Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

31 janv. 2022 Form 1099-NEC box 1. Box 1 will not be used for reporting under section 6050R

Form 1099-NEC (Rev. January 2022)

Form 1099-NEC (Rev. January 2022)

Form 1099-NEC (Rev. 1-2022) www.irs.gov/Form1099NEC or a hobby) report the amount shown in box 1 on the “Other income” line. (on Schedule 1 (Form ...

2021 Instructions for Forms 1099-MISC and 1099-NEC

2021 Instructions for Forms 1099-MISC and 1099-NEC

17 nov. 2020 Form 1099-NEC box 1. Box 1 will not be used for reporting under section 6050R

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

30 sept. 2021 Form 1099-NEC box 1. Box 1 will not be used for reporting under section 6050R

Attention filers of Form 1096: - IRS.gov

Attention filers of Form 1096: - IRS.gov

available at www.irs.gov/form1099 for more information about penalties. Form 1099-NEC. Box 1. Form 1099-OID. Boxes 1

f1099nec--2020.pdf

f1099nec--2020.pdf

Form 1099-NEC. 2020. Nonemployee. Compensation. Copy 1. For State Tax. Department Box 1. Shows nonemployee compensation and/or nonqualified deferred.

2021 Instructions for Schedule C - Profit or Loss From Business

2021 Instructions for Schedule C - Profit or Loss From Business

1099-NEC be sure line 1 includes amounts properly shown on your Forms. 1099-NEC. If the total amounts that were reported in box 1 of Forms.

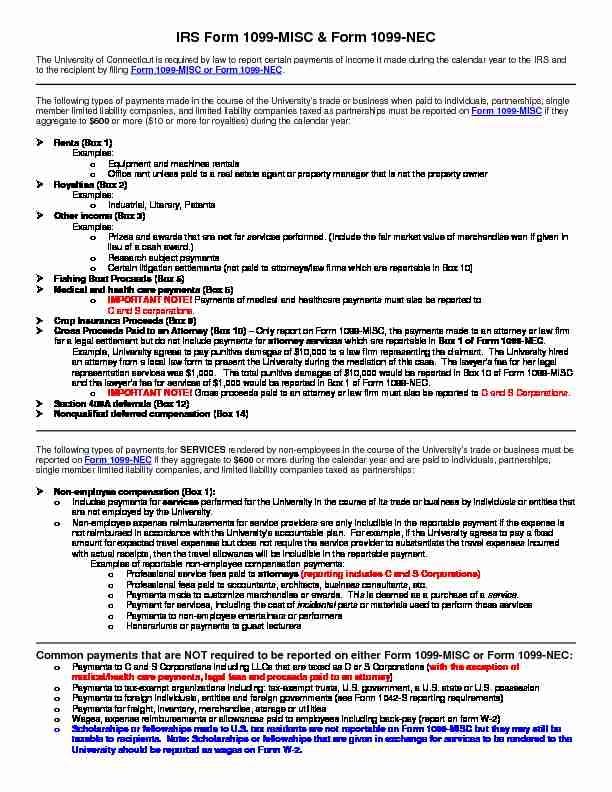

IRS Form 1099-MISC & Form 1099-NEC

IRS Form 1099-MISC & Form 1099-NEC

for a legal settlement but do not include payments for attorney services which are reportable in Box 1 of Form 1099-NEC. Example University agrees to pay

2020 Instructions for Forms 1099-MISC and 1099-NEC

2020 Instructions for Forms 1099-MISC and 1099-NEC

6 déc. 2019 $600 or more paid in the course of your trade or business are reportable in box 1 of Form 1099-NEC under section. 6041A(a)(1).

Instructions for Form 1099-G (Rev. January 2022)

Instructions for Form 1099-G (Rev. January 2022)

Miscellaneous Information or Form 1099-NEC

IRS Form 1099-MISC & Form 1099-NEC

The University of Connecticut is required by law to report certain payments of income it made during the calendar year to the

IRS and

to the recipient by filing Form 1099-MISC or Form 1099-NEC.The following types of payments

made in the course of the University"s trade or business when paid to individuals, partnerships, single member limited liability companies, and limited liability companies taxed as partnershipsmust be reported on Form 1099-MISC if they aggregate to $600 or more ($10 or more for royalties) during the calendar year:

Rents (Box 1)

Examples:

oEquipment and machines rentals

o Office rent unless paid to a real estate agent or property manager that is not the property ownerRoyalties (Box 2)

Examples:

o Industrial, Literary, PatentsOther income (Box 3)

Examples:

o Prizes and awards that are not for services performed. (Include the fair market value of merchandise won if given in

lieu of a cash award.)o Research subject payments o Certain litigation settlements (not paid to attorneys/law firms which are reportable in Box 10)

Fishing Boat Proceeds (Box 5)

Medical and health care payments (Box 6)

o IMPORTANT NOTE! Payments of medical and healthcare payments must also be reported toC and S corporations.

Crop Insurance Proceeds (Box 9)

Gross Proceeds Paid to an Attorney (Box 10) - Only report on Form 1099-MISC, the payments made to an attorney or law firm

for a legal settlement but do not include payments for attorney services which are reportable in Box 1 of Form 1099-NEC.Example, University agrees to pay punitive damages of $10,000 to a law firm representing the claimant. The University hired

an attorney from a local law form to present the University during the mediation of this case. The lawyer's fee for her lega

l representation services was $1,000. The total punitive damages of $10,000 would be reported in Box 10 of Form 1099

-MISC and the lawyer's fee for services of $1,000 would be reported in Box 1 of Form 1099 NEC. oIMPORTANT NOTE! Gross proceeds paid to an attorney or law firm must also be reported to C and S Corporations.

Section 409A deferrals (Box 12)

Nonqualified deferred compensation (Box 14)

The following types of payments

for SERVICES rendered by non-employees in the course of the University's trade or business must be reported onForm 1099

NECif they aggregate to $600 or more during the calendar year and are paid to individuals, partnerships,

single member limited liability companies, and limited liability companies taxed as partnerships:Non-employee compensation (Box 1):

o Includes payments for services performed for the University in the course of its trade or business by individuals or entities that

are not employed by the University.o Non-employee expense reimbursements for service providers are only includible in the reportable payment if the expense is

not reimbursed in accordance with the University's accountable plan. For example, if the University agrees to pay a fixed

amount for expected travel expen ses but does not require the service provider to substantiate the travel expenses incurred with actual receipts, then the travel allowance will be includible in the reportable payment. Examples of reportable non-employee compensation payments: o Professional service fees paid to attorneys (reporting includes C and S Corporations) o Professional fees paid to accountants, architects, business consultants, etc. o Payments made to customize merchandise or awards. This is deemed as a purchase of a service. oPayment for services, including the cost of incidental parts or materials used to perform those services

o Payments to non-employee entertainers or performers oHonorariums or payments to guest lecturers

Common payments

that are NOT required to be reported on either Form 1099-MISC or Form 1099-NEC:o Payments to C and S Corporations including LLCs that are taxed as C or S Corporations (with the exception of

me dical/health care payments, legal fees and proceeds paid to an attorney) o Payments to tax-exempt organizations including: tax-exempt trusts, U.S. government, a U.S. state or U.S. possession o Payments to foreign individuals, entities and foreign governments (see Form 1042-S reporting requirements)

o Payments for freight, inventory, merchandise, storage or utilitieso Wages, expense reimbursements or allowances paid to employees including back-pay (report on form W-2)

o Scholarships or fellowships made to U.S. tax residents are not reportable on Form 1099-MISC but they may still be

taxable to recipients. Note: Scholarships or fellowships that are given in exchange for services to be rendered to the

University should be reported as wages on Form W-2.quotesdbs_dbs31.pdfusesText_37[PDF] 1099 nec instructions

[PDF] 1099 nec vs misc

[PDF] 1099 nec webinars

[PDF] 1099 online

[PDF] 1099 r form meaning

[PDF] 1099 reporting

[PDF] 1099 tax form 2019 pdf

[PDF] 1099 tax form meaning

[PDF] 1099 unemployment

[PDF] 10:1 mixing ratio calculator

[PDF] 10bii financial calculator app manual

[PDF] 10e form pdf in hindi

[PDF] 10k report jcpenney

[PDF] 10th amendment case examples