overnight funding rate

|

Introducing the Secured Overnight Financing Rate (SOFR)

2 нояб. 2017 г. • BGCR – Broad General Collateral Rate: TGCR + GCF repo. • SOFR – Secured Overnight Financing Rate: BGCR + FICC-cleared bilateral repo. • In ... |

|

1 Determination of the Overnight Funding TIIE Index compounded

available record of the Overnight Funding TIIE rate until the last day that such rate is available. For non-business days |

|

Press release January 15th 2020 Publication of the overnight TIIE

15 янв. 2020 г. b. The Circular 3/2012 issued by Banco de México has been modified to establish the new methodology of the overnight TIIE funding rate and to. |

|

ALTERNATIVE REFERENCE RATES COMMITTEE

27 мая 2020 г. broad voluntary adoption of the Secured Overnight Financing Rate (SOFR) the ARRC's recommended alternative reference rate. In conjunction ... |

|

1 Determining the Overnight Interbank Funding Rate Secured with

The Overnight Bank Funding Rate is determined as a volume-weighted median of interest rates paid on Mexican peso denominated repo transactions mentioned in the |

|

More corprorates are using Ameribor a Libor replacement

Ameribor users cite its cheaper costs relative to SOFR the Secured Overnight. Funding Rate created specifically to replace the London Interbank Offered Rate |

|

1 Determining the Overnight TIIE Funding Rate1 In order to obtain a

The Overnight TIIE Funding Rate is determined as a volume-weighted median of interest rates paid on Mexican peso denominated repo transactions mentioned in the |

|

Кредитным и некредитным финансовым организациям Банк

SOFR (Secured Overnight Financing Rate). Обеспеченный. (РЕПО). Федеральный резервный банк. Нью-Йорка. EUR. €STR (Euro short-term rate). Необеспеченный |

|

FAQs on the Secured Overnight Financing Rate

The Secured Overnight Financing Rate or SOFR |

|

LIBOR Countdown: Navigating the Transition

The Secured Overnight Financing Rate has gained momentum in the. U.S. as the successor to LIBOR rates. In June 2017 the Alternative. Reference Rates Committee |

|

Introducing the Secured Overnight Financing Rate (SOFR)

2 nov. 2017 SOFR – Secured Overnight Financing Rate: BGCR + FICC-cleared bilateral repo. • In June 2017 the ARRC identified the SOFR as its preferred ... |

|

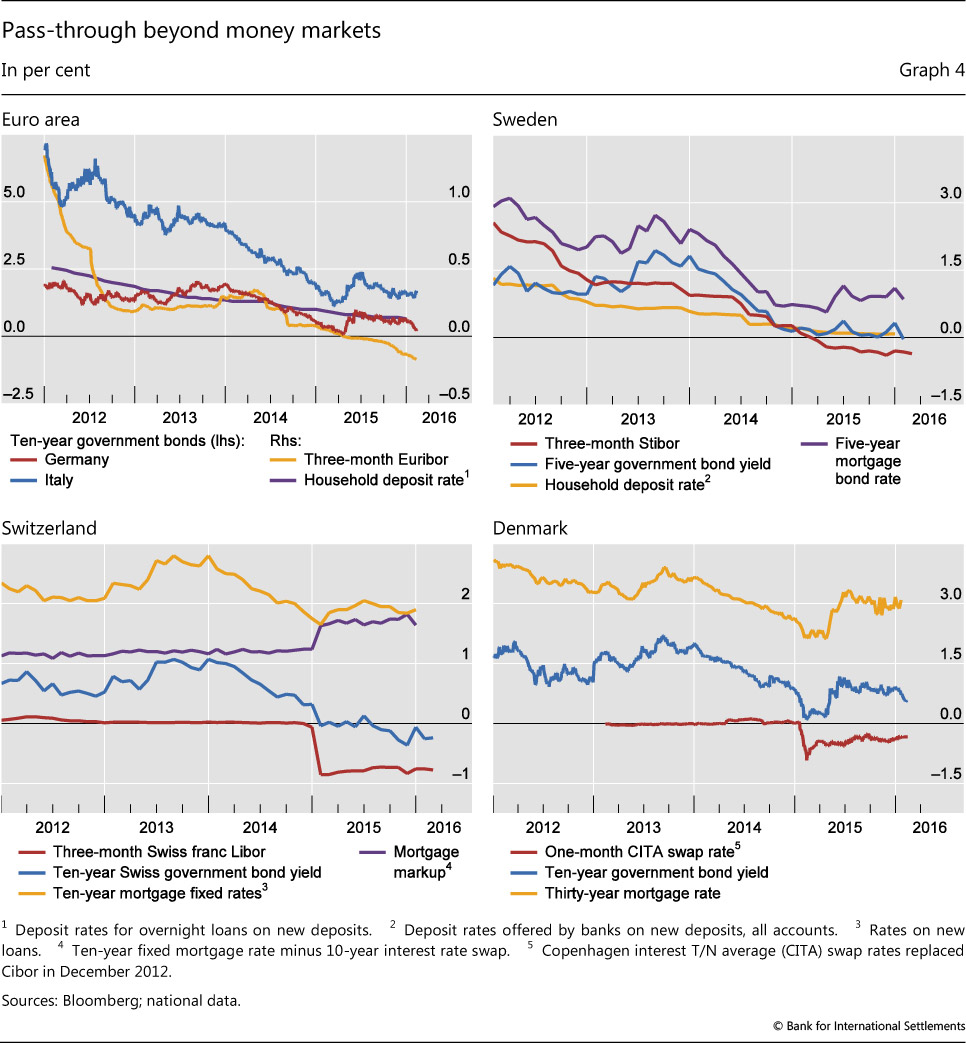

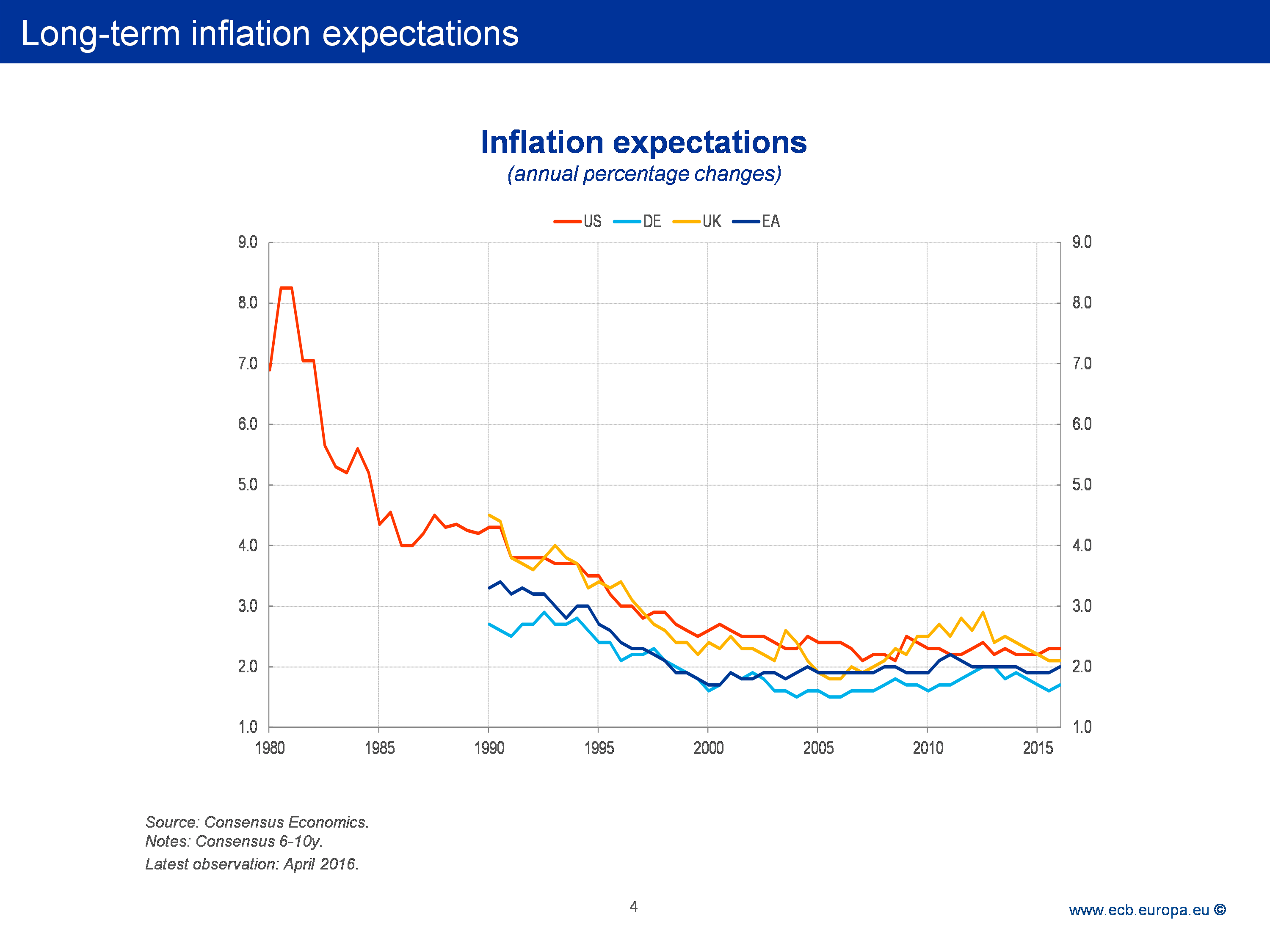

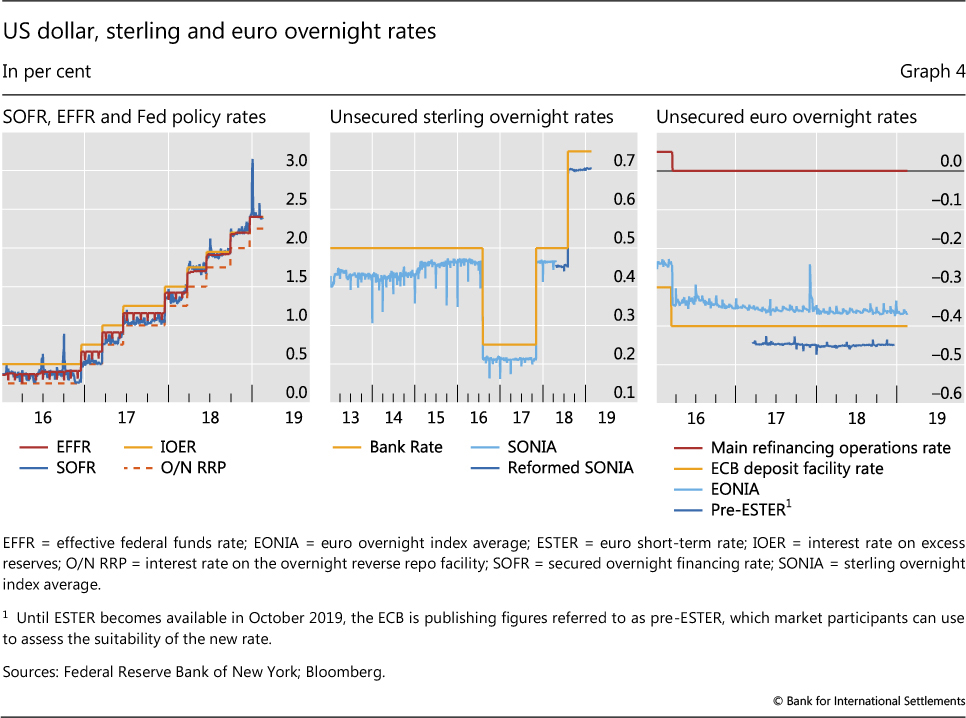

Beyond LIBOR: a primer on the new benchmark rates

rate loan to a client by drawing on short-term (variable rate) funding federal funds rate or the euro overnight index average are exchanged for a fixed ... |

|

First ECB public consultation on developing a euro unsecured

develop a euro unsecured overnight interest rate based on data already The interbank money market borrowing and lending rates5 for euro area banks. |

|

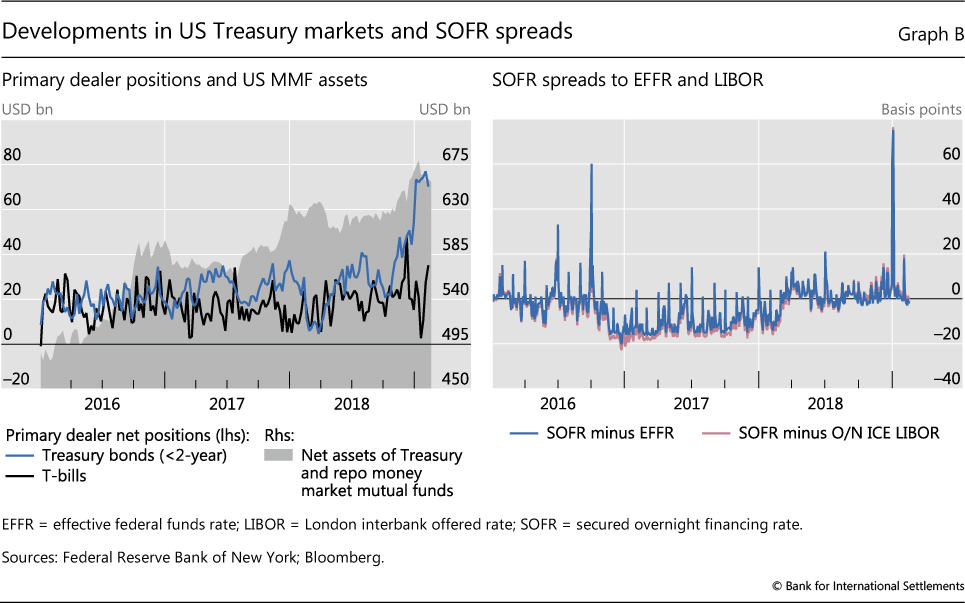

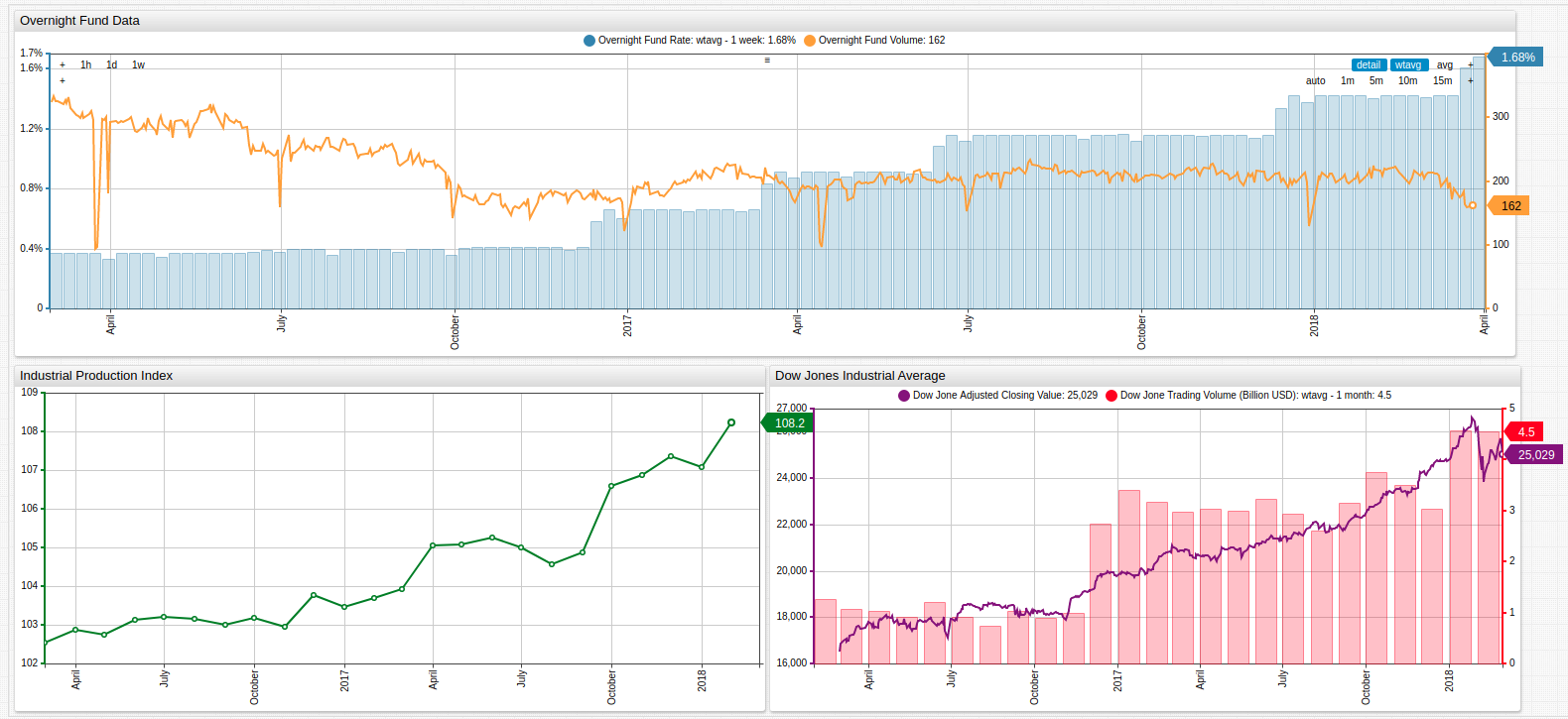

Effects of Changing Monetary and Regulatory Policy on Overnight

ics of key overnight funding markets. We find that the federal funds rate continued to provide an anchor albeit weaker |

|

LIBOR Countdown: Navigating the Transition

The Secured Overnight Financing Rate has gained momentum in the. U.S. as the successor to LIBOR rates. In June 2017 the Alternative. Reference Rates Committee |

|

First ECB public consultation on developing a euro unsecured

develop a euro unsecured overnight interest rate based on data already The interbank money market borrowing and lending rates5 for euro area banks. |

|

1 Determining the Overnight TIIE Funding Rate1 In order to obtain a

The Overnight TIIE Funding Rate is determined as a volume-weighted median of interest rates paid on Mexican peso denominated repo transactions mentioned in the |

|

Overnight Risk-Free Rates: A Users Guide

4 juin 2019 unsecured funding markets from which some interbank offered rates (IBORs) are constructed. ... Secured Overnight Financing Rate (SOFR). |

|

RISK RATIONALIZATION OF OTC DERIVATIVES IN SOFR

24 mars 2022 Overnight Funding Rate) discounting switch and Libor cessation. Key rate Duration (KRD) or. Bucketed DV01 is a vital risk report that gives ... |

|

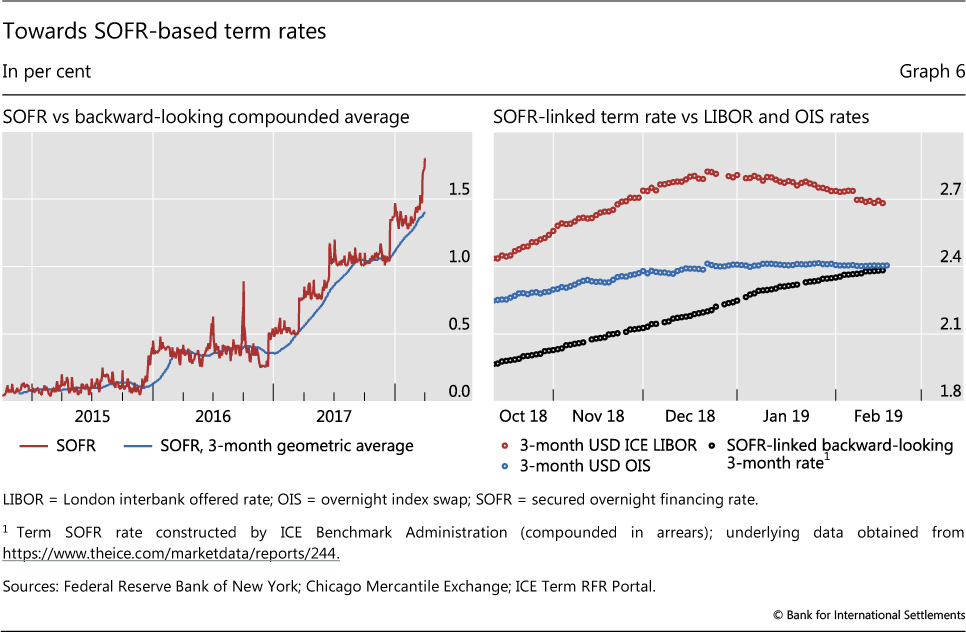

Inferring Term Rates from SOFR Futures Prices” Finance and

5 févr. 2019 Secured Overnight Financing Rate (SOFR) in financial contracts that ... federal funds futures with observed overnight rates and OIS rates ... |

|

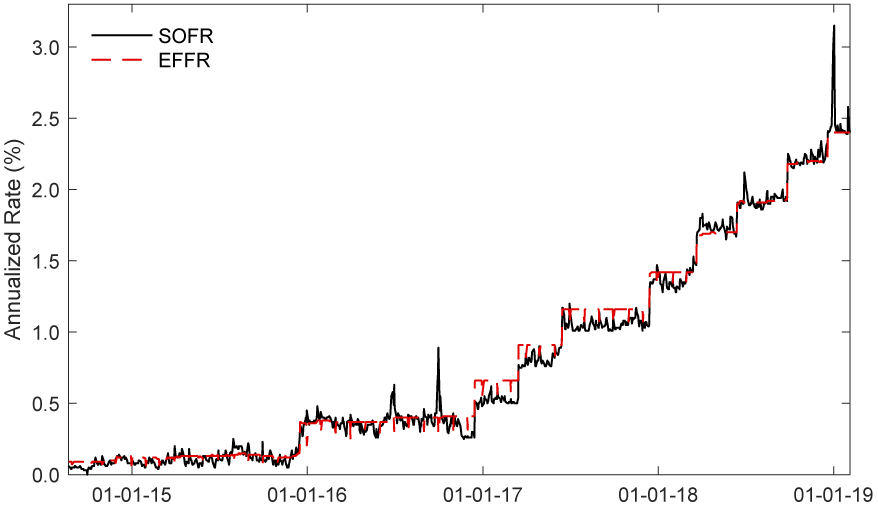

SOFR Explained - Federal Reserve Bank of New York

The Secured Overnight Financing Rate (SOFR) SOFR is based on overnight borrowing in the U S Treasury repo market The U S treasury repo market involves a wide set of financial firms including many asset managers and other buysidefirms not just banks As such SOFR represents the private sector risk-free rate |

|

The Dynamics of the US Overnight Triparty

process for the overnight segment which regularly provides over $1 trillion in daily funding Besides highlighting the relevance of the overnight segment within the greater U S repo market we present novel facts about how it behaves emphasizing the role that participants collateral and trading relationships play |

|

Bank of Canada Interest Rate 1935-2022 & 2022 Forecast - WOWAca

Nov 2 2017 · SOFR – Secured Overnight Financing Rate: BGCR + FICC-cleared bilateral repo In June 2017 the ARRC identified the SOFR as its preferred alternative to USD LIBOR The SOFR is the broadest of the three repo rates and will begin publication in the first half of 2018 Current expectations are for publication to begin in Q2 |

|

BlackRock’s Guide to LIBOR Transition

US Dollar Secured Overnight Financing Rate (SOFR) Repo-based index to reflect overnight funding rates (calculated as volume-weighted median based on tri-party repo data from Bank of New York Mellon and general collateral financing repo data from DTCC) NY Fed began publishing the overnight rate in April 2018 and SOFR Averages and Index in March |

|

Secured Overnight Funding Rate (SOFR) Webinar Presentation

Secured Overnight Financing Rate (SOFR) - Endorsed to Federal Reserve by ARRC June 22 1 - Based on overnight repurchase agreement (repo) transactions on US Treasury securities (Treasury repo) Publishers - FRBNY in cooperation with US Office of Financial Research (OFR) Publication Schedule - Daily |

|

Searches related to overnight funding rate filetype:pdf

bank funding rate with both overnight and term rates of up to 12 months available There are two major differences between SOFR and USD LIBOR that make the transition to SOFR challenging First SOFR is an overnight rate and LIBOR is published for seven tenors of forward-looking term rates |

What is the overnight interest rate?

- The Target Overnight Rate will increase by 0.25 percentage points to 0.50%. CPI inflation of 5.1% is at a 30-year high not seen since 1991, and remains well above the Bank of Canada’s 2% target. It’s widely expected that interest rates will climb an additional 100 basis points to 1.25% by the end of the year.

What is overnight money market rate?

- The overnight rate is the interest rate at which a depository institution (generally banks) lends or borrows funds with another depository institution in the overnight market. In many countries, the overnight rate is the interest rate the central bank sets to target monetary policy.

What is the daily fed funds rate?

- The fed funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight, on an uncollateralized basis. The Federal Open Market Committee (FOMC) meets eight times a year to determine the federal funds target rate. The current federal funds rate as of April 08, 2022 is 0.33%.

|

The Overnight Money Market; - Federal Reserve Bank of Chicago

Because of its very short maturity the price of a Treasury bill is hardly exposed to interest rate fluctuations Therefore, it can be liquidated early with little interest rate |

|

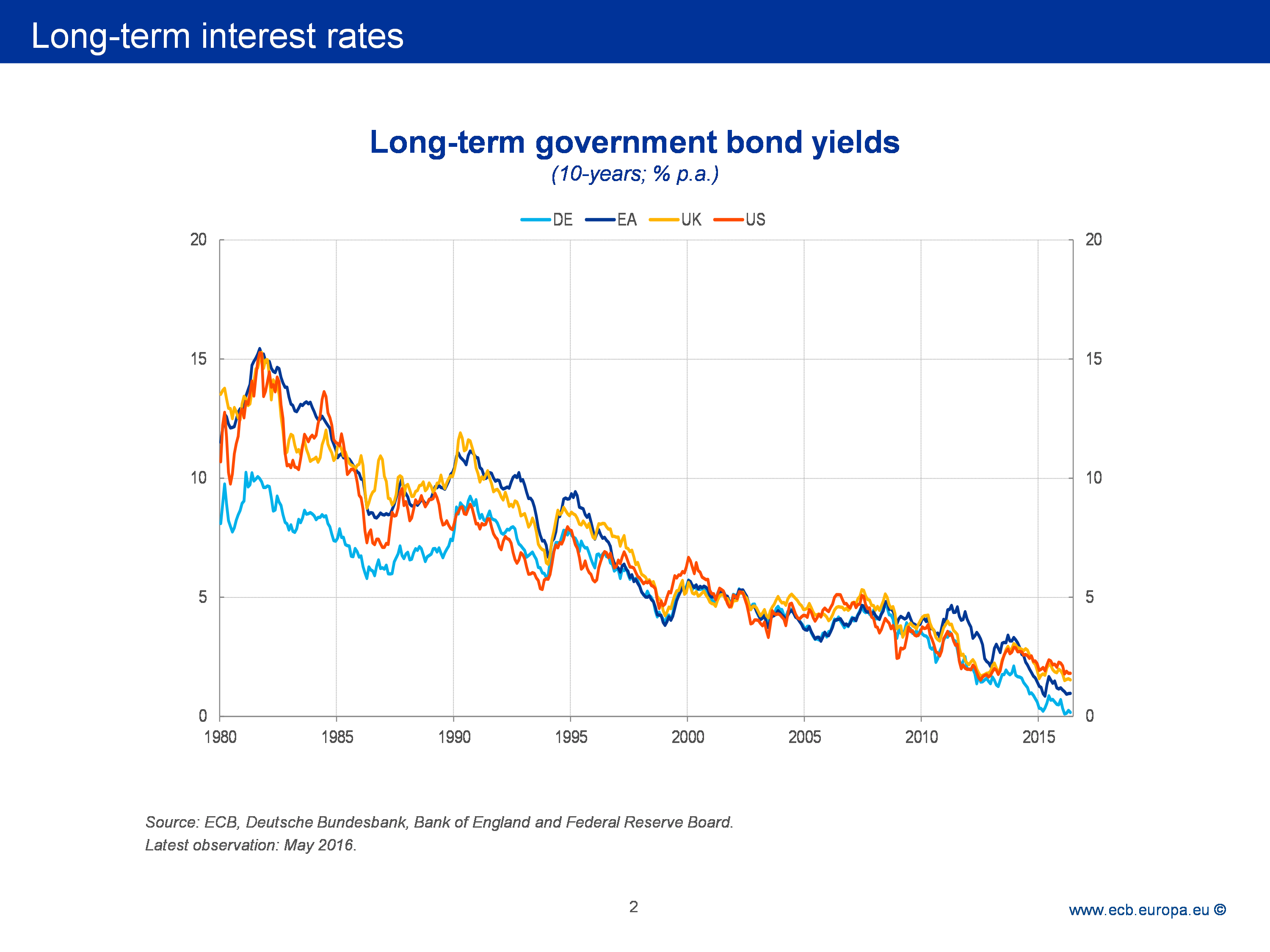

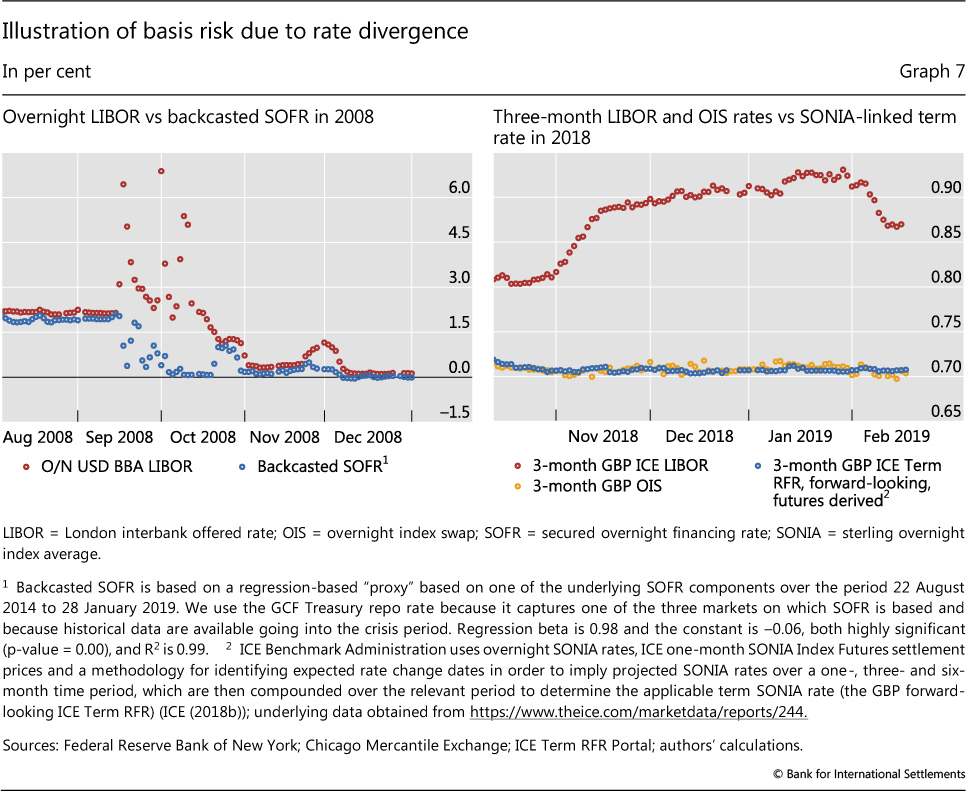

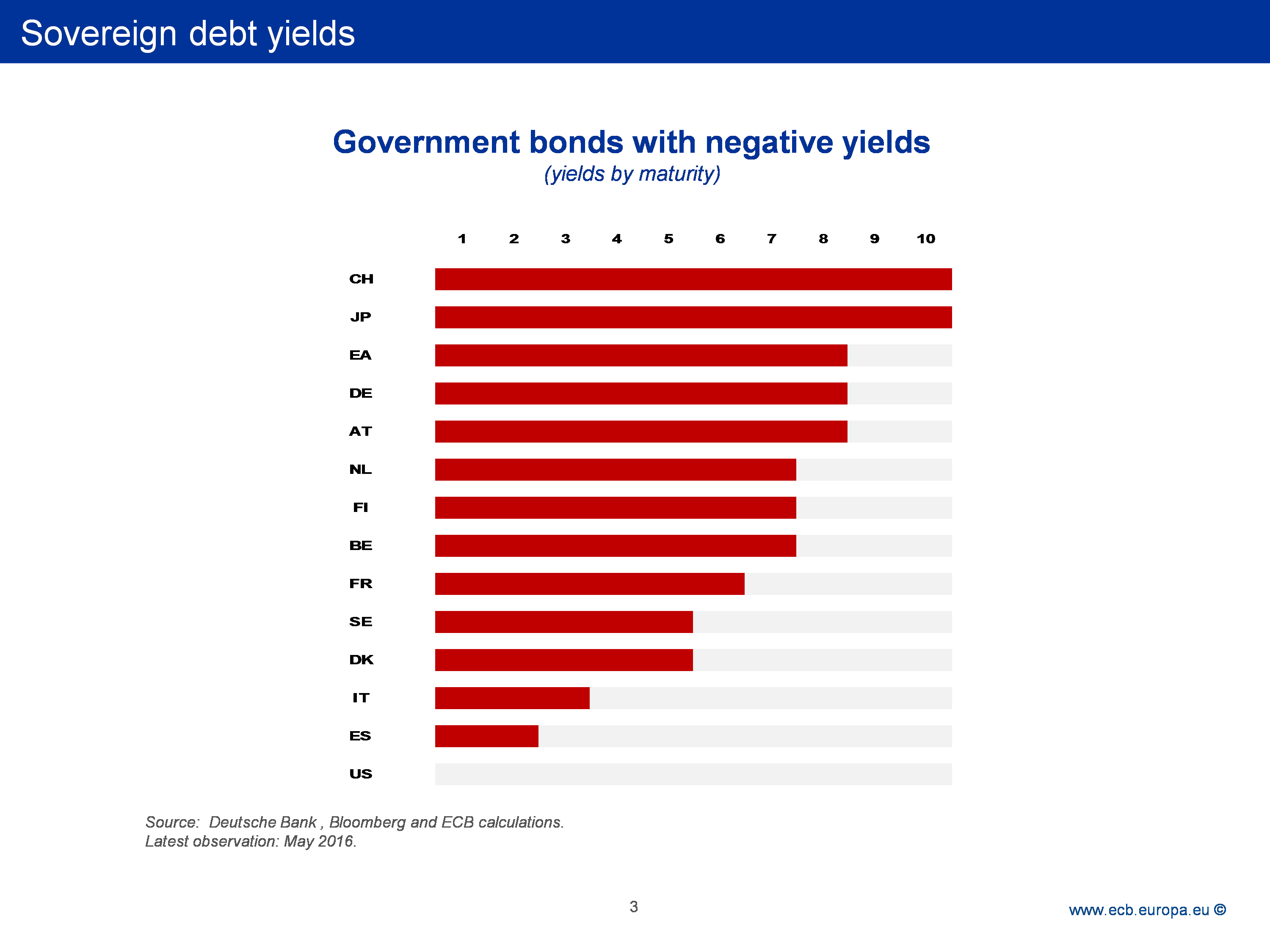

Beyond LIBOR: a primer on the new benchmark rates - Bank for

credible overnight reference rates rooted in transactions in liquid markets, they do so at the expense of not capturing banks' marginal term funding costs Hence |

|

More corprorates are using Ameribor, a Libor replacement

Ameribor users cite its cheaper costs relative to SOFR, the Secured Overnight Funding Rate created specifically to replace the London Interbank Offered Rate, |

|

The determinants of the overnight interest rate in the euro area - CORE

Therefore, understanding better the behavior of the short end of the yield curve - the overnight rate - helps explaining other interest rates further out the term |

|

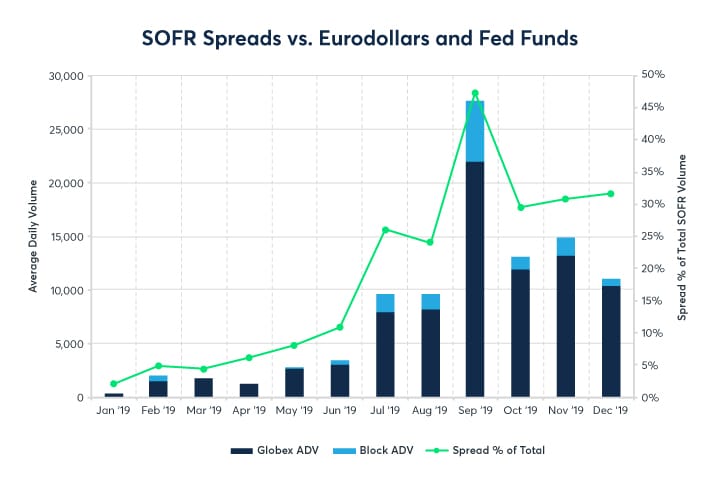

Dynamics of SOFR vs Fed Funds - Sydney Banking and Financial

Fed Funds rate and the associated term rates implied by overnight index swaps ( OIS) Thus one would expect a spread between LIBOR and SOFR based term |

|

Interest Rate Corridor, Liquidity Management and the Overnight

As a result, the spread between the Borsa Istanbul overnight repo interest rate and the CBRT average funding rate (overnight spread) has become wider |

|

Summer SOFR Series SOFR Explained - Federal Reserve Bank of

7 août 2020 · Overnight Financing Rate (SOFR) Overnight Bank Funding Rate Effective Federal Funds Rate 3-month T- bills 3-month GSIB wholesale |

|

Surecomp Product Management August 2020 Planning for the

The Federal Reserve Bank of New York began publishing the SOFR , Secured Overnight Funding Rate, in April 2018 as part of an effort to replace LIBOR It is |

|

LIBOR Transition: Global Interest Rate Benchmark Reform - Deloitte

ARRs available have focused on risk free rate or near risk free rates based on transactions of overnight funding (See Figure 2) Transition challenges The Market |

|

What is the Alternative Reference Rates Committee FAQs - SECgov

On June 22, 2017, the ARRC identified the Secured Overnight Financing Rate ( SOFR), as its recommended alternative to USD LIBOR The ARRC considered a |