| PDF |

Strategies for Canadians with U.S. retirement plans

IRAs and 401(k) plans unless otherwise noted. 5 A Roth IRA is similar to a Canadian Tax-Free Savings Account (TFSA). Roth IRA contributions may not be deducted

|

| PDF |

Strategies for Canadians with U.S. retirement plans

1 mars 2015 Like RRSPs IRA balances grow tax deferred

|

| PDF |

Moving your U.S. retirement plan to Canada

and contributed to a U.S. retirement plan – such as a 401(k) room there are both U.S. and Canadian income tax issues to consider. U.S. tax implications.

|

| PDF |

Your U.S. retirement plan

For Canadian tax purposes the lump sum withdrawal from a traditional IRA or 401(k) plan would result in an income inclusion in the year of withdrawal. However

|

| PDF |

Transferring Your IRA / 401k to Canada

|

| PDF |

Your US retirement plan - Bringing it home

For Canadian tax purposes the lump sum withdrawal from a traditional IRA or 401(k) plan would result in an income inclusion in the year of withdrawal. However

|

| PDF |

STRATEGIES FOR CANADIANS WITH U.S. RETIREMENT PLANS

401(k) plans are subject to the same rules as IRAs.5. CONTINUING TAX DEFERRAL OF CANADIAN-OWNED U.S. PLANS. Under the Income Tax Act6 and the Canada

|

| PDF |

Tax Ramifications of Investing in U.S. Registered and Non

Canadian income tax return. Individuals with a 401(k) through their American employer may move their money to an IRA; this can.

|

| PDF |

Transferring a foreign- based retirement plan to an RRSP

the United States (U.S.) you may have participated in a 401(k) or 403(b) RRSP under Canadian tax rules does not create an obligation for a foreign.

|

| PDF |

IRS Simplifies Procedures for Favorable Tax Treatment on

7 oct. 2014 IRS Simplifies Procedures for Favorable Tax Treatment on Canadian ... retirement accounts (IRAs) and 401(k) plans. In general U.S. citizens ...

|

| PDF |

Are Your 401(K) Contributions Deductible in Canada?

You know contributing to the 401(K) plan lowers your taxable income in the U S Does the same hold true for your taxable income in Canada? Are the matching

|

| PDF |

Strategies for Canadians with US retirement - Sun Life of Canada

Like RRSPs IRA balances grow tax deferred and IRA withdrawals are taxed as income in the year withdrawn A 401(k) plan closely resembles a defined

|

| PDF |

Strategies for Canadians with US retirement - Sun Life of Canada

Like RRSPs IRA balances grow tax deferred and IRA withdrawals are taxed as income in the year withdrawn A 401(k) plan closely resembles a defined

|

| PDF |

Tax Ramifications of Investing in US Registered and Non - GGFL

Canadian income tax return Individuals with a 401(k) through their American employer may move their money to an IRA; this can

|

| PDF |

Your US retirement plan - TD Wealth Locator

For Canadian tax purposes the lump sum withdrawal from a traditional IRA or 401(k) plan would result in an income inclusion in the year of withdrawal However

|

| PDF |

Your US retirement plan - TD Wealth Locator

For Canadian tax purposes the lump sum withdrawal from a traditional IRA or 401(k) plan would result in an income inclusion in the year of withdrawal However

|

| PDF |

Transferring Your IRA / 401k to Canada

Aside from the practical aspects of the move there are also tax and financial considerations to assess In particular you may have accumulated savings in a

|

| PDF |

Moving to Canada with a US Roth IRA RBC Wealth Management

il y a 8 jours · Furthermore income accruing in your Roth IRA is generally subject to Canadian tax unless you make a one-time election under the Canada- U S

|

| PDF |

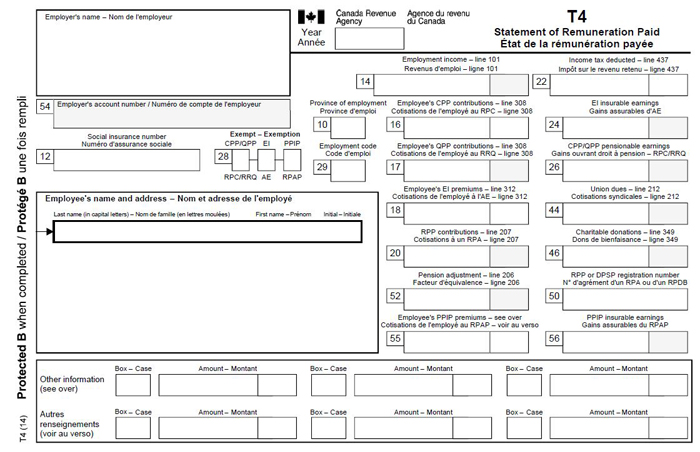

RC267 Employee Contributions to a United States Retirement Plan

This form is used by individuals who have taken up employment in Canada while continuing to participate in a retirement plan offered by their U S employer

|

| PDF |

IRS Simplifies Procedures for Favorable Tax Treatment on

7 oct 2014 · IRS Simplifies Procedures for Favorable Tax Treatment on Canadian retirement accounts (IRAs) and 401(k) plans In general U S citizens

|

You know contributing to the 401(K) plan lowers your taxable income in the U.S. Does the same hold true for your taxable income in Canada? Are the matching

Is 401k income taxable in Canada?

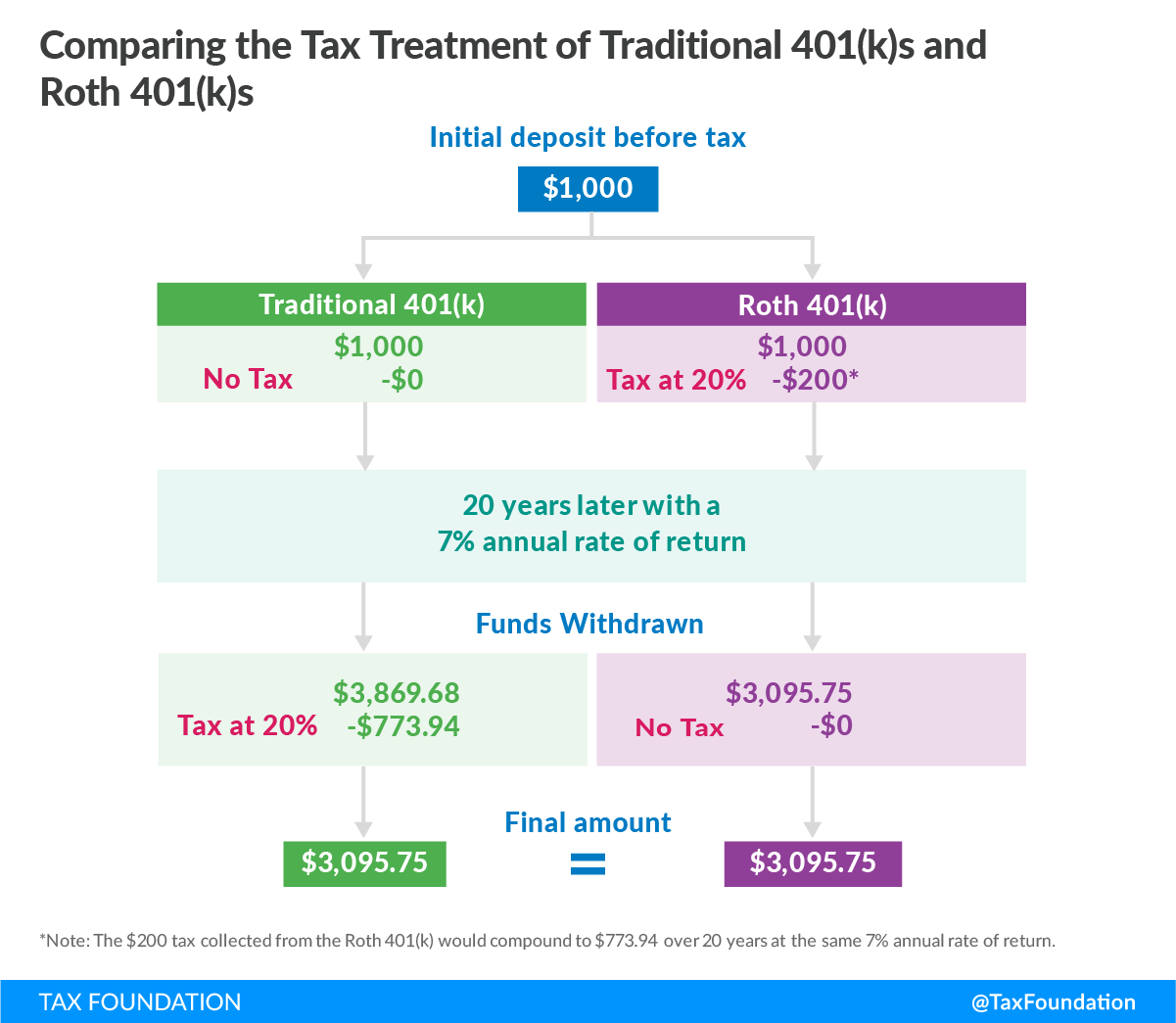

Because only traditional IRAs and 401(k) plans are referred to in these provisions, these plans continue to enjoy the tax-deferral treatment in Canada. By contrast, the accrued income in either a Roth IRA or a Roth 401(k) plan will be taxable in Canada each year.Is 401k tax deductible in Canada?

Under the U.S.-Canada tax treaty, your contribution to the plan (up to your remaining RRSP deduction room) may be deductible for Canadian tax purposes. But you need to be careful because your 401(K) deduction on your Canadian return is limited to your RRSP contribution room.What happens to 401k if I move to Canada?

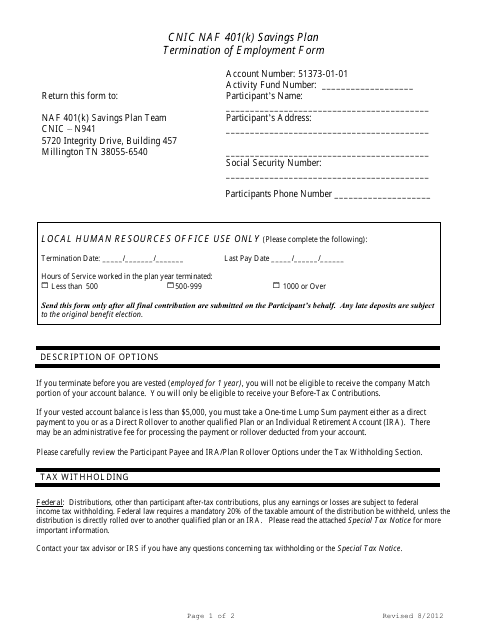

401k/IRA Options

If contributions were made by your employer while you were a resident of US, you will be allowed to make a transfer of a lump-sum payment from your 401k. Specifically, you will be able to transfer a 401k to a rollover IRA (employer permitting) and then transfer the IRA to a Canadian RRSP.- RRSPs can be considered the Canadian equivalent of the American 401(k), and vice versa. Both are retirement plans designed to encourage savings with similar tax benefits.