How to Construct and Bootstrap Yield Curve

How to Construct and Bootstrap Yield Curve

The term structure of interest rates also known as yield curve

Matrix Theory Application in the Bootstrapping Method for the Term

Matrix Theory Application in the Bootstrapping Method for the Term

Ingersoll. Stephen A. Ross (1985)]. Theoretical spot rate curve estimation using bootstrapping method. The yield on a zero coupon bond for a

Deriving Zero-Coupon Rates: Alternatives to Orthodoxy

Deriving Zero-Coupon Rates: Alternatives to Orthodoxy

First proposed by Caks (1977) in the context of deriving a zero-coupon curve for Treasuries the bootstrapping technique was later extended by oth- ers to

Multiple Interest Rate Curve Bootstrapping

Multiple Interest Rate Curve Bootstrapping

2013年9月23日 bootstrap the overnight curve corresponding to the prices of collateral zero-coupon bonds. Unfortunately overnight index swaps in general ...

1. Spot and Forward Interest Rates. Bootstrapping - 1.1 Money market

1. Spot and Forward Interest Rates. Bootstrapping - 1.1 Money market

(c) Calculate continuously compounded forward rates and the appropriate spot rates. (d) Compute spot prices of zero coupon bonds using: (i). continuously

Estimation of zero-coupon curves in DataMetrics

Estimation of zero-coupon curves in DataMetrics

The modified bootstrapping technique assumes the instantaneous forward interest rate is a constant between observed bond or other security maturities. We

IRS Pricing

IRS Pricing

2022年3月14日 derived by bootstrapping. Market Quotes. Valuation. Date. 29-Nov-21 ... Coupon PV (Floating Leg) = Notional * Day Count Fraction * Floating ...

TRANSFORMATION OF PAR YIELD CURVES ON ZERO YIELD

TRANSFORMATION OF PAR YIELD CURVES ON ZERO YIELD

The bootstrapping can handle various coupon payment frequencies and can be based on zero-coupon bonds as well. A high coupon on a bond doesn't guarantee a

A Teaching Note on Pricing and Valuing Interest Rate Swaps Using

A Teaching Note on Pricing and Valuing Interest Rate Swaps Using

In Bond Math I use the traditional method of bootstrapping implied spot (i.e.

FinPricing

FinPricing

Inflation curves can be bootstrapped from liquid inflation indexed bonds zero coupon swaps

Génération de scénarios économiques - Modélisation des taux d

Génération de scénarios économiques - Modélisation des taux d

22 nov. 2013 Méthode du bootstrapping. Illustration. Sur le marché toutes les échéances d'obligation zéro-coupon n'existent pas.

Projet Courbe de Taux

Projet Courbe de Taux

Reconstitution de la courbe de taux Zéro Coupons par diverses méthodes: Bootstrap. Interpolations linéaire

How to Construct and Bootstrap Yield Curve

How to Construct and Bootstrap Yield Curve

maturity on a zero coupon bond and the bond's maturity. Zero yield curves play an essential role in the valuation of all financial products.

RiskMetrics Journal - Summer 2002 Volume 3 Number 1

RiskMetrics Journal - Summer 2002 Volume 3 Number 1

DataMetrics is modifying the bootstrapping technique it uses to estimate zero-coupon curves. The modified bootstrapping technique assumes the instantaneous

Création dun outil de couverture de taux dintérêts en ligne

Création dun outil de couverture de taux dintérêts en ligne

de taux zéro-coupon des facteurs d'actualisation et des taux forward. Table 9 – Zéro coupon obtenu avec la méthode du Bootstrapping. Cas taux swap :.

Matrix Theory Application in the Bootstrapping Method for the Term

Matrix Theory Application in the Bootstrapping Method for the Term

Ingersoll. Stephen A. Ross (1985)]. Theoretical spot rate curve estimation using bootstrapping method. The yield on a zero coupon bond for a

Methods for Constructing a Yield Curve

Methods for Constructing a Yield Curve

the issue of bootstrapping and discuss how the interpolation algorithm should be tween the yield-to-maturity on a zero coupon bond and the bond's matu-.

CALCULATING EURO SWAPNOTE® FUTURES PRICES

CALCULATING EURO SWAPNOTE® FUTURES PRICES

20 juin 2014 Bootstrapping Technique. To calculate the zero coupon discount factors using the swap market rates the following “bootstrapping” technique ...

1. Spot and Forward Interest Rates. Bootstrapping - 1.1 Money market

1. Spot and Forward Interest Rates. Bootstrapping - 1.1 Money market

Spot and forward rates for a zero coupon bond. The spot rates for a zero coupon bonds are following: Period. Spot rate. 1. 5%. 2. 6%. 3. 7%.

Universiteit Twente Double Effect

Universiteit Twente Double Effect

23 sept. 2013 bootstrap the overnight curve corresponding to the prices of collateral zero-coupon bonds. Unfortunately overnight index swaps in general ...

[PDF] BIS Papers No 25: Zero-coupon yield curves: technical documentation

[PDF] BIS Papers No 25: Zero-coupon yield curves: technical documentation

Technical note on the estimation of forward and zero coupon yield curves as applied to Italian euromarket rates Research Department (Bank of Italy)

[PDF] Matrix Theory Application in the Bootstrapping Method for the Term

[PDF] Matrix Theory Application in the Bootstrapping Method for the Term

Theoretical spot rate curve estimation using bootstrapping method The yield on a zero coupon bond for a given maturity is the spot rate for the maturity

[PDF] How to Construct and Bootstrap Yield Curve - Zenodo

[PDF] How to Construct and Bootstrap Yield Curve - Zenodo

The objective of the bootstrap algorithm is to find the zero yield or discount factor for each maturity point and cash flow date sequentially so that all curve

[PDF] Methods for Constructing a Yield Curve

[PDF] Methods for Constructing a Yield Curve

The term structure of interest rates is defined as the relationship be- tween the yield-to-maturity on a zero coupon bond and the bond's matu- rity If we are

(PDF) Bootstrapping Yield Curves - ResearchGate

(PDF) Bootstrapping Yield Curves - ResearchGate

PDF We will now explain how to obtain zero-coupon yield curves from market data for coupon bonds or interest rate swaps To do so we begin with some

Bootstrapping Yield Curve - WallStreetMojo

Bootstrapping Yield Curve - WallStreetMojo

Guide to Bootstrapping Yield Curve Here we discuss how to construct a zero coupon yield curve using bootstrapping excel examples

[PDF] Zero Coupon Yield Curves Technical Documentation Bis

[PDF] Zero Coupon Yield Curves Technical Documentation Bis

When economic appeal is of the utmost importance we find parametric models to be more suitable than bootstrapping However we show that bootstrapping can be

Bootstrapping of Zero Curves - Springer Link

Bootstrapping of Zero Curves - Springer Link

It does not quote discount factors or zero rates for longer maturities To get a zero curve from market data usually two or three types of market data are used

[PDF] Financial Market Analysis (FMAx) Module 4 - edX

[PDF] Financial Market Analysis (FMAx) Module 4 - edX

It is the relationship between the yield-to-maturity of zero-coupon bonds and “If you fall into a well and no one is around you use your bootstrap to

[PDF] Zero-Coupon Yield Curve Estimation with the Package termstrc

[PDF] Zero-Coupon Yield Curve Estimation with the Package termstrc

However another application is based on zero yields which may be obtained from a bootstrap Page 7 Journal of Statistical Software 7 procedure The

What is bootstrapping zero coupon rates?

What is Bootstrapping Yield Curve? Bootstrapping is a method to construct a zero-coupon yield curve. The slope of the yield curve provides an estimate of expected interest rate fluctuations in the future and the level of economic activity.How to bootstrap zero rates?

Bootstrapping Spot Rate Curve (Zero Curve)

1Step 1: Decide on the Instrument for Yield Curve. 2Step 2: Select the Par Yield Curve. 3Step 3: Interpolate the Missing Yields. 4Step 4: Calculate Spot Rates Using Treasury Yields.What is bootstrapping formula?

Example: Bootstrapping Spot Rates

The one-year implied spot rate is 2%, as it is simply the one-year par yield. The two-year implied spot rate is determined as follows: 1=0.0261.02+(1+0.026)(1+r(2))2r(2)=2.61%- To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods.

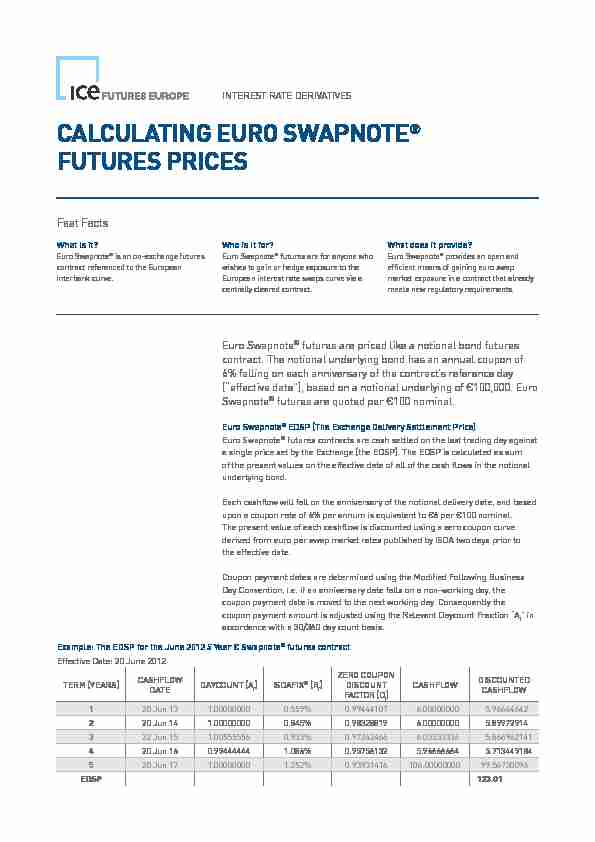

INTEREST RATE DERIVATIVES

Euro Swapnote

futures are priced like a notional bond futures contract. The notional underlying bond has an annual coupon of6% falling on each anniversary of the contract's reference day

("effective date"), based on a notional underlying of €100,000. EuroSwapnote

futures are quoted per €100 nominal.Euro Swapnote

EDSP (The Exchange Delivery Settlement Price)

Euro Swapnote

futures contracts are cash settled on the last trading day against a single price set by the Exchange (the EDSP). The EDSP is calculated as sum of the present values on the effective date of all of the cash flows in the notional underlying bond. Each cashflow will fall on the anniversary of the notional delivery date, and based upon a coupon rate of 6% per annum is equivalent to €6 per €100 nominal. The present value of each cashflow is discounted using a zero coupon curve derived from euro par swap market rates published by ISDA two days prior to the effective date. Coupon payment dates are determined using the Modified Following Business Day Convention, i.e. if an anniversary date falls on a non-working day, the coupon payment date is moved to the next working day. Consequently the coupon payment amount is adjusted using the Relevant Daycount Fraction "Ai " in accordance with a 30/360 day count basis. Example: The EDSP for the June 2012 5 Year € Swapnote futures contractEffective Date: 20 June 2012TERM (YEARS)CASHFLOW

DATEDAYCOUNT (A

i )ISDAFIX® (R

i )ZERO COUPONDISCOUNT

FACTOR (D

i )CASHFLOWDISCOUNTED

CASHFLOW

120 Jun 131.000000000.559%0.994441076.000000005.96664642

220 Jun 141.000000000.845%0.983288196.000000005.89972914

322 Jun 151.005555560.933%0.972424666.033333365.866962141

420 Jun 160.994444441.086%0.957561325.966666645.713449184

520 Jun 171.000000001.252%0.93931416106.0000000099.56730096

EDSP123.01

CALCULATING EURO SWAPNOTE

FUTURES PRICES

Fast Facts

What is it?

Euro Swapnote®

is an on-exchange futures contract referenced to the European interbank curve.Who is it for?

Euro Swapnote

futures are for anyone who wishes to gain or hedge exposure to theEuropean interest rate swaps curve via a

centrally cleared contract.What does it provide?

Euro Swapnote

provides an open and efficient means of gaining euro swap market exposure in a contract that already meets new regulatory requirements.Bootstrapping Technique

To calculate the zero coupon discount factors using the swap market rates, the following "bootstrapping" technique is employed. The one year swap rate represents a single fixed payment, with the first discount factor calculated as follows: d i =1 1 + A i R iWhere R

i is the one year euro swap rate quoted vs. 3 month Euribor in nominal terms. As per the example, R i =0.00599. The swap rates for two years and beyond cover multiple annual fixed payments. The bootstrapping methodology needs to take into account earlier annual payments to calculate the zero discount factor for each subsequent payment; calculated as follows: d i =1 - R i ∑ A j d j 1 + A i R iEuro Swapnote

Market Price

The market price of Swapnote

futures can be calculated using forward par swap rates as of the contract's effective date. Euro Swapnote futures effective dates follow the IMM convention, i.e. Swapnote futures can be calculated using IMM par swap rates. Euro par swap rates represent the annual fixed rates payable on a fixed-for- floating interest rate swap of different term-to-maturities. Euro par swap rates are established on the basis that the value of a par swap at the start of the swap's life is zero. To have the starting value equal to zero, the fixed rate on the swap has to be set such that the present value of the swap's fixed payments equals the present value of the swap's floating payment. The IMM par swap rates can be calculated using a forwarding curve with future payments present valued using a discounting curve as follows:For a par swap:P V fixed = P V floating

P V fixed = fixedrate x ∑ daycount n x discount n P V floating = ∑ floatrate m x daycount m x discount mRe-arranging:fixedrate =∑ floatrate

m x daycount m x discount m ∑ daycount n x discount n i - 1 j = 1 Example: 2 Year IMM par swap rate quoted vs. 6 month EuriborValuation Date:

12 June 2012

IMM Date:

20 June 2012

FIXED SIDEFLOATING SIDE

PAYMENT DATEDAYCOUNTEONIA DISCOUNT

(DISCOUNTINGCURVE)6M EURIBOR

(FORWARDINGCURVE)DAYCOUNTEONIA DISCOUNT

(DISCOUNTINGCURVE)

20 Dec 120.937%0.500000000.99862

20 Jun 131.000000000.997420.821%0.500000000.99742

20 Dec 130.836%0.500000000.99600

20 Jun 141.000000000.994000.938%0.500000000.99400

SUM1.991420.017598

FIXED RATE= 0.017598 / 1.99142 = 0.884% (to 3 d.p.) Using this technique, IMM par swap rates can be calculated for all relevant cashflows in the 2, 5 and 10 Year € Swapnote contracts.2 YEAR € SWAPNOTE

MATURITYANNIVERSARY

DATE (IMM)IMM PAR SWAP

RATEDAYCOUNTZERO COUPON

DISCOUNT

FACTORCASHFLOWDISCOUNTED

CASHFLOW

120 Jun 130.607%1.000000000.993962766.000000005.96377656

220 Jun 140.884%1.000000000.98253670106.00000000104.14889020

VALUE110.115

5 YEAR € SWAPNOTE

MATURITYANNIVERSARY

DATE (IMM)IMM PAR SWAP

RATEDAYCOUNTZERO COUPON

DISCOUNT

FACTORCASHFLOWDISCOUNTED

CASHFLOW

120 Jun 130.607%1.000000000.993962766.000000005.96377656

220 Jun 140.884%1.000000000.982536706.000000005.89522020

322 Jun 150.985%1.005555560.970908946.033333365.85781730

420 Jun 161.133%0.994444440.955773735.966666645.70278323

520 Jun 171.293%1.000000000.93742789106.0000000099.36735634

VALUE122.79

10 YEAR € SWAPNOTE

MATURITYANNIVERSARY

DATE (IMM)IMM PAR SWAP

RATEDAYCOUNTZERO COUPON

DISCOUNT

FACTORCASHFLOWDISCOUNTED

CASHFLOW

120 Jun 130.607%1.000000000.993962766.000000005.96377656

220 Jun 140.884%1.000000000.982536706.000000005.89522020

322 Jun 150.985%1.005555560.970908946.033333365.85781730

420 Jun 161.133%0.994444440.955773735.966666645.70278323

520 Jun 171.293%1.000000000.937427896.000000005.62456734

620 Jun 181.436%1.000000000.917301496.000000005.50380894

720 Jun 191.557%1.000000000.896387786.000000005.37832668

822 Jun 201.663%1.005555560.874744386.033333365.27762445

921 Jun 211.752%0.997222220.853137295.983333325.10460477

1020 Jun 221.833%0.997222220.83107561105.9833333288.08016339

VALUE122.79

Further Information

Interest Rate Derivatives

+44 (0)20 7429 4640rates@theice.com theice.com/products/futures-&- options/financials/interest-rates

© 2014 Intercontinental Exchange, Inc. The information and materials contained in this document - including text, graphics, links or other items - are provided "as is" and "as available." ICE and its subsidiaries do not warrant the accuracy, adequacy or completeness of this

information and materials and expressly disclaims liability for errors or omissions in this information and materials. This document is provided for information purposes only and in no way constitutes investment advice or a solicitation to purchase investments or market data

or otherwise engage in any investment activity. No warranty of any kind, implied, express or statutory, is given in conjunction with the information and materials. The information in this document is liable to change and ICE undertakes no duty to update such information. You

should not rely on any information contained in this document without first checking that it is correct and up to date. The content of this document is proprietary to ICE in every respect and is protected by copyright. No part of this material may be copied, photocopied or

duplicated in any form by any means or redistributed without the prior written consent of ICE. All third party trademarks are owned by their respective owners and are used with permission.

Swapnote® is a registered trademark of ICAP plc and has been licensed for use by Liffe. The Swapnote® contract design and algorithm are protected by patent (US 6,304,858 BI), owned by Adams, Viner and Mosler Ltd ("AVM") and is exclusively licensed to Liffe worldwide.

Euribor® and Eonia® are registered trademarks of Euribor-FBE. ISDA® and ISDAFIX® are registered trademarks of the International Swaps and Derivatives Association, Inc.

Trademarks of ICE and/or its affiliates include Intercontinental Exchange, ICE, ICE block design, NYSE, New York Stock Exchange and Liffe. Information regarding additional trademarks and intellectual property rights of Intercontinental Exchange, Inc. and/or its affiliates is

located at https://www.intercontinentalexchange.com/terms-of-usequotesdbs_dbs32.pdfusesText_38[PDF] obligation zero coupon calcul

[PDF] courbe zero coupon bloomberg

[PDF] prix zero coupon

[PDF] construction de l'union européenne cm2

[PDF] construction jeux

[PDF] construction définition juridique

[PDF] construction de lego

[PDF] construction batiment

[PDF] construction simulator 2014

[PDF] construction antiquité

[PDF] méthodes numériques appliquées pour le scientifique et l'ingénieur pdf

[PDF] methode numerique et programmation

[PDF] methode numérique matlab pdf

[PDF] examen methode numerique