Ranking major retail companies COVID-19 compensation for workers

Ranking major retail companies COVID-19 compensation for workers

Nov 20 2020 Kroger

Liste des revues et des produits de la recherche HCÉRES pour le

Liste des revues et des produits de la recherche HCÉRES pour le

Jan 30 2019 classement se fait en 3 catégories : A pour les revues classées 1*

The SIPRI Top 100 Arms-producing and Military Services

The SIPRI Top 100 Arms-producing and Military Services

taken to slow the spread of the virus disrupted supply chains and delayed deliveries. The pandemic also affected restructuring as exemplified by the.

Le futur est déjà là : Comment lIA rend les chaînes logistiques plus

Le futur est déjà là : Comment lIA rend les chaînes logistiques plus

Une entreprise du classement Fortune 500 était confrontée à un manque de visibilité sur Artificial Intelligence Transforms the Supply Chain.

Liste des revues et des produits de la recherche HCÉRES pour le

Liste des revues et des produits de la recherche HCÉRES pour le

Jul 9 2021 classement se fait en 3 catégories : A pour les revues classées 1*

Liste des revues et des produits de la recherche HCÉRES pour le

Liste des revues et des produits de la recherche HCÉRES pour le

Mar 3 2020 classement se fait en 3 catégories : A pour les revues classées 1*

OECD

OECD

Breweries supply beverages to 10 other countries in Southern and Eastern strengthening of the food production chain in the continent. ... 14 Classement.

CLASSEMENT DES REVUES SCIENTIFIQUES EN SCIENCES DE

CLASSEMENT DES REVUES SCIENTIFIQUES EN SCIENCES DE

Jun 25 2019 Le classement des revues scientifiques de Gestion par le Collège des ... Entreprises et Histoire ... Journal of Supply Chain Management.

The Business Benchmark on Farm Animal Welfare Report 2019

The Business Benchmark on Farm Animal Welfare Report 2019

employees setting objectives and targets

Leaders league-classement Opération Achats

Leaders league-classement Opération Achats

https://www.klbgroup.com/files/Leadersleague_classement_Opration_Achats_SupplyChain.pdf

[PDF] OPTIMISATION DE LA CHAÎNE LOGISTIQUE ET PRODUCTIVITÉ

[PDF] OPTIMISATION DE LA CHAÎNE LOGISTIQUE ET PRODUCTIVITÉ

Au début des années 2000 la revue Logistics Today identifiait les entreprises qu'elle jugeait les « Best-in-class » en matière de gestion de la chaîne

Schneider Electric à la quatrième place du classement 2021 Supply

Schneider Electric à la quatrième place du classement 2021 Supply

25 mai 2021 · Le classement annuel de Gartner identifie les entreprises leaders en matière de supply chain et met en lumière leurs bonnes pratiques

[PDF] Le Top 15 des ERP en France - Stratégies Logistique

[PDF] Le Top 15 des ERP en France - Stratégies Logistique

CLASSEMENT EXCLUSIF auprès des moyennes et grandes entreprises » gestion intégré) et le SCM (Supply Chain Management – gestion de la chaîne

[PDF] LA CONTRIBUTION DUNE LOGISTIQUE PERFORMANTE A LA

[PDF] LA CONTRIBUTION DUNE LOGISTIQUE PERFORMANTE A LA

C'est dans ce sens que la recherche de la performance a toujours été une préoccupation de la logistique et du Supply Chain Management (SCM) depuis leurs débuts

[PDF] guide 2020-2021 - des formations supérieures supply chain en france

[PDF] guide 2020-2021 - des formations supérieures supply chain en france

5 nov 2020 · Classé 3e du classement EdUniversal 2020 des meilleurs masters en logistique au même titre que le MSc Global Supply Chain Management ce

[PDF] La supply chain

[PDF] La supply chain

Au regard du rôle central joué par la chaîne d'approvisionnement dans l'optimisation de l'activité de toute entreprise cet ouvrage a pour objectif de présenter

[PDF] THESE DE DOCTORAT Discipline : Sciences de Gestion Présentée

[PDF] THESE DE DOCTORAT Discipline : Sciences de Gestion Présentée

développés en amont de la supply chain (entreprise - fournisseur) Cette matrice facilite le classement et la visualisation des catégories de risques

M1202 TD2 Classement ABC (Profs) Gestion de la chaîne logistique

M1202 TD2 Classement ABC (Profs) Gestion de la chaîne logistique

Classement ABC suivant Valeur utilisation Le ratio de discrimination est égale à 081 cours pdf TD1 supply chain management -approvisonnement

[PDF] Pour une chaîne logistique plus compétitive au service des

[PDF] Pour une chaîne logistique plus compétitive au service des

16 sept 2019 · La France est classée 15ème dans le classement agrégé LPI (Logistics Performance Index) de la Banque mondiale des années 2012 à 2018

Classement des stratégies de production des PME dAlicante - Érudit

Classement des stratégies de production des PME dAlicante - Érudit

Cooper et J D Pagh (1998) «Supply chain management: implementation issues and research opportunities » The International Journal of Logistics Management

KEY FACTS

w The arms sales of the SIPRITop 100 arms-producing and

military services companies totalled $531 billion in 2020, an increase of 1.3 per cent compared with sales in 2019. w Taken together, the arms sales of the 41 companies in theTop100 based in the United

States increased by 1.9percent

to $285 billion. These US companies accounted for54percent of the Top 100"s total

arms sales in 2020. w The combined arms sales of the ve Chinese companies listed in the Top 100 were $66.8billion, an increase of1.5per cent on 2019. These

Chinese rms made up

13percent of total Top 100 arms

sales in 2020. w The Top 100 lists26companies based in Europe.

Their combined arms sales

amounted to $109billion in2020, an increase of 1.0percent

on 2019. Together, theseEuropean companies accounted

for 21per cent of total Top 100 arms sales. w The combined arms sales of the nine Russian companies listed in the Top 100 declined by 6.5 per cent to $26.4 billion in 2020. Their share of theTop100"s total arms sales was

5.0percent in 2020.

w Global arms production proved to be largely resilient against the Covid-19 pandemic and resulting economic downturn. However, there were dierences in impact between industry sectors and between individual companies.THE SIPRI TOP 100

ARMS-PRODUCING AND

MILITARY SERVICES

COMPANIES, 2020

alexandra marksteiner, lucie béraud-sudreau, nan tian, diego lopes da silva and alexandra kuimovaSIPRI Fact Sheet

December 2021

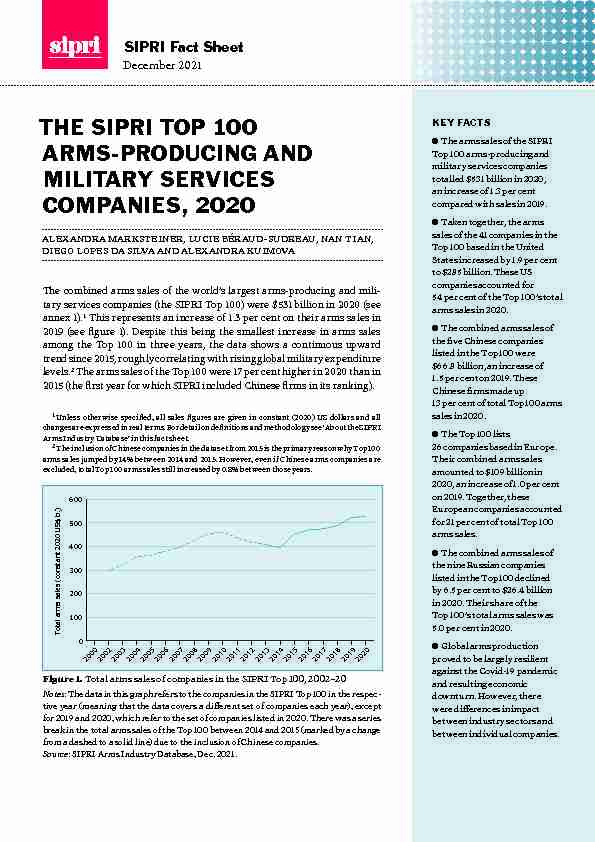

The combined arms sales of the world"s largest arms-producing and mili- tary services companies (the SIPRI Top 100) were $531 billion in 2020 (see annex1). 1 This represents an increase of 1.3 per cent on their arms sales in2019 (see gure 1). Despite this being the smallest increase in arms sales

among the Top 100 in three years, the data shows a continuous upward trend since 2015, roughly correlating with rising global military expenditure levels. 2 The arms sales of the Top 100 were 17 per cent higher in 2020 than in2015 (the rst year for which SIPRI included Chinese rms in its ranking).

1 Unless otherwise specied, all sales gures are given in constant (2020) US dollars and all changes are expressed in real terms. For detail on denitions and methodology see About the SIPRIArms Industry Database" in this fact sheet.

2 The inclusion of Chinese companies in the data set from 2015 is the primary reason why Top 100 arms sales jumped by 14% between 2014 and 2015. However, even if Chinese arms companies are excluded, total Top 100 arms sales still increased by 0.8% between those years. Figure 1. Total arms sales of companies in the SIPRI Top100, 2002-20 Notes: The data in this graph refers to the companies in the SIPRI Top 100 in the respec- tive year (meaning that the data covers a dierent set of companies each year), except for 2019 and 2020, which refer to the set of companies listed in 2020. There was a series break in the total arms sales of the Top 100 between 2014 and 2015 (marked by a change from a dashed to a solid line) due to the inclusion of Chinese companies.Source: SIPRI Arms Industry Database, Dec. 2021.

Total arms sales (constant 2020 US$ b.)

0100200300400500600

20002002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2 sipri fact sheet

THE EFFECTS OF COVID-19 ON GLOBAL ARMS PRODUCTION

Global arms production was largely resilient against the shock of the Covid-19 pandemic and the resulting economic downturn. While the global economy contracted by 3.1 per cent in 2020, the aggregated arms sales of the Top100 increased. This can be attributed to at least three key factors. First, the arms industry, like many other economic sectors, beneted from expansionary scal policies during the rst year of the pandemic. Military manu facturers were largely shielded by sustained government demand for military goods and services. Second, some states rolled out specic measures to mitigate the eects of government-mandated lockdowns on their arms companies, such as accelerated payments or order schedules. Third, because arms procure- ment contracts usually span several years, many arms companies were able to make gains on orders placed before the outbreak of the health crisis. However, despite these and other factors, global arms production was not fully immune to the impact of the pandemic. In many cases, measures taken to slow the spread of the virus disrupted supply chains and delayed deliveries. The pandemic also aected restructuring, as exemplied by the cancelled merger of Hexcel and Woodward, both of which are based in the United States and produce components for military aircraft. Had the merger taken place as planned, the resulting company would probably have entered the Top 100 in 2020. During 2020, the rst year of the Covid-19 pandemic, many companies involved in both the civilian and the military sectors saw a rise in their arms sales as a proportion of their total sales. This means that their military sales either grew faster or declined at a slower rate than their civilian sales, or remained stable while civilian sales fell. It illustrates the relative resilience of the demand for military goods and services, whicheven before theTable 1. The 10 largest increases in arms sales as a share of total sales among arms companies in the SIPRI Top 100, 2020

All sales gures are in millions of constant (2020) US dollars. Arms sales gures for 2020 are rounded to the nearest $10 million and

percentage shares are rounded to whole numbers.CompanyCountry

Arms sales, 2020Arms sales, 2019

Total sales, 2020

Total sales, 2019

Arms sales

as a % of total sales, 2020Arms sales

as a % of total sales, 2019Change in

share in % points,2019-20

BoeingUnited States32 13034 09058 15877 722554411

SafranFrance4 5103 63118 80528 214241311

Curtiss-Wright Corp.United States1 2601 0962 3912 52653439MeggittUnited Kingdom9801 0642 1592 94446369

Israel Aerospace IndustriesIsrael3 5103 1734 1844 23384759 Oshkosh Corp.United States2 2602 0616 8578 50933249Hanwha Corp.South Korea1 1709833 3983 78634268

Rolls-RoyceUnited Kingdom4 8704 77115 15919 98632248FincantieriItaly2 6602 1716 7016 67540337

RheinmetallGermany4 2404 0316 6977 16563567

Corp. = corporation.

Notes: Percentage shares and changes calculated using the data in this table may not precisely correspond to those stated due to

rounding. For detail on denitions and methodology see annex 1 and About the SIPRI Arms Industry Database" in this fact sheet.

Source: SIPRI Arms Industry Database, Dec. 2021.

the sipri top 100 arms companies, 2020 3 pandemicwas somewhat insulated from the busi- ness cycles experienced in the commercial sector.The companies in the Top 100 that recorded the

largest increases in arms sales as a share of total sales in 2020 included Boeing and Safran, both of which increased their share by more than 10percentage points (see table 1). Several of these companies are involved in the civilian aerospace sector, which was hit particularly hard during the rst year of the pandemic. Of the companies listed in the Top 100, only 15 saw a decrease in their arms sales share of one percentage point or more. Of those, seven areRussian companies, which are currently implement-

ing a government policy to diversify their product lines and increase their sales in the civilian sector to30per cent of their total sales by 2025 and 50percent

by 2030.REGIONAL DEVELOPMENTS IN THE TOP 100

United States

With 41 arms companies, the USA hosted the high-

est number of companies ranked in the Top 100 of any country worldwide. Together, their arms sales amounted to $285 billion, an increase of 1.9 per cent compared with 2019 (see gure 2). US companies accounted for 54 per cent of the combined arms sales of the Top 100 (see gure 3).Since 2018, the top ve arms companies in the

ranking have all been based in the USA. Lockheed Martin, by far the largest arms company in the world, has occupied the top rank every year since 2009.In 2020 its revenue from arms sales and military

services totalled $58.2 billion or 11 per cent of the Top100"s total arms sales. Of the companies included in the 2020 ranking, Lockheed Martin recorded the largest absolute year-on-year growth in arms sales of $4.2 billion (or 7.7 per cent in real terms).Raytheon Technologies is the world"s second larg-

est arms company with arms sales of $36.8billion.It was formed by the merger of Raytheon Company

and United Technologies Corporation in 2020. Com- pared with the combined (pro forma) arms sales of these two rms in 2019, its arms sales in 2020 were5.7 per cent lower.

Boeing, one of the world"s largest military aero-

space manufacturers, ranked third. Due to theCovid-19 pandemic and the impact of government-

mandated lockdowns and travel restrictions on Figure 2. Percentage change in arms sales of companies in the SIPRI Top100, by country, 2019-20 Notes: The change refers to the companies in the Top 100 for 2020. Figures are based on arms sales in constant (2020) US dollars. The category Other" consists of countries whose companies" arms sales comprise less than 1.0% of the total: Canada, Norway, Poland, Singa- pore, Spain, Sweden, Turkey, the United Arab Emirates and Ukraine.Source: SIPRI Arms Industry Database, Dec. 2021.

1.9% 1.5% 6.2% -6.5% -7.7% 3.7% 2.4% 3.3% 2.7% 1.3% 4.6% 1.7%2.0%United States

ChinaUnited Kingdom

Russia

France

Trans-European

ItalyIsrael

JapanGermany

South Korea

India Other -10-50510 Figure 3. Share of total arms sales of companies in theSIPRI Top100 for 2020, by country

Notes: The Top 100 classies companies according to the country in which they are headquartered. This means that sales by an overseas subsidiary are counted towards the total for the parent company"s country. The Top 100 does not encompass the entire arms industry in each country covered, only the largest companies. The category Other" consists of countries whose companies" arms sales comprise less than 1.0% of the total: Canada, Norway, Poland, Singapore, Spain, Sweden, Turkey, the United Arab Emirates and Ukraine. Percentage shares may not add up to a total of 100% due to rounding.Source: SIPRI Arms Industry Database, Dec. 2021.

Other 3.4% India 1.2%South Korea

1.2%Germany

1.7% Japan 1.9%Israel

2.0% Italy 2.6%Trans-European

3.0%France

4.7%Russia

5.0%United Kingdom

7.1% China 13%United States

54%4 sipri fact sheet

commercial aviation, Boeing recorded a loss in total sales of $19.6 billion in2020. Its arms sales also decreased (by 5.8percent) from $34.1 billion in 2019

to $32.1 billion in 2020. Northrop Grumman ranked fourth with arms sales of $30.4 billion or 5.7 per cent of the Top 100 total. General Dynamics was in fth position with arms sales of $25.8 billion, equivalent to 4.9 per cent of the total.Mergers and acquisitions in the US arms industry

To reinforce its military advantage and hedge against perceived threats emanating from what it considers to be its strategic competitors (namely China and Russia), the USA has been investing more heavily in research and development and the procurement of next-generation weapon systems. 3 This has prompted a wave of mergers and acquisitions in the US arms indus- try in recent years, with some companies looking to broaden their product portfolios to gain a competitive edge when bidding for contracts (see box 1). The all-stock merger-of-equals between Raytheon Company and United Technologies Corporation, which was nalized in April 2020, was one of the largest mergers in the history of the arms industry. The multibillion merger of L3 Technologies and Harris Corporation was completed a year earlier, in June 2019. The resulting company, L3Harris Technologies, ranked 10th in2020. The trend continued in 2021 with the merger of Peraton and Perspecta,

valued at $7.1 billion, as well as the acquisition of FLIR Systems by TeledyneTechnologies for $8.2 billion.

The trend of mergers and acquisitions is particularly pronounced in the space sector. For example, in 2018 Northrop Grumman acquired Orbital 3 Lopes da Silva, D., Tian, N. and Marksteiner, A., Trends in world military expenditure, 2020",SIPRI Fact Sheet, Apr. 2021.

Box 1. The evolving role of technology companies in the arms industryAdvances in information and communication technologies (ICT) over the past two decades have changed the character of war

as well as the military technical and industrial base. The adoption of network-centric warfare doctrines in the 2000s fuelled the

demand for enabling technologies, especially in the United States. This meant that ICT specialists, as well as systems integrators,

recorded increasing volumes of arms sales. The arms sales of Leidos, for example, have grown by 68 per cent since 2013, when it

restructured to focus on ICT solutions; it ranked 16th in 2020 with arms sales of $7.3 billion. Other large ICT companies include

Booz Allen Hamilton (ranked 19th) and CACI International (ranked 29th), with arms sales of $5.5 billion and $4.2 billion in 2020,

respectively. More traditional arms industry players moved to acquire companies with a focus on ICT during this time. Notably,

General Dynamics acquired CSRA, an information technology solutions provider, for $9.7 billion in 2018.

In recent years, some technology giantsfrom Microsoft to Oraclehave sought to deepen their involvement in the arms

industry. aWhile these companies continue to generate most of their revenue through commercial sales, they are now being

selected for high-value military contracts with increasing regularity. This is a clear indication that the US Department of Defense

is looking to benet from Silicon Valley"s technical expertise in articial intelligence, machine learning and cloud computing,

which is considered to be far beyond that of more traditional military contractors. Microsoft, for instance, will supply the US

Army with integrated visual augmentation devices as part of a 10-year contract awarded in 2021 worth $22 billion. Another

example is the Central Intelligence Agency"s cloud enterprise contract awarded in 2020 to a consortium comprising Amazon,

Google, IBM, Microsoft and Oracle. The contract is reportedly worth tens of billions of dollars over a 15-year period. The trend

also extends across the Atlantic: in 2021 Amazon struck a deal to host classied material belonging to three British intelligence

agencies on its Amazon Web Services platform. Nevertheless, so far none of these technology companies has recorded annual

arms sales high enough to cross the threshold to be ranked in the SIPRI Top 100. a (2021). the sipri top 100 arms companies, 2020 5 ATK, a space systems contractor, for approximately $9.2 billion. Lockheed Martin followed suit in 2020 by announcing plans to acquire competitor Aerojet Rocketdyne (ranked 75th) for $4.4 billion, although the deal has yet to be approved by regulators. KBR"s (ranked 43rd) acquisition of Centauri, a provider of space and directed energy capabilities, was nalized in October 2020.China The combined arms sales of the ve Chinese companies included in the ranking amounted to an estimated $66.8 billion in 20201.5 per cent more than in 2019. With a 13 per cent share of total Top 100 arms sales, Chinese arms companies had the second highest volume of aggregated arms sales in

2020, behind US rms and ahead of British companies. The rise of China as a

major arms producer has been driven by its aim to become more self-reliantquotesdbs_dbs29.pdfusesText_35[PDF] appel d offre logistique

[PDF] classement transporteur routier francais

[PDF] inbound logistics

[PDF] logistique magazine

[PDF] 3pl

[PDF] test de classement francais secondaire gratuit

[PDF] test de classement numérique

[PDF] test de classement secondaire

[PDF] test de classement francais rosemont

[PDF] exemple de test de francais pour admission au cegep

[PDF] test de classement alphanumérique

[PDF] test de classement francais cegep

[PDF] test de francais college ahuntsic

[PDF] classement des assurances en cote d'ivoire 2016