|

Capital Gains and Losses

2016 Form 1040 (Schedule D) Part I Short-Term Capital Gains and Losses—Assets Held One Year or Less Part II Long-Term Capital Gains and Losses—Assets Held More Than One Year For Paperwork Reduction Act Notice see your tax return instructions |

|

2016 Form 1040 (Schedule A)

▷ Information about Schedule A and its separate instructions is at www irs gov/schedulea ▷ Attach to Form 1040 OMB No 1545-0074 2016 Attachment |

|

2016 Form 1040 (Schedule D)

▷ Information about Schedule D and its separate instructions is at www irs gov/scheduled ▷ Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 |

|

SCHEDULE D Capital Gains and Losses (Form 1040) 2016

2016 SCHEDULE D (Form 1040) 12 Part I Short-Term Capital Gains and Losses - Assets Held One Year or Less Part II Long-Term Capital Gains and Losses - Assets Held More Than One Year Attach to Form 1040 or Form 1040NR Use Form 8949 to list your transactions for lines 1b 2 3 8b 9 and 10 Your social security number 1a 1b 2 3 4 4 5 5 6 6 7 7 |

|

2016 Form IL-1040 Instructions

You must use Schedule SA (IL-1040) or the blended income tax rate to calculate your tax if your tax year ends on or after July 1 2017 See Specific |

|

2016 I-028 Schedule I Adjustments to Convert 2012 Federal

Fill in your 2016 federal adjusted gross income from line 37 Form 1040 (line 21 Form 1040A) 1 2 Capital gains and losses (federal Schedule D) |

|

Schedule D Tax Worksheet 2016

Drake-produced PDF Schedule D Tax Worksheet (Keep for Your Records) 2016 Name(s) as shown on return Name(s) as shown on return Tax ID Number Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 line |

|

2016 Individual Income Tax Return Long Form MO-1040

This form is available upon request in alternative accessible format(s) Form MO-1040 (Revised 12-2016) SIGNATURE Under penalties of perjury I declare |

|

Schedule F IL-1040 Instructions

the net capital gain from your federal Form 1040 Schedule D Line 16; or zero if your federal Form 1040 Schedule D Line 16 is blank or shows a loss |

|

2016 Instruction 1040 Schedule D

Use this worksheet to figure your capital loss carryovers from 2015 to 2016 if your 2015 Schedule D line 21 is a loss and (a) that loss is a |

|

2016 Instruction 1040 Schedule D

Title: 2016 Instruction 1040 Schedule D Author: W:CAR:MP:FP Subject: 2016 Instructions for Schedule D Capital Gains and Losses Created Date: 12/15/2016 10:25:21 AM |

|

And Losses Capital Gains

These instructions explain how to complete Schedule D (Form 1040) Complete Form 8949 before you complete line 1b 2 3 8b 9 or 10 of Schedule D Use Schedule D: To figure the overall gain or loss from transactions reported on Form 8949; To report certain transactions you don\'t have to report on Form 8949; |

|

2016 Schedule CR Credit for Tax Paid to Other States

52 Illinois Residents: Enter your Illinois tax due from Form IL‑1040 Line 13 Part-year Residents: Enter the amount from Step 5 Line 49 52 00 |

|

F1040--2016pdf

U S Individual Income Tax Return 2016 OMB No 1545-0074 IRS Use Only—Do not write or staple in this space For the year Jan 1–Dec 31 |

|

Lines 6 and 14 Schedule D 2016

Enter the loss from your 2016 Schedule D line 7 as a positive amount Enter any gain from your 2016 Schedule D line 15 If a loss enter -0-Add lines 4 and 6 Short-term capital loss carryover to 2017 Subtract line 7 from line 5 If zero or less enter -0-Enter the loss from your 2016 Schedule D line 15 as a positive amount |

To request either transcript online, go to www.IRS.gov and look for our new online tool, Order a Transcript.

To order by phone, call 800-908-9946 and follow the prompts in the recorded message.

What is a 1040 form?

Form 1040.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return.

The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

|

2016 Form 1040 (Schedule D)

? Attach to Form 1040 or Form 1040NR. ? Information about Schedule D and its separate instructions is at www.irs.gov/scheduled. ? Use Form 8949 to list your |

|

2016 Instruction 1040 Schedule D

19 oct. 2016 2016 Instructions for Schedule D ... To report a capital loss carryover from 2015 to 2016. ... www.irs.gov/pub/irs-irbs/irb97-39.pdf. |

|

2016 Schedule D (Form 1041)

? Use Form 8949 to list your transactions for lines 1b 2 |

|

2016 Schedule D (Form 1065)

Information about Schedule D (Form 1065) and its separate instructions is at www.irs.gov/form1065. OMB No. 1545-0123. 2016. Name of partnership. |

|

2016 Form 1120 S (Schedule D)

? Use Form 8949 to list your transactions for lines 1b 2 |

|

2016 Instructions for Schedule D (Form 1065)

1 déc. 2016 Use Schedule D (Form 1065) to report the following. The overall capital gains and losses from transactions reported on Form 8949. Certain ... |

|

F1040--2016.pdf

Form 1040 Department of the Treasury—Internal Revenue Service. (99). U.S. Individual Income Tax Return 2016 OMB No. Attach Schedule D if required. |

|

2016 Schedule D (Form 990)

? Information about Schedule D (Form 990) and its instructions is at www.irs.gov/form990. OMB No. 1545-0047. 2016. Open to Public. Inspection. Name |

|

2016 Instruction 1040

15 déc. 2016 Gross income includes gains but not losses |

|

2017 Instructions for Schedule D - Capital Gains and Losses

27 oct. 2017 These instructions explain how to complete Schedule D (Form 1040). Complete Form ... To report a capital loss carryover from 2016 to 2017. |

|

2016 Form 1040 (Schedule D) - Internal Revenue Service

ormation about Schedule D and its separate instructions is at www irs gov/ scheduled ▷ Use Form |

|

2016 Instruction 1040 Schedule D - Internal Revenue Service

pub › irs-priorPDF |

|

2016 Schedule D (Form 1041) - Internal Revenue Service

pub › irs-priorPDF |

|

2016 Schedule D (Form 1065) - Internal Revenue Service

pub › irs-priorPDF |

|

2016 MICHIGAN Adjustments of Capital Gains and Losses MI

short-term totals from MI-8949, line 2 and U S Form 1040 Schedule D, line 1a, column h |

|

Form 1 - Massgov

Schedule D Long-Term Capital Gains and Losses the amount from U S Form 1040, line 13 or U S Form 1040A, line 10 8 Carryover losses from prior years (from 2016 Schedule D, line 23) |

|

Form 4797 Sample ProblemFinalpdf Form 1040 (2016)

If you did not 13 Capital gain or (loss) Attach Schedule D if required If not required, |

|

2016 Form 1040 (Schedule D) - Internal Revenue Service

[PDF] Form (Schedule D) Internal Revenue Service irs gov pub irs pdf fsd pdf |

|

2016 Instruction 1040 Schedule D - Internal Revenue Service

[PDF] Instruction Schedule D Internal Revenue Service irs gov pub irs pdf isd pdf |

|

2017 Form 1040 (Schedule D) - Internal Revenue Service

[PDF] Form (Schedule D) Internal Revenue Service irs gov pub irs dft fsd dft pdf |

|

2016 Instruction 1040

[PDF] Instruction apps irs gov capital gain tax worksheet i pdf |

|

Form 8949, Sales and Other Dispositions of Capital Assets

[PDF] Form , Sales and Other Dispositions of Capital Assets irs gov pub irs pdf f pdf |

|

2016 Form 1040 (Schedule H) - Internal Revenue Service

[PDF] Form (Schedule H) Internal Revenue Service irs gov pub irs pdf fsh pdf |

|

2015 Form 1040 (Schedule C)

[PDF] Form (Schedule C) njit edu financialaid %Schedule%C pdf |

|

2016 MICHIGAN Adjustments of Capital Gains and Losses MI-1040D

[PDF] MICHIGAN Adjustments of Capital Gains and Losses MI D michigan gov documents taxes MI D pdf |

|

Book Form 1040 Schedule D Capital Gains And Losses (PDF, ePub

[PDF] Book Form Schedule D Capital Gains And Losses (PDF, ePub db dev tm wieni be form schedule d capital gains and losses pdf |

|

Schedule D - Massgov

Schedule D Long Term Capital Gains and Losses Excluding Collectibles the amount from U S Form , line or U S Form A, line |

- form 8949

- schedule d 1040 form 2016

- schedule d instructions

- form 2555

- schedule d form 1040

- sch deo favente

- qualified dividends and capital gain tax worksheet

Schedule C Form - Fill Out and Sign Printable PDF Template

Source: signNow

2016 Form IRS 1040 - Schedule A Fill Online Printable Fillable

Source:https://www.pdffiller.com/preview/6/954/6954790/large.png

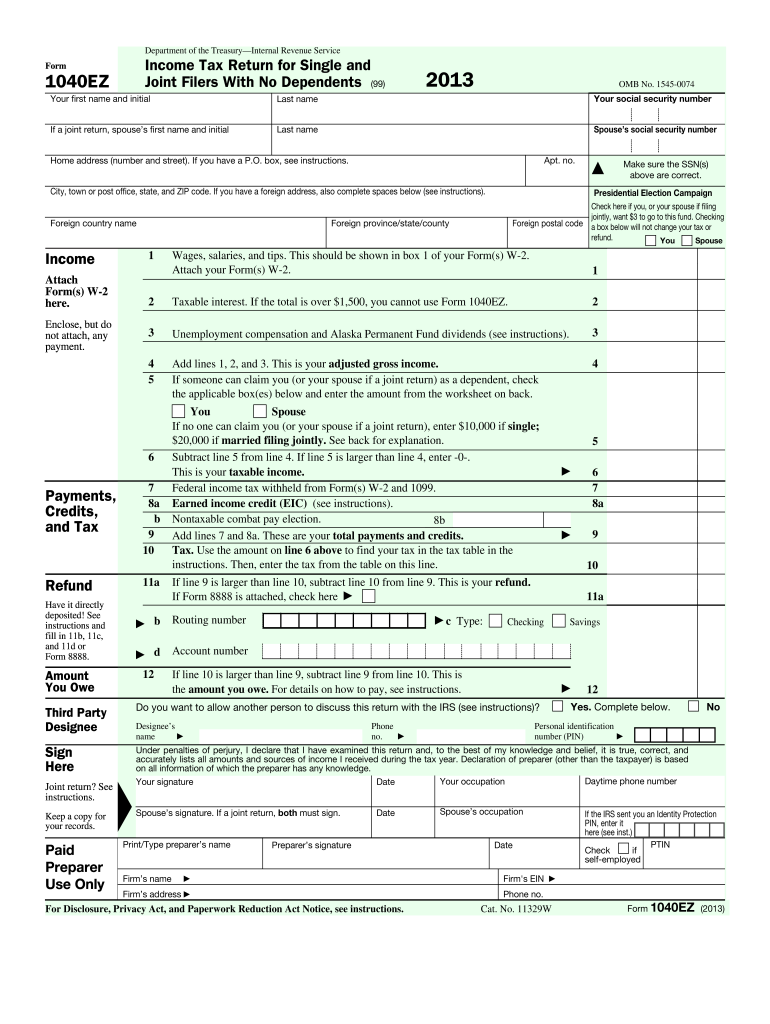

2013 Form IRS 1040-EZ Fill Online Printable Fillable Blank

Source:https://upload.wikimedia.org/wikipedia/commons/thumb/6/64/Form_1040%2C_2011.pdf/page1-1275px-Form_1040%2C_2011.pdf.jpg

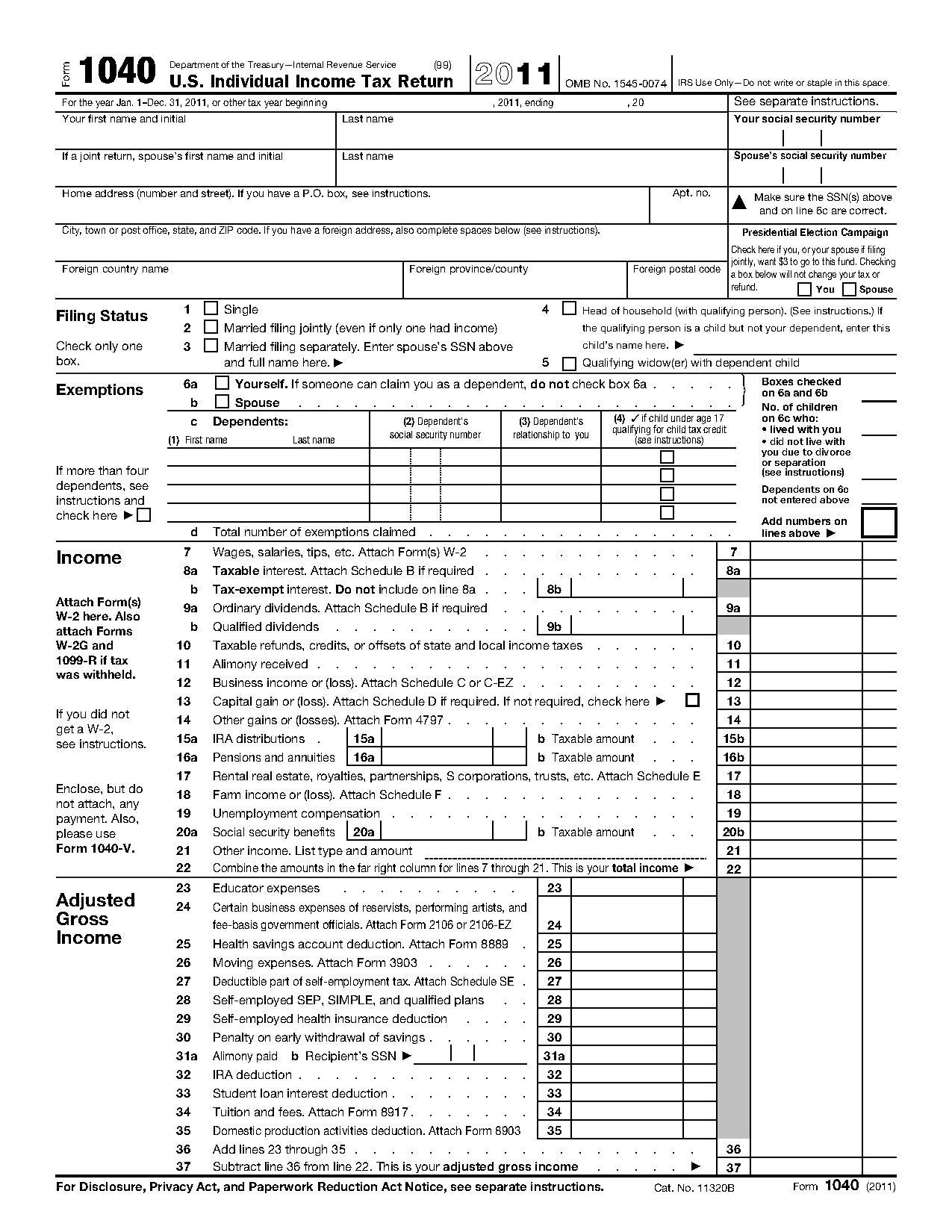

File:Form 1040 2011pdf - Wikimedia Commons

Source:https://upload.wikimedia.org/wikipedia/commons/thumb/7/77/Form_1040a%2C_2015.pdf/page1-220px-Form_1040a%2C_2015.pdf.jpg

Form 1040 - Wikipedia

Source:https://www.incometaxpro.net/images/tax/2017/2016-1040-instructions-booklet.jpg

2016 Form 1040 Instructions PDF

Source:https://upload.wikimedia.org/wikipedia/commons/thumb/b/ba/Form_1040%2C_2015.pdf/page2-180px-Form_1040%2C_2015.pdf.jpg

form 1040-es 2017 voucher

2017 Form 1040-ES - Internal Revenue Service

form 1040nr

Form 1040NR - Internal Revenue Service

- 1040nr instructions

- 1040nr-ez

- formulaire 1040nr en francais

- comment remplir le formulaire 1040

- schedule e form 1040

form 1065 schedule d 2015 pdf

2016 Schedule D (Form 1065) - Internal Revenue Service

form 1116

1116, Foreign Tax Credit - Internal Revenue Service

- form 1116 instructions

- form 2555

- form 6251

- form 1040