IEC/FDIS 31010

IEC/FDIS 31010

International standard ISO/IEC 31010 has been prepared by IEC technical committee 56: Dependability together with the ISO TMB “Risk management” working group.

Manajemen risiko – Teknik penilaian risiko

Manajemen risiko – Teknik penilaian risiko

ISO 31010:2016 dengan judul Manajemen risiko – ... Apabila pengguna menemukan keraguan dalam Standar ini maka disarankan untuk melihat standar aslinya yaitu IEC/ ...

NLi1` 11 :`31010: Gestão de riscos - Técnicas para o processo de

NLi1` 11 :`31010: Gestão de riscos - Técnicas para o processo de

Aug 3 2559 BE ... 0310&+ 1D 13:43:37 de uso exclusivo de INSTITUTO N CIONAL DE TECNOLOGIA. ABNT NBR ISO/IEC 31010:2012. Página. PrefácioNacional .

MALAYSIAN STANDARD

MALAYSIAN STANDARD

International standard IEC/ISO 31010 has been prepared by IEC technical committee 56: Dependability together with the ISO TMB “Risk management” working group.

Risk assessment techniques ISO 31010

Risk assessment techniques ISO 31010

• ISO / IEC Guide 73 Risk management -. Vocabulary. • ISO 31010

Untitled

Untitled

Apr 24 2556 BE 1 de 104. Page 6. NORMA TÉCNICA COLOMBIANA. NTC-IEC/ISO 31010. ¿cuál es la probabilidad de su ocurrencia en el futuro? ¿existen factores que ...

ISO 31000:2009 IEC/ISO 31010:2009 & ISO Guide 73:2009

ISO 31000:2009 IEC/ISO 31010:2009 & ISO Guide 73:2009

Nov 27 2552 BE 2009 ISO/IEC 31010 published. Page 4. KNOWLEDGE. ABOUT OUTCOMES. Well-defined outcomes.

IEC-ISO 31010: el uso de técnicas para la evaluación del riesgo

IEC-ISO 31010: el uso de técnicas para la evaluación del riesgo

RESUMEN. La norma IEC-ISO 31010 creada en 2009 y actualizada en 2018

ДСТУ IEC/ISO 31010:2013 Керування ризиком. Методи

ДСТУ IEC/ISO 31010:2013 Керування ризиком. Методи

ДСTY IEC/ISO 31010:2013. НАЦІОНАЛЬНИЙ ВСТУП. Цей стандарт в письмовий переклад IEC/ISO 31010:2009 Risk management - Risk assessment techniques (Керування

ก ก Tools and Techniques for Enterprise Risk Management (ERM

ก ก Tools and Techniques for Enterprise Risk Management (ERM

ISO 31010 - Risk Assessment Technique. ERM Framework Comparison. Conclusion ISO 31010. 2010. COSO. ISO 31000. COSO Internal Control Framework. Monitoring.

IEC/FDIS 31010

IEC/FDIS 31010

31010. Risk management — Risk assessment techniques International standard ISO/IEC 31010 has been prepared by IEC technical committee 56:.

ISO 31010 Risk assessment techniques 1

ISO 31010 Risk assessment techniques 1

A graphical model of variables and their cause-effect relationships expressed using probabilities. A basic Bayesian network has variables representing

Risk management - Risk assessment techniques (IEC/ISO 31010

Risk management - Risk assessment techniques (IEC/ISO 31010

1 May 2010 ISO 22000. NOTE Harmonized as EN ISO 22000. I.S. EN 31010:2010. This is a free 14 page sample. Access the full version online.

ISO 31000:2009 IEC/ISO 31010:2009 & ISO Guide 73:2009

ISO 31000:2009 IEC/ISO 31010:2009 & ISO Guide 73:2009

27 Nov 2009 IEC/ISO 31010:2009. & ISO Guide 73:2009. International Standards for the. Management of Risk. Kevin W Knight AM. CHAIRMAN. UNECE GRM.

Risk assessment techniques ISO 31010

Risk assessment techniques ISO 31010

This International Standard is a companion standard ISO 31000. ISO / IEC Guide 73 Risk management -. Vocabulary. • ISO 31010

Manajemen risiko – Teknik penilaian risiko

Manajemen risiko – Teknik penilaian risiko

SNI IEC/ISO 31010:2016. Manajemen risiko – Teknik penilaian risiko. Risk management – Risk assessment techniques. (IEC/ISO 31010:2009 IDT). ICS 03.100.001.

MS IEC/ISO 31010 – Risk Management - Risk Assessment

MS IEC/ISO 31010 – Risk Management - Risk Assessment

Setting the Scene – Risk Management Framework (MS ISO/IEC 31000). • Framework for managing risk. • Risk Management Process. • MS IEC/ISO 31010 – Risk

NTE INEN-IEC/ISO 31010

NTE INEN-IEC/ISO 31010

Esta norma nacional es una traducción idéntica de la Norma Internacional IEC/ISO 31010:2009. NORMA. TÉCNICA. ECUATORIANA. GESTIÓN DE RIESGOS - TÉCNICAS DE

PECB Change Log Form

PECB Change Log Form

23 Aug 2019 Replaced the parts where IEC/ISO 31010:2009 was used with the newest edition of this standard i.e. IEC 31010:2019.

MALAYSIAN STANDARD

MALAYSIAN STANDARD

This Malaysian Standard is identical with IEC/ISO 31010:2009 Risk management - Risk assessment techniques

ISO 31000:2009

IEC/ISO 31010:2009

& ISO Guide 73:2009International Standards for the

Management of Risk

Kevin W Knight AM

CHAIRMAN

UNECE GRM

P 0 BOX 226, NUNDAH Qld 4012, Australia

E-mail: kknight@bigpond.net.au

02/17We all manage risk consciously or unconsciously

-but rarely systematicallyManaging risk means forward thinking

Managing risk means responsible thinking

Managing risk means balanced thinking

Managing risk is all about maximising opportunity

and minimising threats The risk management process provides a framework to facilitate more effective decision makingManaging Risk

History of the ISO and

Risk Management

Over 80 separate ISO and IEC Technical Committees are addressing aspects of risk management27thJune 2002, ISO/IEC Guide 73, Risk Management -

2004 ISO Technical Management Board (TMB)

approached by Australia and JapanAS/NZS 4360:2004 to be adopted by ISO.

June 2005, TMB sets up Working Group (WG)

15.11.2009 ISO 31000 & ISO Guide 73 published

27.11.2009 ISO/IEC 31010 published.

KNOWLEDGE

ABOUT OUTCOMES

Well-defined

outcomesPoorly

defined outcomesSome basis for

probabilitiesrisk ambiguityKNOWLEDGE

ABOUTLIKELIHOODS

³INCERTITUDE´

No basis for

probabilitiesuncertaintyignoranceUniversity of Cambridge.

The Pivotal Definition

risk effect of uncertainty on objectives NOTE 1 An effect is a deviation from the expected positive and/or negative. NOTE 2 Objectives can have different aspects (such as financial, health and safety, and environmental goals) and can apply at different levels (such as strategic, organization-wide, project, product and process). NOTE 3 Risk is often characterized by reference to potential events and consequences, or a combination of these. NOTE 4 Risk is often expressed in terms of a combination of the consequences of an event (including changes in circumstances) and the associated likelihood of occurrence. NOTE 5 Uncertainty is the state, even partial, of deficiency of information related to, understanding or knowledge of, an event, its consequence, or likelihood. [ISO Guide 73:2009] risk owner person or entity with the accountability and authority to manage a risk control measure that is modifying risk NOTE 1 Controls include any process, policy, device, practice, or other actions which modify risk.NOTE 2 Controls may not always exert the intended

or assumed modifying effect. [ISO Guide 73:2009]Accountable

Responsible

Liability for the outcomes of actions or

decisionsNOTE: Includes failure to act or make

decisions OR being obligated to answer for a decision OR obligation to answer for an action.Obligation to carry out duties or

decisions, or control over others as directed OR having the obligation to act OR obligation to carry out instructions.Yet to be defined

AS/NZS ISO 31000:2009

-Users AS/NZS ISO 31000:2009 is intended to be used by a wide range of stakeholders including: those responsible for implementing risk management within their organization; those who need to ensure that an organization manages risk; those who need to manage risk for the organization as a whole or within a specific area or activity; in managing risk; anddevelopers of standards, guides, procedures, and codes of practice that in whole or in part set out how risk is to be managed within the specific context of these documents.

A Business PrinciplesApproach to the

Management of Risk

Corporate Governance

The way in which an organisation is governed and

controlled in order to achieve its objectives. The control environment makes an organisation reliable in achieving these objectives within a tolerabledegree of risk. It is the glue which holds the organisation together in pursuit of its objectives while risk management provides the resilience. Queensland Audit Office ±Report No. 7 1998-99: -Corporate Governance

³7OH V\VPHP N\ ROLŃO HQPLPLHV MUH

GLUHŃPHG MQG ŃRQPUROOHGB´

´FRUSRUMPH JRYHUQMQŃH JHQHUMOO\ UHIHUV

to the processes by which organisations are directed, controlled and held to account. It encompasses authority, accountability, stewardship, leadership, direction and controlH[HUŃLVHG LQ POH RUJMQLVMPLRQB´

SAA HB 254-2005

Governance, risk management and control assurance

Standards Australia. ISBN 0 7337 6892 X

ACCOUNTABILITY

SUPERVISION

GOVERNANCE

STRATEGIC

MANAGEMENT

MANAGEMENT

EXECUTIVE

MANAGEMENT

DECISION & CONTROL

OPERATIONAL MANAGEMENT

Potential greater

future role of risk managementTraditional and current

risk management applicationMandate and Commitment

(4.2)Implementing

RiskManagement

(4.4)Design of

Framework

(4.3)Continual

Improvement

of theFramework

(4.6)Monitoring

and Review of theFramework

(4.5)Framework

(Clause 4) a) Creates value b) Integral part of organizational processes c) Part of decision making d) Explicitly addresses uncertainty e) Systematic, structured and timely f) Based on the best available information g) Tailored h) Takes human and cultural factors into account i) Transparent and inclusive j) Dynamic, iterative and responsive to change k) Facilitates continual improvement and enhancement of the organizationPrinciples

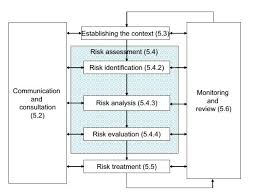

(Clause 3)Process

(Clause 5)Establishing

the context (5.3)Risk treatment

(5.5) Risk identification (5.4.2)Risk analysis

(5.4.3) Risk evaluation (5.4.4)Risk assessment

(5.4) M o n i t o r i n g r e v i e w (5.6) C o m u n i c a t i o n c o n s u l t a t i o n 5.2 ISO 31000:2009 Figure 1 ±Relationship between the principles, framework and processBusiness Principles Approach

AS/NZS ISO 31000:2009 Principles (Clause 3)

1.Create value

2.Be an integral part of organisational processes

3.Be part of decision making

4.Explicitly address uncertainty

5.Be systematic and structured

6.Be based on the best available information

7.Be tailored

8.Take into account human factors

9.Be transparent and inclusive

10.Be dynamic, iterative and responsive to change

11.Be capable of continual improvement and enhancement

Risk management should

create valueRM contributes to the

achievement of objectives.Protects value minimise

downside risk, protects people, systems and processes.Risk management should be an

integral part of organizational processesRM is not a stand-alone activity

from the management system of the organisation.RM is part of the process -not

Risk management should be

part of decision makingRisk management helps decision

makers make informed choices, prioritize actions and distinguish among alternative courses of action.Helps allocate scarce resources.

Risk management explicitly

addresses uncertaintyRisk management explicitly takes

account of uncertainty, the nature of that uncertainty, and how it can be addressed.RM addresses uncertainty, no

matter the level of uncertainty.Risk management should be

systematic and structuredquotesdbs_dbs14.pdfusesText_20[PDF] iso 80000

[PDF] iso 9000 2008

[PDF] iso 9000 wikipedia

[PDF] iso 9000:2008 pdf

[PDF] iso 9000:2015

[PDF] iso 9001 2000

[PDF] iso 9001 2015

[PDF] iso 9001 2015 pour les pme comment procéder pdf

[PDF] iso 9001 2015 ppt

[PDF] iso 9001 7.1 6

[PDF] iso 9001 avantages et inconvénients

[PDF] iso 9001 c'est quoi

[PDF] iso 9001 certification

[PDF] iso 9001 définition