FORM 1099 MISC – GENERAL GUIDELINES

FORM 1099 MISC – GENERAL GUIDELINES

be paid as an employee a 1099-MISC must be issued to the recipient.*. Gifts to missionaries. Maybe. If the gift is paid directly to the missionary in

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

31 janv. 2022 1099-MISC Form 1099-NEC

Gift Cards are Taxable!

Gift Cards are Taxable!

Per IRS Regulations gift cards are taxable to the recipient and must be reported as the gift card amount will be reported on Form 1099-MISC if total ...

The purpose of the Gift Card Guidelines is to provide guidance for

The purpose of the Gift Card Guidelines is to provide guidance for

The University discourages the use of gift cards but does recognize that there more per calendar year must be reported to the IRS on Form 1099-MISC as ...

2020 Instructions for Forms 1099-MISC and 1099-NEC

2020 Instructions for Forms 1099-MISC and 1099-NEC

30 sept. 2019 for Form 1099-MISC. File Form 1099-MISC Miscellaneous Income

Gifts Prizes and Awards

Gifts Prizes and Awards

1 juil. 2019 Such payments are reported as taxable income to the recipient using Form 1099- MISC. Page 3. Tax Policy – Gifts

1099 Information

1099 Information

be reported as 1099 MISC income. Benevolent gifts. No. Benevolent gifts to non-employees are not taxable and a recipient should not receive a 1099.

Gift Refund Protocol Prepared by John H. Taylor April 25 2020 Gift

Gift Refund Protocol Prepared by John H. Taylor April 25 2020 Gift

25 avr. 2020 Gift Reversals and Error Refunds: Tax-deductible donations to the [name of ... regulations do not require us to issue a 1099-MISC.

Notice of Tax Reportable Gift Card / E-Gift Card / Gift Certificate

Notice of Tax Reportable Gift Card / E-Gift Card / Gift Certificate

receive a 1099-MISC at the end of the calendar year. If it is determined that a student has received over $600 in gift cards or prizes the student will be

Instructions for Forms 1099 1098

Instructions for Forms 1099 1098

and W-2G

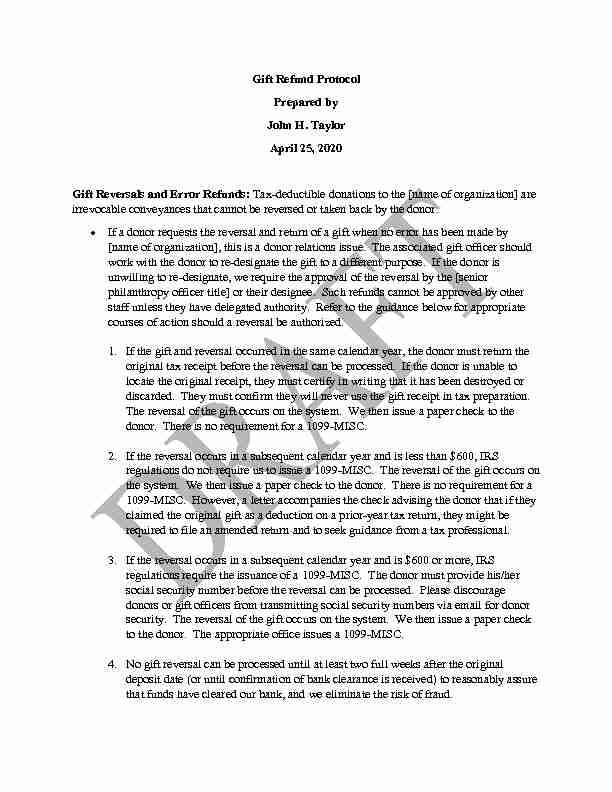

Gift Refund Protocol

Prepared by

John H. Taylor

April 25, 2020

Gift Reversals and Error Refunds:

Tax-deductible donations to the [name of organization] are irrevocable conveyances that cannot be reversed or taken back by the donor. If a donor requests the reversal and return of a gift when no error has been made by [name of organization], this is a donor relations issue. The associated gift officer should work with the donor to re-designate the gift to a different purpose. If the donor is unwilling to re-designate, we require the approval of the reversal by the [senior philanthropy officer title] or their designee. Such refunds cannot be approved by other staff unless they have delega ted authorityRefer to the guidance below for appropriate

courses of action should a reversal be authorized. 1.If the gift and reversal occurred in the same calendar year, the donor must return the original tax receipt before the reversal can be processed. If the donor is unable to

locate the original receipt, they must certify in writing that it has been destroyed or discarded. They must confirm they will never use the gift receipt in tax preparation. The reversal of the gift occurs on the system. We then issue a paper check to the donor. There is no requirement for a 1099-MISC. 2.If the reversal occurs in a subsequent calendar year and is less than $600, IRS regulations do not require us to issue a 1099-MISC. The reversal of the gift occurs on

the system. We then issue a paper check to the donor. There is no requirement for a 1099-MISC. However, a letter accompanies the check advising the donor that if they claimed the original gift as a deduction on a prior-year tax return, they might be required to file an amended return and to seek guidance from a tax professional. 3.

If the reversal occurs in a subsequent calendar year and is $600 or more, IRS regulations require the issuance of a 1099-MISC. The donor must provide his/her

social security number before the reversal can be processed.Please discourage

donors or gift officers from transmitting social security numbers via email for donor security. The reversal of the gift occurs on the system. We then issue a paper check to the donor. The appropriate office issues a 1099-MISC. 4. No gift reversal can be processed until at least two full weeks after the original deposit date (or until confirmation of bank clearance is received) to reasonably assure that funds have cleared our bank and we eliminate the risk of fraud. 5. Electronic payments of gift reversals are not allowed, even if EFT was the source.We must only issue p

aper checks for reversals. 6. For any gift reversal of $1,000 or higher, Advancement Services must research the donor to assure the name, address, business, background, and wealth screening. Halt the refund process and report any anomalies which may indicate fraud to leadership for review. When occasional errors occur, and we did not issue a tax receipt, Advancement Services will initiate a full or partial refund to the donor via the following protocols: 7.Credit Card Refunds

a) If a donor has executed an erroneous or duplicate credit card charge, we will refund the donor via the original credit card only. It is fraud to repay a different credit card number than the one on which a charge has taken place.If a donor

requests that a different credit card be refunded for any reason, immediately alert leadership. The credit card may have been compromised. b) We cannot process any credit card refund until we receive proof of settlement to our bank account. c) The [senior philanthropy officer title] or their designee must approve any credit card refund of $1,000 or more. 8.Non-Credit Card Refunds

a) If a donor has erroneously overpaid or sent duplicate payment via any other tender (paper check, wire, stock, etc.), we will refund the donor via paper check only. b) Electronic payments of gift reversals are not allowed. We only issue paper checks for reversals.c) No gift reversal can be processed until at least two full weeks after the original deposit date (or until confirmation of bank clearance is received) to

reasonably assure that funds have cleared our bank and we eliminate the risk of fraud. 9.Security Gift Refunds

a) These are complicated by the fact that when donated, the donors are often able to avoid capital gains taxes when donated to charity. As the shares no longer exist at least not in the donor"s name the original transaction cannot be undone. However, the donor is now, possibly, subject to those capital gains taxes they initially avoided.Before proceeding, you should consult both your

own business office as well as the donor"s transfer agent to seek further guidance before issuing a refund check.At no time should the institution

provide tax guidance to the donor, but suggest they seek independent counsel. Regardless, per the above, a 1099-MISC must be issued if the payment amount is $600+.quotesdbs_dbs31.pdfusesText_37[PDF] 1099 misc instructions 2019 attorneys

[PDF] 1099 misc instructions 2019 deadline

[PDF] 1099 misc instructions 2019 due date

[PDF] 1099 misc instructions 2019 pdf

[PDF] 1099 misc instructions 2019 where to mail

[PDF] 1099 misc rules 2019

[PDF] 1099 nec 2019 form

[PDF] 1099 nec 2020 instructions

[PDF] 1099 nec box 1

[PDF] 1099 nec form 2020

[PDF] 1099 nec instructions

[PDF] 1099 nec vs misc

[PDF] 1099 nec webinars

[PDF] 1099 online