Financial Projections Guide

Financial Projections Guide

This guide was created to accompany the SCORE Financial. Projections Template which is part of the Simple Steps for. Starting Your Business® program.

Financial Projections Model

Financial Projections Model

analyze potential financial performance under adverse conditions. DFC has provided a model template and template instructions that may assist some applicants in.

Financial Projections Template Instructions

Financial Projections Template Instructions

The CDFI Bond Guarantee Program will utilize a template form to be completed by program applicants to support the financial projections review. 1. The

User Guide for OPIC Financial Projections Model Builder Tool 4/2

User Guide for OPIC Financial Projections Model Builder Tool 4/2

2 ኤፕሪ 2013 It is a Microsoft Excel-based template that utilizes Visual Basic for Applications (VBA) macros as well as formulas that require the Excel ...

In local currency (unless noted otherwise) Template 2 - Financial

In local currency (unless noted otherwise) Template 2 - Financial

Projected Operating Cash Outflows. F) Labor: i) Marketing Labor ii) Customer Support Labor iii) Technical Labor. G) Marketing. H) Facilities.

Financial projections template_05.2022.xlsx

Financial projections template_05.2022.xlsx

Instructions for filling out the financial projections template: 1. The "Income statement" "Cash Flow" and "Balance Sheet" sections are applicable for all

FORECASTING TOOL.docx

FORECASTING TOOL.docx

A financial forecast is an estimate of future financial outcomes for a project. >CMB FORECASTING TEMPLATE BY P/G. ***THE FOLLOWING STEPS ARE VERY IMPORTANT ...

Title Layout

Title Layout

• Using the financial tool Clinical Trial (CT) Calc Template it offers: • summary of earnings and staff salary projections. • a clear list of all billable

User Manual on the Input Template of Financial Projection Model.

User Manual on the Input Template of Financial Projection Model.

3 ማርች 2014 In this regard Bangladesh Bank has designed a tool named "Financial Projection Model. (FPM)" with the aims to assess the strengths and ...

Section I – Projected Cash inflows and outflows

Section I – Projected Cash inflows and outflows

The first projection (Template 1) should show the Financial Projections associated with the Most Likely scenario expected. This projection should include

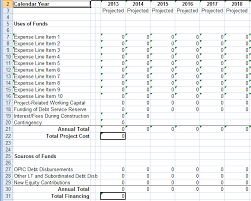

PROJECT FINANCIAL PLAN TEMPLATE

PROJECT FINANCIAL PLAN TEMPLATE

01 Sept 2016 Below is a sample Project Financial Plan Template. Missions are encouraged to modify as needed. PROGRAM CYCLE GUIDANCE.

Financial Projections Guide

Financial Projections Guide

This guide was created to accompany the SCORE Financial. Projections Template which is part of the Simple Steps for. Starting Your Business® program.

Business Plan Template for a Startup Business

Business Plan Template for a Startup Business

It can help convince investors or lenders to finance your business. It can persuade partners or key employees to join your company. Most importantly it serves

How To Prepare A Financial Forecast

How To Prepare A Financial Forecast

“Financial Projections” “Financial Model” and “Pro Forma Financials”. Click here for a completed sample template and here for more SCORE Templates.

PROJECT FINANCIAL PLAN TEMPLATE

PROJECT FINANCIAL PLAN TEMPLATE

01 Sept 2016 Below is a sample Project Financial Plan Template. Missions are encouraged to modify as needed. PROGRAM CYCLE GUIDANCE.

Long Term Financial Plan Policy

Long Term Financial Plan Policy

It sets out indicative revenue and projected expenditure for the budget year plus two outer financial years. Page 4. Page

Business Plan Template for a Startup Business

Business Plan Template for a Startup Business

It can help convince investors or lenders to finance your business. It can persuade partners or key employees to join your company. Most importantly it serves

Growth Projection Report (1).xlsx

Growth Projection Report (1).xlsx

Initial User Base. {$initial_users}. Monthly Growth Rate. {$growth_rate}. Avg Revenue/User. {$arpu}. Users. Revenue. 1-Jan {$initial_users}. #VALUE!

In local currency (unless noted otherwise) Template 2 - Financial

In local currency (unless noted otherwise) Template 2 - Financial

I) Projected Cash inflows and outflows. A) Forecasted registration volume. B) Registration fee. C) Registration cash inflows.

Section I – Projected Cash inflows and outflows

Section I – Projected Cash inflows and outflows

The application process requires the applicant to submit two cash basis Financial Projections. The first projection (Template 1) should show the Financial

BUSINESS FINANCIAL PLAN - Smartsheet

BUSINESS FINANCIAL PLAN - Smartsheet

>BUSINESS FINANCIAL PLAN - Smartsheethttps://www smartsheet com/ /IC-Business-Financial-Plan-10876 · Fichier PDF

Financial Projections Guide

Financial Projections Guide

>Financial Projections Guidehttps://s3 amazonaws com/mentoring redesign/s3fs-public/Financi · Fichier PDF

What is a financial projection template?

Our financial projection template will help you forecast future revenues and expenses by building up from payroll schedules, operating expenses schedules, and sales forecast to the three financial statements. Below is a screenshot of the financial projection template: Enter your name and email in the form below and download the free template now

What is a financial plan template?

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Why do you need a financial projection?

If you’re starting a business venture, a financial projection helps you plan your start-up budget. If you already have a business, a financial projection helps you set your goals and stay on track. If you’re thinking about getting outside financing, you need a financial projection to convince investors or lenders of the potential of your business.

ANNEXURE 14

LONG TERM FINANCIAL PLAN POLICY

2023/24 BUDGET (MAY 2023)

Page |2

LONG TERM FINANCIAL PLAN POLICY

2023/24 Budget (May 2023)

Annexure 14

TABLE OF CONTENTS

1. DEFINITIONS AND ABBREVIATIONS ................................................................................ 3

2. INTRODUCTION .................................................................................................................. 4

3. PROBLEM STATEMENT ..................................................................................................... 4

4. PURPOSE ............................................................................................................................ 5

5. STRATEGIC FOCUS AREA ................................................................................................ 5

6. GUIDING PRINCIPLES ........................................................................................................ 5

7. ROLE PLAYERS AND STAKEHOLDERS .......................................................................... 5

8. REGULATORY CONTEXT ................................................................................................... 6

9. POLICY DIRECTIVE DETAILS ............................................................................................ 7

10. EVALUATION AND REVIEW ............................................................................................. 9

Page |3

LONG TERM FINANCIAL PLAN POLICY

2023/24 Budget (May 2023)

Annexure 14

1. DEFINITIONS AND ABBREVIATIONS

In this policy unless the context indicates otherwise Bmeans a municipal service that is necessary to ensure an acceptable and reasonable quality of life and which, if not provided, would endanger public health or safety or the environment. means Budget Steering Committee, a committee established in terms of regulation 4 of the Municipal Budget Reporting Regulations (MBRR), to provide technical assistance to the Mayor in discharging the responsibilities set out in section53 of the Municipal Finance Management Act (MFMA).

Budget-means a policy of a municipality affecting or affected by the annual budget of the municipality, including (a) the tariffs policy which the municipality must adopt in terms of section 74 of theMunicipal Systems Act;

(b) the rates policy which the municipality must adopt in terms of legislation regulating municipal property rates; or (c) the credit control and debt collection policy which the municipality must adopt in terms of section 96 of the Municipal Systems Act. means the City of Cape Town, a municipality established by the City of Cape Town Establishment Notice No 479 of 22 September 2000 issued in terms of the Local Government Municipal Structures Act 1998 or any structure or employee of the City acting in terms of delegated authority. means a person designated in terms of section80(2)(a) of the MFMA.

means the Integrated Development Plan. means Long Term Financial Plan. Long-means debt repayable over a period exceeding one year. means the Municipal Budget and Reporting Regulations. means the Municipal Finance Management Act No 56 of 2003. means Medium Term Revenue and Expenditure Framework, as prescribed by the MFMA. It sets out indicative revenue and projected expenditure for the budget year, plus two outer financial years.Page |4

LONG TERM FINANCIAL PLAN POLICY

2023/24 Budget (May 2023)

Annexure 14

"Municipal Council" or "council" means the council of a municipality referred to in section 18 of the Municipal Structures Act. Mmeans a tariff for services, which a municipality may set for the provision of a service to the local community, and includes a surcharge on such tariff. Mmeans property rates or other taxes, levies or duties that a municipality may impose. means the National Treasury established by Section 5 of thePublic Finance Management Act.

refers to a period up to 3 (three) years. refers to a period between 3 (three) and 5 (five) years. refers to any period longer than 5 (five) years).2. INTRODUCTION

2.1. The Local Government: Municipal Finance Management Act No 56 of 2003

(hereafter MFMA) has instituted various financial reform measures. Sound financial management practices have been identified as essential to the long- term sustainability of municipalities. In this regard the MFMA necessitates that municipalities must have a policy related the Long Term Financial Plan (hereafterLTFP).

2.2. A

revenue and expenditure streams to give effect to the Integrated Development Plan (hereafter IDP). It provides guidance for the development of current budgets and expenditure outcomes, operating expenditure trends, optimal asset management plans and the consequential impact on rates, tariffs and other service charges.2.3. The City has developed a financial model that aims to determine the appropriate

mix of parameters and assumptions within which the City should operate to facilitate budgets which are affordable and sustainable at least 10 years into the future. In addition, it identifies the consequential financial impact of planned capital projects3. PROBLEM STATEMENT

Preceding the inception of the MFMA municipal budgets usually catered for immediate demands with little or no view of future needs or the future consequences of particular decisions. This poor planning practice fragmented the sustainability of municipal budgets.Page |5

LONG TERM FINANCIAL PLAN POLICY

2023/24 Budget (May 2023)

Annexure 14

4. PURPOSE

The policy aims to ensure that all long-term financial planning is based on a structured and consistent methodology therefore enabling delivery of City Strategies whilst ensuring lity in order to achieve objectives over the medium and long term.5. STRATEGIC FOCUS AREA

5.1. -2027) identifies six priorities and three foundation

areas, which support the vision of creating a City of Hope and provide a solid foundation for the articulation of service delivery. The priorities and foundation areas are:Priority:

1. Economic Growth

2. Basic Services

3. Safety

4. Housing

5. Public Space, Environment and Amenities

6. Transport

Foundation:

1. A resilient City

2. A more spatially integrated and inclusive City

3. A capable and collaborative City government

The City has identified linked objectives and programmes within the above areas.5.2. This policy supports the following priority/foundation area, objective and

programme:5.2.1. Foundation 3 - Objective 16: A capable and collaborative City government

and Programme 16.1: Operational sustainability Programme.6. GUIDING PRINCIPLES

6.1. The policy is based on the following principles

6.1.1. Future financial sustainability inclusive of realistic revenue sources;

6.1.2. Optimal collection of revenue, taking into consideration the socio economic

environment;6.1.3. Optimal utilisation of grant funding;

6.1.4. Continuous improvement and expansion in service delivery framework; and

6.1.5. Prudent financial strategies.

7. ROLE PLAYERS AND STAKEHOLDERS

7.1. The following role players will ensure that the LTFP is implemented in accordance

with the prescribed legislative requirements and Council processes.7.1.1. Budgets department

Page |6

LONG TERM FINANCIAL PLAN POLICY

2023/24 Budget (May 2023)

Annexure 14

7.1.1.1. Responsible for the preparation, compilation and presentation of

the LTFP in line with this policy; and7.1.1.2. Review this policy, in consultation with relevant stakeholders, to

ensure maximum compliance in terms of legislation.7.1.2. Directorates and departments

7.1.2.1. Responsible for providing information to the Budgets department

to update the financial plan;7.1.2.2. Required to identify revenue and expenditure plans for both

operating and capital budgets for at least 3 years; and7.1.2.3. Required to make recommendations on future service delivery

matters.7.1.3. Executive Management Team

7.1.3.1. Mechanism of engagement in the Strategic Management

Framework (SMF) process; and

7.1.3.2. The SMF process informs planning and helps ensure delivery on

the strategic objectives set out in the IDP7.1.4. Budget Steering Committee

7.1.4.1. Responsible for providing guidance on technical budget principles

on matters relevant to the LTFP; and7.1.4.2. Responsible for endorsing the projected MTREF assumptions and

parameters contemplated by the LTFP.7.1.5. Executive Mayor

7.1.5.1. Provides guidance in terms of section 53 of the MFMA.

8. REGULATORY CONTEXT

8.1. Section 17 (3) of the MFMA states that when an annual budget is tabled it must be

any proposed amendments to the budget- related policies of the municipality8.2. Section 21 of the MFMA states that the mayor of a municipality must at least 10

months before the start of the budget year, table in the municipal council a time schedule outlining key deadlines for, amongst others: (ii) the annual review of - (aa) the Integrated Development Plan in terms of section 34 of theMunicipal Systems Act; and

(bb) the budget-related policies; (iii) the tabling and adoption of any amendments to the integrated development plan and the budget-related policies; and (iv) any consultative processes forming part of the processes referred to in subparagraphs (ii) and (iii).Page |7

LONG TERM FINANCIAL PLAN POLICY

2023/24 Budget (May 2023)

Annexure 14

8.3. Section 7 (1) of the Local Government: Municipal Finance Management Act, 2003,

Municipal Budget and Reporting Regulations, 2009 (hereafter MBRR) states that: Municipal Manager of a municipality must prepare, or take all reasonable steps to ensure the preparation of budget-related policies of the municipality, or any or any necessary amendments to such policies, in accordance with the legislation applicable to those policies for tabling in the municipal council by the applicable8.4. as defined in section 1

of the MFMA. Policies that affect or are affected by the annual budget of a8.5. Section 21 (1)(a) of the MFMA states that the mayor of a municipality must co-

ordinate the processes for preparing the annual budget and for reviewing the that the tabled budget and any revision of the integrated development plan and budget related policies are mutually consistent and credible.8.6. Section 53(1)(a) of the MFMA states that the mayor of the municipality must provide

general political guidance over the budget process and the priorities that must guide that the mayor of a municipality must establish a budget steering committee to provide technical assistance to the mayor in discharging the responsibilities set out in section 53 of the MFMA8.7. Section 26 (h) of the Local Government: Municipal Systems Act 32 of 2000

(hereafter An Integrated Development Plan must reflect a financial plan, which must include a budget projection for at least the next three years9. POLICY DIRECTIVE DETAILS

9.1. Financial strategies

9.1.1. An intrinsic feature of the LTFP is to give e

strategies. These strategies include9.1.1.1. Maintaining or improving basic municipal services;

9.1.1.2. Maintaining fair, equitable and cost reflective rates and tariff

increases;9.1.1.3. Continuous improvement to the financial position;

9.1.1.4. Ensuring funding for asset maintenance and renewal;

9.1.1.5. Ensuring realistic revenue sources and affordable debt levels to

fund the capital budget;9.1.1.6.

9.1.1.7. Achieving and maintaining a breakeven/surplus in the total

Operating budget (inclusive of appropriations and secondary budget); and9.1.1.8. Ensuring full cost recovery for the provision of internal services.

Page |8

LONG TERM FINANCIAL PLAN POLICY

2023/24 Budget (May 2023)

Annexure 14

9.2. Non financial strategies

The LTFP is a key component for achieving the goals listed in the IDP of the City and must consider the IDP inclusive of other City strategies and frameworks.9.2.1. In preparation of the LTFP

9.2.1.1. The fiscal overview must be considered by reviewing past financial

performance and taking into account strategic and policy direction of the City to ensure sustainability.9.2.1.2. The LTFP being a forecasting model requires assumptions on,

amongst other, the following internal and external factors: (a) External factors demographic trends related to socio economic factors e.g. Population migration, employment, health, development of businesses, and new residential areas, etc.; (b) General inflation outlook and its impact on the municipal activities; (c) Affordability of municipal rates and tariffs; (d) Credit rating outlook; (e) Interest rates for borrowing and investment of funds; (f) Rates, tariffs, charges and timing of revenue collection; (g) Growth or decline in tax base of the municipality; (h) Collection rates for each revenue source; (i) Price movements on specifics e.g. bulk purchases of water and electricity, fuel etc.; (j) Average salary increases; (k) Industrial relations climate, reorganisation and capacity building; (l) Changing demand characteristics (demand for services); (m) Trends in demand for free or subsidised basic services; (n) Impact of national, provincial and local policies; (o) Ability of the municipality to spend and deliver on the programmes; (p) Implications of organisational restructuring and other major events into the future; (q) Consideration of the Cost Containment Regulatory measures; and (r) Sector Plans and Infrastructure Masterplans.9.2.1.3. Intergovernmental fiscal transfers/allocations/subsidies from

National and Provincial government play a pivotal role in the finances of the City. The following unconditional transfers/allocations must be considered, as a minimum, when projecting the budget: (a) Local Government Equitable Share; (b) Fuel levy; andPage |9

LONG TERM FINANCIAL PLAN POLICY

2023/24 Budget (May 2023)

Annexure 14

(c) Grants related to the provision of Provincial government functions.9.3. The annual updated LTFP must identify the following:

9.3.1. Assumptions and parameters to be used to compile the operating- and

capital budget over the next MTREF;9.3.2. Future operating revenue and expenditure projections based on

assumptions and parameters;9.3.3. Future affordability of projected capital plans; and

9.3.4. Funding requirements, which include external funding.

10. EVALUATION AND REVIEW

10.1. This policy shall be implemented once approved by Council.

10.2. This policy must be reviewed on an annual basis, or as required due to any

contextual/legislative changes.10.3. Changes in financial strategy, nonfinancial strategic strategies and legislation

must be taken into account for future amendments to this policy.10.4. Any amendments must be tabled to Council for approval as part of the budget

process.quotesdbs_dbs17.pdfusesText_23[PDF] financial statement 2016

[PDF] financial statements of a company pdf

[PDF] financial times executive mba ranking

[PDF] financial times master finance 2017

[PDF] financial times master in finance ranking 2017

[PDF] financial times master in management 2017

[PDF] financial times ranking

[PDF] financial times ranking 2017

[PDF] financial times ranking business school

[PDF] financial times ranking finance

[PDF] financial times ranking master finance 2017

[PDF] financial times ranking master in finance 2017

[PDF] financial times ranking master management

[PDF] financial times ranking master management 2016