Present Value Table

Present Value Table

Present value of an annuity of 1 i.e.. 1 − (1 + r)-". Where r = discount rate n = number of periods. Annuity Table. Discount rate (r). Periods. (n). 1%. 2%. 3%.

F9 formulae sheet and maths tables

F9 formulae sheet and maths tables

Annuity Table. Present value of an annuity of 1 i.e.. Where r = discount rate n = number of periods. Discount rate (r). Periods. (n). 1%. 2%. 3%. 4%. 5%. 6%. 7%.

Present value and Future value tables Table 1 - KnowledgEquity

Present value and Future value tables Table 1 - KnowledgEquity

Table 4 - Present value interest factors for an annuity. Formula: PV = [1 - 1/(1 + k)^n] / k. Period. (n) / per cent (k). 1%. 2%. 3%. 4%. 5%. 6%. 7%. 8%. 9%. 10

This table shows the present value of $1 at various interest rates ( i

This table shows the present value of $1 at various interest rates ( i

It is used to calculate the present value of any single amount. Page 2. TABLE 4 Present Value of an Ordinary Annuity of $1. PVA i n/i 1.0%. 1.5%. 2.0%. 2.5%.

Tables of the Present Value of a Life-Annuity at Any Age According

Tables of the Present Value of a Life-Annuity at Any Age According

IV. Tables of the present Value of a Life-Annuity at any Age accord ing to Dr. WiggleswortK s Bill of Mortality. BY J. INGERSOLL BOWDITCH. The Table

PRESENT VALUE TABLES

PRESENT VALUE TABLES

Table of Present Value Annuity Factor. Number of periods. 1%. 2%. 3%. 4%. 5%. 6%. 7%. 8%. 9%. 10%. 1. 0.9901. 0.9804. 0.9709. 0.9615. 0.9524. 0.9434. 0.9346.

TABLE II.A. Present value of reversions and annuities-certain upon a

TABLE II.A. Present value of reversions and annuities-certain upon a

Present worth of an annuity of one dollar payable at the end of each year for a certain number of years. ①. ②. ③. 0.005. Reversion. Annuity. 1. 0.995025.

− =√ =√ ̅ = ̅ = σ = √ σ = √ − ( )

− =√ =√ ̅ = ̅ = σ = √ σ = √ − ( )

Annuity Table. Present value of an annuity of 1 i.e.. Where r = discount rate n = number of periods. 1 - (1 + r)-n r. Discount rate (r). Periods. (n). 1%. 2%. 3

2023 Nevada Workers Compensation Actuarial Table and Notice of

2023 Nevada Workers Compensation Actuarial Table and Notice of

01-Jul-2022 495(6). /. NOTICE OF ADOPTION OF ACTUARIAL ANNUITY TABLE. The Division of Industrial Relations of the Department of Business and ...

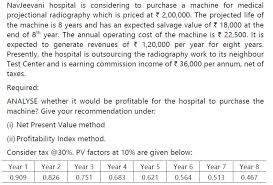

VIRTUAL COACHING CLASSES INTERMEDIATE LEVEL PAPER

VIRTUAL COACHING CLASSES INTERMEDIATE LEVEL PAPER

31-Jan-2022 Net Present Value = Present Value of (net) Cash Inflows ... Looking at 4 in annuity table for 6 years we see that it lies between 2 values.

PRESENT VALUE TABLE - ) n

PRESENT VALUE TABLE - ) n

PRESENT VALUE TABLE. Present value of $1 that is ( where r = interest rate; n = number of periods until payment or receipt. )

PRESENT VALUE TABLE - ) n

PRESENT VALUE TABLE - ) n

PRESENT VALUE TABLE. Present value of $1 that is ( where r = interest rate; n = number of periods until payment or receipt. )

F9 formulae sheet and maths tables

F9 formulae sheet and maths tables

Annuity Table. Present value of an annuity of 1 i.e.. Where r = discount rate n = number of periods. Discount rate (r). Periods.

Present value and Future value tables Table 1 - KnowledgEquity

Present value and Future value tables Table 1 - KnowledgEquity

Present value and Future value tables. Visit KnowledgEquity.com.au for Table 2 - Future value interest factors for an annuity. Formula: FV = [(1 + k)^n ...

Present Value and Future Value Tables

Present Value and Future Value Tables

Present Value and Future Value Tables Table A-2 Future Value Interest Factors for a One-Dollar Annuity Compouned at k Percent for n Periods: FVIFA kn ...

Present Value Factor for an Ordinary Annuity - (Interest rate = r

Present Value Factor for an Ordinary Annuity - (Interest rate = r

Present Value Factor for an Ordinary Annuity. (Interest rate = r Number of periods = n) n r. 1%. 2%. 3%. 4%. 5%. 6%. 7%. 8%. 9%. 10%. 11%. 12%. 13%. 14%.

cima - cumulative present value table

cima - cumulative present value table

CUMULATIVE PRESENT VALUE TABLE. Cumulative present value of $1 per annum Receivable or Payable at the end of each year for n.

This table shows the present value of $1 at various interest rates ( i

This table shows the present value of $1 at various interest rates ( i

It is used to calculate the present value of any single amount. Page 2. TABLE 4 Present Value of an Ordinary Annuity of $1. PVA.

Present value of 1 ie (1 + r)-n

Present value of 1 ie (1 + r)-n

Present Value Table. Present value of 1 i.e. (1 + r)-n. Where r = discount rate Annuity Table. 1- (1 + r)-n. Present value of an annuity of 1 i.e..

Financial Mathematics for Actuaries : Annuities

Financial Mathematics for Actuaries : Annuities

Solution: Table 2.1 summarizes the present values of the payments as well as their total. Table 2.1: Present value of annuity. Year Payment ($).

PRESENT VALUE TABLES - Texas A&M University-Commerce

PRESENT VALUE TABLES - Texas A&M University-Commerce

Table of Present Value Annuity Factor Number of periods 1 2 3 4 5 6 7 8 9 10 1 0 9901 0 9804 0 9709 0 9615 0 9524 0 9434 0 9346 0 9259 0 9174 0 9091

Formulae Sheet - ACCA Global

Formulae Sheet - ACCA Global

Annuity Table Present value of an annuity of 1 i e Where r = discount rate n = number of periods 1 - (1 + r)-n r Discount rate (r) Periods

Present Value Annuity Tables Formula: PV = [1- 1 / (1 + i)n] / i

Present Value Annuity Tables Formula: PV = [1- 1 / (1 + i)n] / i

Present Value Annuity Tables Formula: PV = [1- 1 / (1 + i)n ] / i n / i 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 1 0 9901 0 9804 0 9709 0 9615 0 9524 0 9434

PRESENT VALUE OF AN ANNUITY - Texas State University

PRESENT VALUE OF AN ANNUITY - Texas State University

PRESENT VALUE OF AN ANNUITY DEFINITIONS: Present value of an annuity: lump sum amount that equals the value now of a set of equal periodic payments to be paid in the future Formulas and Examples: PV = (PMT)K where Example: Find the present value of an annuity with periodic payments of $2000

Searches related to present value annuity table filetype:pdf

Searches related to present value annuity table filetype:pdf

May 28 2020 · These Present Value Factors apply to the following: Computations of alternative annuities FERCCA actuarial reductions and actuarial reductions applied to CSRS annuities for the purpose of paying redeposits for service ending before March 1 1991 if the commencing date of those annuities are on/after October 1 2019;

How do you use an annuity table to calculate present value?

- An annuity table is a tool that simplifies the calculation of the present value of an annuity. Also referred to as a “present value table,” an annuity table contains the present value interest factor of an annuity (PVIFA), which you then multiply by your recurring payment amount to get the present value of your annuity.

What is the purpose of present value annuity tables?

- The purpose of the present value annuity tables is to make it possible to carry out annuity calculations without the use of a financial calculator. They provide the value now of 1 received at the end of each period for n periods at a discount rate of i%.

What is the formula for calculating the present value of an ordinary annuity?

- The formula for calculating the present value of an ordinary annuity is: P = The present value of the annuity stream to be paid in the future

How can I calculate the future value of an annuity due?

- One can also determine the future value of a series of investments using the respective annuity table. For example, the annuity table can be used to determine the present value of the annuity that is expected to make eight payments of $15,000 at a 6% interest rate, as well as the value of the payments on of a future date.

[PDF] present value of annuity due table

[PDF] present value table

[PDF] present value table pdf

[PDF] presentation about yourself ideas

[PDF] presentation assignment sheet

[PDF] presentation assignment template

[PDF] presentation on environment ppt

[PDF] preserving indigenous languages

[PDF] président macron allocution

[PDF] president of anytime fitness

[PDF] president's budget 2020

[PDF] presidential commission on the space shuttle challenger accident pdf

[PDF] presidential election essay

[PDF] presidents day 2020 nc