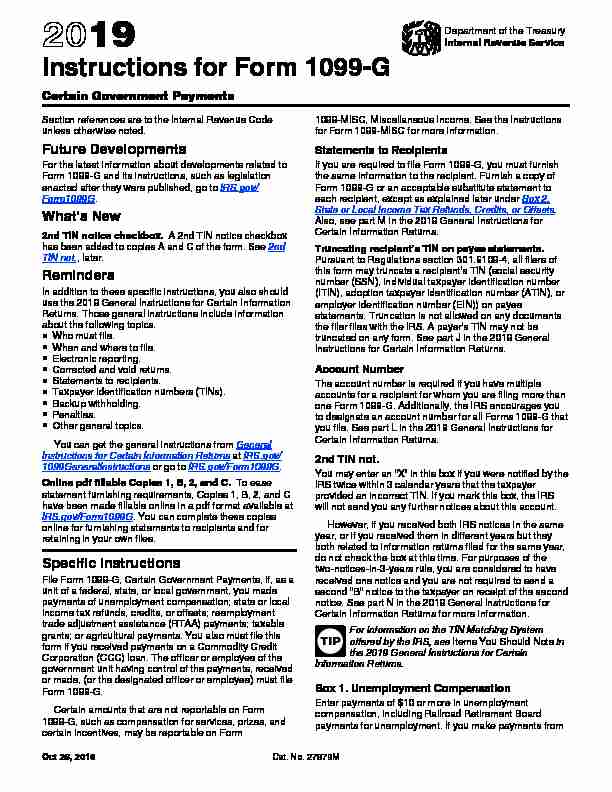

2019 Instructions for Form 1099-G

2019 Instructions for Form 1099-G

26-Oct-2018 File Form 1099-G Certain Government Payments

Form 1099-G (Rev. January 2022)

Form 1099-G (Rev. January 2022)

See IRS Publications 1141 1167

Attention:

Attention:

See IRS Publications 1141 1167

Attention:

Attention:

Form 1099-G. 2020. Cat. No. 14438M. Certain. Government. Payments. Copy A. For. Internal Revenue. Service Center. Department of the Treasury - Internal

Instructions for Form 1099-G (Rev. January 2022)

Instructions for Form 1099-G (Rev. January 2022)

You must also file Form 1099-G for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules

Untitled

Untitled

benefits received is provided to claimants on a 1099-G form - Certain If a claimant received a form 1099-G for 2019 and did not receive UI benefits in.

DEPARTMENT OF UNEMPLOYMENT ASSISTANCE UI POLICY

DEPARTMENT OF UNEMPLOYMENT ASSISTANCE UI POLICY

17-Jan-2020 If a claimant received a form 1099-G for 2019 and did not receive UI benefits in. 2019 the claimant should be transferred to 617-626-6684 to ...

UNEMPLOYMENT INSURANCE 1099G FORMS FOR 2019 TAX

UNEMPLOYMENT INSURANCE 1099G FORMS FOR 2019 TAX

UNEMPLOYMENT INSURANCE 1099G FORMS FOR 2019 TAX YEAR. NOW AVAILABLE ONLINE FROM CT DEPARTMENT OF LABOR. January 10 2020. WETHERSFIELD – Claimants who have

2020 Instructions for Form 1099-G

2020 Instructions for Form 1099-G

29-Aug-2019 For example enter “2019

1099-G: CERTAIN GOVERNMENT PAYMENTS

1099-G: CERTAIN GOVERNMENT PAYMENTS

The 1099-G form is a document sent by a government agency to report income that may not due a refund for tax year 2019 the taxpayer will not receive a.

quotesdbs_dbs31.pdfusesText_37

quotesdbs_dbs31.pdfusesText_37[PDF] 1099 g nys

[PDF] 1099 g ohio

[PDF] 1099 g turbotax

[PDF] 1099 g unemployment

[PDF] 1099 instructions 2019

[PDF] 1099 int 2018

[PDF] 1099 int form 2019 pdf

[PDF] 1099 int form definition

[PDF] 1099 int instructions 2019

[PDF] 1099 k form definition

[PDF] 1099 misc 2019

[PDF] 1099 misc box 14

[PDF] 1099 misc box 3 h&r block

[PDF] 1099 misc box 3 income