Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

Jan 31 2022 These payments are not subject to self-employment tax and are reportable in box 3 (rather than box 1 of Form 1099-NEC) if all the following ...

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

Sep 30 2021 These payments are not subject to self-employment tax and are reportable in box 3 (rather than box 1 of Form 1099-NEC) if all the following ...

Form 1099-MISC (Rev. January 2022)

Form 1099-MISC (Rev. January 2022)

Form 1099-MISC Amounts shown may be subject to self-employment (SE) tax. ... Box 3. Generally report this amount on the “Other income” line of Schedule ...

2021 Instructions for Forms 1099-MISC and 1099-NEC

2021 Instructions for Forms 1099-MISC and 1099-NEC

Nov 17 2020 These payments are not subject to self-employment tax and are reportable in box 3 (rather than box 1 of Form 1099-NEC) if all the following ...

2017 Instructions for Form 1099-MISC

2017 Instructions for Form 1099-MISC

Oct 20 2016 File Form 1099-MISC

2019 Instructions for Form 1099-MISC

2019 Instructions for Form 1099-MISC

Nov 19 2018 File Form 1099-MISC

2021 Form 1099-MISC

2021 Form 1099-MISC

Form 1099-MISC Amounts shown may be subject to self-employment (SE) tax. ... Box 3. Generally report this amount on the “Other income” line of Schedule ...

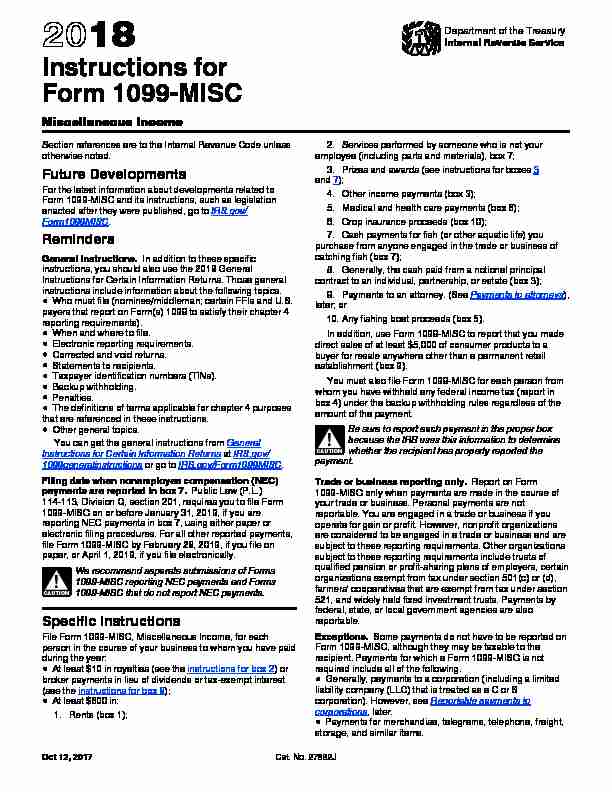

2018 Instructions for Form 1099-MISC

2018 Instructions for Form 1099-MISC

Oct 12 2017 File Form 1099-MISC

2019 Form 1099-MISC

2019 Form 1099-MISC

3 Other income. $. 4 Federal income tax withheld. $. 5 Fishing boat proceeds. $. 6 Medical and health care payments. $. 7 Nonemployee compensation.

2016 Instructions for Form 1099-MISC

2016 Instructions for Form 1099-MISC

Dec 30 2015 File Form 1099-MISC

Form 1099-MISC

20 18Cat. No. 14425J

Miscellaneous

Income

Copy A

ForInternal Revenue

Service Center

Department of the Treasury - Internal Revenue ServiceFile with Form 1096.

OMB No. 1545-0115

For Privacy Act

and PaperworkReduction Act

Notice, see the

2018 General

Instructions for

Certain

Information

Returns.9595

VOIDCORRECTED

PAYER"S name, street address, city or town, state or province, countr y, ZIP or foreign postal code, and telephone no.PAYER"S TINRECIPIENT"S TIN

RECIPIENT"S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal code Account number (see instructions)FATCA ?ling requirement2nd TIN not. 1 Rents 2Royalties

3Other income

4 Federal income tax withheld

5Fishing boat proceeds

6 Medical and health care payments

7 Nonemployee compensation

8 Substitute payments in lieu of

dividends or interest9 Payer made direct sales of

$5,000 or more of consumer products to a buyer (recipient) for resale 10Crop insurance proceeds

111213

Excess golden parachute

payments 14Gross proceeds paid to an

attorney 15aSection 409A deferrals

15bSection 409A income

16State tax withheld

17State/Payer"s state no.18 State income

Form 1099-MISCwww.irs.gov/Form1099MISC

Do Not Cut or Separate Forms on This Page - Do Not Cut or Separate Forms on This PageZ Builders

123 Maple Avenue

Oaktown, AL 00000

555-555-1212

10-9999999

123-00-6789

Ronald Green

dba/ Y Drywall456 Flower Lane

Oaktown, AL 000005500.00

Thecompleted Form 1099-MISC illustrates the following example. Z Builders is a contractor that subcontracts drywall work to

Ronald

Green, a sole proprietor who does business as Y Drywall. During the year, Z Builders pays Mr. Green $5,500. Z Builders

must?le Form 1099-MISC because they paid Mr. Green $600 or more in the course of their trade or business, and Mr. Green is

not a corporation.quotesdbs_dbs31.pdfusesText_37[PDF] 1099 misc box 7 2020

[PDF] 1099 misc box 7 codes

[PDF] 1099 misc box 7 lacerte

[PDF] 1099 misc box 7 nonemployee compensation what do i do with it

[PDF] 1099 misc box 7 on 1040

[PDF] 1099 misc box 7 schedule c turbotax

[PDF] 1099 misc e file requirements

[PDF] 1099 misc form definition

[PDF] 1099 misc form meaning

[PDF] 1099 misc gift

[PDF] 1099 misc instructions

[PDF] 1099 misc instructions 2019 attorneys

[PDF] 1099 misc instructions 2019 deadline

[PDF] 1099 misc instructions 2019 due date