Present Value Table

Present Value Table

Present value of an annuity of 1 i.e.. 1 − (1 + r)-". Where r = discount rate n = number of periods. Annuity Table. Discount rate (r). Periods. (n). 1%. 2%. 3%.

F9 formulae sheet and maths tables

F9 formulae sheet and maths tables

Annuity Table. Present value of an annuity of 1 i.e.. Where r = discount rate n = number of periods. Discount rate (r). Periods. (n). 1%. 2%. 3%. 4%. 5%. 6%. 7%.

Present value and Future value tables Table 1 - KnowledgEquity

Present value and Future value tables Table 1 - KnowledgEquity

Table 4 - Present value interest factors for an annuity. Formula: PV = [1 - 1/(1 + k)^n] / k. Period. (n) / per cent (k). 1%. 2%. 3%. 4%. 5%. 6%. 7%. 8%. 9%. 10

This table shows the present value of $1 at various interest rates ( i

This table shows the present value of $1 at various interest rates ( i

It is used to calculate the present value of any single amount. Page 2. TABLE 4 Present Value of an Ordinary Annuity of $1. PVA i n/i 1.0%. 1.5%. 2.0%. 2.5%.

Tables of the Present Value of a Life-Annuity at Any Age According

Tables of the Present Value of a Life-Annuity at Any Age According

IV. Tables of the present Value of a Life-Annuity at any Age accord ing to Dr. WiggleswortK s Bill of Mortality. BY J. INGERSOLL BOWDITCH. The Table

PRESENT VALUE TABLES

PRESENT VALUE TABLES

Table of Present Value Annuity Factor. Number of periods. 1%. 2%. 3%. 4%. 5%. 6%. 7%. 8%. 9%. 10%. 1. 0.9901. 0.9804. 0.9709. 0.9615. 0.9524. 0.9434. 0.9346.

TABLE II.A. Present value of reversions and annuities-certain upon a

TABLE II.A. Present value of reversions and annuities-certain upon a

Present worth of an annuity of one dollar payable at the end of each year for a certain number of years. ①. ②. ③. 0.005. Reversion. Annuity. 1. 0.995025.

− =√ =√ ̅ = ̅ = σ = √ σ = √ − ( )

− =√ =√ ̅ = ̅ = σ = √ σ = √ − ( )

Annuity Table. Present value of an annuity of 1 i.e.. Where r = discount rate n = number of periods. 1 - (1 + r)-n r. Discount rate (r). Periods. (n). 1%. 2%. 3

2023 Nevada Workers Compensation Actuarial Table and Notice of

2023 Nevada Workers Compensation Actuarial Table and Notice of

01-Jul-2022 495(6). /. NOTICE OF ADOPTION OF ACTUARIAL ANNUITY TABLE. The Division of Industrial Relations of the Department of Business and ...

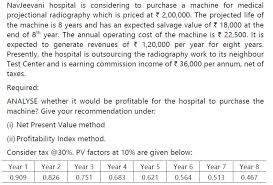

VIRTUAL COACHING CLASSES INTERMEDIATE LEVEL PAPER

VIRTUAL COACHING CLASSES INTERMEDIATE LEVEL PAPER

31-Jan-2022 Net Present Value = Present Value of (net) Cash Inflows ... Looking at 4 in annuity table for 6 years we see that it lies between 2 values.

PRESENT VALUE TABLE - ) n

PRESENT VALUE TABLE - ) n

PRESENT VALUE TABLE. Present value of $1 that is ( where r = interest rate; n = number of periods until payment or receipt. )

PRESENT VALUE TABLE - ) n

PRESENT VALUE TABLE - ) n

PRESENT VALUE TABLE. Present value of $1 that is ( where r = interest rate; n = number of periods until payment or receipt. )

F9 formulae sheet and maths tables

F9 formulae sheet and maths tables

Annuity Table. Present value of an annuity of 1 i.e.. Where r = discount rate n = number of periods. Discount rate (r). Periods.

Present value and Future value tables Table 1 - KnowledgEquity

Present value and Future value tables Table 1 - KnowledgEquity

Present value and Future value tables. Visit KnowledgEquity.com.au for Table 2 - Future value interest factors for an annuity. Formula: FV = [(1 + k)^n ...

Present Value and Future Value Tables

Present Value and Future Value Tables

Present Value and Future Value Tables Table A-2 Future Value Interest Factors for a One-Dollar Annuity Compouned at k Percent for n Periods: FVIFA kn ...

Present Value Factor for an Ordinary Annuity - (Interest rate = r

Present Value Factor for an Ordinary Annuity - (Interest rate = r

Present Value Factor for an Ordinary Annuity. (Interest rate = r Number of periods = n) n r. 1%. 2%. 3%. 4%. 5%. 6%. 7%. 8%. 9%. 10%. 11%. 12%. 13%. 14%.

cima - cumulative present value table

cima - cumulative present value table

CUMULATIVE PRESENT VALUE TABLE. Cumulative present value of $1 per annum Receivable or Payable at the end of each year for n.

This table shows the present value of $1 at various interest rates ( i

This table shows the present value of $1 at various interest rates ( i

It is used to calculate the present value of any single amount. Page 2. TABLE 4 Present Value of an Ordinary Annuity of $1. PVA.

Present value of 1 ie (1 + r)-n

Present value of 1 ie (1 + r)-n

Present Value Table. Present value of 1 i.e. (1 + r)-n. Where r = discount rate Annuity Table. 1- (1 + r)-n. Present value of an annuity of 1 i.e..

Financial Mathematics for Actuaries : Annuities

Financial Mathematics for Actuaries : Annuities

Solution: Table 2.1 summarizes the present values of the payments as well as their total. Table 2.1: Present value of annuity. Year Payment ($).

PRESENT VALUE TABLES - Texas A&M University-Commerce

PRESENT VALUE TABLES - Texas A&M University-Commerce

Table of Present Value Annuity Factor Number of periods 1 2 3 4 5 6 7 8 9 10 1 0 9901 0 9804 0 9709 0 9615 0 9524 0 9434 0 9346 0 9259 0 9174 0 9091

Formulae Sheet - ACCA Global

Formulae Sheet - ACCA Global

Annuity Table Present value of an annuity of 1 i e Where r = discount rate n = number of periods 1 - (1 + r)-n r Discount rate (r) Periods

Present Value Annuity Tables Formula: PV = [1- 1 / (1 + i)n] / i

Present Value Annuity Tables Formula: PV = [1- 1 / (1 + i)n] / i

Present Value Annuity Tables Formula: PV = [1- 1 / (1 + i)n ] / i n / i 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 1 0 9901 0 9804 0 9709 0 9615 0 9524 0 9434

PRESENT VALUE OF AN ANNUITY - Texas State University

PRESENT VALUE OF AN ANNUITY - Texas State University

PRESENT VALUE OF AN ANNUITY DEFINITIONS: Present value of an annuity: lump sum amount that equals the value now of a set of equal periodic payments to be paid in the future Formulas and Examples: PV = (PMT)K where Example: Find the present value of an annuity with periodic payments of $2000

Searches related to present value annuity table filetype:pdf

Searches related to present value annuity table filetype:pdf

May 28 2020 · These Present Value Factors apply to the following: Computations of alternative annuities FERCCA actuarial reductions and actuarial reductions applied to CSRS annuities for the purpose of paying redeposits for service ending before March 1 1991 if the commencing date of those annuities are on/after October 1 2019;

How do you use an annuity table to calculate present value?

- An annuity table is a tool that simplifies the calculation of the present value of an annuity. Also referred to as a “present value table,” an annuity table contains the present value interest factor of an annuity (PVIFA), which you then multiply by your recurring payment amount to get the present value of your annuity.

What is the purpose of present value annuity tables?

- The purpose of the present value annuity tables is to make it possible to carry out annuity calculations without the use of a financial calculator. They provide the value now of 1 received at the end of each period for n periods at a discount rate of i%.

What is the formula for calculating the present value of an ordinary annuity?

- The formula for calculating the present value of an ordinary annuity is: P = The present value of the annuity stream to be paid in the future

How can I calculate the future value of an annuity due?

- One can also determine the future value of a series of investments using the respective annuity table. For example, the annuity table can be used to determine the present value of the annuity that is expected to make eight payments of $15,000 at a 6% interest rate, as well as the value of the payments on of a future date.

Present Value Table

Present value of 1 i.e. (1 +r)

Where r = discount raten = number of periods until paymentDiscount rate (r)

Periods

(n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%1 0Ġ990 0Ġ980 0Ġ971 0Ġ962 0Ġ952 0Ġ943 0Ġ935 0Ġ926 0Ġ917 0Ġ909 1

2 0Ġ980 0Ġ961 0Ġ943 0Ġ925 0Ġ907 0Ġ890 0Ġ873 0Ġ857 0Ġ842 0Ġ826 2

3 0Ġ971 0Ġ942 0Ġ915 0Ġ889 0Ġ864 0Ġ840 0Ġ816 0Ġ794 0Ġ772 0Ġ751 34 0Ġ961 0Ġ924 0Ġ888 0Ġ855 0Ġ823 0Ġ792 0Ġ763 0Ġ735 0Ġ708 0Ġ683 4

5 0Ġ951 0Ġ906 0Ġ863 0Ġ822 0Ġ784 0Ġ747 0Ġ713 0Ġ681 0Ġ650 0Ġ621 5

6 0Ġ942 0Ġ888 0Ġ837 0Ġ790 0Ġ746 0Ġ705 0Ġ666 0Ġ630 0Ġ596 0Ġ564 6

7 0Ġ933 0Ġ871 0Ġ813 0Ġ760 0Ġ711 0Ġ665 0Ġ623 0Ġ583 0Ġ547 0Ġ513 7

8 0Ġ923 0Ġ853 0Ġ789 0Ġ731 0Ġ677 0Ġ627 0Ġ582 0Ġ540 0Ġ502 0Ġ467 89 0Ġ914 0Ġ837 0Ġ766 0Ġ703 0Ġ645 0Ġ592 0Ġ544 0Ġ500 0Ġ460 0Ġ424 9

10 0Ġ905 0Ġ820 0Ġ744 0Ġ676 0Ġ614 0Ġ558 0Ġ508 0Ġ463 0Ġ422 0Ġ386 10

11 0Ġ896 0Ġ804 0Ġ722 0Ġ650 0Ġ585 0Ġ527 0Ġ475 0Ġ429 0Ġ388 0Ġ350 11

12 0Ġ887 0Ġ788 0Ġ701 0Ġ625 0Ġ557 0Ġ497 0Ġ444 0Ġ397 0Ġ356 0Ġ319 12

13 0Ġ879 0Ġ773 0Ġ681 0Ġ601 0Ġ530 0Ġ469 0Ġ415 0Ġ368 0Ġ326 0Ġ290 1314 0Ġ870 0Ġ758 0Ġ661 0Ġ577 0Ġ505 0Ġ442 0Ġ388 0Ġ340 0Ġ299 0Ġ263 14

15 0Ġ861 0Ġ743 0Ġ642 0Ġ555 0Ġ481 0Ġ417 0Ġ362 0Ġ315 0Ġ275 0Ġ239 15

(n) 11% 12% 13% 14% 15% 16% 17% 18% 19% 20%1 0Ġ901 0Ġ893 0Ġ885 0Ġ877 0Ġ870 0Ġ862 0Ġ855 0Ġ847 0Ġ840 0Ġ833 1

2 0Ġ812 0Ġ797 0Ġ783 0Ġ769 0Ġ756 0Ġ743 0Ġ731 0Ġ718 0Ġ706 0Ġ694 23 0Ġ731 0Ġ712 0Ġ693 0Ġ675 0Ġ658 0Ġ641 0Ġ624 0Ġ609 0Ġ593 0Ġ579 3

4 0Ġ659 0Ġ636 0Ġ613 0Ġ592 0Ġ572 0Ġ552 0Ġ534 0Ġ516 0Ġ499 0Ġ482 4

5 0Ġ593 0Ġ567 0Ġ543 0Ġ519 0Ġ497 0Ġ476 0Ġ456 0Ġ437 0Ġ419 0Ġ402 5

6 0Ġ535 0Ġ507 0Ġ480 0Ġ456 0Ġ432 0Ġ410 0Ġ390 0Ġ370 0Ġ352 0Ġ335 6

7 0Ġ482 0Ġ452 0Ġ425 0Ġ400 0Ġ376 0Ġ354 0Ġ333 0Ġ314 0Ġ296 0Ġ279 78 0Ġ434 0Ġ404 0Ġ376 0Ġ351 0Ġ327 0Ġ305 0Ġ285 0Ġ266 0Ġ249 0Ġ233 8

9 0Ġ391 0Ġ361 0Ġ333 0Ġ308 0Ġ284 0Ġ263 0Ġ243 0Ġ225 0Ġ209 0Ġ194 9

10 0Ġ352 0Ġ322 0Ġ295 0Ġ270 0Ġ247 0Ġ227 0Ġ208 0Ġ191 0Ġ176 0Ġ162 10

11 0Ġ317 0Ġ287 0Ġ261 0Ġ237 0Ġ215 0Ġ195 0Ġ178 0Ġ162 0Ġ148 0Ġ135 11

12 0Ġ286 0Ġ257 0Ġ231 0Ġ208 0Ġ187 0Ġ168 0Ġ152 0Ġ137 0Ġ124 0Ġ112 1213 0Ġ258 0Ġ229 0Ġ204 0Ġ182 0Ġ163 0Ġ145 0Ġ130 0Ġ116 0Ġ104 0Ġ093 13

14 0Ġ232 0Ġ205 0Ġ181 0Ġ160 0Ġ141 0Ġ125 0Ġ111 0Ġ099 0Ġ088 0Ġ078 14

15 0Ġ209 0Ġ183 0Ġ160 0Ġ140 0Ġ123 0Ġ108 0Ġ095 0Ġ084 0Ġ074 0Ġ065 15

9Annuity Table

Present value of an annuity of 1 i.e.

Where r = discount rate

n = number of periodsDiscount rate (r)

Periods

(n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10%1 0Ġ990 0Ġ980 0Ġ971 0Ġ962 0Ġ952 0Ġ943 0Ġ935 0Ġ926 0Ġ917 0Ġ909 1

2 1Ġ970 1Ġ942 1Ġ913 1Ġ886 1Ġ859 1Ġ833 1Ġ808 1Ġ783 1Ġ759 1Ġ736 2

3 2Ġ941 2Ġ884 2Ġ829 2Ġ775 2Ġ723 2Ġ673 2Ġ624 2Ġ577 2Ġ531 2Ġ487 3

4 3Ġ902 3Ġ808 3Ġ717 3Ġ630 3Ġ546 3Ġ465 3Ġ387 3Ġ312 3Ġ240 3Ġ170 4

5 4Ġ853 4Ġ713 4Ġ580 4Ġ452 4Ġ329 4Ġ212 4Ġ100 3Ġ993 3Ġ890 3Ġ791 5

6 5Ġ795 5Ġ601 5Ġ417 5Ġ242 5Ġ076 4Ġ917 4Ġ767 4Ġ623 4Ġ486 4Ġ355 6

7 6Ġ728 6Ġ472 6Ġ230 6Ġ002 5Ġ786 5Ġ582 5Ġ389 5Ġ206 5Ġ033 4Ġ868 7

8 7Ġ652 7Ġ325 7Ġ020 6Ġ733 6Ġ463 6Ġ210 5Ġ971 5Ġ747 5Ġ535 5Ġ335 8

9 8Ġ566 8Ġ162 7Ġ786 7Ġ435 7Ġ108 6Ġ802 6Ġ515 6Ġ247 5Ġ995 5Ġ759 9

10 9Ġ471 8Ġ983 8Ġ530 8Ġ111 7Ġ722 7Ġ360 7Ġ024 6Ġ710 6Ġ418 6Ġ145 10

11 10Ġ37 9Ġ787 9Ġ253 8Ġ760 8Ġ306 7Ġ887 7Ġ499 7Ġ139 6Ġ805 6Ġ495 11

12 11Ġ26 10Ġ58 9Ġ954 9Ġ385 8Ġ863 8Ġ384 7Ġ943 7Ġ536 7Ġ161 6Ġ814 12

13 12Ġ13 11Ġ35 10Ġ63 9Ġ986 9Ġ394 8Ġ853 8Ġ358 7Ġ904 7Ġ487 7Ġ103 13

14 13Ġ00 12Ġ11 11Ġ30 10Ġ56 9Ġ899 9Ġ295 8Ġ745 8Ġ244 7Ġ786 7Ġ367 14

15 13Ġ87 12Ġ85 11Ġ94 11Ġ12 10Ġ38 9Ġ712 9Ġ108 8Ġ559 8Ġ061 7Ġ606 15

(n) 11% 12% 13% 14% 15% 16% 17% 18% 19% 20%1 0Ġ901 0Ġ893 0Ġ885 0Ġ877 0Ġ870 0Ġ862 0Ġ855 0Ġ847 0Ġ840 0Ġ833 1

2 1Ġ713 1Ġ690 1Ġ668 1Ġ647 1Ġ626 1Ġ605 1Ġ585 1Ġ566 1Ġ547 1Ġ528 2

3 2Ġ444 2Ġ402 2Ġ361 2Ġ322 2Ġ283 2Ġ246 2Ġ210 2Ġ174 2Ġ140 2Ġ106 3

4 3Ġ102 3Ġ037 2Ġ974 2Ġ914 2Ġ855 2Ġ798 2Ġ743 2Ġ690 2Ġ639 2Ġ589 4

5 3Ġ696 3Ġ605 3Ġ517 3Ġ433 3Ġ352 3Ġ274 3Ġ199 3Ġ127 3Ġ058 2Ġ991 5

6 4Ġ231 4Ġ111 3Ġ998 3Ġ889 3Ġ784 3Ġ685 3Ġ589 3Ġ498 3Ġ410 3Ġ326 6

7 4Ġ712 4Ġ564 4Ġ423 4Ġ288 4Ġ160 4Ġ039 3Ġ922 3Ġ812 3Ġ706 3Ġ605 7

8 5Ġ146 4Ġ968 4Ġ799 4Ġ639 4Ġ487 4Ġ344 4Ġ207 4Ġ078 3Ġ954 3Ġ837 8

9 5Ġ537 5Ġ328 5Ġ132 4Ġ946 4Ġ772 4Ġ607 4Ġ451 4Ġ303 4Ġ163 4Ġ031 9

10 5Ġ889 5Ġ650 5Ġ426 5Ġ216 5Ġ019 4Ġ833 4Ġ659 4Ġ494 4Ġ339 4Ġ192 10

11 6Ġ207 5Ġ938 5Ġ687 5Ġ453 5Ġ234 5Ġ029 4Ġ836 4Ġ656 4Ġ486 4Ġ327 11

12 6Ġ492 6Ġ194 5Ġ918 5Ġ660 5Ġ421 5Ġ197 4Ġ988 4Ġ793 4Ġ611 4Ġ439 12

13 6Ġ750 6Ġ424 6Ġ122 5Ġ842 5Ġ583 5Ġ342 5Ġ118 4Ġ910 4Ġ715 4Ġ533 13

14 6Ġ982 6Ġ628 6Ġ302 6Ġ002 5Ġ724 5Ġ468 5Ġ229 5Ġ008 4Ġ802 4Ġ611 14

15 7Ġ191 6Ġ811 6Ġ462 6Ġ142 5Ġ847 5Ġ575 5Ġ324 5Ġ092 4Ġ876 4Ġ675 15

rEnd of Question Paper

quotesdbs_dbs14.pdfusesText_20[PDF] present value of annuity due table

[PDF] present value table

[PDF] present value table pdf

[PDF] presentation about yourself ideas

[PDF] presentation assignment sheet

[PDF] presentation assignment template

[PDF] presentation on environment ppt

[PDF] preserving indigenous languages

[PDF] président macron allocution

[PDF] president of anytime fitness

[PDF] president's budget 2020

[PDF] presidential commission on the space shuttle challenger accident pdf

[PDF] presidential election essay

[PDF] presidents day 2020 nc