Attention:

Attention:

Form 1099-INT. 2018. Cat. No. 14410K. Interest. Income. Copy A. For. Internal Revenue. Service Center. Department of the Treasury - Internal Revenue Service.

2018 Instructions for Forms 1099-INT and 1099-OID

2018 Instructions for Forms 1099-INT and 1099-OID

27.09.2017 Interest Income later. Interest excluded from reporting. You are not required to file Form 1099-INT for interest on an obligation issued by an ...

F1099DIV 2018.pdf

F1099DIV 2018.pdf

Form 1099-DIV. 2018. Cat. No. 14415N. Dividends and. Distributions. Copy A. For. Internal Revenue. Service Center. Department of the Treasury - Internal

2018 Instructions for Form 1099-DIV

2018 Instructions for Form 1099-DIV

31.12.2021 2018. Instructions for Form. 1099-DIV. Dividends and Distributions. Department of the Treasury. Internal Revenue Service.

f1099div--2019.pdf

f1099div--2019.pdf

See IRS Publications 1141 1167

2018 General Instructions for Certain Information Returns

2018 General Instructions for Certain Information Returns

20.07.2018 TIN Matching allows a payer or authorized agent who is required to file Forms 1099-B DIV

Form 1099-DIV (Rev. January 2022)

Form 1099-DIV (Rev. January 2022)

See IRS Publications 1141 1167

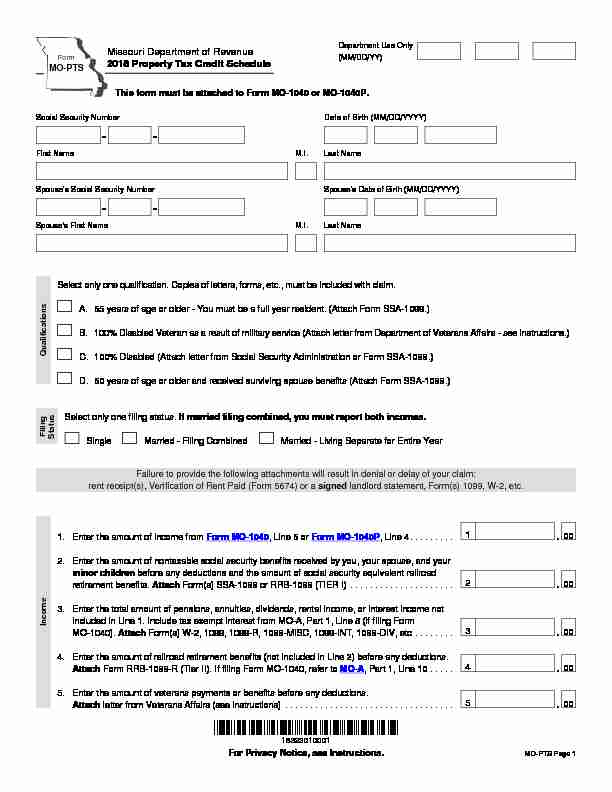

Form MO-PTS - 2018 Property Tax Credit Schedule

Form MO-PTS - 2018 Property Tax Credit Schedule

2018 Property Tax Credit Schedule (Attach Form SSA-1099.) ... Attach Form(s) W-2 1099

2018 Form 1099-MISC

2018 Form 1099-MISC

See IRS Publications 1141 1167

Attention filers of Form 1096:

Attention filers of Form 1096:

2018. FILER'S name. Street address (including room or suite number) 1099-B. 79. 1099-C. 85. 1099-CAP. 73. 1099-DIV. 91. 1099-G. 86. 1099-INT. 92. 1099-K.

This form must be attached to Form MO-1040 or MO-1040P.

This form must be attached to Form MO-1040 or MO-1040P. 18323010001

Missouri Department of Revenue

2018 Property Tax Credit Schedule

Department Use Only

(MM/DD/YY)Social Security Number

Spouse's Social Security Number

FormMO-PTS

Date of Birth (MM/DD/YYYY)

Spouse's Date of Birth (MM/DD/YYYY)

Select only one qualification. Copies of letters, forms, etc., must be i ncluded with claim. A.65 years of age or older - You must be a full year resident. (Attach Fo

rm SSA-1099.)B. 100% Disabled Veteran as a result of military service (Attach letter fr om Department of Veterans Affairs - see instructions.) C. 100% Disabled (Attach letter from Social Security Administration or For m SSA-1099.) D. 60 years of age or older and received surviving spouse benefits (AttachForm SSA-1099.)

QualificationsSelect only one filing status. If married filing combined, you must report both incomes.

1. Enter the amount of income from Form MO-1040, Line 6 or Form MO-1040P, Line 4.........

2. Enter the amount of nontaxable social security benefits receiv ed by you, your spouse, and your minor childr en before any deductions and the amount of social security equivalent railroad retirement be nefits.Attach

Form(s) SSA-1099 or RRB-1099 (TIER I)

3. Enter the total amount of pensions, annuities, dividends, rental income, or interest income not included in Line 1. Include tax exempt interest from MO-A, Part 1, Line 8 (if filin g Form 4. Enter the amount of railroad retirement benefits (not included in Line2) before any deductions.

Attach Form RRB-1099-R (Tier II). If filing Form MO-1040, refer to MO-A, Part 1, Line 10 . . . . .Attach

letter from Veterans Affairs (see instructions) ..................................Filing

Status

MO-1040). Attach Form(s) W-2, 1099, 1099-R, 1099-MISC, 1099-INT, 1099-DIV, etc ........ 1 2 3 4 5Income

00 00 .00 00 005. Enter the amount of veterans payments or benefits before any deductions.

Single Married - Filing CombinedMarried - Living Separate for Entire YearM.I. Last NameFirst Name

M.I. Last NameSpouse's First Name- -

For Privacy Notice, see Instructions.

Failure to provide the following attachments will result in denial or de lay of your claim:rent receipt(s), Verification of Rent Paid (Form 5674) or a signed landlord statement, Form(s) 1099, W-2, etc.

MO-PTS Page 1

18323020001

9. Enter the appropriate amount from the options below..................................

10. Net household income - Subtract Line 9 from Line 8 and enter the amount here............. If you rented or did not own and occupy your home for the entire year an d Line 10 is greater than $27,500, you are not eligible to file this claim. If you owned and occupied your home for the entire year and Line 10 is g reater than $30,000, you are not eligible to file this claim. 11. If you owned your home, enter the total amount of property tax paid for your home, less special assessments, or $1,100, whichever is less. Attach a copy of paid real estate tax receipt(s). If your home is on more than five acres or you own a mobil e home, attach the 12. If you rented, enter the total amount from Certification of Rent Paid (Form(s) MO-CRP), Line 9

or $750, whichever is less. Attach a completed Verification of Rent Paid (Form 5674). Note : If you rent from a facility that does not pay property tax, you are not eligible for a 13. Enter the total of Lines 11 and 12, or $1,100, whichever is less .......................... 14. Apply Lines 10 and 13 to the chart in the instructions for MO-1040, page s 49-51 or MO-1040P, pages 29-31 to figure your Property Tax Credit. You must use the chart to see how much credit you are allowed. Enter this amount on Form MO-1040, Line 37 or Form MO-1040P, Line 17.....

This form must be attached to Form MO-1040 or Form MO-1040P. 11 12 14 13Income (continued)

Real Estate or Rent

Credit

8. Total household income - Add Lines 1 through 7 and enter the total here .................

800900

1000

00 00 00 00 Assessor's Certification (Form 948) ............................................... 7. Enter the amount of nonbusiness loss(es). You must include nonbusiness loss(es) in your household income (as a positive amount) here. (Include capital loss from Federal Form 1040,

7 00 . Schedule 1, Line 13.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6. Enter the total amount received by you, your spouse, and your minor children from: public assistance, SSI, child support, or Temporary Assistance payments (TA and TANF). Attach a letter from the Social Security Administration that includes the total a mount of assistance received and Form 1099 from Employment Security, if applicable ........................ 600

• Single or Married Living Separate - Enter $0

Married and Filing Combined - rented

or did not own your home for the entire year - Enter $2,000Married and Filing Combined - owned and

occupied your home for the entire year - Enter $4,000 KRAUDepartment Use Only

Property Tax Credit ............................................................MO-PTS Page 2 (Revised 12-2018)

quotesdbs_dbs31.pdfusesText_37[PDF] 1099 int form definition

[PDF] 1099 int instructions 2019

[PDF] 1099 k form definition

[PDF] 1099 misc 2019

[PDF] 1099 misc box 14

[PDF] 1099 misc box 3 h&r block

[PDF] 1099 misc box 3 income

[PDF] 1099 misc box 3 or box 7

[PDF] 1099 misc box 3 schedule c

[PDF] 1099 misc box 3 schedule c robinhood

[PDF] 1099 misc box 3 self employment tax

[PDF] 1099 misc box 3 turbotax

[PDF] 1099 misc box 7 2020

[PDF] 1099 misc box 7 codes