Tax in Australia - What you need to know

Tax in Australia - What you need to know

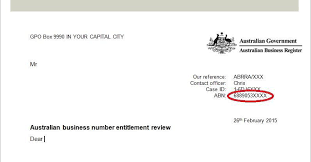

Your tax file number (TFN) is your personal reference number. It is free to an Australian business number (ABN) to work in Australia. Having an ABN means ...

Tax-return-for-individuals-2021.pdf

Tax-return-for-individuals-2021.pdf

Payer's Australian business number. Tax withheld – do not The ATO is authorised by the Taxation Administration Act 1953 to request your tax file number (TFN).

Rates - secondary template

Rates - secondary template

24 lug 2012 the payee has provided you with a valid Tax file number declaration. Rounding of withholding amounts. Any withholding amount calculated using ...

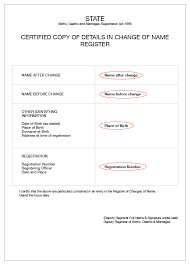

Verifying identity documents online

Verifying identity documents online

This example shows where you will find the details on your Australian passport. number (sometimes called an Evidence No.) on the front in the bottom left.

Tax file number – application for a deceased estate Section A

Tax file number – application for a deceased estate Section A

9 Is an organisation acting as trustee or executor? Full name. Australian business number (ABN) (This must be a street address for example

Individual-tax-return-instructions-2022.pdf

Individual-tax-return-instructions-2022.pdf

30 giu 2022 tax file number or Australian business number to the investment body. • You derived Australian sourced taxable income (excluding any ...

Application for departing Australia superannuation payment (DASP

Application for departing Australia superannuation payment (DASP

1 Australian tax file number (TFN). 2 Name. Title: Mr. Mrs. Miss. Ms. Other. Family name. First given name. Other given name/s. 6 Phone and fax numbers. Office

Jurisdictions name: Australia Information on Tax Identification

Jurisdictions name: Australia Information on Tax Identification

Australian Tax File Number (TFN). The TIN in Australia is referred to as the Tax File Number (TFN). The TFN is used by individuals and entities that have a

TFN application or enquiry for individuals - instructions

TFN application or enquiry for individuals - instructions

9 ago 2022 were born in Australia have taken out Australian citizenship are an Australian resident for tax purposes. Applying for a tax file number (TFN) ...

DSP guide to Payment Reference Number (PRN) validation

DSP guide to Payment Reference Number (PRN) validation

UNCLASSIFIED – ATO payments: DSP guide to Payment Reference Number (PRN) validation 1.3 Australian Tax Office payments. WebPOS framework changes will be ...

Jurisdictions name: Australia Information on Tax Identification

Jurisdictions name: Australia Information on Tax Identification

The TIN in Australia is referred to as the Tax File Number (TFN). The TFN is used by individuals Examples of such interactions include the need to.

Tax file number declaration

Tax file number declaration

Who should complete this form? You should complete this form before you start to receive payments from a new payer – for example: ?.

Tax file number – application for a deceased estate Section A

Tax file number – application for a deceased estate Section A

9 Is an organisation acting as trustee or executor? Full name. Australian business number (ABN). OR. Australian Company Number (ACN)/. Australian Registered

Application for departing Australia superannuation payment (DASP

Application for departing Australia superannuation payment (DASP

superannuation payment (DASP) from a super fund or retirement savings account. Section A: Temporary resident's details. 1 Australian tax file number (TFN).

Tax file number

Tax file number

be 15 years old or older have an Australian passport – it can be up to 3 years expired have at least one other Australian identity document – for example a

Tax file number – application or enquiry for individuals Section A

Tax file number – application or enquiry for individuals Section A

What date did you arrive in Australia? If you have a foreign passport you may be eligible to apply for a TFN online at iar.ato.gov.au. (

Tax file number – application or enquiry for individuals living outside

Tax file number – application or enquiry for individuals living outside

You do not need to declare this income on your Australian tax return. However you must: ? inform your investment bodies (for example

Tax-return-for-individuals-2020.pdf

Tax-return-for-individuals-2020.pdf

Your tax file number (TFN). See the Privacy note in the Taxpayer's declaration on page 10 of this return. Yes. No. Are you an Australian resident?

Contact us

Contact us

If we are required to access your account you will need your tax file number (TFN) or Australian business number (ABN) ready when you phone our self-help

Tax-return-for-individuals-2021.pdf

Tax-return-for-individuals-2021.pdf

Your tax file number (TFN). See the Privacy note in the Taxpayer's declaration on page 10 of this return. Yes. No. Are you an Australian resident?

OFFICIAL: Sensitive (when completed)Page 1

Individual tax return instructions 2021 to fill in this tax return.Print clearly using a black pen only.

Use BLOCK LETTERS and print one character in each box. 2 Print 8 in all appropriate boxes.Do not use correction fluid or tape.

Complete your details carefully to avoid

NAT 2541-06.2021

See the Privacy note in the Taxpayer"s

on page 10 of this return. YesNoPrint your home address below.

Has any part of your name changed

Read on.

Your mobile phone number

(if different from your mobile phone number)Your email address

Your contact details may be used by the ATO:

to advise you of tax return lodgment options to correspond with you with regards to your taxation and superannuation affairs to issue notices to you, or to conduct research and marketing. -XO\WR-XQH7D[UHWXUQIRULQGLYLGXDOV

25410621

OFFICIAL: Sensitive (when completed)Page 2

6DODU\RUZDJHV

Payer"s Australian business number Tax withheld - do not show cents Income - do not show cents R HAmount A in lump sum payments box

TYPE ASD\PHQWVOLNH1HZVWDUW -RE6HHNHUDQG$XVWXG\SD\PHQWV 6 You must complete item T1 in Tax offsets.

B LQFRPHVWUHDPV

Z Untaxed element

Y Taxed elementLump sum in arrears - taxable component I Taxable componentCODEDay

Your main salary and

Write the BSB number, account number and account name below. Day A1 on page 7.

WD[UHWXUQLQWKHIXWXUH"

YesFINAL TAX RETURNDon"t know

K G TYPE F TYPE E TYPE D TYPE C TYPE N$ Untaxed element

J$ Taxed elementTaxable component

M Assessable amount from capped defined benefit income stream OFFICIAL: Sensitive (when completed)TAX RETURN FOR INDIVIDUALS 2021 I Tax return for individuals (supplementary

LOSS LOSS Add up the income amounts and deduct any loss amount in the Your tax file number (TFN)

Attach here all documents that the instructions tell you to attach. Do not send in your tax return until you have attached all V Unfranked amount

S T U Discount from taxed upfront

D Discount from taxed upfront schemes

E Discount from deferral schemes

F Total assessable discount amount$

B Foreign source discounts$

A TFN amounts withheld from discountsC$

Gross interest

M Tax file number amounts

If you are a foreign-resident make sure you have printed L 25410821

- continued Add up the $ boxes.

O TYPE Payer"s

P$Untaxed element

QTaxed elementTaxable component

Tax withheld - do not show cents

OFFICIAL: Sensitive (when completed)Page 4

:RUNUHODWHGFDUH[SHQVHV A TYPE B C TYPE D TYPE E K I H J N L M Add amounts at items D1 to

LOSS You must read

are claiming D1-D6.

7D[ORVVHVRIHDUOLHULQFRPH\HDUV

F Z Primary production losses

Q R Primary production losses carried

If you were not required to complete ,

write the amount from above If you completed , add up the amounts you wrote at and Z and take the total away from . Write the answer at . LOSS D Tax return for individuals (supplementary section) , write here the amount from Interest charged by the ATO

OFFICIAL: Sensitive (when completed)TAX RETURN FOR INDIVIDUALS 2021 7 N CODE If you had a spouse during 2020

-21 you must also Spouse details - married or de facto

on pages 8-9. TAX OFFSET CODE box.

Y CODE S Add up all the tax offset amounts at items T2 and . U 7 Tax return for individuals (supplementary section) 25410821

Your tax file number (TFN)

OFFICIAL: Sensitive (when completed)Page 6

0 0HGLFDUHOHY\UHGXFWLRQRUH[HPSWLRQ

If you have completed item M1 and had a spouse during 2020 -21 you must also Spouse details - married or de facto on pages 8-9. YNumber of dependent children and students

CLAIM VFull 2.0% levy exemption - number of days

WHalf 2.0% levy exemption - number of days

Reduction based on family income

NOTE Medicare levy reduction or exemption

If you do not complete this item you may be charged the full Medicare levy surcharge.quotesdbs_dbs4.pdfusesText_8

You must complete item T1 in Tax offsets.

BLQFRPHVWUHDPV

ZUntaxed element

Y Taxed elementLump sum in arrears - taxable component ITaxable componentCODEDay

Your main salary and

Write the BSB number, account number and account name below. DayA1 on page 7.

WD[UHWXUQLQWKHIXWXUH"

YesFINAL TAX RETURNDon"t know

K G TYPE F TYPE E TYPE D TYPE C TYPE N$Untaxed element

J$Taxed elementTaxable component

M Assessable amount from capped defined benefit income stream OFFICIAL: Sensitive (when completed)TAX RETURN FOR INDIVIDUALS 2021 ITax return for individuals (supplementary

LOSS LOSS Add up the income amounts and deduct any loss amount in theYour tax file number (TFN)

Attach here all documents that the instructions tell you to attach. Do not send in your tax return until you have attached all VUnfranked amount

S T UDiscount from taxed upfront

DDiscount from taxed upfront schemes

EDiscount from deferral schemes

FTotal assessable discount amount$

BForeign source discounts$

ATFN amounts withheld from discountsC$

Gross interest

MTax file number amounts

If you are a foreign-resident make sure you have printed L25410821

- continuedAdd up the $ boxes.

O TYPEPayer"s

P$Untaxed element

QTaxed elementTaxable component

Tax withheld - do not show cents

OFFICIAL: Sensitive (when completed)Page 4

:RUNUHODWHGFDUH[SHQVHV A TYPE B C TYPE D TYPE E K I H J N L MAdd amounts at items D1 to

LOSSYou must read

are claimingD1-D6.

7D[ORVVHVRIHDUOLHULQFRPH\HDUV

F ZPrimary production losses

Q RPrimary production losses carried

If you were not required to complete ,

write the amount from above If you completed , add up the amounts you wrote at and Z and take the total away from . Write the answer at . LOSS D Tax return for individuals (supplementary section) , write here the amount fromInterest charged by the ATO

OFFICIAL: Sensitive (when completed)TAX RETURN FOR INDIVIDUALS 2021 7 N CODEIf you had a spouse during 2020

-21 you must alsoSpouse details - married or de facto

on pages 8-9.TAX OFFSET CODE box.

Y CODE S Add up all the tax offset amounts at items T2 and . U 7 Tax return for individuals (supplementary section)25410821

Your tax file number (TFN)

OFFICIAL: Sensitive (when completed)Page 6

00HGLFDUHOHY\UHGXFWLRQRUH[HPSWLRQ

If you have completed item M1 and had a spouse during 2020 -21 you must also Spouse details - married or de facto on pages 8-9.YNumber of dependent children and students

CLAIMVFull 2.0% levy exemption - number of days

WHalf 2.0% levy exemption - number of days

Reduction based on family income

NOTEMedicare levy reduction or exemption

If you do not complete this item you may be charged the full Medicare levy surcharge.quotesdbs_dbs4.pdfusesText_8[PDF] australiansuper/com/forms

[PDF] australisch rijbewijs geldig in nederland

[PDF] austria economy after ww1

[PDF] austria economy coronavirus

[PDF] austria economy covid

[PDF] austria economy facts

[PDF] austria economy ranking

[PDF] austria economy reopening

[PDF] austria exports 2019

[PDF] austria exports by country

[PDF] austria exports statistics

[PDF] austria exports to germany

[PDF] austria exports to india

[PDF] austria exports to pakistan