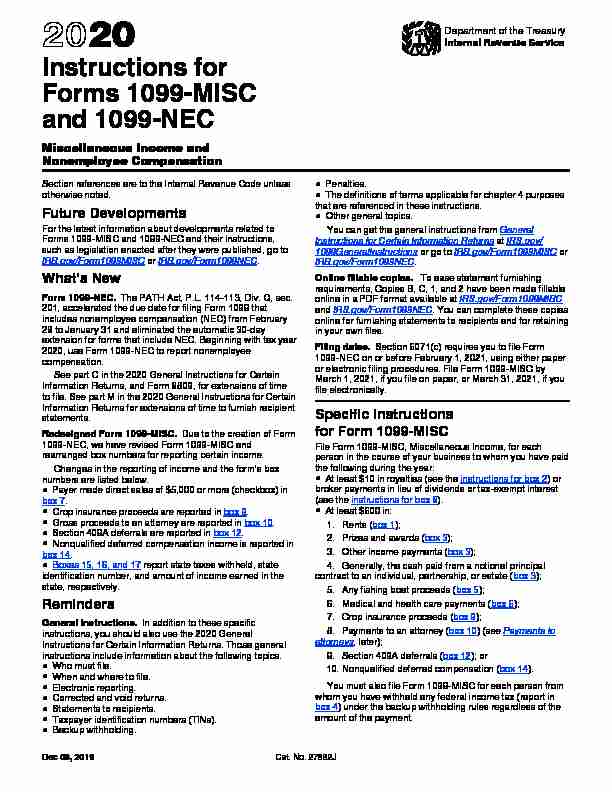

2020 Instructions for Forms 1099-MISC and 1099-NEC

2020 Instructions for Forms 1099-MISC and 1099-NEC

6 déc. 2019 Beginning with tax year. 2020 use Form 1099-NEC to report nonemployee compensation. See part C in the 2020 General Instructions for Certain.

f1099nec--2020.pdf

f1099nec--2020.pdf

State income tax withheld reporting boxes. Future developments. For the latest information about developments related to Form 1099-NEC and its instructions

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

31 janv. 2022 Form. 1099-MISC Form 1099-NEC

Form 1099-NEC (Rev. January 2022)

Form 1099-NEC (Rev. January 2022)

Click on. Employer and Information Returns and we'll mail you the forms you request and their instructions

2022 General Instructions for Certain Information Returns

2022 General Instructions for Certain Information Returns

1099-MISC 1099-NEC

2020 Instructions for Forms 1099-MISC and 1099-NEC

2020 Instructions for Forms 1099-MISC and 1099-NEC

30 sept. 2019 Beginning with tax year. 2020 use Form 1099-NEC to report nonemployee compensation. See part C in the 2020 General Instructions for Certain.

2020 General Instructions for Certain Information Returns

2020 General Instructions for Certain Information Returns

9 mars 2020 The PATH Act accelerated the due date for filing Form 1099 that included nonemployee compensation (NEC) to January 31 and Treasury. Regulations ...

2021 Instructions for Form 1040-NR

2021 Instructions for Form 1040-NR

18 janv. 2022 need to follow the Instructions for Schedule NEC later

2020 Instructions for Form 1099-DIV

2020 Instructions for Form 1099-DIV

4 sept. 2019 the instructions for box 8 in the 2020 Instructions for Forms. 1099-MISC and 1099-NEC. Substitute payments in lieu of dividends may be.

2021 Instructions for Schedule C - Profit or Loss From Business

2021 Instructions for Schedule C - Profit or Loss From Business

amounts shown on a Form 1099 such as Form 1099-MISC

Form 1099-NEC

20 20Cat. No. 72590N

Nonemployee

Compensation

Copy A

ForInternal Revenue

Service Center

Department of the Treasury - Internal Revenue ServiceFile with Form 1096.

OMB No. 1545-0116

For Privacy Act

and PaperworkReduction Act

Notice, see the

2020 General

Instructions for

Certain

Information

Returns. 7171

VOID CORRECTED

PAYER'S name, street address, city or town, state or province, countr y, ZIP or foreign postal code, and telephone no.PAYER'S TINRECIPIENT'S TIN

RECIPIENT'S name

Street address (including apt. no.)

City or town, state or province, country, and ZIP or foreign postal codeFATCA ling

requirementAccount number (see instructions)

2nd TIN not.

1Nonemployee compensation

2 3 4Federal income tax withheld

5State tax withheld

6State/Payer"s state no.7 State income

Form 1099-NEC www.irs.gov/Form1099NEC

Do Not Cut or Separate Forms on This Page - Do Not C ut or Separate Forms on This PageZ Builders

123 Maple Avenue

Oaktown, AL 00000

555-555-1212

10-9999999

123-00-6789

Ronald Green

dba/ Y Drywall456 Flower Lane

Oaktown, AL 000005500.00

The completed Form 1099-NEC illustrates the following example. Z Builder s is a contractor that subcontracts drywall work to Ronald Green, a sole proprietor who does business as Y Drywall. During t he year, Z Builders pays Mr. Green $5,500. Z Builders must ?le Form 1099-NEC because they paid Mr. Green $600.00 or more in the course of their trade or business, and Mr. Green is not a corporation.quotesdbs_dbs31.pdfusesText_37[PDF] 1099 nec form 2020

[PDF] 1099 nec instructions

[PDF] 1099 nec vs misc

[PDF] 1099 nec webinars

[PDF] 1099 online

[PDF] 1099 r form meaning

[PDF] 1099 reporting

[PDF] 1099 tax form 2019 pdf

[PDF] 1099 tax form meaning

[PDF] 1099 unemployment

[PDF] 10:1 mixing ratio calculator

[PDF] 10bii financial calculator app manual

[PDF] 10e form pdf in hindi

[PDF] 10k report jcpenney