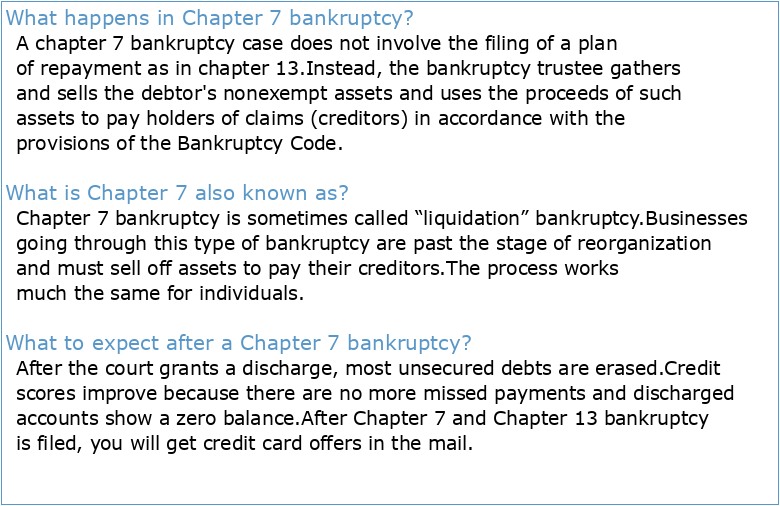

What happens in Chapter 7 bankruptcy?

A chapter 7 bankruptcy case does not involve the filing of a plan of repayment as in chapter 13.

Instead, the bankruptcy trustee gathers and sells the debtor's nonexempt assets and uses the proceeds of such assets to pay holders of claims (creditors) in accordance with the provisions of the Bankruptcy Code.What is Chapter 7 also known as?

Chapter 7 bankruptcy is sometimes called “liquidation” bankruptcy.

Businesses going through this type of bankruptcy are past the stage of reorganization and must sell off assets to pay their creditors.

The process works much the same for individuals.What to expect after a Chapter 7 bankruptcy?

After the court grants a discharge, most unsecured debts are erased.

Credit scores improve because there are no more missed payments and discharged accounts show a zero balance.

After Chapter 7 and Chapter 13 bankruptcy is filed, you will get credit card offers in the mail.- Chapter 11 is the chapter used by large businesses to reorganize their debts and continue operating.

Corporations, partnerships, and limited liability companies cannot use chapter 13 to reorganize and must cease business operations if a chapter 7 bankruptcy is filed.

CHAPTER 7 PETITION PACKAGE

A termes entomologiques

Exercice 2 (spécialité)

POL-1006 : Administration publique

POLITIQUE PUBLIQUE ET MANAGEMENT PUBLIC DE

Business Bankruptcy: Executive Summary

Consequences of Converting a Bankruptcy Case

CHARGEE DE COMMUNICATION SECTEUR CULTUREL

CHARGÉ DE COMMUNICATION PATRIMOINE ET MUSÉES (H/F)