ting Reference (PR) column—is left blank in a manual system when entering a transaction in the

| Previous PDF | Next PDF |

Accounting-PracticeExam2015pdf - UNLV

Accounting-PracticeExam2015pdf - UNLV

e choice questions and the Accounting Cycle Practice problem into two sections: prepared to answer questions based on the following topics: Understand why adjusting journal entries are made

CHAPTER 2 ACCOUNTING FOR TRANSACTIONS - Harper

CHAPTER 2 ACCOUNTING FOR TRANSACTIONS - Harper

ed capital stock for $16,000 b) Paid rent on office building for the month, $3,000 c) Purchased

Accounting Cycle Exercises II

Accounting Cycle Exercises II

journal that he maintained for transactions occurring during January All amounts are in the

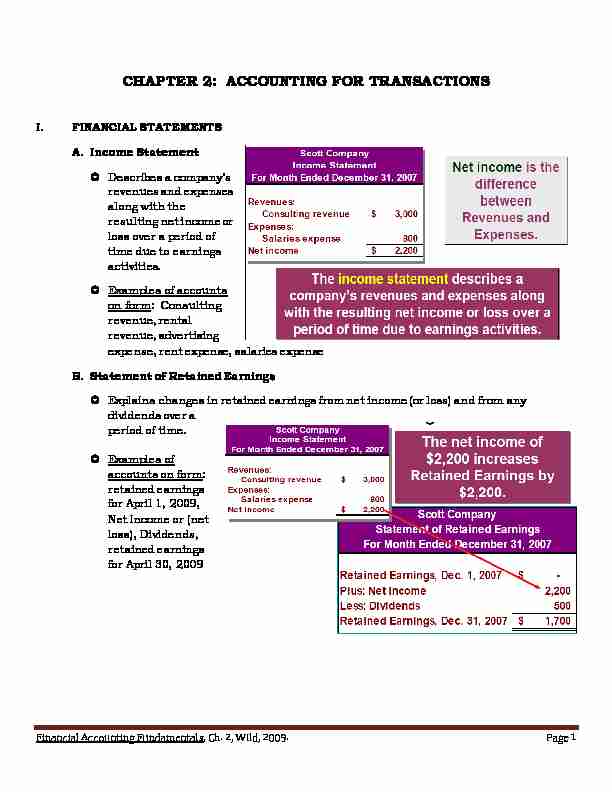

CHAPTER 2: ACCOUNTING FOR TRANSACTIONS

CHAPTER 2: ACCOUNTING FOR TRANSACTIONS

ting Reference (PR) column—is left blank in a manual system when entering a transaction in the

Balance sheet exercises with answers pdf - Squarespace

Balance sheet exercises with answers pdf - Squarespace

od does an accountant do with transactions? Why? - What's the accounting equation? Why does it

Activity 1: Transactions

Activity 1: Transactions

e entries from the general journal into a general ledger using both the running balance format and

Accounting I

Accounting I

l transactions have been recorded in the journal, they are posted to the ledger and a trial balance

[PDF] acheter pied a terre paris

[PDF] acid base problems with answers pdf

[PDF] acide base exercice corrigé pdf

[PDF] acide base physique

[PDF] acide et base ph

[PDF] acide faible base faible

[PDF] acide faible ph formule

[PDF] acids and bases practice problems with answers

[PDF] acquisition de la nationalité française par mariage forum

[PDF] acsm physical activity guidelines 2020

[PDF] activité enzymatique définition

[PDF] activité la voix et l'oreille humaine

[PDF] activité paris juillet 2019

[PDF] activités langage maternelle petite section

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 1

Financial Accounting Fundamentals, Ch. 2, Wild, 2009. Page 1