2019 Instruction 1040

2019 Instruction 1040

8 Jan 2020 Including the instructions for. Schedules 1 through 3 and. 1040-SR. 2019. TAX YEAR. Department of the Treasury Internal Revenue Service ...

2019 Schedule 3 (Form 1040 or 1040-SR)

2019 Schedule 3 (Form 1040 or 1040-SR)

? Go to www.irs.gov/Form1040 for instructions and the latest information. OMB No. 1545-0074. 2019. Attachment. Sequence No. 03. Name(

2021 Schedule 3 (Form 1040)

2021 Schedule 3 (Form 1040)

? Go to www.irs.gov/Form1040 for instructions and the latest information. OMB No. 1545-0074. Attachment. Sequence No. 03. Name(s) shown on Form

2021 Instruction 1040

2021 Instruction 1040

21 Dec 2021 and wish to claim the premium tax credit on Schedule 3 line 9. ... opments affecting Form 1040 or 1040-SR or the instructions

Instructions for Form 1040-X (Rev. September 2021)

Instructions for Form 1040-X (Rev. September 2021)

Use the July 2021 revision of Form 1040-X to amend 2019 and return and to Schedules 1 through 3 (Form 1040) for the year of the return being amended.

2019 Schedule 1 (Form 1040 or 1040-SR)

2019 Schedule 1 (Form 1040 or 1040-SR)

Go to www.irs.gov/Form1040 for instructions and the latest information. OMB No. 1545-0074. 2019 3. Business income or (loss). Attach Schedule C . .

2021 Instructions for Form 1116

2021 Instructions for Form 1116

To make the election just enter on the foreign tax credit line of your tax return (for example

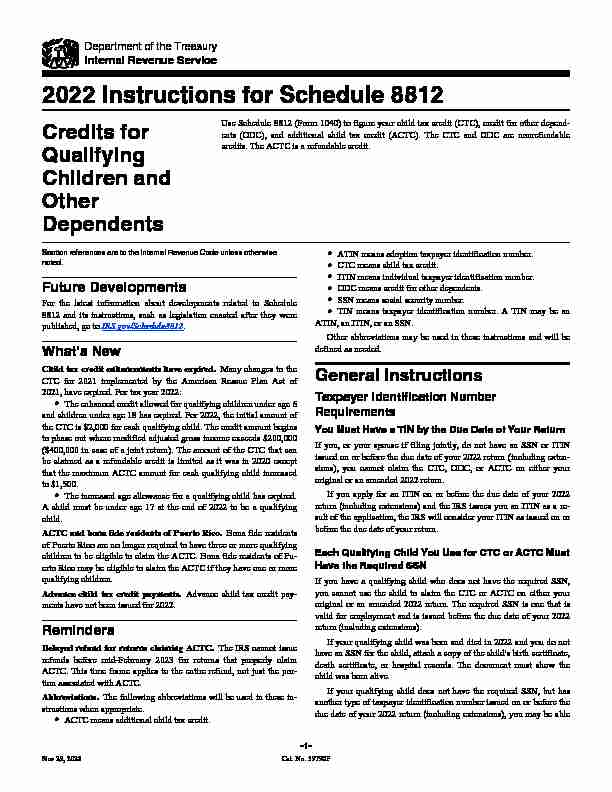

2021 Instructions for Schedule 8812 - Credits for Qualifying Children

2021 Instructions for Schedule 8812 - Credits for Qualifying Children

7 Jan 2022 Use Schedule 8812 (Form 1040) to figure your child tax credits ... based on information from either a 2019 or 2020 tax return

2019 Instructions for Schedule R - Credit for the Elderly or the

2019 Instructions for Schedule R - Credit for the Elderly or the

6 Aug 2019 Fill in Part II and lines 11 and 13 of Part III if they apply to you. Then check box c on Schedule 3 (Form 1040 or 1040-SR)

2019 Schedule 3 (Form 1040 or 1040-SR)

2019 Schedule 3 (Form 1040 or 1040-SR)

Attach to Form 1040 or 1040-SR. ? Go to www.irs.gov/Form1040 for instructions and the latest information. OMB No. 1545-0074. 2019. Attachment. Sequence No.

,56JRY6FKHGXOH &UHGLWIRU2WKHU'HSHQGHQWV 2'& :KR4XDOLILHVDV

,56JRY6FKHGXOH &UHGLWIRU2WKHU'HSHQGHQWV 2'& :KR4XDOLILHVDV4XDOLILHVDV &UHGLWVIRU4XDOLI\LQJ&KLOGUHQ $GRSWHGFKLOG 'H SHQGHQWV

DQGWKH2'&

3DUW,,$$GGLWLRQ

DO&KLOG7D[&UHGLWIRU$OO)LOHUV

TIP CAUTION

'HSHQGHQWV LWIRURWKHUGHSHQGHQWVER[IRUWKHVDPHSHUVRQ

'HSHQGHQWV LWIRURWKHUGHSHQGHQWVER[IRUWKHVDPHSHUVRQ

,IWKHDPRXQWRQOLQHLVPRUHWKDQOLQH\RXPD\EH )RUP 65RU 15WKURXJK OLQH DOVR WD[FUHGLW

CAUTION

CAUTION

TIP CAUTION

WKHFRPSXWDWLRQRIHDUQHGLQFRPHRQOLQHD

FDUHWD[HVVKRXOGEHVKRZQRQ)RUPV:ER[HVDQG

DQG3XHUWR5LFR)RUPV5:35ER[HVDQG

CAUTION

1. 2.1 2Enter the amount from line 18 of your Form 1040, 1040-SR, or 1040-NR.

Add the following amounts (if applicable) from: 4.If you are not completing Credit Limit Worksheet B, enter -0-; otherwise, enter

the amount from Credit Limit Worksheet B.4 Enter the total. Schedule 3

, line 6e . . . . . . . . . .

Schedule 3

, line 6f . . . . . . . . . . Schedule 3, line 6d . . . . . . . . . .

Form 5695, line 30 . . . . . . . . . .

3.Subtract line 2 from line 1.3

55.Subtract line 4 from line 3. Enter here and on Schedule 8812, line 13. Schedule 3, line 1 . . . . . . . . . . .

Schedule

3 line 2 Schedule

3 line 3 Schedule

3 line 4 Complete Credit Limit Worksheet B

only if you meet all of the following. 1. You are claiming one or more of the following credits.

a. Mortgage interest credit, Form 8396. b. Adoption credit, Form 8839. c. Residential clean energy credit, Form 5695, Part I. d. District of Columbia ?rst-time homebuyer credit, Form 8859. 2. You are not ?ling Form 2555.

3. Line 4 of Schedule 8812 is more than zero.

Schedule

3 line 6l . . . . . . . . . .

Complete

the Earned Income Worksheet, later, in these instructions. 6. 8. 7 If your employer withheld or you paid Additional Medicare Tax or Tier 1 RRTA taxes, use the Additional Medicare Tax and RRTA Tax Worksheet to ?gure the amount to enter; otherwise enter the following amounts. Enter the total of any amounts from

Schedule 1

, line 15; Schedule 2

, line 5; Schedule 2

, line 6; and Schedule 2

, line 13. 8 9.Add lines 7 and 8. Enter the total.9

• S ocial security tax withheld from Form(s) W-2, box 4, and Puerto Rico Form(s) 499R-2/W-2PR, box 21 and • M edic are tax withheld from Form(s) W-2, box 6, and Puerto Rico Form(s) 499R-2/W-2PR, box 23

.Use this worksheet only if you meet each of the items discussed under li ne 3 of Credit Limit Worksheet A, including that you are not ling Form 2555. Before

you begin: 3.3Enter your earned income from line 7 of the Earned

Income

Worksheet.

No. Leave line 4 blank, enter -0- on line 5, and go to line 6.4.Is the amount on line 3 more than $2,500? Yes. Subtract $2,500 from the amount on line 3.

Enter the result. 5.Multiply the amount on line 4 by 15% (0.15) and enter the result.

On line 2 of this worksheet, is the amount $4,500 or more? No. 4 5 If married ?ling

jointly, include your spouse"s amounts with yours when completing lines 7 and 8.

Yes. If line 5 above is equal to or more than line 1 above, leave lines 7 through 10 blank, enter -0- on line 11, and go to line 12. Otherwise, go to line 7. 7. CAUTION

If you are a bona ?de resident of Puerto Rico and line 5 above is less than line 1 above, go to line 7. Otherwise, leave lines 7 through 10 blank, enter -0- on line 11, and go to line 12. 1040 and 1040-SR ?lers.

Complete line 27; Schedule 2, line 5; Schedule 2, line 6; and Schedule 3, line 11 of your return if they apply to you. 1040-NR ?lers.

Complete Schedule 2, line 5; Schedule 2, line 6; and Schedule 3, line 11 of your return if they apply to you. 1.Enter the amount from Schedule 8812, line 12 . . . . . . . . . . . .

1 2.2 TIP: The number of children you use for this line is the same as the number of children you used for line 4 of Schedule 8812. Number of qualifying children under 17 with the required social security number: $1,500. Enter the result. 14. 14Is the amount on line 13 of this worksheet more than the amount on line

1? 15.Enter the total of the amounts from

Form 5695, line 15

15 Yes. Enter -0-.No. Subtract line 13 from line 1. Enter the result. Next, ?gure the amount of any of the following credits that you are claiming. Residential clean energy credit, Form 5695, Part I. Then, go to line 15.

12.Enter the larger of line 5 or line 11.12

• Mortgage interest credit, Form 8396. Schedule 3

line 6c 11.Subtract line 10 from line 9. If the result is zero or less, enter -0-.11

• District of Columbia ?rst-time homebuyer credit, Form 8859. Schedule 3

line 6h, and• Adoption credit, Form 8839. Schedule 3

line 6g 10.1040 and 1040-SR ?lers. Enter the total of the amounts

from Form 1040 or 1040-SR, line 27, and Schedule 3, line 11.10 1040-NR lers.

Enter the amount from Schedule 3,

line 11. 13.Enter the smaller of line 2 or line 12.13

Enter this amount on line 4 of Credit Limit

Worksheet A.

quotesdbs_dbs31.pdfusesText_37

SHQGHQWV

DQGWKH2'&

3DUW,,$$GGLWLRQ

DO&KLOG7D[&UHGLWIRU$OO)LOHUV

TIPCAUTION

'HSHQGHQWVLWIRURWKHUGHSHQGHQWVER[IRUWKHVDPHSHUVRQ

'HSHQGHQWVLWIRURWKHUGHSHQGHQWVER[IRUWKHVDPHSHUVRQ

,IWKHDPRXQWRQOLQHLVPRUHWKDQOLQH\RXPD\EH )RUP 65RU 15WKURXJK OLQH DOVRWD[FUHGLW

CAUTION

CAUTION

TIPCAUTION

WKHFRPSXWDWLRQRIHDUQHGLQFRPHRQOLQHD

FDUHWD[HVVKRXOGEHVKRZQRQ)RUPV:ER[HVDQG

DQG3XHUWR5LFR)RUPV5:35ER[HVDQG

CAUTION

1. 2.12Enter the amount from line 18 of your Form 1040, 1040-SR, or 1040-NR.

Add the following amounts (if applicable) from:4.If you are not completing Credit Limit Worksheet B, enter -0-; otherwise, enter

the amount from Credit Limit Worksheet B.4 Enter the total.Schedule 3

, line6e . . . . . . . . . .

Schedule 3

, line6f . . . . . . . . . . Schedule 3, line 6d . . . . . . . . . .

Form5695, line 30 . . . . . . . . . .

3.Subtract line 2 from line 1.3

55.Subtract line 4 from line 3. Enter here and on Schedule 8812, line 13. Schedule 3, line 1 . . . . . . . . . . .

Schedule

3 line 2Schedule

3 line 3Schedule

3 line 4Complete Credit Limit Worksheet B

only if you meet all of the following.1. You are claiming one or more of the following credits.

a. Mortgage interest credit, Form 8396. b. Adoption credit, Form 8839. c. Residential clean energy credit, Form 5695, Part I. d. District of Columbia ?rst-time homebuyer credit, Form 8859.2. You are not ?ling Form 2555.

3. Line 4 of Schedule 8812 is more than zero.

Schedule

3 line6l . . . . . . . . . .

Complete

the Earned Income Worksheet, later, in these instructions. 6. 8. 7 If your employer withheld or you paid Additional Medicare Tax or Tier 1 RRTA taxes, use the Additional Medicare Tax and RRTA Tax Worksheet to ?gure the amount to enter; otherwise enter the following amounts.Enter the total of any amounts from

Schedule 1

, line 15;Schedule 2

, line 5;Schedule 2

, line 6; andSchedule 2

, line 13. 89.Add lines 7 and 8. Enter the total.9

• S ocial security tax withheld from Form(s) W-2, box 4, and Puerto Rico Form(s) 499R-2/W-2PR, box 21 and • M edic are tax withheld from Form(s) W-2, box 6, andPuerto Rico Form(s) 499R-2/W-2PR, box 23

.Use this worksheet only if you meet each of the items discussed under li ne 3 of Credit Limit Worksheet A, including that you are not ling Form 2555.Before

you begin:3.3Enter your earned income from line 7 of the Earned

Income

Worksheet.

No. Leave line 4 blank, enter -0- on line 5, and go to line 6.4.Is the amount on line 3 more than $2,500? Yes.Subtract $2,500 from the amount on line 3.

Enter the result.5.Multiply the amount on line 4 by 15% (0.15) and enter the result.

On line 2 of this worksheet, is the amount $4,500 or more? No. 4 5If married ?ling

jointly, include your spouse"s amounts with yours when completing lines7 and 8.

Yes. If line 5 above is equal to or more than line 1 above, leave lines 7 through 10 blank, enter -0- on line 11, and go to line 12. Otherwise, go to line 7. 7.CAUTION

If you are a bona ?de resident of Puerto Rico and line 5 above is less than line 1 above, go to line 7. Otherwise, leave lines 7 through 10 blank, enter -0- on line 11, and go to line 12.1040 and 1040-SR ?lers.

Complete line 27; Schedule 2, line 5; Schedule 2, line 6; and Schedule 3, line 11 of your return if they apply to you.1040-NR ?lers.

Complete Schedule 2, line 5; Schedule 2, line 6; and Schedule 3, line 11 of your return if they apply to you.1.Enter the amount from Schedule 8812, line 12 . . . . . . . . . . . .

1 2.2 TIP: The number of children you use for this line is the same as the number of children you used for line 4 of Schedule 8812. Number of qualifying children under 17 with the required social security number: $1,500. Enter the result. 14.14Is the amount on line 13 of this worksheet more than the amount on line

1?15.Enter the total of the amounts from

Form5695, line 15

15 Yes. Enter -0-.No. Subtract line 13 from line 1. Enter the result. Next, ?gure the amount of any of the following credits that you are claiming. Residential clean energy credit, Form 5695, Part I.Then, go to line 15.

12.Enter the larger of line 5 or line 11.12

• Mortgage interest credit, Form 8396.Schedule 3

line 6c11.Subtract line 10 from line 9. If the result is zero or less, enter -0-.11

• District of Columbia ?rst-time homebuyer credit, Form 8859.Schedule 3

line 6h, and• Adoption credit, Form 8839.Schedule 3

line 6g10.1040 and 1040-SR ?lers. Enter the total of the amounts

from Form 1040 or 1040-SR, line 27, and Schedule 3, line 11.101040-NR lers.

Enter the amount from Schedule 3,

line 11.13.Enter the smaller of line 2 or line 12.13

Enter this amount on line4 of Credit Limit

Worksheet A.

quotesdbs_dbs31.pdfusesText_37[PDF] 1040 instructions 2019 schedule b

[PDF] 1040 instructions 2019 schedule c

[PDF] 1040 instructions 2020

[PDF] 1040 long form 2018 pdf

[PDF] 1040 schedule 1

[PDF] 1040 schedule 2

[PDF] 1040 sr form 2019 pdf

[PDF] 1040 tax form 2018 pdf

[PDF] 1040 tax form 2019 pdf

[PDF] 1040a 2019 tax form

[PDF] 1040ez form 2019 pdf

[PDF] 1040nr stimulus check

[PDF] 107 bus route

[PDF] 1080i 50hz vs 60hz in india