libor vs ois the derivatives discounting dilemma

|

LIBOR vs. OIS: The Derivatives Discounting Dilemma

LIBOR vs. OIS: The Derivatives Discounting Dilemma. Introduction. The “risk-free” term structure of interest rates is a key input to the pricing of |

|

The FVA Debate

“LIBOR vs. OIS: The Derivatives Discounting Dilemma”. Journal of Investment Management Valuing Derivatives: Funding Value Adjustment and Fair. |

|

LIBOR vs. OIS: The Derivatives Discounting Dilemma

LIBOR vs. OIS: The Derivatives Discounting Dilemma. Introduction. The “risk-free” term structure of interest rates is a key input to the pricing of |

|

Derivatives Discounting Explained Wujiang Lou1

Nov 27 2019 forged a consensus to discount such derivatives at the OIS curve |

|

Euro area riskxfree interest rates: measurement issues recent

White “LIBOR vs. OIS: The Derivatives Discounting Dilemma” |

|

The FVA Debate

Jul 13 2012 Hull |

|

Synthetic forwards and cost of funding in the equity derivative market

Jan 2 2022 LIBOR vs. OIS: The derivatives discounting dilemma |

|

JOHN C. HULL

Investment Management in 2013. The paper is entitled “LIBOR vs. OIS: The. Derivatives Discounting Dilemma” (with Alan White). |

|

A Measure of Turkeys Sovereign and Banking Sector Credit Risk

and White Alan |

|

LIBOR vs OIS: The Derivatives Discounting Dilemma

Most derivatives dealers now use interest rates based on overnight indexed swap (OIS) rates rather than LIBOR when valuing collateralized derivatives LCH |

|

LIBOR vs OIS: The Derivatives Discounting Dilemma

4 fév 2013 · This paper examines this practice and concludes that OIS rates should be used in all situations Keywords: LIBOR OIS Derivatives Discounting |

|

Libor vs OIS: The Derivatives Discounting Dilemma Request PDF

Traditionally practitioners have used LIBOR and LIBOR-swap rates as proxies for risk-free rates when valuing derivatives This practice has been called into |

|

LIBOR vs OIS: The Derivatives Discounting - DefaultRiskcom

This practice has been called into question by the credit crisis that started in 2007 Many banks now consider that overnight indexed swap (OIS) rates should be |

|

LIBOR vs OIS: The Derivatives Discounting Dilemma - PDF Free

Dataline A look at current financial reporting issues No 2013-25 December 10 2013 What s inside: Overview 1 Background 2 OIS discounting an illustration |

|

Derivatives Discounting Explained Wujiang Lou1 - arXiv

22 déc 2017 · The practice of discounting derivatives cash flows exclusively at the LIBOR is thus no longer appropriate and LIBOR itself has been subject to |

|

OIS DISCOUNTING INTEREST RATE DERIVATIVES AND THE

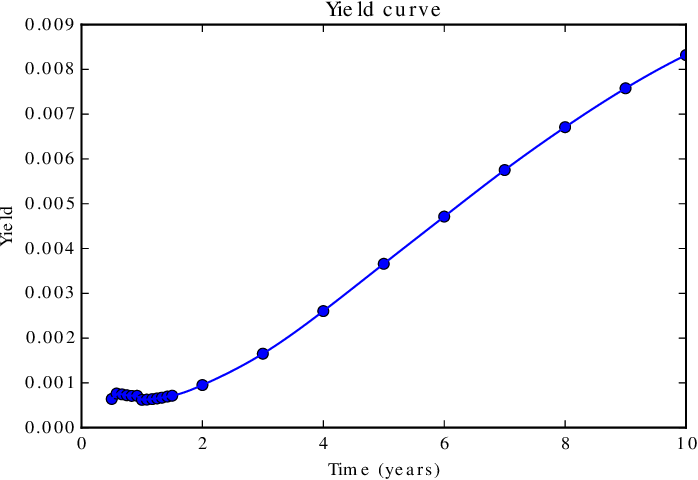

In this section we review the procedures for bootstrapping a riskless zero curve from LIBOR swap rates We start by examining how bonds and swaps are priced |

|

LIBOR Versus OIS: The Derivatives Discounting Dilemma

14 juil 2014 · This paper examines this practice and concludes that OIS rates should be used in all situations 0 comments add one Please Login to post a |

|

A Teaching Note on Pricing and Valuing Interest Rate Swaps Using

With OIS discounting the result that the implicit floating-rate bond paying LIBOR is priced at par value no longer holds It is useful to infer the LIBOR |

|

The Multi-Curve Framework: A Practitioners Guide - Canopee Group

For several years practitioners have build a single curve to discount and forecast cash flow within interest rate deriva- tives market |

What is the difference between LIBOR and OIS?

3-month LIBOR is generally a floating rate of financing, which fluctuates depending on how risky a lending bank feels about a borrowing bank. The OIS is a swap derived from the overnight rate, which is generally fixed by the local central bank.What is the difference between Ted spread and LIBOR-OIS spread?

Indicator of Counterparty Risk

The TED spread is an indicator of perceived credit risk in the general economy, since T-bills are considered risk-free while LIBOR reflects the credit risk of lending to commercial banks.What is OIS discounting?

OIS discounting is the standard methodology for valuing cash-collateralised derivatives contracts using overnight index swap rates – the rate that would be paid by the collateral receiver to the poster. Previously, Libor was used to discount all derivatives.- The major reason for switching from using LIBOR to the OIS as a term structure for pricing interest rate swaps is that OIS discounting better reflects the counterparty credit risk in a collateralized interest rate swap.

|

LIBOR vs OIS: The Derivatives Discounting Dilemma - University of

The use of LIBOR to value derivatives was called into question by the credit crisis that started in mid-2007 Most derivatives dealers now use interest rates based on overnight indexed swap (OIS) rates rather than LIBOR when valuing collateralized derivatives LCH |

|

OIS DISCOUNTING, INTEREST RATE DERIVATIVES, AND THE

curve bootstrapped from overnight indexed swap (OIS) rates for discounting This paper derivatives transactions 2 Both LIBOR and OIS rates are based on Discount Fwd rate life effect effect T otal effect effect T otal effect effect T otal ( Yrs) V LO − vs OIS: The Derivatives Discounting Dilemma,” Journal of Invest- |

|

Interest Rate Derivatives: Pricing in a Multiple-Curve - CORE

Building an OIS discounting curve and multiple-curve pricing primary interest rates of the interbank market, e g Libor, Euribor, Eonia, and Federal Funds |

|

Multi-Curve Discounting - - Munich Personal RePEc Archive

10 avr 2018 · curve was based on Libor rates at most banks, during and after the crisis banks switched to OIS discounting [5, 3, 2] OIS discounting values a derivative as if there is a collateral agreement rOIS)T (the order to which we have calculated V ) Dilemma, Available at SSRN: http://ssrn com/abstract=2211800 |

|

Valorización Libre de Riesgo en CCP - Comder

Página 9 “LIBOR vs OIS: The Derivatives Discounting Dilemma” John Hull and Alan White “We agree that the current practice of using the rate paid on |

|

Implications of Multiple Curve Construction in the Swedish - DiVA

4 jui 2014 · Keywords: collateral, cross currency, discount curve, forward curve, forward starting, off- Libor vs ois: The derivatives discounting dilemma |

|

The FVA Debate - NYU Stern

“LIBOR vs OIS: The Derivatives Discounting Dilemma” Journal of Investment Valuing Derivatives: Funding Value Adjustment and Fair Value” Copyright |

|

Affine LIBOR Models with Multiple Curves - Laboratoire de

same is true for the three-month versus six-month basis swap spread However usual choice is the OIS curve, and then as many LIBOR curves as market tenors ( e g , 1 month, liquid interest rate derivatives such as swaps, caps, swaptions, and basis swaptions OIS: The derivatives discounting dilemma, J Invest |

![PDF] CSA Discounting: Impacts on Pricing and Risk of Commodity PDF] CSA Discounting: Impacts on Pricing and Risk of Commodity](https://demo.fdocuments.in/img/378x509/reader024/reader/2021010111/544bbeaab1af9fb60f8b48e2/r-1.jpg)

![Valuing Interest Rate Swaps Using OIS Discounting - [PDF Document] Valuing Interest Rate Swaps Using OIS Discounting - [PDF Document]](https://d3i71xaburhd42.cloudfront.net/4bd23296f556372984785395fda1faf73c2168f9/5-Figure1-1.png)

![PDF] CSA Discounting: Impacts on Pricing and Risk of Commodity PDF] CSA Discounting: Impacts on Pricing and Risk of Commodity](https://d3i71xaburhd42.cloudfront.net/4bd23296f556372984785395fda1faf73c2168f9/8-Figure8-1.png)

![PDF] CSA Discounting: Impacts on Pricing and Risk of Commodity PDF] CSA Discounting: Impacts on Pricing and Risk of Commodity](https://cyberleninka.org/viewer_images/1358057/f/1.png)

![Quantifi Whitepaper - OIS and CSA Discounting - [PDF Document] Quantifi Whitepaper - OIS and CSA Discounting - [PDF Document]](http://html.scirp.org/file/5-2410073x45.png)

![PDF] Credit Value Adjustment: The Aspects of Pricing Counterparty PDF] Credit Value Adjustment: The Aspects of Pricing Counterparty](https://reader018.staticloud.net/reader018/html5/2019112015/55cf986e550346d033979721/bg1.png)

![Principia OIS Discounting PaperII - [PDF Document] Principia OIS Discounting PaperII - [PDF Document]](https://media.springernature.com/lw785/springer-static/image/chp%3A10.1007%2F978-3-319-49800-3_5/MediaObjects/430629_1_En_5_Fig23_HTML.gif)

![Frm Study Guide Changes 2014-Web - [PDF Document] Frm Study Guide Changes 2014-Web - [PDF Document]](https://demo.fdocuments.in/img/378x509/reader024/reader/2021010111/544bbeaab1af9fb60f8b48e2/r-2.jpg)

![Valuing Interest Rate Swaps Using OIS Discounting - [PDF Document] Valuing Interest Rate Swaps Using OIS Discounting - [PDF Document]](https://ars.els-cdn.com/content/image/1-s2.0-S154461232031655X-gr3.jpg)

![PDF] Credit Value Adjustment: The Aspects of Pricing Counterparty PDF] Credit Value Adjustment: The Aspects of Pricing Counterparty](http://html.scirp.org/file/5-2410073x36.png)