Walsh College Student Name: Intermediate Accounting II Practice

Walsh College Student Name: Intermediate Accounting II Practice

Intermediate Accounting II Practice Evaluation Exam. 1. This exam is 25 multiple choice questions. All answers must go on the Scantron card. Be sure to fully

Accounting Skills Assessment Practice Exam Page 1 of 11

Accounting Skills Assessment Practice Exam Page 1 of 11

Use the following information to answer the next three questions. Beginning inventory. 100 units @ $8.00 = $ 800. Purchase # 1. 200 units @ $6.00 = 1200.

This study will therefore address the following research questions:

This study will therefore address the following research questions:

responses” (p.568). Surveys of student perceptions may also have validity ... questions and the exam used in Intermediate Accounting III contained thirty.

Accounting-PracticeExam2015.pdf

Accounting-PracticeExam2015.pdf

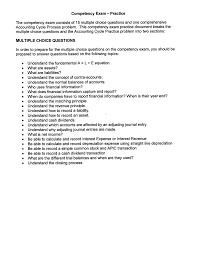

In order to prepare for the multiple choice questions on the competency exam you should be prepared to answer questions based on the following topics:.

This course is the first course of a two-part sequence of intermediate

This course is the first course of a two-part sequence of intermediate

Intermediate Accounting 13e. All other materials will be provided freely on I will randomly ask questions and collect answers from you. If you are not ...

Intermediate Accounting

Intermediate Accounting

Nov 23 2017 for early practice with CPA exam style questions. Multiple-Choice ... of Final Answer Questions and Worked Solutions in MyLab Accounting.

Chapter 6 Questions Multiple Choice

Chapter 6 Questions Multiple Choice

Chapter 6 Questions. Multiple Choice. 1. In a perpetual inventory system a. LIFO cost Answers to Matching. 1. I. 6. C. 2. E. 7. F. 3. B. 8. H. 4. G. 9. D. 5.

ACCT 3321 Fall 2023 Syllabus - Page 1 ACCT 3321 Intermediate

ACCT 3321 Fall 2023 Syllabus - Page 1 ACCT 3321 Intermediate

• Recognize important accounting issues ask critical questions

ACCT 3322 SPRING 2017 Syllabus - Page 1 ACCOUNTING 3322

ACCT 3322 SPRING 2017 Syllabus - Page 1 ACCOUNTING 3322

A continuation of Intermediate Accounting I. An in-depth study of financial Generally the more you volunteer answers or ask questions

Aligning Academic Courses with the 2015 CMA Exam

Aligning Academic Courses with the 2015 CMA Exam

of typical undergraduate accounting and finance pro- grams that is specifically Managerial Accounting and Intermediate Accounting. To the extent there is ...

Walsh College Student Name: Intermediate Accounting II Practice

Walsh College Student Name: Intermediate Accounting II Practice

1. This exam is 25 multiple choice questions. All answers must go on the Scantron card. Be sure to fully erase any stray marks on

Accounting Skills Assessment Practice Exam Page 1 of 11

Accounting Skills Assessment Practice Exam Page 1 of 11

Use the following information to answer the next three questions. Beginning inventory. 100 units @ $8.00 = $ 800. Purchase # 1. 200 units @ $6.00 = 1200.

140 free CPA Exam multiple-choice questions (MCQs)

140 free CPA Exam multiple-choice questions (MCQs)

50 MCQs from the Financial Accounting and Reporting (FAR) Section. Pages 68-118 Question. •. Answer choices. •. Item ID (unique question identifier).

Student Performance in Intermediate Accounting: A Comparison of

Student Performance in Intermediate Accounting: A Comparison of

In this paper we compare student exam performance across two sections of Intermediate Accounting II

INTERMEDIATE ACCOUNTING II

INTERMEDIATE ACCOUNTING II

Intermediate Accounting Gordon

ACCT 3753 – INTERMEDIATE ACCOUNTING II Course Description

ACCT 3753 – INTERMEDIATE ACCOUNTING II Course Description

The quizzes are all multiple choice CPA exam type questions. Job interviews

Accounting Principles Question Paper Answers and Examiners

Accounting Principles Question Paper Answers and Examiners

2 Jun 2017 a) It is a three-hour handwritten examination and a writing booklet for your answers is supplied. b) There will be five (5) questions each ...

A practical guide to accounting for agricultural assets

A practical guide to accounting for agricultural assets

Contact global.ifrs.publications@uk.pwc.com for hard copies. Questions and answers on impairment of non- financial assets in the current crisis. Provides

Read Online Intermediate Accounting Chapter 18

Read Online Intermediate Accounting Chapter 18

intermediate accounting solution manualIntermediate Accounting Prac Mock Exams ¦ PDF ¦ Stocks Intermediate Accounting III Chapter 6 HW.

PDF Accounting Practice Exam 2015

PDF Accounting Practice Exam 2015

The Competency Exam may include questions asking you to account for the sale of common stock by a company transactions related to cash dividends

Rutgers University-Camden Intermediate Accounting I (ACC 305

Rutgers University-Camden Intermediate Accounting I (ACC 305

Intermediate Accounting I provides an in?depth development of both the basic theory underlying financial accounting and the accounting process with an emphasis on their application to items on financial statements This course builds upon Introduction of Financial Accounting and covers concepts standards

The Intermediate Accounting Vol 1 - Robles & Empleo

The Intermediate Accounting Vol 1 - Robles & Empleo

Gleim Financial Accounting Exam Questions and Explanations 19th edition This book contains CPA exam questions and explanations It is meant for self-study and will prove very helpful toward (a) doing well in this class and (b) the ultimate goal for most of you: passing the CPA exam To give you an additional incentive to study this

Accounting Skills Assessment Practice Exam Page 1 of 11

Accounting Skills Assessment Practice Exam Page 1 of 11

Accounting Skills Assessment Practice Exam Page 3 of 11 13 What is the amount of Income from Operations that a company should report on its current year multiple-step income statement based on the following data? Cost of goods sold $ 250000 Net sales $ 600000 Income taxes expense 50000 Selling general &

Final Examination Booklet Intermediate Accounting 1 - JustAnswer

Final Examination Booklet Intermediate Accounting 1 - JustAnswer

IntermediateAccounting 1 Intermediate Accounting 1 EXAMINATION NUMBER: 06140900 Complete the following exam by answering the questions andcompiling your answers into a word-processing document Whenyou’re ready to submit your answers refer to the instructions atthe end of your exam booklet

Intermediate Accounting (Gordon/Raedy/Sannella) Chapter 2

Intermediate Accounting (Gordon/Raedy/Sannella) Chapter 2

Intermediate Accounting (Gordon/Raedy/Sannella) Chapter 2 Financial Reporting Theory 2 1 Overview of the Conceptual Framework 1) The FASB has taken the conceptual framework to a higher level than the IASB Answer: FALSE Diff: 2 Objective: 2 1 IFRS/GAAP: GAAP AACSB: Application of knowledge

Searches related to intermediate accounting exam questions and answers pdf filetype:pdf

Searches related to intermediate accounting exam questions and answers pdf filetype:pdf

This is a Sample PDF of our Financial Accounting Exam You can view the entire Exam (74 pages containing 640 questions plus answers) when you join AccountingCoach PRO PRO members also have access to online versions of our exams which include instant grading

How many pages are in the Intermediate Accounting Vol 1?

- The Intermediate Accounting Vol. 1 - Robles & Empleo -... This preview shows page 1 - 4 out of 78 pages. CHAPTER 1 THE DEVELOPMENT OF THE ACCOUNTING PROFESSION 1-1.

What is Intermediate Accounting and what does it cover?

- It’s still all about generally accepted accounting principles (GAAP) and preparing financial statements.The material that intermediate accounting covers, however, goes beyond basic accounting scenarios. Think of financial accounting as the appetizer and intermediate accounting as the main course. What Does Intermediate Accounting Cover?

What are the practice questions for intermediate management accounting primer?

- Intermediate Management Accounting Primer Practice questions 1. Multiple-choice questions: i. When are departmental overhead rates generally preferred to plant-wide overhead rates? a) When activities of each of the various departments in the plant are not homogenous

What is intermediate accounting for Dummies cheat sheet?

- Intermediate Accounting For Dummies Cheat Sheet. Intermediate accounting builds on basic financial accounting skills. It’s still all about generally accepted accounting principles (GAAP) and preparing financial statements.The material that intermediate accounting covers, however, goes beyond basic accounting scenarios.

Rutgers University-Camden

Intermediate Accounting I (ACC 305)

Spring 2018

Section 01: class time & room: Monday & Wednesday 12:30-1:50pm BSB118 Section 40: class time & room: Monday 6:00- 8:50pm BSB116Instructor: Jun Guo, Ph. D.

EǦmail: jun.guo.acct@Rutgers.edu or jg1131@camden.rutgers.edu Office Hours: 11:30-12:30pm on Monday and Wednesday & 4:30-5:30pm on Monday or by appointmentOffice: BSB 333A

Phone: (856) 225Ǧ2585

Required Course Materials:

1. Intermediate Accounting, 16th Edition by Kieso, Weygandt, and Warfield, 2016.

ISBN#: 9781118742976

E-book or Loose-version of the 16th edition is acceptable. th Edition.ISBN#: 9781618540232

This book contains CPA exam questions and explanations for self-study. Note: Both books are required in Intermediate Accounting I & II.Course Overview

Intermediate Accounting I provides an inǦdepth development of both the basic theory underlying financial accounting and the accounting process, with an emphasis on their application to items on financial statements. This course builds upon Introduction of Financial Accounting, and covers concepts, standards, principles and procedures underlying GAAP (and will make comparisons with IFRS) in much greater details. Intermediate Accounting I is a comprehensive analysis of financial accounting topics involved in preparing financial statements including: financial accounting standards; the accounting process; the balance sheet; the income statement; revenue recognition; the time value of money; cash; receivables; inventory methods; property plant and equipment. These courses require intensive study and analysis. The objective is to help students develop a solid understanding of financial accounting standards.After taking this course, students will:

- Have a much deeper understanding of the preparation of financial statements in accordance withUS GAAP.

- A much more developed understanding of the role of the FASB and SEC in providing the regulatory framework for financial reporting in the US.Class Procedure:

Class sessions will be a combination of lecture, problem solving and discussion. Lecture outlines will be available on Sakai. Please ensure that your settings on Sakai are configured to notify you promptly whenever new course material is posted. You should come to class having read the assigned chapter material. For each class session, you As we have limited amount of class time only the most important material will be covered in class. However, students will be responsible for all the material assigned.Class Attendance/Participation:

sses. Students are responsible for all announcements made during class. You are also responsible for getting notes and learning what was covered in class if you have to miss a class. No teaching for the same class content should be expected during office hour if you miss a class for any reason.Grading:

Your final grade will be determined according to the following formula:Assignments Total

Midterm exam I (1-4) 25%

Midterm exam II (5,6&18) 25%

Final exam (7-11) 30%

Attendance and in-class exercise 10%

Required homework assignments 10%

Total 100%

Bonus homework 3%

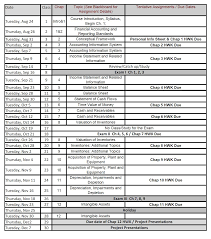

Exams (80%): There are two mid-term exams and one final exam in this course. All exams are closed book, in-class exams. The format of each exam will be a combination of multiple choice questions and numerical problems. Basic calculators are permitted during exams however you may not use a calculator with data storage capabilities. Cell phones are prohibited as are all text messaging and other devices that possess wireless communication capabilities. Every effort will be made to give exams on the scheduled dates per the syllabus. The exams will be scheduled on the following dates/times:Exam 1 Class time, 2/19

Exam 2 Class time, 3/26

Final* Final week, TBA

Class Withdraw deadline is 4/2.

All dates are tentative and subject to change. Students are responsible for all announcements and schedule change made in class and on the course website.Make-up Exams:

Make-up exams will be given only for documented medical or family emergencies, at documentation, you will not get a make-up exam. A grade of 0 will be assigned for unexcused absences. If you have a medical/family emergency, let me know before the exam no excuses will be accepted after the scheduled exam/quiz time. Note: The medical report should mention that the student was too sick to take the exam on the exam date.Attendance and in-class exercise (10%):

Attendance is mandatory. You will have 12 in-class exercises during the whole semester. 10 best -class exercises and class attendance/participation. If you exercise in class due to medical reason, you have to provide the valid medical report for late submission.Homework assignments (Required 10% + Bonus 3%):

You will have required homework from each chapter. The questions are either from textbook or from excel worksheet that I will send you. Usually you will have one week to finish all the homework assignments. Bonus homework: In order to motivate students to understand and prepare for CPA exams, bonus CPA exam-like questions will be assigned from some chapters. Bonus homework is not required but you will have 3% bonus added to your final grade once you do all the bonus questions and submit on time.CPA Review Questions:

Gleim CPA Exam review questions will be integrated into the curriculum to help frame your expectations, and familiarize you with the rigorous nature of the exam. I recommend that you work through the Gleim EQE questions in conjunction with the material we cover in week in class. You can find a cross reference between the Gleim EQE questions and the Kieso textbook chapters,here (https://www.gleim.com/accounting/eqe/xref/?page=2#EQEǦcrossrefǦbookǦtitleǦ1). I also

encourage you to access the Gleim online bank of practice questions at https://www.gleim.com/Grading Scale:

A 103 90.0%

B+ 89.9 86.0%

B 85.9 - 80.0%

C+ 79.9 76.0%

C 75.9 70.0%

D 69.9 60.0%

F 59.9 0.0%

Academic Integrity:

Please see http://academicintegrity.rutgers.edu

Violations of academic integrity may include: cheating (the use of inappropriate and unacknowledged materials, information, or study aids in any academic exercise); fabrication (the falsification or invention of any information or citation in an academic exercise); facilitating academic dishonesty (when students knowingly or negligently allow their work to be used by other students or who otherwise aid others in academic dishonesty); plagiarism (the representation of the words or ideas of another as one's own in any academic exercise); and denying others access to information or material. Students who engage in scholastic dishonesty are subject to disciplinary penalties, including thepossibility of failure in the course and dismissal from the university. Scholastic dishonesty includes

quotesdbs_dbs7.pdfusesText_5[PDF] intermediate appellate court definition

[PDF] intermediate appellate court example

[PDF] intermediate appellate court in the federal system

[PDF] intermediate appellate courts quizlet

[PDF] intermediate english book pdf

[PDF] intermediate french for dummies free pdf

[PDF] intermediate german vocabulary

[PDF] intermediate illustrator tutorials

[PDF] intermediate syllabus

[PDF] intermolecular forces and colligative properties

[PDF] intern housing geneva

[PDF] internal architecture of 8086 microprocessor ppt

[PDF] internal carbon price

[PDF] internal energy of mixing