2004 Form W-4 - Internal Revenue Service

2004 Form W-4 - Internal Revenue Service

2004 expires February 16, 2005 See Pub 505, Tax Withholding and Estimated Tax Check your withholding After your Form W-4 takes effect, use Pub 919 to see how the dollar amount you are having withheld compares to your projected total tax for 2004 See Pub 919, especially if your earnings exceed $125,000 (Single) or $175,000 (Married

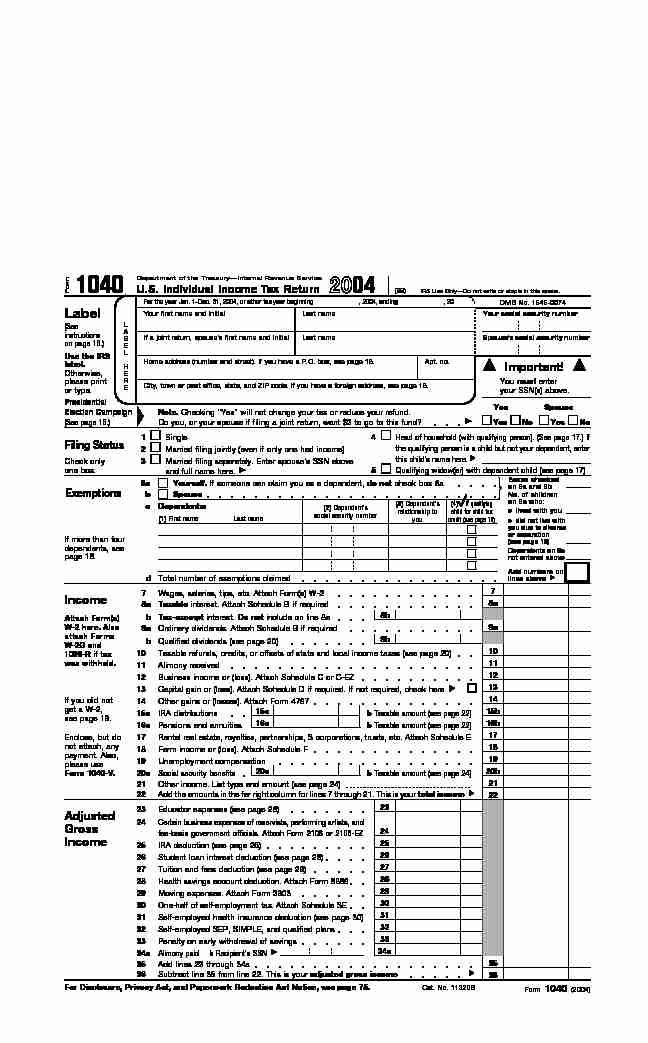

2004 Form 1040 - Internal Revenue Service

2004 Form 1040 - Internal Revenue Service

64 2004 estimated tax payments and amount applied from 2003 return 64 Payments 65a Amount paid with request for extension to file (see page 54)68 67 Excess social security and tier 1 RRTA tax withheld (see page 54) 66 68 70 69 Other payments from: 72a 73 73 If line 70 is more than line 62, subtract line 62 from line 70 This is the amount you

2004 - Centers for Disease Control and Prevention

2004 - Centers for Disease Control and Prevention

DIMETHYLACETAMIDE 2004 CH 3CON(CH 3) 2 MW: 87 12 CAS: 127-19-5RTECS: AB7700000 METHOD: 2004, Issue 2 EVALUATION: FULL Issue 1: 15 May 1989 Issue 2: 15 August 1994 OSHA : 10 ppm (skin)

THE 2004 PROHIBITED LIST INTERNATIONAL STANDARD

THE 2004 PROHIBITED LIST INTERNATIONAL STANDARD

The Prohibited List 2004 26 March 2004 3 concentration of the Prohibited Substance or its metabolites or markers and/or the relevant ratio(s) in the thlete’s SampleA is attributable to a pathological or physiological condition In all cases, and at any concentration, the laboratory will

US State Department Form DS-2004 - Notification of

US State Department Form DS-2004 - Notification of

INSTRUCTIONS FOR COMPLETING FORM DS-2004, NOTIFICATION OF APPOINTMENT OF FOREIGN GOVERNMENT EMPLOYEE This form is to be completed for all employees of foreign missions except diplomatic and consular officers All questions should be answered completely and accurately If a question does not apply, please type N/A

IS 2004 (1991): Carbon steel forgings for general engineering

IS 2004 (1991): Carbon steel forgings for general engineering

IS 2004 : 1991 12i1 2 1 Smaller sizes shall be bent in full section by a former having a diameter propor- tional to that specified for a 32 mm square test piece Each bend test shall comply with the requirements without fracture 12 1 2 2 Subsequently, the ends of the test

2004 Model Year Scheduled Maintenance Guide

2004 Model Year Scheduled Maintenance Guide

Get the most from your vehicle with routine maintenance Routine maintenance is the best way to help ensure you get the performance, dependability, long life and

SENATE BILL 607 Unofficial Copy 2004 Regular Session By

SENATE BILL 607 Unofficial Copy 2004 Regular Session By

6 July 1, 2004 Title: Microsoft Word - sb0607f doc Author: Administrator Created Date: 1/4/2005 3:56:36 AM

2003 & 2004 MEDIUM DUTY C SERIES ELECTRICAL

2003 & 2004 MEDIUM DUTY C SERIES ELECTRICAL

The Electrical section of the 2003 & 2004 Medium Duty C Series Body Builder Manual is not split between Family 2 and Family 3 t rucks The Electrical systems are common between the families

74th NCAA Wrestling Tournament 2004 3/18/2004 to 3/20/2004 at

74th NCAA Wrestling Tournament 2004 3/18/2004 to 3/20/2004 at

3/18/2004 to 3/20/2004 at St Louis 2004 NCAA Wrestling Championship Page 2 of 30 McKnight, SUNY-Buffalo Eustice, Iowa Rebmann, Drexel Stuart, Lehigh Dubuque 6-3 Valenti 9-6 Noto DFT 6:18 Pitts 11-4 Dubuque 6-4 Valenti 3-2 OT Rebmann 6-4 OT Stuart 14-9 Valenti DFT 6:13 Stuart 7-3 Hazewinkel, Oklahoma Moreno, Cal Poly-SLO Hazewinkel 2-0 Stuart 4

[PDF] ebook astronomie gratuit

[PDF] améliorer calcul mental

[PDF] ne ferme pas ta porte tome 3 ekladata

[PDF] ne ferme pas ta porte integrale ekladata

[PDF] ne ferme pas ta porte tome 3 pdf

[PDF] ne ferme pas ta porte tome 2 pdf

[PDF] ne ferme pas ta porte 5 pdf

[PDF] ne ferme pas ta porte tome 5 pdf ekladata

[PDF] ne ferme pas ta porte tome 4 pdf

[PDF] comment réussir ses études au lycée

[PDF] comment réussir ses études universitaires

[PDF] comment réussir ses études pdf

[PDF] asymétrie d'information sur les marchés

[PDF] asymétrie d information entre preteurs et emprunteurs

4 I.R.S. SPECIFICATIONSTO BE REMOVED BEFORE PRINTING DO NOT PRINT ó DO NOT PRINT ó DO NOT PRINT ó DO NOT PRINTTLS, have you transmitted all R text files for this cycle update? Date

4 I.R.S. SPECIFICATIONSTO BE REMOVED BEFORE PRINTING DO NOT PRINT ó DO NOT PRINT ó DO NOT PRINT ó DO NOT PRINTTLS, have you transmitted all R text files for this cycle update? Date Action

Revised proofs

requestedDate Signature

O.K. to printINSTRUCTIONS TO PRINTERS

FORM 1040, PAGE 1 of 2

MARGINS: TOP 13 mm (

1 ⁄2"), CENTER SIDES. PRINTS: HEAD to HEADPAPER: WHITE WRITING, SUB. 20. INK: BLACK

FLAT SIZE: 203 mm (8") ? 279 mm (11")

PERFORATE: (NONE)

Department of the Treasury - Internal Revenue Service1040U.S. Individual Income Tax Return

OMB No. 1545-0074

For the year Jan. 1-Dec. 31, 2004, or other tax year beginning , 2004, ending , 20 Last nameYour first name and initialYour social security number (See instructions on page 16.) L A B E L H E R E Last nameSpouse's social security numberIf a joint return, spouse's first name and initialUse the IRS

label.Otherwise,

please print or type. Home address (number and street). If you have a P.O. box, see page 16.Apt. no. City, town or post office, state, and ZIP code. If you have a foreign address, see page 16.Presidential

Election Campaign1Single

Filing Status

Married filing jointly (even if only one had income)2Check only

one box.3 Qualifying widow(er) with dependent child (see page 17)6a Yourself. If someone can claim you as a dependent, do not check box 6a

ExemptionsSpouseb

(4) if qualifying child for child tax credit (see page 18)Dependents:c

(2) Dependent's social security number(3) Dependent's relationship to you(1) First name Last nameIf more than four

dependents, see page 18. dTotal number of exemptions claimed 7Wages, salaries, tips, etc. Attach Form(s) W-27

8a8a Taxable interest. Attach Schedule B if required

Income

8b b Tax-exempt interest. Do not include on line 8aAttach Form(s)W-2 here. Also

attach FormsW-2G and

1099-R if tax

was withheld.9a9aOrdinary dividends. Attach Schedule B if required

1010Taxable refunds, credits, or offsets of state and local income taxes (see page 20)

1111Alimony received

1212Business income or (loss). Attach Schedule C or C-EZ

Enclose, but do

not attach, any payment. Also, please useForm 1040-V.13

13Capital gain or (loss). Attach Schedule D if required. If not required, check here

1414Other gains or (losses). Attach Form 4797

15a 15bIRA distributions

bTaxable amount (see page 22)15a16b16a

Pensions and annuitiesbTaxable amount (see page 22)16a 1717Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

1818Farm income or (loss). Attach Schedule F

1919Unemployment compensation

20b20ab

Taxable amount (see page 24)20aSocial security benefits 212122Add the amounts in the far right column for lines 7 through 21. This is your total income

2225IRA deduction (see page 26)

232726

One-half of self-employment tax. Attach Schedule SE 29

Self-employed health insurance deduction (see page 30)27 3029

Self-employed SEP, SIMPLE, and qualified plans3130

Penalty on early withdrawal of savings

3231Alimony paid b Recipient's SSN

35Add lines 23 through 34a

32Subtract line 35 from line 22. This is your adjusted gross income 33

Adjusted

GrossIncome

36If you did not

get a W-2, see page 19. Form Married filing separately. Enter spouse's SSN above and full name here.Cat. No. 11320B

LabelForm1040(2004)

IRS Use Only - Do not write or staple in this space. Head of household (with qualifying person). (See page 17.) If the qualifying person is a child but not your dependent, enter this child's name here. Other income. List type and amount (see page 24)Moving expenses. Attach Form 3903 2526

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see page 75.

Boxes checkedon 6a and 6b

No. of childrenon 6c who:

Dependents on 6c

not entered aboveAdd numbers on

lines above ●lived with you ●did not live withyou due to divorceor separation(see page 18)34a34a

Student loan interest deduction (see page 28)

3335