[PDF] PD7A Form

[PDF] PD7A Form

ENQUIRES. If you need more information or help in completing the form or using the Payroll Deductions Tables

Required Documents Checklist

Required Documents Checklist

(Form 5010-R). • T2125 Statement of Business or Professional Activities. If ... • PD7A Payroll filing documents. • Payroll or cheque run. Page 2. Section 2 ...

Employers Guide - Payroll Deductions and Remittances

Employers Guide - Payroll Deductions and Remittances

Starting January 1 2015

Canada Alberta Job Grant Applicant Guide

Canada Alberta Job Grant Applicant Guide

Apr 28 2023 • PD7A Summary of Federal Deductions; or. • T4. Note ... CAJG Application Form and the CAJG Training Completion Form

Ceridian

Ceridian

Mar 31 2021 Note: 2020 Online tax forms via epost™ are delivered in PDF format

2022 Year End Customer Guide (CAN)

2022 Year End Customer Guide (CAN)

Mar 13 2023 Confirm these numbers are correct by comparing them to the CRA PD7A form. PD7As are available online through CRA's My Business Account. Note ...

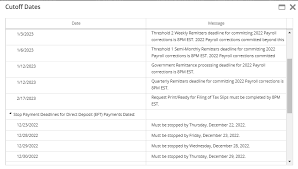

Paying and Filing Payroll Taxes and Liabilities

Paying and Filing Payroll Taxes and Liabilities

Use this worksheet to fill in your monthly PD7A amounts online or on the original forms sent by the CRA. Submit your. PD7A to the CRA along with CPP

2021 Year-End Customer Guide

2021 Year-End Customer Guide

Mar 17 2022 Ceridian can provide you with a copy of your 2021 employer tax forms on CD-ROM in .pdf format

Online Tax Filing Government Creditor List November 2022

Online Tax Filing Government Creditor List November 2022

Form Number. • Benefits and Credits Repayment. (CTB3). • Garnishee of Individual. (RC103) (PD7A-TM). • Federal Payroll Source Deductions - Threshold 2. (PD7A- ...

Chapter 9 QuickBooks Online Payroll

Chapter 9 QuickBooks Online Payroll

QuickBooks presets the Form PD7A. 6. Choose How often you pay your taxes T4 forms are the yearly forms which report employee earnings and deductions.

Untitled

Untitled

ENQUIRES. If you need more information or help in completing the form or using the Payroll Deductions Tables

Payroll Deductions and Remittances

Payroll Deductions and Remittances

and due dates how to make a remittance

Paying and Filing Payroll Taxes and Liabilities

Paying and Filing Payroll Taxes and Liabilities

This number will be printed on T4 slips and other payroll forms. in your monthly PD7A amounts online or on the original forms sent by the CRA.

Required Documents Checklist

Required Documents Checklist

The first section of the owners' T1 return (Form 5010-R). • T2125 Statement of Business or PD7A Payroll filing documents. • Payroll or cheque run ...

7. Government Remittance Service

7. Government Remittance Service

GoVeRnMenT ReMITTanCe FoRMS aVaIlaBle In aCCèSD aFFaIReS. These electronic forms are (PD7A)*. Federal Payroll Deductions twice monthly (Thrs.1). (PD7A)*.

AIR TRAVELLERS SECURITY CHARGE /BALANCE DUE AIR

AIR TRAVELLERS SECURITY CHARGE /BALANCE DUE AIR

PAYROLL CURRENT YEAR - REMITTANCE (PD7A RB) - TT06. PAYROLL CURRENT YEAR - REMITTANCE (PD7A TM) - TT06. PAYROLL CURRENT YEAR - REMITTANCE (PD7A) - TT06.

2020 Year-End Customer Guide

2020 Year-End Customer Guide

Mar 31 2021 Note: 2020 Online tax forms via epost™ are delivered in PDF format

Save time by using AccèsD Affaires for your government tax and

Save time by using AccèsD Affaires for your government tax and

(forms PD7A PD7A(TM)

PRE-SHOW AFTER-SHOW

PRE-SHOW AFTER-SHOW

T2 Form: Corporation Income Tax Return should be filed by June. 30th of following calendar year a corporation receives payment for services rendered in Canada.

[PDF] pdf 1984 george

[PDF] pdf a 2b

[PDF] pdf a 3

[PDF] pdf algebre premier cycle

[PDF] pdf art

[PDF] pdf bullet journal

[PDF] pdf citations d'amour

[PDF] pdf citations litteraires

[PDF] pdf cloison placostil

[PDF] pdf convertisseur

[PDF] pdf creator mode d'emploi 2016

[PDF] pdf creator windows 10

[PDF] pdf dinamico

[PDF] pdf gratuit