Pub 25 Utah Sales and Use Tax General Information

Purchase price and sales price include: • the seller's cost of the tangible personal property products transferred electronically or services;.

Problems on marginal costing 1The following data is given: Fixed

Salma Banu department of Commerce and Management

ACC 102- CHAPTER 1

Sales variable expenses and contribution margin are all variable

Publication 25 Auto Repair Garages and Service Stations

The taxable selling price of the part should include the cost of the labor Many auto repair shops treat the sale of reconditioned and rebuilt parts just ...

2022 Back-to-School Sales Tax Holiday – July 25 2022 Through

6 mai 2022 This sales tax holiday begins on Monday July 25

Revisionary Test Paper_Intermediate_Syllabus 2012_Dec2013

The selling price and variable cost per unit are independent of each other. The specific fixed cost relating to this product is ` 20000. How much will be

MONTHLY NEW RESIDENTIAL SALES JULY 2022

23 août 2022 The median sales price of new houses sold in July 2022 was $439400. The average sales price was $546

Paper 8- Cost Accounting

DoS The Institute of Cost Accountants of India (Statutory Body under an Act of 25. 20. 15. Total fixed selling expenses are 10% of total cost of sales ...

National Dairy Products Sales Report

il y a 6 jours Butter prices received for 25-kilogram and 68-pound boxes meeting United States Department of Agriculture (USDA). Grade AA standards averaged ...

Fixed cost =?12000 Selling price =?12 per unit Variable cost

Fathima Zehra department of Commerce and Management

90_2TIP_22A01_08.pdf

90_2TIP_22A01_08.pdf Tax Information Publication - 2022 Back-to-School Sales Tax Holiday, Page 1Tax Information Publication

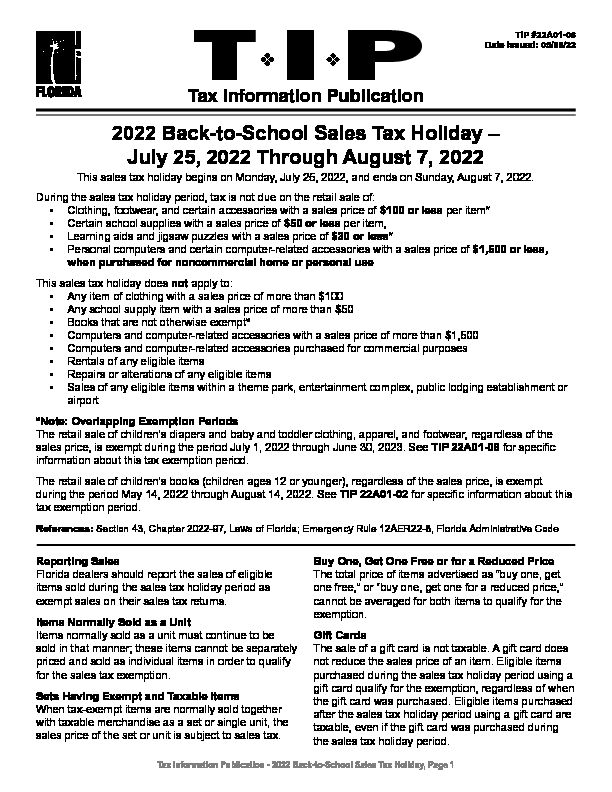

TIP #22A01-08

Date Issued: 05/06/22

2022 Back-to-School Sales Tax Holiday -

July 25, 2022 Through August 7, 2022

This sales tax holiday begins on Monday, July 25, 2022, and ends on Sunday, August 7, 2022. During the sales tax holiday period, tax is not due on the retail sale o f: Clothing, footwear, and certain accessories with a sales price of $100 or less per item* Certain school supplies with a sales price of $50 or less per item, Learning aids and jigsaw puzzles with a sales price of $30 or less* Personal computers and certain computer-related accessories with a sales price of $1,500 or less, en-USwhen purchased for noncommercial home or personal useThis sales tax holiday does not apply to:

Any item of clothing with a sales price of more than $100 Any school supply item with a sales price of more than $50 Books that are not otherwise exempt* Computers and computer-related accessories with a sales price of more th an $1,500 Computers and computer-related accessories purchased for commercial purp oses Rentals of any eligible items Repairs or alterations of any eligible items Sales of any eligible items within a theme park, entertainment complex, public lodging establishment or airport *Note: Overlapping Exemption PeriodsThe retail sale of children's diapers and baby and toddler clothing, apparel, and footwear, regardless of the

sales price, is exempt during the period July 1, 2022 through June 30, 2