INSTRUCTIONS: Please provide all information requested below

INSTRUCTIONS: Please provide all information requested below

DIVISION OF UNEMPLOYMENT INSURANCE. 1100 North Eutaw Street. Baltimore MD 21201. AFFIDAVIT FOR CORRECTION OF FORM 1099-G. INSTRUCTIONS: Please provide all

Maryland Employer Reporting of 1099s Instructions and Specifications

Maryland Employer Reporting of 1099s Instructions and Specifications

Sep 23 2020 MD follows new IRS Form 1099-NEC requirements ... Using the Unemployment Insurance number instead of the Maryland Central.

502LU.pdf

502LU.pdf

SUBTRACTIONS. 4. Amount of Maryland unemployment benefits included in FAGI (See Box 1 1099-G

ANNUAL EMPLOYER WITHHOLDING RECONCILIATION RETURN

ANNUAL EMPLOYER WITHHOLDING RECONCILIATION RETURN

Make check payable to Comptroller of MD - WH Tax. Name. Address 1. Address 2 Enter total number of a) W-2 and/or b) 1099 Forms. (ATTACH PAPER COPY.).

2021 Maryland Employer Reporting 1099s Instructions and

2021 Maryland Employer Reporting 1099s Instructions and

MD follows new IRS Form 1099-NEC requirements. • Filing Year 2022 (for Tax Year Using the Unemployment Insurance number instead of the Maryland Central.

2021 State & Local Tax Forms & Instructions

2021 State & Local Tax Forms & Instructions

SB496 (The Relief Act) allows an unemployment compensation income subtraction for single 1099 forms) showing Maryland and local tax withheld equal to.

RELIEF Act Tax Alert V3 (UI)

RELIEF Act Tax Alert V3 (UI)

Mar 4 2021 provided with any forms revised as a result of ... and their FAGI is less than $75

Reemployment Assistance IRS 1099-G Form

Reemployment Assistance IRS 1099-G Form

This form is also provided to claimants to show the total amount of unemployment compensation paid to the claimant during the calendar year 2021.

TY - 2021 - NONRESIDENT BOOKLET

TY - 2021 - NONRESIDENT BOOKLET

NONRESIDENT INCOME TAX. RETURN INSTRUCTIONS. MARYLAND. FORM. 505. 2021. 1 What Form to file? Amount of unemployment compensation reported on 1099-G.

Tax Alert

Tax Alert

Feb 17 2022 the exclusion of unemployment compensation for individual taxpayers. ... tax year 2020

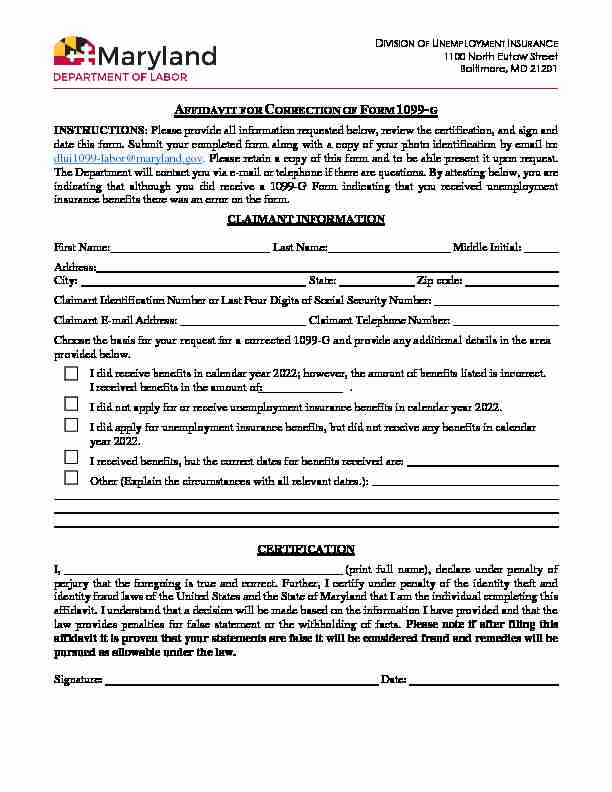

DIVISION OF UNEMPLOYMENT INSURANCE

1100 North Eutaw Street

Baltimore, MD 21201

AFFIDAVIT FOR CORRECTION OF FORM 1099-G INSTRUCTIONS: Please provide all information requested below, review the certification, and sign and

date this form. Submit your completed form along with a copy of your photo identification by email to:

dlui1099-labor@maryland.gov. Please retain a copy of this form and to be able present it upon request. The Department will contact you via e-mail or telephone if there are questions. By attesting below, you are

indicating that although you did receive a 1099-G Form indicating that you received unemployment insurance benefits there was an error on the form.CLAIMANT INFORMATION

First Name: Last Name: Middle Initial:

Address:

City: State: Zip code:

Claimant Identification Number or Last Four Digits of Social Security Number: Claimant E-mail Address: Claimant Telephone Number: Choose the basis for your request for a corrected 1099-G and provide any additional details in the area provided below. I did receive benefits in calendar year 202; however, the amount of benefits listed is incorrect. I received benefits in the amount of: . I did not apply for or receive unemployment insurance benefits in calendar year 202 I did apply for unemployment insurance benefits, but did not receive any benefits in calendar year 202 I received benefits, but the correct dates for benefits received are:Other (Explain the circumstances with all

relevant dates.): CERTIFICATION I, (print full name), declare under penalty ofperjury that the foregoing is true and correct. Further, I certify under penalty of the identity theft and

identity fraud laws of the United States and the State of Maryland that I am the individual completing this

affidavit. I understand that a decision will be made based on the information I have provided and that the

law provides penalties for false statement or the withholding of facts. Please note if after filing this

affidavit it is proven that your statements are false it will be considered fraud and remedies will be

pursued as allowable under the law.Signature: Date:

quotesdbs_dbs31.pdfusesText_37[PDF] 1099 form unemployment pa

[PDF] 1099 g california

[PDF] 1099 g form 2019

[PDF] 1099 g form meaning

[PDF] 1099 g nys

[PDF] 1099 g ohio

[PDF] 1099 g turbotax

[PDF] 1099 g unemployment

[PDF] 1099 instructions 2019

[PDF] 1099 int 2018

[PDF] 1099 int form 2019 pdf

[PDF] 1099 int form definition

[PDF] 1099 int instructions 2019

[PDF] 1099 k form definition