irs 2019 tax payment deadline

|

2021 Instructions for Form 1120-F

U.S. Income Tax Return of a Foreign Corporation If the due date of any filing falls on a ... 2019 through 2022 by a QDD in its equity. |

|

2021 Instructions for Form 1040-NR

18 janv. 2022 Go to IRS.gov/Payments to see all your electronic payment options. Most tax return preparers are now required to use IRS e-file. If you are ... |

|

Form 4868 Application for Automatic Extension of Time to File U.S.

See How To Make a Payment later. 2. You can file Form 4868 electronically by accessing IRS e-file using your tax software or by using a tax professional who. |

|

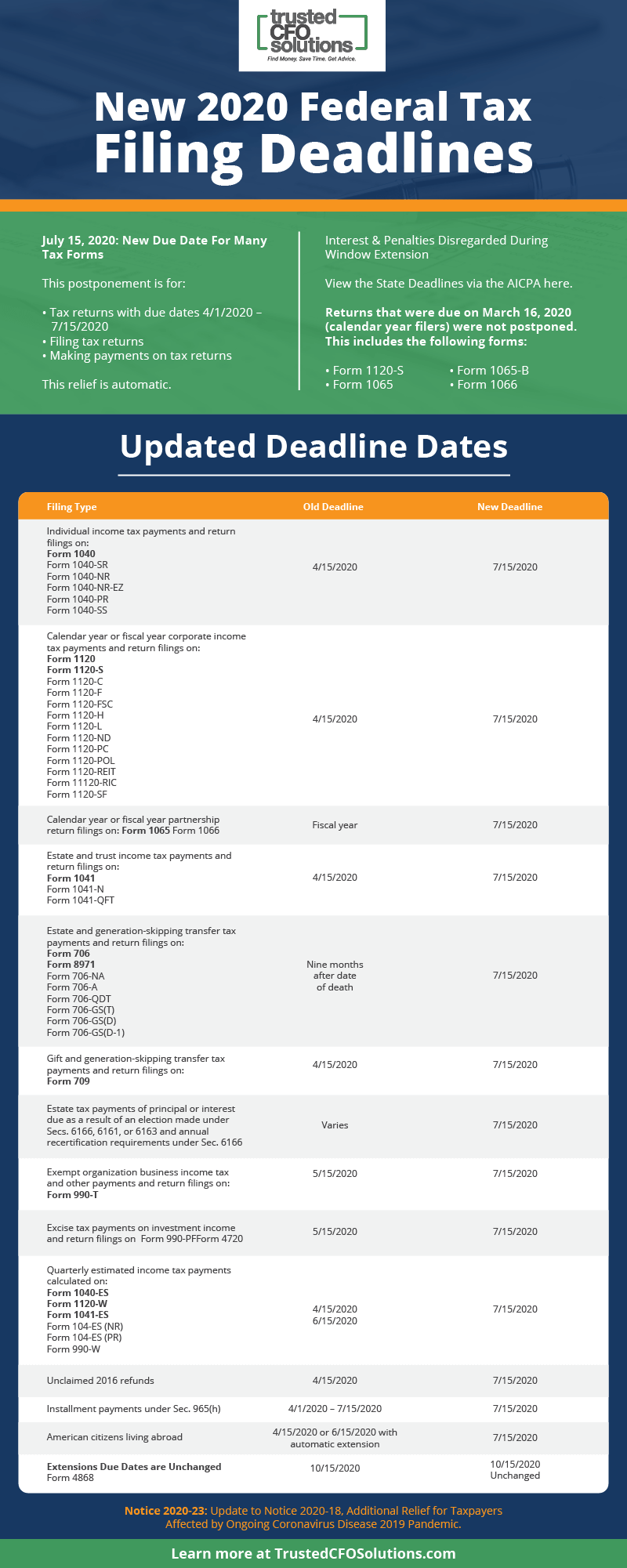

Notice 2020-23

6 avr. 2020 in response to the ongoing Coronavirus Disease 2019 (COVID-19) pandemic ... Treasury “to provide relief from tax deadlines to Americans who ... |

|

2021 Instructions for Form 1042

31 déc. 2021 Annual Withholding Tax Return for U.S. Source Income of Foreign Persons ... procedure until the extended due date for filing Form 1042-S ... |

|

Instructions for Form 1040-X (Rev. September 2021)

You can file. Form 1040-X electronically with tax filing software to amend. 2019 or later Forms 1040 or 1040-SR. See IRS.gov/Filing/ · Amended-Return-Frequently |

|

2021 Instructions for Form 1120

Section references are to the Internal Revenue. Code unless otherwise noted. tax due in full no later than the due date for ... December 22 2019. |

|

IRS.gov

If you don't have an EIN by the time a tax deposit is due send your payment to the Internal Revenue Service Center for your filing area as shown in the |

|

Return Due Dates – Tax Year 2019 - IRS

Note: Forms 1041-A and 5227 are calendar year returns and are due on April 15 (or the next business day if the 15th falls on a weekend or holiday) The |

|

2019 tax returns and payments due July 15 Internal Revenue Service

13 juil 2020 · IRS gives tips on filing paying electronically and checking The deadline to submit 2019 tax returns is July 15 2020 for most people |

|

F1040es--2019pdf - IRS

17 jan 2019 · Payment Due Dates You can pay all of your estimated tax by April 15 2019 or in four equal amounts by the dates shown below 1st payment |

|

2019 Publication 509 - IRS

14 nov 2018 · The due date for giving the recipient these forms generally remains Janu- ary 31 March 1 Farmers and fishermen File your 2018 income tax |

|

2019 Publication 17 - IRS

17 juil 2020 · applies to returns whose due date (with extensions) is after Decem- ber 31 2019 (Chapter 1) Tax benefits The following tax |

|

2019 Instructions for Form 2210 - IRS

Certain estimated tax payment deadlines for taxpayers who reside or have a business in a federally declared disaster area are postponed for a period during and |

|

IRS extends more tax deadlines to cover individuals trusts estates

9 avr 2020 · additional key tax deadlines for individuals and businesses 15 to file their 2019 federal income tax return and pay any tax due |

|

2019 Instruction 1040 - IRS

8 jan 2020 · puts you in control of paying your tax bill and gives you peace of mind You determine the payment date and you will receive an immediate |

|

F4868--2019pdf - IRS

the Electronic Federal Tax Payment System or using a credit or debit card File Form 4868 by the regular due date of your return |

|

Notice 2019-25 - IRS

would otherwise be required to make tax year 2018 estimated income tax payments on or before January 15 2019 This notice makes the following changes to |

How do I download 2019 taxes?

The only way you can obtain copies of your tax return from the IRS is by filing Form 4506 with the IRS. You can download this form from the IRS website.What period is the 2019 tax year?

In the U.S., the tax year for individuals runs from Jan. 1 to Dec. 31 and includes taxes owed on earnings during that period.- Go to https://www.irs.gov/individuals/get-transcript and click on “Get Transcript ONLINE” or “Get Transcript by Mail.” and enter the tax filer's information. NOTE: Use the address currently on file with the IRS. This will be the address that was listed on the latest tax return filed.

|

Due Dates - Internal Revenue Service

31 déc 2020 · You have until April 15 to file your 2020 income tax return (Form 1040 or Form 1040-SR) If you don't pay your estimated tax by January 15, you must file your 2020 return and pay any tax due by March 1, 2021, to avoid an estimated tax penalty |

|

2019 Publication 509 - Internal Revenue Service

14 nov 2018 · ing the Electronic Federal Tax Payment Gener- ally, if a due date for performing any act for tax This tax calendar has the due dates for 2019 |

|

Form 4868 - Internal Revenue Service

the Electronic Federal Tax Payment System, or using a credit or debit card Be sure to have a copy of your 2019 tax return— you'll be asked to provide you don't pay the amount due by the regular due date for Form 709, you'll owe interest |

|

2021 Publication 509 - Internal Revenue Service

6 oct 2020 · due dates for payroll taxes for 2021 Most of ally, if a due date for performing any act for tax dar quarter of 2019 or 2020 to household em- |

|

If you missed the tax deadline, these tips can help

There is no penalty for filing a late return after the tax deadline if a refund is due If you didn't file and owe tax, file a return as soon as you can and pay as much as possible to reduce penalties and interest • For those who qualify, IRS Free File is still available on IRS gov through October 15 documents Date: May 10, 2019 |

|

Delay of tax filings and payments is welcome relief for mobile - PwC

15 avr 2020 · The IRS has expanded favorable guidance regarding the delay of filing US postponed tax return or payment due dates (examples include payment Extended deadline to make payment 2019 income tax return payments |

|

AICPA Comments on Postponement for the Filing and Payment

4 mar 2021 · “Coronavirus”) during 2020 (the 2019 tax year) and the IRS to act immediately to provide tax filing and payment relief for Though we are concerned that a postponement of the filing and payment deadlines will create |

|

Like the IRS, Wisconsin Extends Tax Filing Deadline to July 15

21 mar 2020 · Both federal and Wisconsin income tax payment and return due dates are automatically extended to July 15, 2020 Wisconsin law will |