Observations définitives : Réseau de transport délectricité (RTE)

Observations définitives : Réseau de transport délectricité (RTE)

31 mars 2017 C'est en effet

Planification du reseau de transport delectricite et maitrise de la

Planification du reseau de transport delectricite et maitrise de la

RTE entité indépendante de EDF sur le plan de la gestion et du management

Valorisation des services système sur un réseau de transport d

Valorisation des services système sur un réseau de transport d

17 févr. 2009 VALORISATION DES SERVICES SYSTEME SUR UN RESEAU DE TRANSPORT D'ELECTRICITE EN. ENVIRONNEMENT CONCURRENTIEL. Soutenue le 5 février 2009 devant ...

RÈGLEMENT (UE) 2017/ 1485 DE LA COMMISSION - du 2 août

RÈGLEMENT (UE) 2017/ 1485 DE LA COMMISSION - du 2 août

25 août 2017 ... réseau de transport; h) contribuer à la gestion et au développement efficaces du réseau de transport de l'électricité et du secteur électrique.

Charte facture RTE

Charte facture RTE

6 avr. 2021 La facture doit être libellée au nom de « RTE - Réseau de transport d'électricité » et mentionner l'Adresse de facturation portée sur la ...

DIRECTIVE (UE) 2019/ 944 DU PARLEMENT EUROPÉEN ET DU

DIRECTIVE (UE) 2019/ 944 DU PARLEMENT EUROPÉEN ET DU

14 juin 2019 c) les achats ou ventes d'énergie nécessaires à l'exploitation du réseau de transport. 9. Le cadre chargé du respect des engagements s ...

Les reseaux de transport delectricite en Europe occidentale depuis

Les reseaux de transport delectricite en Europe occidentale depuis

2. Voir dans une perspective strictement française

Bilan électrique 2019 - RTE

Bilan électrique 2019 - RTE

L'électricité se stockant difficilement le réseau de transport doit assurer en permanence l'équilibre entre la production et la consommation. La fréquence du

Règlement (CE) No 714/2009 du Parlement européen et du Conseil

Règlement (CE) No 714/2009 du Parlement européen et du Conseil

13 juil. 2009 Ledit plan de développement du réseau devrait comporter des réseaux viables de transport d'électricité et les interconnexions régionales ...

Etude comparative des tarifs dutilisation des réseaux de distribution

Etude comparative des tarifs dutilisation des réseaux de distribution

22 juil. 2016 l'achat de pertes pour les réseaux de transport et de distribution d'électricité (bonus/malus selon l'atteinte de l'objectif fixé ex-ante) ...

Futurs énergétiques 2050

Futurs énergétiques 2050

Shaw. 27 1442 AH de la part de l'électricité

Futurs énergétiques 2050 - Principaux résultats

Futurs énergétiques 2050 - Principaux résultats

Rab. I 19 1443 AH Certains usages basculent plus rapidement ou fortement vers l'électricité. C'est particulièrement le cas dans le secteur des transports

DIRECTIVE (UE) 2019/ 944 DU PARLEMENT EUROPÉEN ET DU

DIRECTIVE (UE) 2019/ 944 DU PARLEMENT EUROPÉEN ET DU

Shaw. 11 1440 AH qui vendent leur électricité au réseau

RTE Réseau de transport délectricité

RTE Réseau de transport délectricité

SUPPLEMENT DATED 19 NOVEMBER 2021 TO THE BASE PROSPECTUS DATED 9 JULY 2021. RTE Réseau de transport d'électricité. Euro 12000

RÈGLEMENT (UE) 2017/ 1485 DE LA COMMISSION - du 2 août

RÈGLEMENT (UE) 2017/ 1485 DE LA COMMISSION - du 2 août

Dhu?l-H. 3 1438 AH échanges transfrontaliers d'électricité

Valorisation des services système sur un réseau de transport d

Valorisation des services système sur un réseau de transport d

Saf. 22 1430 AH La répartition des moyens de production d'énergie réactive (alternateurs

ATTESTATION PERMETTANT DE BENEFICIER DE LA

ATTESTATION PERMETTANT DE BENEFICIER DE LA

ATTESTATION PERMETTANT DE BENEFICIER DE LA REDUCTION SUR LE TARIF. D'UTILISATION DU RESEAU PUBLIC DE TRANSPORT D'ELECTRICITE PREVUE A. L'ARTICLE L. 341-4-2 DU

Arrêté fixant la méthodologie tarifaire pour le réseau de transport d

Arrêté fixant la méthodologie tarifaire pour le réseau de transport d

Shaw. 14 1439 AH La COMMISSION DE RÉGULATION DE L'ÉLECTRICITÉ ET DU GAZ (CREG) détermine ci-après sa méthodologie tarifaire adapté pour le réseau de ...

Tarification des injections sur les réseaux de transport délectricité

Tarification des injections sur les réseaux de transport délectricité

Jum. I 22 1436 AH réseaux de transport d'électricité. Analyse quantitative : Simulation

RÈGLEMENT (UE) 2019/ 943 DU PARLEMENT EUROPÉEN ET DU

RÈGLEMENT (UE) 2019/ 943 DU PARLEMENT EUROPÉEN ET DU

Shaw. 11 1440 AH marché intérieur de l'électricité a renforcé la concurrence

[PDF] Concepts et chiffres de lénergie : Le transport de lélectricité - Eduscol

[PDF] Concepts et chiffres de lénergie : Le transport de lélectricité - Eduscol

12 avr 2021 · Dans cette ressource nous proposons au lecteur les données concernant le réseau de transport et de distribution de l'électricité en France

[PDF] Gestion de lénergie sur le réseau de transport délectricité - Eduscol

[PDF] Gestion de lénergie sur le réseau de transport délectricité - Eduscol

Cette série d'exercices aborde plusieurs aspects des problèmes liés au transport et à la gestion de l'énergie électrique Ces exercices indépendants sont

(PDF) Réseaux et Transport dElectricité Cours - ResearchGate

(PDF) Réseaux et Transport dElectricité Cours - ResearchGate

PDF On Jul 2 2021 Sihem Bouri published Réseaux et Transport d'Electricité Cours Find read and cite all the research you need on ResearchGate

[PDF] RÉSEAUX DE TRANSPORT ET DE DISTRIBUTION ÉLECTRIQUE

[PDF] RÉSEAUX DE TRANSPORT ET DE DISTRIBUTION ÉLECTRIQUE

Ce cours de réseaux électriques UEF 13 est destiné aux étudiants en Master électrotechnique en parti- culier les étudiants en Master 1

[PDF] Production transport et distribution de lénergie électrique 1

[PDF] Production transport et distribution de lénergie électrique 1

Le réseau électrique est structuré en plusieurs niveaux de tension : Les réseaux de transport à très haute tension (THT) transportant l'énergie électrique

[PDF] [PDF] Un cours

[PDF] [PDF] Un cours

LE TRANSPORT ET LA DISTRIBUTION D'ENERGIE ELECTRIQUE: UN ENJEU cette énergie les réseaux de transport et de distribution d'énergie électrique

[PDF] Chapitre I Généralités sur les réseaux de transport d

[PDF] Chapitre I Généralités sur les réseaux de transport d

Une grande majorité des lignes de transport d'énergie électrique sont à courant alternatif fonctionnant à plusieurs valeurs de tension (10 kV à 800 kV) Les

[PDF] TRANSPORT ET DISTRIBUTION DE LÉLECTRICITÉ

[PDF] TRANSPORT ET DISTRIBUTION DE LÉLECTRICITÉ

Tout est possible depuis l'application distante Batissez votre réseau de postes HTA/BT sur le long terme 0 1 0

[PDF] Réseaux Electriques - CU-ELBAYADHDZ

[PDF] Réseaux Electriques - CU-ELBAYADHDZ

intermédiaires entre le réseau de transport et le réseau de distribution Ce sont des réseaux haute tension dont le rôle est de répartir l'énergie

RTE Réseau de transport d'électricité

Euro 12,000,000,000

Euro Medium Term Note Programme

This supplement (the "Supplement") is supplemental to, and should be read in conjunction with, the Base Prospectus dated 9 July 2021

(the "Base Prospectus") prepared in relation to the 12,000,000,000 Euro Medium Term Note Programme (the "Programme") of RTE

Réseau de transport d'électricité (the "Issuer"). The Base Prospectus as supplemented from time to time constitutes a base prospectus

for the purpose of Article 8 of the Regulation (EU) 2017/1129 as amended (the "Prospectus Regulation "). The Autorité des marchés financiers (the "AMF") has granted approval no. 21-308 on 9 July 2021 on the Base Prospectus.Application has been made for approval of this Supplement to the AMF in its capacity as competent authority under the Prospectus

Regulation. This Supplement constitutes a supplement to the Base Prospectus and has been prepared for the purposes of Article 23 of the Prospectus Regulation. The Base Prospectus (which includes, for the avoidance of doubt, this Supplement) constitutes a base

prospectus for the purposes of Article 8 of the Prospectus Regulation.This Supplement has been produced for the purposes of (i) amending the section relating to risk factors in connection with the issue of

Notes with a specific use of proceeds (i.e Green Bonds, as defined herein), (ii) updating the section intitled "Use of Proceeds" and (iii) updating the sub-section "Recent Developments".

Save as disclosed in this Supplement, there has been no other significant new factor, material mistake or inaccuracy relating to

information included in the Base Prospectus which is material in the context of the Programme since the publication of the Base

Prospectus. To the extent that there is any inconsistency between (a) any statement in this Supplement and (b) any other statement in, or incorporated by reference in, the Base Prospectus, the statements in this Supplement will prevail.

Unless the context otherwise requires, terms defined in the Base Prospectus shall have the same meaning when used in this Supplement.

Copies of this Supplement (a) may be obtained, free of charge, at the registered office of the Issuer during normal business hours, (b) will be available on the website of the Issuer (www.rte-france.com), (c) will be available on the website of the AMF (www.amf-

france.org) and (d) will be available during usual business hours on any weekday (Saturdays, Sundays and public holidays excepted)

for collection at the offices of the Fiscal Agent so long as any of the Notes are outstanding.CONTENTS

IMPORTANT INFORMATION 1

RISK FACTORS 2

USE OF PROCEEDS 3

RECENT DEVELOPMENTS 4

PERSONS RESPONSIBLE FOR THE INFORMATION GIVEN IN THE SUPPLEMENT 6In this Supplement, unless otherwise stated, references to "Company" or "RTE" refer to the Issuer and references to "RTE

Group" and "Group" refer to the Issuer and its respective consolidated subsidiaries taken as a whole.

IMPORTANT INFORMATION

The section "Important Information" of the Base Prospectus is supplemented by the following paragraph:

Neither the Arrangers nor any of the Dealers makes any representation as to the suitability of any Green Bonds (as

defined herein), including the listing or admission to trading thereof on any dedicated "green", "environmental",

"sustainable" or other equivalently-labelled segment of any stock exchange or securities market, to fulfil any green,

environmental or sustainability criteria required by any prospective investors. The Arrangers and the Dealers have not

undertaken, nor are they responsible for, any assessment of the eligibility criteria for Eligible Green Projects (as defined

herein), any verification of whether the Eligible Green Projects meet such criteria or the monitoring of the use of

proceeds of any Green Bonds. Investors should refer to the Green Financing Framework (as defined herein), the Second

Party Opinion (as defined herein) delivered in respect thereof, and any public reporting by or on behalf of the Issuer in

respect of the application of the proceeds of any issue of Green Bonds for further information. The Green Financing

Framework and Second Party Opinion, and any such public reporting, will not be incorporated by reference in this

Base Prospectus and neither the Arrangers nor any of the Dealers make any representation as to the suitability or

contents thereof. - 2 -RISK FACTORS

The paragraph 2 (Risks related to the structure of a particular issue of Notes) of the sub-section II (Risk related to the Notes)

of the section "Risk Factors" appearing on page 20 of the Base Prospectus is supplemented by the following:

2.8 Notes issued with a specific use of proceeds (i.e. Green Bonds )

The Final Terms relating to any specific Tranche of Notes may provide that it will be the Issuer's intention to issue "green

bonds" and apply an amount equal to the net proceeds of the issue to finance and/or refinance, in whole or in part, new or

existing projects from any of the Eligible Green Projects (such Notes being "Green Bonds") as defined in the "Use of Proceeds"

section of this Base Prospectus and of the relevant Final Terms.There is currently no established definition (legal, regulatory or otherwise) of, nor market consensus as to what constitutes, a

"green", "sustainable" or an equivalently-labelled project. A basis for the determination of such a definition has been established

in the European Union with the adoption on 18 June 2020 of Regulation (EU) No. 2020/852 on the establishment of a

framework to facilitate sustainable investment by the Council and the European Parliament (the "Taxonomy Regulation").

The Taxonomy Regulation establishes a single EU-wide classification system, or "taxonomy", which provides companies and

investors with a common language for determining which economic activities can be considered environmentally sustainable.

A first delegated act establishing the technical screening criteria for determining the conditions under which an economic

activity qualifies as contributing substantially to climate change mitigation or climate change adaptation and for determining

whether that economic activity causes no significant harm to any of the other environmental was formally adopted on 4 June

2021. In addition, a second delegated act supplementing Regulation (EU) 2020/852 by specifying the content and presentation

of information to be disclosed by undertakings subject to Articles 19a or 29a of Directive 2013/34/EU concerning

environmentally sustainable economic activities, and specifying the methodology to comply with that disclosure obligation

was formally adopted on 6 July 2021. However, these two delegated acts have not been yet published on the European Union

Official Journal and the Taxonomy Regulation remains subject to further developments.As a result, alignment of the financing of Eligible Green Projects with the Taxonomy Regulation is not certain. Furthermore,

any project included in the Green Financing Framework (as defined in the "Use of Proceeds" section of this Base Prospectus)

may not meet any or all investor expectations regarding such "green", "sustainable" or other equivalently-labelled performance

objectives or any adverse environmental and/or other impacts may occur during the implementation of any project included in

the Green Financing Framework.The use of the proceeds for any projects included in the Eligible Green Projects may not satisfy, whether in whole or in part,

any present or future investor expectations or requirements as regards any investment criteria or guidelines with which such

investor or its investments are required to comply, whether by any present or future applicable laws or regulations or by its

own by-laws or other governing rules or investment portfolio mandates.The Second Party Opinion (as defined in the "Use of Proceeds" section of this Base Prospectus) provided by V.E in respect of

the Green Financing Framework or any opinion or certification of any third party (whether or not solicited by the Issuer) which

may be made available in connection with the issue of any Green Bonds and in particular with any Eligible Green Projects to

fulfil any environmental, sustainability and/or other criteria may not be suitable for Noteholders' purposes. Currently, the

providers of such opinions and certifications are not subject to any specific regulatory or other regime or oversight. In the event

that any such Green Bonds are listed or admitted to trading on any dedicated "green", "environmental", "sustainable" or other

equivalently-labelled segment of any stock exchange or securities market (whether or not regulated), the criteria for any such

listings or admission to trading may vary from one stock exchange or securities market to another. Any such listing or admission

to trading may not be obtained in respect of any such Green Bonds or, if obtained, any such listing or admission to trading may

not be maintained during the life of the Green Bonds.While it is the intention of the Issuer to apply the proceeds of the Green Bonds in, or substantially in, the manner described in

the relevant Final Terms, the relevant project(s) or use(s) the subject of, or related to, any Eligible Green Projects may not be

capable of being implemented in or substantially in such manner and/or accordance with any timing schedule and, accordingly,

such proceeds may not be totally or partially disbursed for such projects, and such projects may not be completed within any

specified period or at all or with the results or outcome (whether or not related to the environment) as originally expected or

anticipated by the Issuer. Any such event or failure by the Issuer will not constitute an Event of Default under the Notes.

Any such event or failure and/or withdrawal of any opinion or certification may have a material adverse effect on the value of

such Notes and also potentially the value of any other Notes which are intended to finance such projects and/or result in adverse

consequences for certain investors with portfolio mandates to invest in securities to be used for a particular purpose and,

consequently, Noteholders could be adversely affected. - 3 -USE OF PROCEEDS

The paragraph of the section "Use of Proceeds" appearing on page 68 of the Base Prospectus is deleted and replaced by the

following paragraph:The net proceeds of the issue of the Notes will be applied by the Issuer (i) for general corporate purposes or (ii) in the case of

Green Bonds, to finance or refinance Eligible Green Projects, as defined below and more fully described in the framework on

the issues of Green Bonds by the Issuer ) (as amended and completed at any time) (the "Green Financing Framework") which

is available on the Issuer's website (https://www.rte-france.com/finances/chiffres-cles-et-publications-

financieres#ProgrammeEMTN).If, for a given issue of Notes, there is a particular use of the proceeds (other than those indicated above), it will be specified in

the relevant Final Terms.The Green Financing Framework establishes categories of eligible projects that have been identified by the Issuer as creating

substantial environmental benefits by reducing greenhouse gas emissions (GHG), promoting grid flexibility and the

development of renewable sources electricity generation distribution (the "Eligible Green Projects").

The Issuer will apply processes for project evaluation and selection, management of proceeds and reporting consistent with

guidelines set out in the Green Bond Principles 2021 published by the International Capital Markets Association (ICMA) (or

any more recent version that may be indicated in the relevant Final Terms).In addition to the description of the Eligible Green Projects, the Green Financing Framework describes (i) the management of

proceeds, (ii) the reporting in the form of a green financing report which will include an allocation report and an environmental

impact report, and (iii) the external reviews applicable to the Green Bonds, i.e. the Second Party Opinion (as defined below)

and the post issuance external verification by an external auditor to verify that the proceeds of the Green Bonds are allocated

to Eligible Green Projects and that the Eligible Green Projects benefiting from such allocation comply with the criteria set out

in the Green Financing Framework. Any such opinion or certification is not, nor should be deemed to be, a recommendation

by the Issuer, the Dealers or any other person to buy, sell or hold any such Notes. As a result, neither the Issuer nor the Dealers

will be, or shall be deemed, liable for any issue in connection with its content.The Issuer appointed V.E to issue a second party opinion (the "Second Party Opinion") which assesses the environmental

added value of the Green Financing Framework and the compliance of the Green Financing Framework with the Green Bond

Principles 2021 published by ICMA. This Second Party Opinion, and any other opinion or certification rendered in the context

of an issue of Green Bonds in accordance with the Green Financing Framework, will be available on the Issuer's website

The Green Financing Framework may be amended and supplemented from to time to time. Any such change or supplement

will be made available on the Issuer's website. - 4 -RECENT DEVELOPMENTS

The sub-section "Recent Developments" included on page 101 of the Base Prospectus is supplemented by the following

information:"Energy Futures 2050" - Consumption and production: the paths of RTE's electricity towards carbon neutrality

RTE has published the main findings of its prospective study entitled "Energy Futures 2050". It analyses changes in

consumption and compares the six electrical system scenarios that guarantee security of supply, so that France has low-carbon

electricity in 2050. This work is unprecedented in the scope and the level of consultation it required.

"France must simultaneously face two challenges: on the one hand, produce more electricity by oil and gas, and to renew the

nuclear power generation facilities that are already in operation which will gradually reach their operating limit by 2060. The

question is: what are the technologies to produce this totally decarbonised electricity? Renewable and / or new energies nuclear

and in what proportions? RTE's "Energy Futures 2050" study aims to document and analyse the electricity mix options, their

advantages, disadvantages, impacts and consequences. This is essential to inform the public debate" explains Xavier

Piechaczyk, President of the Executive Board of RTE.Key finding from the study

Achieving carbon neutrality requires a transformation of the economy and lifestyles, as well as a restructuring of the system in

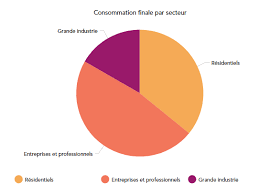

order for electricity to replace fossil fuels as the country's main energy source.About consumption

1) Impacting consumption through energy efficiency, or even energy sobriety, is essential to achieve the climate objectives;

2) Energy consumption will decrease but electricity consumption will increase to replace fossil energies;

3) Accelerating the reindustrialisation of the country through the electrification of processes increases electricity consumption

but reduces France's carbon footprint;About the transformation of the electricity mix

4) Achieving carbon neutrality is impossible without significantly developing renewable energies;

5) Not building new nuclear reactors requires a faster pace of development of renewable energies than in the most dynamic

European countries;

About the economy

6) Building new nuclear reactors is relevant from an economic point of view, especially when it enables to keep a fleet of about

40 GW in 2050 (existing and new nuclear power);

7) Electrical renewable energies have become competitive solutions. This is all the more true for large solar and wind farms on

land and at sea;8) The methods of control which the system needs to ensure the security of supply are very different depending on the scenarios.

There is an economic interest in increasing the control of consumption, developing interconnections and hydraulic storage, as

well as installing batteries to support the solar sector. Beyond that, the need for newly built thermal power plants based on

stocks of decarbonised gas (including hydrogen) is significant if the revival of nuclear power is minimal and such need becomes

massive - and therefore costly - if the objective is to reach 100% of renewable energies;9) In all scenarios, electricity networks must be rapidly resized to enable the energy transition;

About technology

10) Creating a performing "low-carbon hydrogen system" is an asset for decarbonising certain sectors which are difficult to

electrify, and a need for scenarios with a strong growth of renewable energies with regard to energy storage;

11) Scenarios with very high contribution from renewable energies, or the one requiring the extension of existing nuclear

reactors beyond 60 years, imply major technological challenges in order to reach carbon neutrality in 2050;

12) The transformation of the electrical system must from now on take into account the likely consequences of climate change,

in particular with regard to water resources, heat waves and wind regimes;About space and the environment

- 5 -13) The development of renewable energies raises the issue of space occupancy and limitation of uses. It can be intensified

without putting excessive pressure on the artificialisation of land, but it must be carried out in each territory while ensuring to

preserve the living environment;14) Even by integrating the full carbon footprint of the entire life cycle of the infrastructures, electricity in France will remain

largely carbon-free and will greatly contribute to achieving carbon neutrality by replacing fossil energies;

15) The energy transition economy may put pressure on the supply of mineral resources, in particular with respect to certain

metals, which will necessarily have to be anticipated;General

16) For 2050, the carbon neutral electrical system can be achieved at a manageable cost for France;

17) For 2030: developing mature renewable energies as quickly as possible and extending existing nuclear reactors with a view

to maximise low-carbon production increases the chances of reaching the target of the new European package "-55% net";

18) Whichever scenario is chosen, there is an urgent need to get involved."

- 6 - PERSONS RESPONSIBLE FOR THE INFORMATION GIVEN IN THE SUPPLEMENTIn the name of the Issuer

To the best knowledge of the Issuer, the information contained in this Supplement is in accordance with the facts and contains

no omission likely to affect its import.Paris, 19 November 2021

RTE Réseau de transport d'électricité

Represented by Laurent Martel

Membre du Directoire

Directeur Général du Pôle Finances AchatsAutorité des marchés financiers

This Supplement to the Base Prospectus has been approved on 19 November 2021 by the AMF, in its capacity as competent

authority under Regulation (EU) 2017/1129 (the "Prospectus Regulation"). The AMF approves this document after having

verified that the information contained in the Base Prospectus is complete, coherent and comprehensible within the meaning

of the Prospectus Regulation.This approval should not be considered to be a favourable opinion on the Issuer and on the quality of the Notes described in

this Supplement. This Supplement to the Base Prospectus has the following approval number: 21-494.quotesdbs_dbs9.pdfusesText_15[PDF] le respect citation

[PDF] le respect dans la bible

[PDF] le respect dans un couple

[PDF] le respect de soi

[PDF] le respect des autres

[PDF] le respect est mort

[PDF] le respect mutuel

[PDF] Le retour veineux se fait par deux réseaux qui communiquent entre eux : • l'un

[PDF] le risque nucléaire en france

[PDF] le risque sismique en france

[PDF] le risque terroriste en france

[PDF] le rôle de la banque

[PDF] le rôle de la famille

[PDF] le rôle de la famille dans la société