2021 Schedule 2 (Form 1040)

2021 Schedule 2 (Form 1040)

SCHEDULE 2. (Form 1040). 2021. Additional Taxes. Department of the Treasury. Internal Revenue Service. ? Attach to Form 1040 1040-SR

2020 Schedule 2 (Form 1040)

2020 Schedule 2 (Form 1040)

SCHEDULE 2. (Form 1040). 2020. Additional Taxes. Department of the Treasury. Internal Revenue Service. ? Attach to Form 1040 1040-SR

2021 Instruction 1040

2021 Instruction 1040

21 déc. 2021 Schedule 2 Part II. Schedule 3

2022 Schedule 2 (Form 1040)

2022 Schedule 2 (Form 1040)

This is an early release draft of an IRS tax form instructions

2019 Schedule 2 (Form 1040 or 1040-SR)

2019 Schedule 2 (Form 1040 or 1040-SR)

2. 3. Add lines 1 and 2. Enter here and include on Form 1040 or 1040-SR line 12b . Part II. Other Taxes. 4. Self-employment tax. Attach Schedule SE .

2018 Schedule 2 (Form 1040)

2018 Schedule 2 (Form 1040)

SCHEDULE 2. (Form 1040). Department of the Treasury. Internal Revenue Service. Tax. ? Attach to Form 1040. ? Go to www.irs.gov/Form1040 for instructions

2021 Schedule SE (Form 1040)

2021 Schedule SE (Form 1040)

2. Net profit or (loss) from Schedule C line 31; and Schedule K-1 (Form 1065)

2021 Schedule 3 (Form 1040)

2021 Schedule 3 (Form 1040)

Part I Nonrefundable Credits. 1. Foreign tax credit. Attach Form 1116 if required . . . . . . . . . . . . . . 1. 2 Credit for child and dependent care

2008 Form 1040A (Schedule 2)

2008 Form 1040A (Schedule 2)

Caution. If the care was provided in your home you may owe employment taxes. If you do

2007 Form 1040A (Schedule 2)

2007 Form 1040A (Schedule 2)

Caution. If the care was provided in your home you may owe employment taxes. If you do

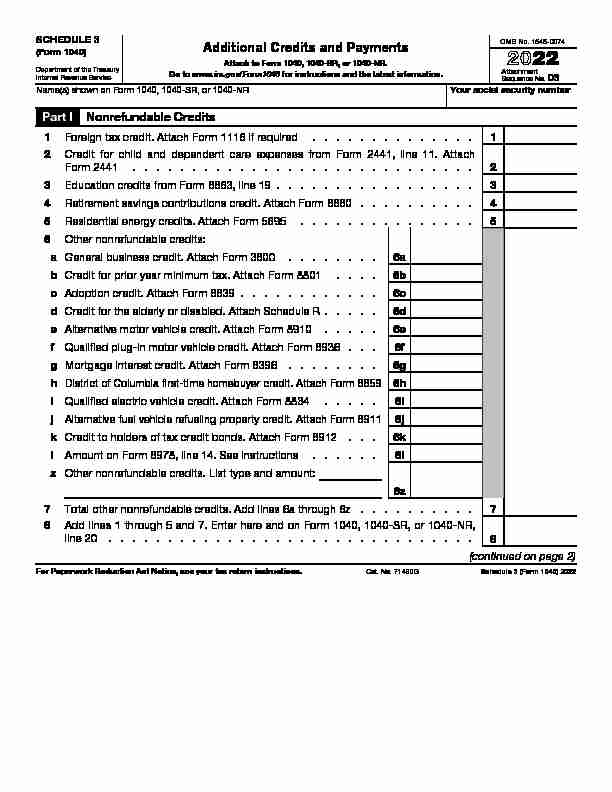

SCHEDULE 3

(Form 1040) 20 22Additional Credits and Payments

Department of the Treasury

Internal Revenue Service

Attach to Form 1040, 1040-SR, or 1040-NR.

Go to www.irs.gov/Form1040 for instructions and the latest information.OMB No. 1545-0074

Attachment

Sequence No.

03 Name(s) shown on Form 1040, 1040-SR, or 1040-NRYour social security numberPart I Nonrefundable Credits

1Foreign tax credit. Attach Form 1116 if required ..............1

2 Credit for child and dependent care expenses from Form 2441, line 11. Attach

Form 2441 .............................

23Education credits from Form 8863, line 19

.................34Retirement savings contributions credit. Attach Form 8880 ..........4

5Residential energy credits. Attach Form 5695 ...............5

6Other nonrefundable credits:

aGeneral business credit. Attach Form 3800 ........6a bCredit for prior year minimum tax. Attach Form 8801 ....6bcAdoption credit. Attach Form 8839 ............6cdCredit for the elderly or disabled. Attach Schedule R .....6d

eAlternative motor vehicle credit. Attach Form 8910 .....6e fQualified plug-in motor vehicle credit. Attach Form 8936 ...6f gMortgage interest credit. Attach Form 8396 ........6g hDistrict of Columbia first-time homebuyer credit. Attach Form 8859 6h iQualified electric vehicle credit. Attach Form 8834 .....6i jAlternative fuel vehicle refueling property credit. Attach Form 89116j kCredit to holders of tax credit bonds. Attach Form 8912 ...6k lAmount on Form 8978, line 14. See instructions ......6l zOther nonrefundable credits. List type and amount: 6z7Total other nonrefundable credits. Add lines 6a through 6z ..........7

8 Add lines 1 through 5 and 7. Enter here and on Form 1040, 1040-SR, or 1040-NR,

line 20 ............................... 8 (continued on page 2)For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71480GSchedule 3 (Form 1040) 2022

Schedule 3 (Form 1040) 2022Page 2

Part IIOther Payments and Refundable Credits

9Net premium tax credit. Attach Form 8962 .................9

10Amount paid with request for extension to file (see instructions) ........10

11Excess social security and tier 1 RRTA tax withheld .............11

12Credit for federal tax on fuels. Attach Form 4136 ..............12

13Other payments or refundable credits:

aForm 2439 ..................... 13a b Credit for qualified sick and family leave wages paid in 2022 from Schedule(s) H for leave taken before April 1, 2021 ...... 13b cReserved for future use ................13c d Credit for repayment of amounts included in income from earlier years ........................ 13d eReserved for future use ................13e fDeferred amount of net 965 tax liability (see instructions) ...13f gReserved for future use ................13g h Credit for qualified sick and family leave wages paid in 2022 from Schedule(s) H for leave taken after March 31, 2021, and before October 1, 2021 ................ 13h zOther payments or refundable credits. List type and amount: 13z14Total other payments or refundable credits. Add lines 13a through 13z .....14

15 Add lines 9 through 12 and 14. Enter here and on Form 1040, 1040-SR, or 1040-NR,

line 31 ............................... 15Schedule 3 (Form 1040) 2022

quotesdbs_dbs31.pdfusesText_37[PDF] 1040 tax form 2018 pdf

[PDF] 1040 tax form 2019 pdf

[PDF] 1040a 2019 tax form

[PDF] 1040ez form 2019 pdf

[PDF] 1040nr stimulus check

[PDF] 107 bus route

[PDF] 1080i 50hz vs 60hz in india

[PDF] 1080p 144hz monitor best buy

[PDF] 1096 form 2018

[PDF] 1096 form 2019

[PDF] 1096 instructions 2019

[PDF] 1099 authorization form

[PDF] 1099 b form meaning

[PDF] 1099 c form meaning