Home Buyers Plan (HBP) Request to Withdraw Funds from an RRSP

Home Buyers Plan (HBP) Request to Withdraw Funds from an RRSP

Home Buyers' Plan (HBP). Request to Withdraw Funds from an RRSP. Use this form to make a withdrawal from your registered retirement savings plan (RRSP) under

Home Buyers Plan (HBP) - Includes Form T1036

Home Buyers Plan (HBP) - Includes Form T1036

owned the home described on Form T1036 Home Buyers'. Plan (HBP) – Request to Withdraw Funds from an RRSP

Canada

Canada

To make an eligible withdrawal from your RRSPs under the HBP you have to use Form Tl036

Manulife

Manulife

Please ensure any appropriate transfer forms are attached. Your transfer information. What type of plan are the funds being transferred to? RRSP/LIRA. Annuity.

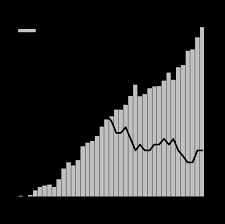

The Budget Plan 2009

The Budget Plan 2009

Jan 1 2009 The Home Buyers' Plan (HBP) allows first-time home buyers to withdraw ... withdraw up to $50

budget-2019-en.pdf

budget-2019-en.pdf

Mar 19 2019 The Canada Workers Benefit will help low- income workers take home more money ... plan to provide an additional. $1.39 billion over two years on a ...

RRSP Home Buyers Plan

RRSP Home Buyers Plan

withdraw up to $25000 from their RRSP tax-free. So

Home Buyers Plan (HBP) - Includes Form T1036

Home Buyers Plan (HBP) - Includes Form T1036

the HBP you have to use Form T1036

Budget Plan 1998

Budget Plan 1998

Feb 24 1998 The HBP allows first-time home buyers to withdraw up to $20

Moving from Canada to another Country

Moving from Canada to another Country

May 20 2010 A tax-free rollover of your RRSP/RRIF to a retirement plan in another country is not permitted. ... Home Buyer's Plan (HBP)/Life Long Learning ...

Home Buyers Plan (HBP) - Request to Withdraw Funds from an RRSP

Home Buyers Plan (HBP) - Request to Withdraw Funds from an RRSP

Home Buyers' Plan (HBP). Request to Withdraw Funds from an RRSP. Use this form to make a withdrawal from your registered retirement savings plan (RRSP)

Home Buyers Plan (HBP)

Home Buyers Plan (HBP)

10 févr. 2008 owned the home described on Form T1036 Home Buyers'. Plan (HBP) – Request to Withdraw Funds from an RRSP

Home Buyers Plan (HBP) - Includes Form T1036

Home Buyers Plan (HBP) - Includes Form T1036

Chapter 1 explains the Home Buyers' Plan and the Plan (HBP) Request to Withdraw Funds from an RRSP more ... she leaves Canada to live in France.

Manulife

Manulife

Please ensure any appropriate transfer forms are attached. Your transfer information. What type of plan are the funds being transferred to? RRSP/LIRA. Annuity.

Homebuyers Guide

Homebuyers Guide

The Home Buyers' Plan (HBP) allows first-time homebuyers or those who have not owned a home for at least 5 years to use funds from their RRSP. (registered

Home Buyers Plan (HBP)

Home Buyers Plan (HBP)

the HBP if you or your spouse or common-law partner owned the home described on Form T1036 Home Buyers'. Plan (HBP) Request to Withdraw Funds from an RRSP

OECD

OECD

sum withdrawal of their retirement savings may request that the portion training programs under the Home Buyers' Plan (HBP) and the Lifelong Learning ...

OECD

OECD

pension funds in stocks of Italian and/or European companies are tax free training programs

Financial incentives for funded private pension plans: OECD country

Financial incentives for funded private pension plans: OECD country

product (life annuity programmed withdrawal or lump sum) in most OECD countries. training programs

The tax treatment of funded private pension plans OECD AND EU

The tax treatment of funded private pension plans OECD AND EU

superannuation fund and be taxed at 49% or be withdrawn from However

[PDF] Home Care Ortschaft Telefon Mail Webseite

[PDF] Home cinema choice (Mai 2012) - Anciens Et Réunions

[PDF] Home cinema DVD Pioneer DCS - Dvrs Et Set-Top Boxes

[PDF] Home Cinema D`après l`académie de Limoges Passionné du 7ème

[PDF] Home Collection Collection Maison

[PDF] Home comfort inside and out.

[PDF] Home déco - Fée au clair de la lune - Anciens Et Réunions

[PDF] Home Designer Pro 10: TITLE - Anciens Et Réunions

[PDF] Home Education in Germany - Home Education in Deutschland - Anciens Et Réunions

[PDF] Home Electronics Protective Device HEPD80 Dispositivo de

[PDF] HOME ENTERTAINMENT Paket 2

[PDF] home features what`s new tutorials gallery downloads

[PDF] Home Find... Go To..

[PDF] Home Fire Safety Checklist