mysolo401k calculator

|

Solo 401k Deep Dive: 2021 Contributions Guide for S-corporations

https://www.mysolo401k.net/. 1-800-489-7571. Page 2. ?. Contribution Limits. ?. Scenarios & Examples. ?. How to Use Online Calculator. |

|

THE FIDELITY SELF-EMPLOYED 401(K) CONTRIBUTION

Calculating Your Maximum Plan Year Contribution. If you are self-employed the worksheet on the other side of this page may help you to calculate. |

|

Https://www.mysolo401k.net/ 1-800-489-7571

your ability to make Solo 401k contributions is based on your self- employment income reported on Line 14 of your K-1 (after. |

|

Solo 401k Deep Dive: Mega Backdoor Roth for S-corporations

Solo 401k Deep Dive: Mega Backdoor Roth for S-corporations & C-Corporations https://www.mysolo401k.net/. 1-800-489-7571 |

|

Self-Directed Solo 401k Deep Dive: Contributions Guide 2020

https://www.mysolo401k.net/. ? 1-800-489-7571 How to Use Online Calculator. ? Deadline ... Step 1 - Calculate Self-Employment. Compensation ... |

|

Self-Directed Solo 401k Contributions For Sole Proprietorship

1-800-489-7581 https://www.mysolo401k.net/ How to Use Online Calculator. ? Deadline ... Step 1 - Calculate Self-Employment. Compensation ... |

|

Mega Backdoor Roth for Sole Proprietors Single Member LLCs

Solo 401k Deep Dive: Mega Backdoor Roth for Sole Proprietors Single Member LLCs &. 1099-MISC/NEC Independent Contractors https://www.mysolo401k.net/. |

|

Add Options Trading and Margin to Your Account

In calculating equity the market value of any security |

|

Self-Directed Solo 401k Deep Dive: Contributions Guide 2020

Step 1 - Calculate Self-Employment Compensation Click “Print” to keep a copy https://www.mysolo401k.net/learn/online-tools/ ... |

|

Determine Your Routing and Account Numbers

07-Apr-2021 To establish direct deposit you'll need your Fidelity direct · deposit/direct debit routing numbers and account numbers.*. |

|

Calculating My Solo 401k contributions for a Sole Proprietor

20 oct 2014 · Fill out the annual contribution form (https://www mysolo401k net/wp-content/uploads/2014/09/Solo_401k_Annual_Contribution_Form pdf ) and keep a |

|

2021-2022-Self-Directed-Solo-401k-Contribution-Guide-S

https://www mysolo401k net/ 1-800-489-7571 How to Use Online Calculator The Solo 401k contribution limits are based on the following factors: |

|

Self-Employed 401(k) Contributions Calculator - AARP

Use the Self-Employed 401(k) Contributions Comparison to estimate the potential contribution that can be made to an Individual 401(k) compared to Profit |

|

Solo 401k Maximum Contribution Calculator - IRA Financial Group

To calculate your Solo 401(k) Plan maximum contribution please input the information in the calculator A PDF document will be created that you can print |

|

The fidelity self-employed 401(k) contribution worksheet for

This form is available online at http://www irs gov/pub/irs- pdf /f1040sse pdf Step 2: Calculate your maximum contributions |

|

Solo 401k Contribution Calculator

Find out how much you can contribute to your Solo 401k with our free contribution calculator Save on taxes and build for a bigger retirment! |

|

Solo or Individual 401(k) for Self-Employed & Small Business

An Individual 401(k) or Solo 401(k) is a flexible retirement plan designed for self-employed small business owners Open an account with Merrill today |

|

Details of Individual 401k-solo 401k plans - Vanguard

An Individual 401(k) is for the self-employed sole proprietors or business partners whose only employees are spouses |

|

How To Set Up Solo 401(k) Plans For Self-Employed Workers

23 nov 2022 · The steps for calculating the maximum contribution to a solo MySolo401k and Nabers Group are the two most experienced firms in the |

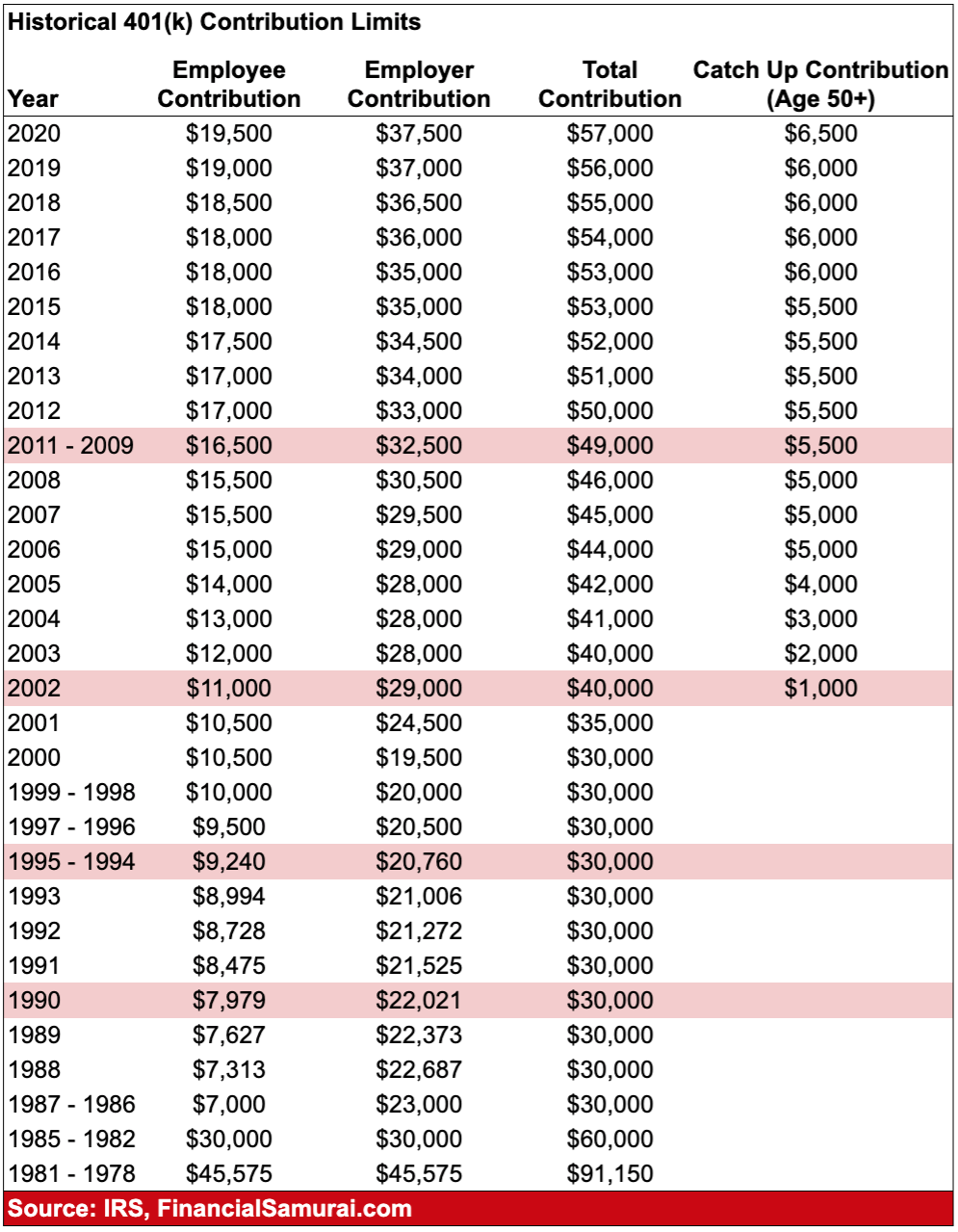

What is the Solo 401k limit for 2023?

Solo 401(k) contribution limits

The total solo 401(k) contribution limit is up to $66,000 in 2023. There is a catch-up contribution of an extra $7,500 for those 50 or older.How do I calculate my 401k contribution?

For example, let's assume your employer provides a 50% match on the first 6% of your annual salary that you contribute to your 401(k). If you have an annual salary of $100,000 and contribute 6%, your contribution will be $6,000 and your employer's 50% match will be $3,000 ($6,000 x 50%), for a total of $9,000.How much can I contribute to i401k?

Elective deferrals up to 100% of compensation (“earned income” in the case of a self-employed individual) up to the annual contribution limit: $22,500 in 2023 ($20,500 in 2022; $19,500 in 2020 and 2021), or $30,000 in 2023 ($27,000 in 2022; $26,000 in 2020 and 2021) if age 50 or over; plus.- A profit sharing contribution can be made up to 20% of net adjusted businesses profits. Net adjusted business profit is calculated by taking gross self employment income and then subtracting business expenses and then subtracting 50% of the self employment tax.

|

THE FIDELITY SELF-EMPLOYED 401(K) CONTRIBUTION

Calculating Your Maximum Plan Year Contribution If you are self-employed, the worksheet on the other side of this page may help you to calculate |

|

Solo 401(k) - Invesco

to use in calculating the required minimum distribution As in the case such contributions into account in the calculation of the Contribution Percent- age), or to |

|

401(k) - Internal Revenue Service

changed how salary deferral contributions are treated when calculating the maximum employee deferrals are removed from the deduction limit calculation |

|

401 Note Taking Guide Answer Key

I'm contemplating taking a distribution from the my solo 401k Individual 401(k) Plans 401(k) Calculator - Will You Have Enough to Retire Note that we're |

|

Schwab Individual 401(k) - Charles Schwab

Establishing plan—To include a full year's compensation when calculating your contribution amount, you should indicate the plan's effective date of January 1 |

|

FAQs about Retirement Plans and ERISA - US Department of Labor

benefit and also to calculate how much you will receive in benefits at retirement Employees in the plan who work part-time, but who work 1,000 hours or more |