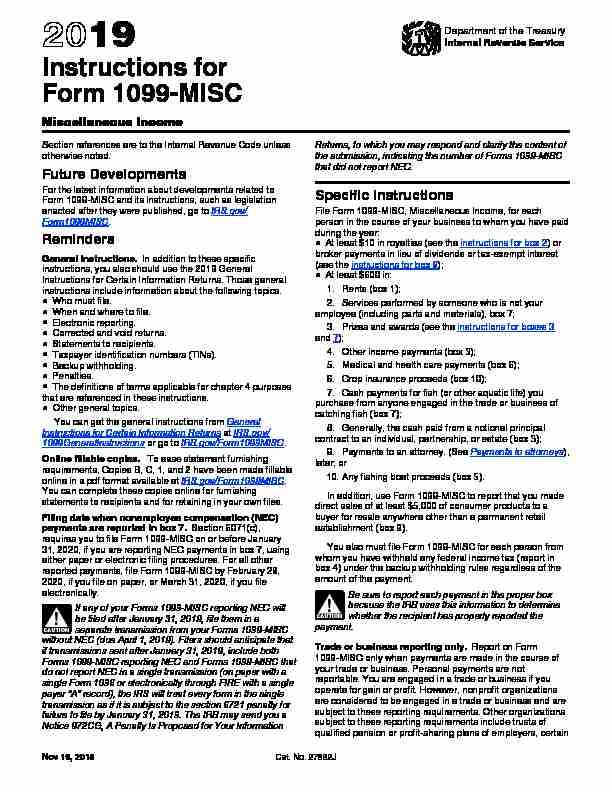

2019 Instructions for Form 1099-MISC

2019 Instructions for Form 1099-MISC

Nov 19 2018 Report these payments in box 7. You are required to keep records showing the date and amount of each cash payment made during the year

2019 Form 1099-MISC

2019 Form 1099-MISC

(Form 1040) (or Form 1040NR) and identify the payment. The amount shown may The due date is extended to. February 18 2020

2019 General Instructions for Certain Information Returns

2019 General Instructions for Certain Information Returns

Apr 17 2019 The due date for furnishing statements to recipients for. Forms 1099-B

2023 General Instructions for Certain Information Returns

2023 General Instructions for Certain Information Returns

The Taxpayer First Act of 2019 enacted July 1

Attention:

Attention:

The 2019 Instructions for Form 1099-S. To order these instructions and If you file electronically the due date is March 31

2023 Instructions for Forms 1099-R and 5498

2023 Instructions for Forms 1099-R and 5498

2019 enacted July 1

Form 1099-SA (Rev. 11-2019)

Form 1099-SA (Rev. 11-2019)

Shows the earnings on any excess contributions you withdrew from an HSA or Archer MSA by the due date of your income tax return. including due dates and to ...

Form 1099-MISC (Rev. January 2022)

Form 1099-MISC (Rev. January 2022)

online federal tax preparation e-filing

f1099b--2019.pdf

f1099b--2019.pdf

Dec 31 2018 The 2019 Instructions for Form 1099-B. To order these instructions ... If you file electronically

Attention:

Attention:

See IRS Publications 1141 1167

2019 Instructions for Form 1099-MISC

2019 Instructions for Form 1099-MISC

Nov 19 2018 Report these payments in box 7. You are required to keep records showing the date and amount of each cash payment made during the year

2019 General Instructions for Certain Information Returns

2019 General Instructions for Certain Information Returns

Apr 17 2019 For all other reported payments

Form 1099-SA (Rev. 11-2019)

Form 1099-SA (Rev. 11-2019)

November 2019) 11-2019) www.irs.gov/Form1099SA. Do Not Cut or Separate Forms on This Page ... or Archer MSA by the due date of your income tax return.

2019 Filing and Remittance Due Dates (Employer W-2 and 1099

2019 Filing and Remittance Due Dates (Employer W-2 and 1099

(EMPLOYER W-2 AND 1099 FORMS). SEMI-MONTHLY REMITTANCE. PERIOD END DATE: 15TH AND LAST DAY OF MONTH. PA-501 DUE DATES. 01/18/2019. 02/05/2019. 02/21/2019.

2022 General Instructions for Certain Information Returns

2022 General Instructions for Certain Information Returns

1099-MISC 1099-NEC

2019 Form 1099-MISC

2019 Form 1099-MISC

The due date is extended to. February 18 2020

2022 Form 1040-ES

2022 Form 1040-ES

Jan 24 2022 These individuals can take credit only for the estimated tax payments that they made. Payment Due Dates. You can pay all of your estimated tax ...

2018 Form 1099-MISC

2018 Form 1099-MISC

1099 3921

2022 Instructions for Forms 1099-R and 5498

2022 Instructions for Forms 1099-R and 5498

File Form 1099-R Distributions From Pensions

Form 8809 (Rev. August 2020)

Form 8809 (Rev. August 2020)

7 If you are requesting an extension for Forms W-2 or 1099-NEC or if you checked returns with the IRS should file this form before the filing due date.

Form 1099-MISC

20 19Cat. No. 14425J

Miscellaneous

Income

Copy A

ForInternal Revenue

Service Center

Department of the Treasury - Internal Revenue ServiceFile with Form 1096.

OMB No. 1545-0115

For Privacy Act

and PaperworkReduction Act

Notice, see the

2019 General

Instructions for

Certain

Information

Returns.9595

VOIDCORRECTED

PAYER"S name, street address, city or town, state or province, countr y, ZIP or foreign postal code, and telephone no.PAYER"S TINRECIPIENT"S TIN

RECIPIENT"S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code Account number (see instructions)FATCA ?ling requirement2nd TIN not. 1 Rents 2Royalties

3Other income

4 Federal income tax withheld

5Fishing boat proceeds

6 Medical and health care payments

7 Nonemployee compensation

8 Substitute payments in lieu of

dividends or interest9 Payer made direct sales of

$5,000 or more of consumer products to a buyer (recipient) for resale 10Crop insurance proceeds

111213

Excess golden parachute

payments 14Gross proceeds paid to an

attorney 15aSection 409A deferrals

15bSection 409A income

16State tax withheld

17State/Payer"s state no.18 State income

Form 1099-MISCwww.irs.gov/Form1099MISC

Do Not Cut or Separate Forms on This Page - Do Not Cut or Separate Forms on This PageZ Builders

123 Maple Avenue

Oaktown, AL 00000

555-555-1212

10-9999999

123-00-6789

Ronald Green

dba/ Y Drywall456 Flower Lane

Oaktown, AL 000005500.00

Thecompleted Form 1099-MISC illustrates the following example. Z Builders is a contractor that subcontracts drywall work to

Ronald

Green, a sole proprietor who does business as Y Drywall. During the year, Z Builders pays Mr. Green $5,500. Z Builders

must?le Form 1099-MISC because they paid Mr. Green $600 or more in the course of their trade or business, and Mr. Green is

not a corporation.quotesdbs_dbs31.pdfusesText_37[PDF] 1099 form 2019 instructions

[PDF] 1099 form 2019 meaning

[PDF] 1099 form 2019 office depot

[PDF] 1099 form 2019 pdf fillable

[PDF] 1099 form 2019 pdf irs

[PDF] 1099 form 2019 pdf printable

[PDF] 1099 form 2019 social security

[PDF] 1099 form 2019 unemployment

[PDF] 1099 form 2020 due date

[PDF] 1099 form 2020 employee

[PDF] 1099 form 2020 florida

[PDF] 1099 form 2020 instructions

[PDF] 1099 form 2020 online

[PDF] 1099 form 2020 order