income tax |

|

Tax Arrears Settlement Scheme

1 août 2022 waiver of penalty and interest included in the tax arrears under the Income Tax Act Value Added. Tax Act or the Gambling Regulatory ... |

|

Alberta Corporate Income Tax Act Information Circular CT-4R7

31 oct. 2017 interest must be included in income. However provisions are available to offset refund and arrears interest for interest periods after 2000 ... |

|

Guidelines for Phased Payment - Instalment Arrangements - Revenue

tax liabilities for VAT Employers Income Tax |

|

CIRCULAR

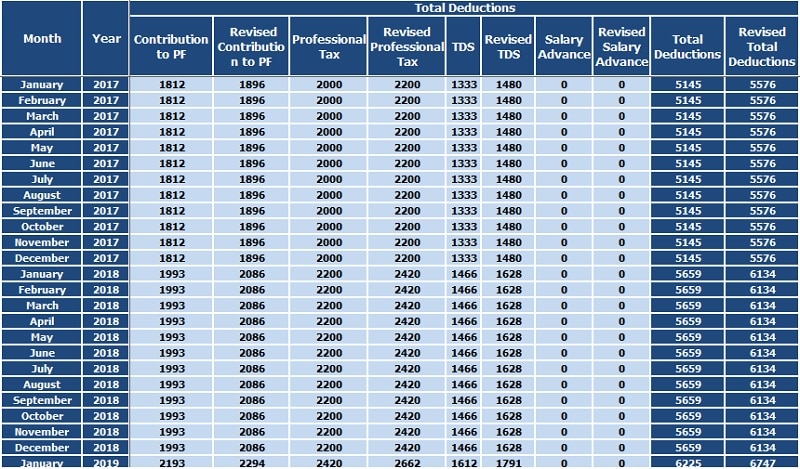

Subject: - Deduction of TDS on account of salary arrears of 7th pay commission. The income tax on the gross arrear amount should be worked out at. |

|

Part 42 - TCA Notes for Guidance FA 2021

31 déc. 2021 972 Duty of employer as to income tax payable by employees ... made under that Chapter and arrears of tax due under PAYE assessments made ... |

|

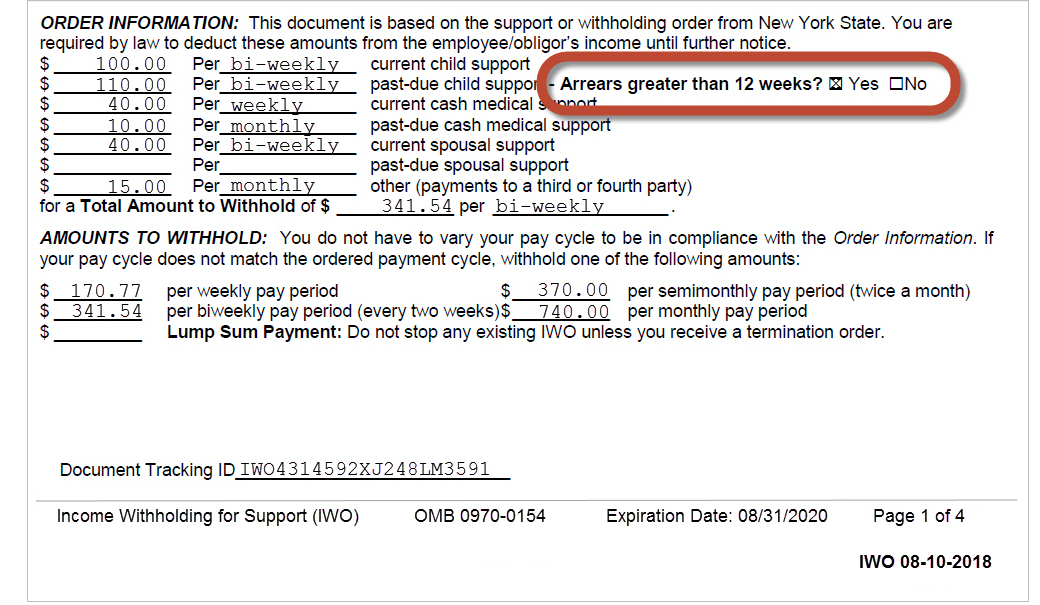

Your Guide to Past-Due Support - Wisconsin Department of

You can download this form from https://www irs gov/pub/irs- pdf /f8379 pdf The Injured Spouse Claim will allow your spouse to receive his or her part of the refund If you have questions about the Injured Spouse Claim or if your spouse's portion of a refund was intercepted after you filed an Injured Spouse Claim contact the IRS at 1-800-829-1040 |

|

FORM NO 10E - Central Board of Direct Taxes

ARREARS OR ADVANCE SALARY 1 Total income (excluding salary received in arrears or advance) 2 Salary received in arrears or advance 3 Total income (as increased by salary received in arrears or advance)[Add item 1 and item 2] 4 Tax on total income (as per item 3) 5 Tax on total income (as per item 1) 6 |

|

What Does It Mean to Pay Property Taxes in Arrears?

Expenditure arrears have been an important issue in most IMF-supported programs As shown in Figure 2 some IMF program countries accumulated expenditure arrears in excess of 20 percent of GDP Arrears-related structural benchmarks or performance criteria were in-cluded in 95 percent of 140 IMF-supported programs between 1999 and 2012 and included |

|

Office of Chief Counsel Internal Revenue Service memorandum

law that income is taxable unless specifically excluded it follows that interest paid on past-due child support is income to the recipient parent and is not excludible income in the same manner as amounts designated for child support are excludible |

|

INCOME TAX OFFSET - INJURED SPOUSE CLAIMS FREQUENTLY ASKED

Feb 26 2013 · tax refunds of non-custodial parents (obligors) who have past due child support balances (arrears) Federal and state laws allow Ohio to offset a federal and/or state tax refund and redirect it to pay child support arrears The arrears must be part of a court or administrative order and be Title IV-D eligible |

|

Le d-ib td-hu va-top mxw-100p>H&R Block® Expat Tax Services - Designed for US Citizens

Income tax arrears Income tax If you have arrears of income tax you should contact HM Revenue and Customs (HMRC) as soon as possible If you don't pay your income tax or don't come to an arrangement with HMRC to pay off the arrears the consequences could be very serious If you pay tax under PAYE |

What does it mean to pay property taxes in arrears?

- When an individual pays property taxes in arrears, they are essentially paying a tax bill for the current year in the closing months of the year. Simply put, individuals are paying property taxes for a defined duration of time at the end of that time period.

What does it mean to pay in arrears?

- “Paid in arrears” means that payment for a service is provided after the service has been rendered. In the financial industry, “in arrears” means that a payment is behind. The term “in arrears” can be applied to both billing and paying. Billing in arrears means you bill customers after providing them with goods or services.

Are real estate taxes paid in arrears in your state?

- States and counties impose property taxes on property owners in their jurisdiction. These are annual taxes based on a valuation of the property. Some states have property taxes that are paid in arrears, meaning that the tax is not paid until after the period for which the tax is being imposed.

Do you pay property tax in advance or arrears?

- Taxpayers may also pay their tax with a personal check, money order or cashier’s check. Are property taxes paid in advance or in arrears? Property taxes are usually paid twice a year—generally March 1 and September 1—and are paid in advance.

|

FORM NO 10E - Income Tax Department

(a) Salary received in arrears or in advance in accordance with the provisions of sub-rule (2) of rule 21A Rs (b) Payment in the nature of gratuity in respect of |

|

Part 42-04-24b - PAYE Regulation 16 - Arrears of pay being paid to

if a Revenue Payroll Notification (RPN) has been sent to or made available to the employer, the amount of tax to be deducted is calculated by reference to the |

|

Part 42-04-24b - PAYE Regulation 19A - Arrears of pay being paid

Introduction The Income Tax (Employments) (Consolidated) Regulations 2001 ( more commonly known as the PAYE Regulations) govern the operation of the |

|

Income Tax Administration - Centro Interamericano de

The paper first seeks to describe an income tax administration income tax administrations in developing countries collection of arrears and monitoring and |

|

Successful Tax Debt Management: Measuring Maturity and - OECD

sector) for Debt recovery CIT Corporate Income Tax COTS Commercial-off-the- shelf CRA Canada Revenue Agency DCMM Debt Management Call Centre |

|

COLLECTION AND RECOVERY OF TAX- AND ARREARS OF

Section 226 of the Income Tax Act, 1961, which can be resorted to by the Assessing Officer as well as the Tax Recovery Officer Briefly, these modes of recovery |

|

An Assessment of the Performance of the Italian Tax Debt Collection

The OECD reports data useful to assess the operational performance of revenue bodies in the area of tax revenue collection, refund of taxes, taxpayers' services, |

|

Income tax arrears - Citizens Advice

21 juil 2014 · If you have arrears of income tax, you should contact HM Revenue and Customs (HMRC) as soon as possible If you don't pay your income tax |

![PDF] Form 10E Claim Relief Under Section 89(1) PDF Download – InstaPDF PDF] Form 10E Claim Relief Under Section 89(1) PDF Download – InstaPDF](https://3.bp.blogspot.com/-0NY3XuacjBM/W7hZ8KwMEaI/AAAAAAAAHps/eEj74xEGa-cZsVf5VjJZ-ZYDywmK2lgCwCLcBGAs/s1600/89%25281%2529%2BPage%2B3.jpg)