Balance Due Returns - Internal Revenue Service

Balance Due Returns - Internal Revenue Service

Balance Due Returns General Information • Taxpayers don’t have to pay if balance due is less than $1 • Payment in full is due by the April filing due date to avoid interest and penalties • Taxpayer should file his or her return by the filing due date, including extensions to avoid a failure-to-file penalty

Correct Use and - Analytical balance, lab scales, counting

Correct Use and - Analytical balance, lab scales, counting

Operating the Balance Leveling the Balance Only a level balance can deliver reliable results – Adjust the feet until the level indicator shows that balance is level; operate the balance only in this position The air bubble must be within (ideally: in the middle) of the circle on the indicator – After leveling the balance, perform

VERIFYING CALIBRATION OF WEIGHING DEVICES USED FOR LABORATORY

VERIFYING CALIBRATION OF WEIGHING DEVICES USED FOR LABORATORY

especially true of two-pan weighing devices used with a variety of counter weights and with multiple beam-arm mechanical devices 4 2 Apply verification test loads in order of increasing value 4 3 For weighing devices with multiple ranges or beam-arms, verify each range and beam-

Correct Use and Handling of Analytical and Microbalances

Correct Use and Handling of Analytical and Microbalances

Operating the Balance Leveling the Balance Only a level balance can deliver reliable results – Adjust the feet until the level indicator shows that balance is level; operate the balance only in this position The air bub-ble must be within (ideally: in the middle) of the circle on the indicator – After leveling the balance, perform

SWORN FINANCIAL STATEMENT - CO Courts

SWORN FINANCIAL STATEMENT - CO Courts

I certify that on _____ (date) a true and accurate copy of the SWORN FINANCIAL STATEMENT was served on the other party by: Hand Delivery, E-filed, Faxed to this number: _____, or By placing it in the United States mail, postage pre-paid, and addressed to the following:

Documentation of Telephone Verification - Oklahoma

Documentation of Telephone Verification - Oklahoma

Documentation of Telephone Verification Applicant/Resident: Unit #:_____ 1 Oral (telephone) verifications may be used when other methods are not feasible Describe the reasons(s) that third-party written or first hand verifications are not feasible in this instance: _____ _____ 2 In lieu of third-party written or first hand verification, on , at

Balance: Dynamic Adjustment of Cryptocurrency Deposits

Balance: Dynamic Adjustment of Cryptocurrency Deposits

mation in XCLAIM makes it a highly suitable Balance use case We show that Balance reduces deposits by 10 while maintaining the same level of payoff for complying with the specification of the protocol The implementation has linear complexity for storing the score of agents depending on the number of layers with a maximum cost of updating a score

Moisture Analyzers - Mettler Toledo

Moisture Analyzers - Mettler Toledo

Balance Capacity 200g 150g Readability 1mg/0 1mg 1mg Drying unit Temperature range 40-230°C 40-230°C Lid-opening Motorized Manual Routine Tests Balance test Sensitivity at free weight, 100g default Sensitivity at free weight, 100g default Heating module test 2-point temp calibration at adjust-ment values plus free definable temp

[PDF] Voici un exemple d 'une balance de vérification produite - Excel FSM

[PDF] TD n°1 : la Balance des Paiements

[PDF] Chapitre 1 - EconomiX

[PDF] Finances publiques et balance des paiements du Maroc - E-Periodica

[PDF] TD n°1 : la Balance des Paiements

[PDF] EXERCISES LESSON 3 BALANCE SHEET

[PDF] l 'entretien des surfaces et des sols - CClin Paris-Nord

[PDF] Étaiement des balcons - OPPBTP

[PDF] De Bâle I ? Bâle III: les principales avancées des accords - lameta

[PDF] De Bâle I ? Bâle III: les principales avancées des accords - lameta

[PDF] Ratio de solvabilité - Bale 1 - 2 et 3 - AISES

[PDF] Balsan - Fabricant de moquette en lé et en dalle

[PDF] Balsan - Fabricant de moquette en lé et en dalle

[PDF] Dans le cadre du Développement de ses activités Barid Al Maghrib

K-20

K-20 Balance Due Returns

General Information

Taxpayers don"t have to pay if balance due is less than $1. interest and penalties. penalty. as they can with the return to reduce penalties and interest.Payment Methods

Electronic Funds Withdrawal

E-filing allows taxpayers to file their return early and schedule their payment for withdrawal from their checkingor savings account on a future date up to the April filing due date. Advise taxpayers that they should check their

account to verify that the payment was made.IRS Direct PayIRS direct pay on the IRS website is a free one-time payment from your checking account to the IRS. Use this

secure service to pay your tax bill or make an estimated tax payment directly from your checking or savings account

at no cost to you. You"ll receive instant confirmation that your payment has been submitted. Just follow the easy

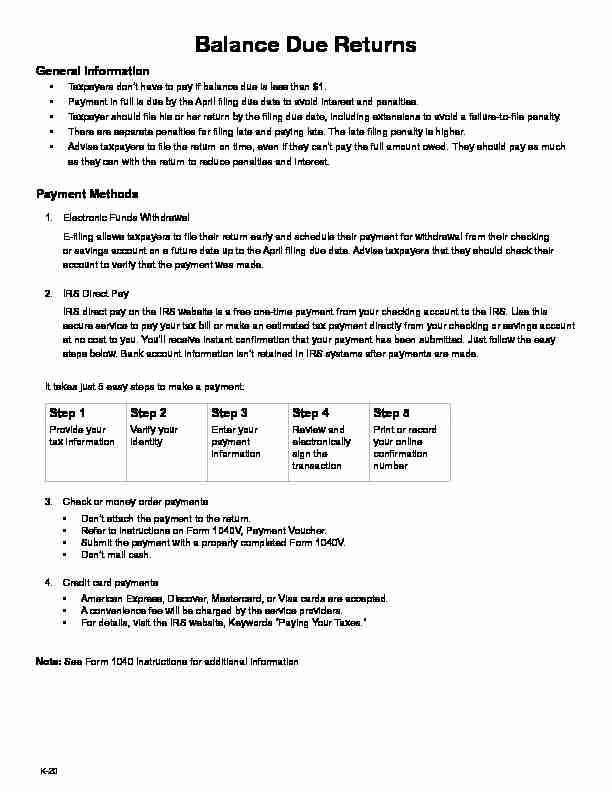

steps below. Bank account information isn"t retained in IRS systems after payments are made. It takes just 5 easy steps to make a payment:Step 1Step 2Step 3Step 4Step 5Provide your

tax informationVerify your

identityEnter your payment informationReview and

electronically sign the transactionPrint or record

your online numberCheck or money order payments

Don"t attach the payment to the return.

Refer to instructions on Form 1040V, Payment Voucher. Submit the payment with a properly completed Form 1040V.Don"t mail cash.

Credit card payments

American Express, Discover, Mastercard, or Visa cards are accepted. A convenience fee will be charged by the service providers.

Note: See Form 1040 Instructions for additional information K-21Balance Due Returns (continued)

Electronic Federal Tax Payment System (EFTPS)

convenient and secure service provided free by the Department of Treasury. For more information or to enroll

individual payments). TTY/TDD help is available by calling 1-800-733-4829. Note: You must have a valid Social Security Number (SSN) to use this applicat ion. This application cannot accommodateCash (at a retail partner)

Taxpayers can make a cash payment without the need of a bank account or credit card at more than 27,000 retail

Pay by Mobile Device

To pay through a mobile device, taxpayers may download the IRS2Go app.Installment Agreement

Because of the Bipartisan Budget Act of 2018, user fees for low-income taxpayers setting up installment a

greements (long-term payment plans) may be waived or reimbursed, under certain c onditions. Taxpayers meeting the low-income threshold (at or below 250% of the fede ral poverty guidelines, as determined for the most recent year) who agree to establish a Direct Debit Install ment Agreement, will not be charged a user fee. Taxpayers who are low income and unable to make electronic payments throu gh a debit instrument by enteringinto a Direct Debit Installment Agreement will be reimbursed the user fee upon completion of the install

ment agreement. K-22 How can a taxpayer avoid a balance due in the future? Taxes If the taxpayer didn't have enough withheld from his/her paycheck, pe nsion income or taxable social security -Advise the taxpayer to access the Tax Withholding Estimator on the IRS website-Advise the taxpayer to submit a revised Form W-4, Employee's Withholding Certificate, to the employer. For

pension income, taxpayers should submit a revised Form W-4P, Withholding Certificate for Pension or Annuity

Payments, to the pension payer or contact the pension administrator to increase w ithholding. -Advise taxpayers who received taxable social security benefits or unempl oyment to submit Form W-4V, Voluntary Withholding Request, to request withholding from social securit y of certain other federal government payments. If the taxpayer had income that wasn"t subject to withholding (such as self-employment, interest income, dividend income, or capital gain income):-Explain estimated taxes to the taxpayer. In TaxSlayer, add Form 1040-ES, Estimated Tax for Individuals,

and complete it. Discuss with taxpayer(s) whether to use the minimum r equired amount or the total amount expected to be due. Advise the taxpayer to review Publication 505, Tax Withholding and Estimated Tax. Forms or Publications can be obtained from the IRS website (irs.gov). If the taxpayer is receiving the advanced premium tax credit (APTC), t hey should notify the Marketplace when they Note: This information only applies to federal balance due returns. For state information, consult the applicable state.quotesdbs_dbs2.pdfusesText_4