IRS-Form-1040-2019.pdf

IRS-Form-1040-2019.pdf

Form 1040 Department of the Treasury—Internal Revenue Service. (99). U.S. Individual Income Tax Return 2019 OMB No. 1545-0074. IRS Use Only—Do not write or

2019 Instruction 1040

2019 Instruction 1040

8 janv. 2020 These instructions cover both. Forms 1040 and 1040-SR. For details on these and other changes see What's New in these instructions. See IRS.gov ...

U.S. Individual Income Tax Return

U.S. Individual Income Tax Return

Form 1040. 2021. U.S. Individual Income Tax Return. Department of the Treasury—Internal Revenue Service. (99). OMB No. 1545-0074. IRS Use Only—Do not write

MO-1040A Single/Married (Income form One Spouse) Short Form

MO-1040A Single/Married (Income form One Spouse) Short Form

DO YOU HAVE THE RIGHT BOOK? You may use this tax book to file your 2019. Missouri Individual Income tax return if you: 1. Are a

Form MO-1040A - 2019 Individual Income Tax Return Single

Form MO-1040A - 2019 Individual Income Tax Return Single

2019 Individual Income Tax Return. Single/Married (One Income). Form. MO-1040A. *19334010006*. 19334010006. For Privacy Notice see Instructions.

2021 Instruction 1040

2021 Instruction 1040

21 déc. 2021 1040-SR and use joint return tax rates for 2021 if all of the following apply. 1. Your spouse died in 2019 or 2020.

2021 Form 1040-SR

2021 Form 1040-SR

U.S. Tax Return for Seniors IRS Use Only—Do not write or staple in this space. Filing. Status. Check only ... c Prior year (2019) earned income .

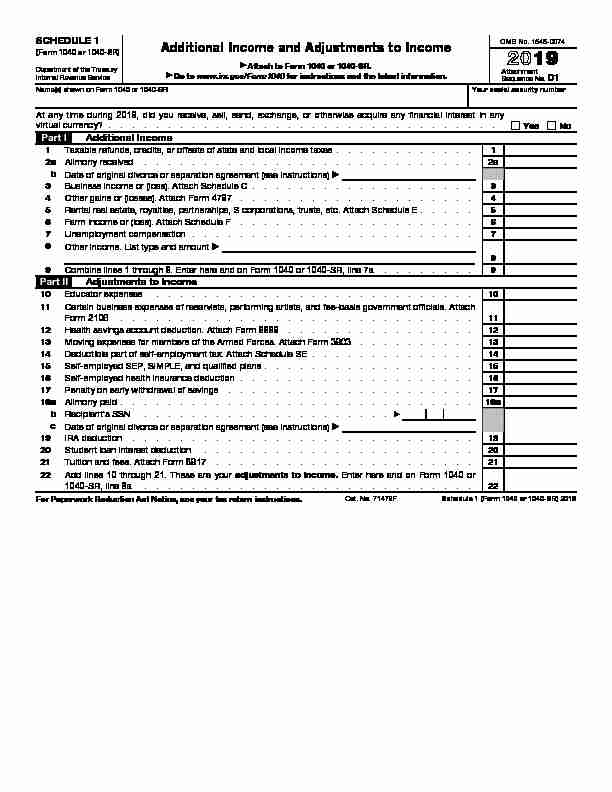

2019 Schedule 1 (Form 1040 or 1040-SR)

2019 Schedule 1 (Form 1040 or 1040-SR)

? Go to www.irs.gov/Form1040 for instructions and the latest information. OMB No. 1545-0074. 2019. Attachment. Sequence No. 01. Name(

2021 Schedule A (Form 1040)

2021 Schedule A (Form 1040)

(Form 1040). Department of the Treasury. Internal Revenue Service (99). Itemized Deductions. ? Go to www.irs.gov/ScheduleA for instructions and the latest

2019 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

2019 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

22 janv. 2020 Brown are filing a joint return. Their taxable income on Form 1040 line 11b

SCHEDULE 1

(Form 1040 or 1040-SR)Department of the Treasury

Internal Revenue Service

Additional Income and Adjustments to Income

Attach to Form 1040 or 1040-SR.

Go to www.irs.gov/Form1040 for instructions and the latest information.OMB No. 1545-0074

20 19Attachment

Sequence No.

01 Name(s) shown on Form 1040 or 1040-SRYour social security numberAt any time during 2019, did you receive, sell, send, exchange, or otherwise acquire any financial interest in any

virtual currency? ............................. ....YesNoPart I Additional Income

1Taxable refunds, credits, or offsets of state and local income taxes ............ 1

2 aAlimony received ............................ 2a bDate of original divorce or separation agreement (see instructions)3Business income or (loss). Attach Schedule C ........

........... 34Other gains or (losses). Attach Form 4797 .................... 4

5Rental real estate, royalties, partnerships, S corporations, trusts, etc

. Attach Schedule E .....56Farm income or (loss). Attach Schedule F .................... 6

7Unemployment compensation .............

........... 78Other income. List type and amount

89Combine lines 1 through 8. Enter here and on Form 1040 or 1040-SR, line

7a ........ 9

Part IIAdjustments to Income

10Educator expenses ........................... 10

11Certain

business expenses of reservists, performing artists, and fee-basis government officials. AttachForm 2106 ..............................11

12Health savings account deduction. Attach Form 8889 ................ 12

13Moving expenses for members of the Armed Forces. Attach Form 3903 ..........13

14Deductible part of self-employment tax. Attach Schedule SE ..............1415Self-employed SEP, SIMPLE, and qualified plans .................. 15

16Self-employed health insurance deduction .................... 16

17Penalty on early withdrawal of savings ..................... 17

18 aAlimony paid ...................... ........18a bRecipient's SSN ..................... cDate of original divorce or separation agreement (see instructions)19IRA deduction ............................. 19

20Student loan interest deduction ................

....... 2021Tuition and fees. Attach Form 8917 ...................... 21

22Add lines 10 through 21. These are your adjustments to income. Enter here and on Form 1040 or

1040-SR, line 8a ............................

22For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 71479FSchedule 1 (Form 1040 or 1040-SR) 2019

quotesdbs_dbs31.pdfusesText_37[PDF] 1040nr stimulus check

[PDF] 107 bus route

[PDF] 1080i 50hz vs 60hz in india

[PDF] 1080p 144hz monitor best buy

[PDF] 1096 form 2018

[PDF] 1096 form 2019

[PDF] 1096 instructions 2019

[PDF] 1099 authorization form

[PDF] 1099 b form meaning

[PDF] 1099 c form meaning

[PDF] 1099 compliance

[PDF] 1099 div form definition

[PDF] 1099 due date 2020

[PDF] 1099 for rent paid to landlord