What is the average 401(k) balance for a 50 year old?

For men, that age is 55. Average 401 (k) balance: $142,069. Median 401 (k) balance: $48,301. This group has hit the age at which catch-up contributions are allowed by the IRS: Participants age 50 and older can contribute an extra $7,500 in 2023, and $8,000 in 2024.

How much would a 401(k) balance grow at age 62?

At age 42, the balance would grow to approximately $190,000. At age 52, the balance would grow to approximately $444,000. At age 62, the balance would grow to approximately $869,000. If this individual did not receive an employer match throughout their career, their 401 (k) balance at age 62 would be approximately $580,000, or lower by one-third.

How much money does a 401(k) make a year?

These numbers don’t reflect what younger investors may have saved elsewhere, in taxable brokerage accounts, or individual retirement accounts, such as Roth or traditional IRAs. Average 401 (k) balance: $30,017. Median 401 (k) balance: $11,357.

How much 401(k) should a 36-year-old have?

Given the median age in America is about 36 years old, the average 36-year-old should have a 401 (k) balance of around $121,700. Unfortunately, $121,700 is still pretty low. But the median 401 (k) balance overall is only about $35,000.

|

FAQs about Retirement Plans and ERISA

401(k) Plan – In this type of defined contribution plan the employee can make up to 6 months after you meet these age and service criteria |

|

IRA Required Minimum Distribution Worksheet

4. Repeat steps 1 through 3 for each of your IRAs. Table III (Uniform Lifetime). Age. Distribution. Period. |

|

2021 Publication 560

age the maximum default deferral percentage may have an earlier due date for salary reduction contributions and elective deferrals |

|

GAO-17-69 401(K) PLANS: Effects of Eligibility and Vesting Policies

21 oct. 2016 level earner who does not save in a plan or receive a 3 percent employer matching contribution from age 18 to 20 could have $134456 less ... |

|

Ten Important Facts About 401(k) Plans

Most 401(k) plan participants receive plan contributions from their employers. 12 FACT 6. 401(k) plan account balances rise with participant age and length |

|

FAQs about Retirement Plans and ERISA

your salary your age |

|

How America Saves 2021

1 jui. 2021 other 46% varied the contribution by age and/or tenure. These nonmatching contributions ... Historically employees in a 401(k) or 403(b). |

|

Workplace Retirement Plans: Facts and Figures

Retirement Savings Plan (Defined Benefit Pension Plans Defined Contribution Plans 401(k) Plan Account Balances Increase With Participant Age and Tenure. |

|

The Defined Contribution Retirement Plan — - Self-Employed 401(k

Effective Date of 401(k) Contributions if you are permitting Eligible You can skip this section unless the Plan adopted a Normal Retirement Age of 55 ... |

|

Insights: Financial Capability—A Snapshot of Investor - SECgov

after controlling for factors such as income, education and age What U S (89 percent) also own a retirement account like a 401(k) or IRA Twenty-nine percent |

|

What Determines 401(k) Participation and Contributions?

such as age, income, and job tenure, the length of an employee's planning horizon is a crucial factor affecting participation in and contribution to a 401(k) plan |

|

Factors Affecting Participation Rates and Contribution Levels in 401(k)

Robert L Clark and SylvesterJ Schieber 77 TABLE 3 Average Contributions to 401 (k) Plans by Age ofWorker for Workers Aged 21 to 64 with Annual Wages |

|

What Determines 401(k) Participation and Contributions?

such as age, income, and job tenure, the length of an employee's planning horizon is a crucial factor affecting participation in and contribution to a 401(k) plan |

|

WP_RI_No one is average_r24indd - JP Morgan Asset Management

Age MARY PHIL AVERAGE JOE AVERAGE Education Annual income Income growth potential Savings rate Current 401(k) savings Current IRA savings |

|

THE INTERACTION BETWEEN IRAS AND 401(K) PLANS IN

25 oct 2017 · information on IRA balances and 401(k) contributions 2014 3 We begin by drawing a 0 1 percent random sample of individuals ages 18 |

|

[PDF] 50 55 59½ 62 65 66 70 70½ Ready, Set, Retire—8 - Merrill Edge

AGE 66 AGE 70 AGE 70½ Tax advantaged “catch up” contributions to 401(k)s and other employer sponsored retirement plans, as well as to IRAs, can begin |

|

[PDF] Fidelity

May 9, 2019 · average 401(k) employee contribution amount, in dollars, reached a The following chart outlines the overall increase in balances for this |

|

[PDF] 401(k) BASICS - TA-Retirement

you are retired1 THE POWER OF STARTING EARLY Retirement income from your 401(k) account, if contributions begin at age 25 or age 45 v $1,000 $1,733 |

|

[PDF] VANGUARD 2018 DEFINED CONTRIBUTION PLAN DATA

Jun 2, 2019 · to influence employee retirement savings behavior contribution by age and or tenure In a typical 401(k) or 403(b) plan, employees must |

|

[PDF] Insights: Financial Capability—A Snapshot of Investor - SECgov

after controlling for factors such as income, education and age What US (89 percent) also own a retirement account like a 401(k) or IRA Twenty nine percent |

|

[PDF] Maximum 401k contributions - Urban Institute

Employees ages 50 and over may make additional “catch up” contributions to the accounts of $4,000 in tax year 2005 and $5,000 in tax year 2006, for a total |

- 401k withdrawal age 65

- age limit for 401k

- can i cash out my 401k at age 65

- at what age can you withdraw from 401k without paying taxes

- 401k withdrawal age 62

- how to withdraw from 401k after age 60

- what age do you have to withdraw from 401k

- what age can you withdraw from 401k without penalty?

- 401k savings by age

- 401k savings by age and income

- 401k contributions by age

- 401k savings by age chart

- 401k statistics by age

- 401k savings by age 35

- 401k savings by age group

- 401k savings by age 40

PDF) What is a 401k Company Match Employer Contribution

Source: Pratick

PDF) Contribution Behavior of 401(k) Plan Participants

Source:https://cdn.aarp.net/content/dam/aarp/retirement/planning-for-retirement/2020/04/1140-401-k-statement.web.jpg

Many Firms End 401(k) Matching Benefit to Cut Costs

Source:https://i2.wp.com/financialsamurai.com/wp-content/uploads/2021/01/401k-maximum-contributions-2021.png

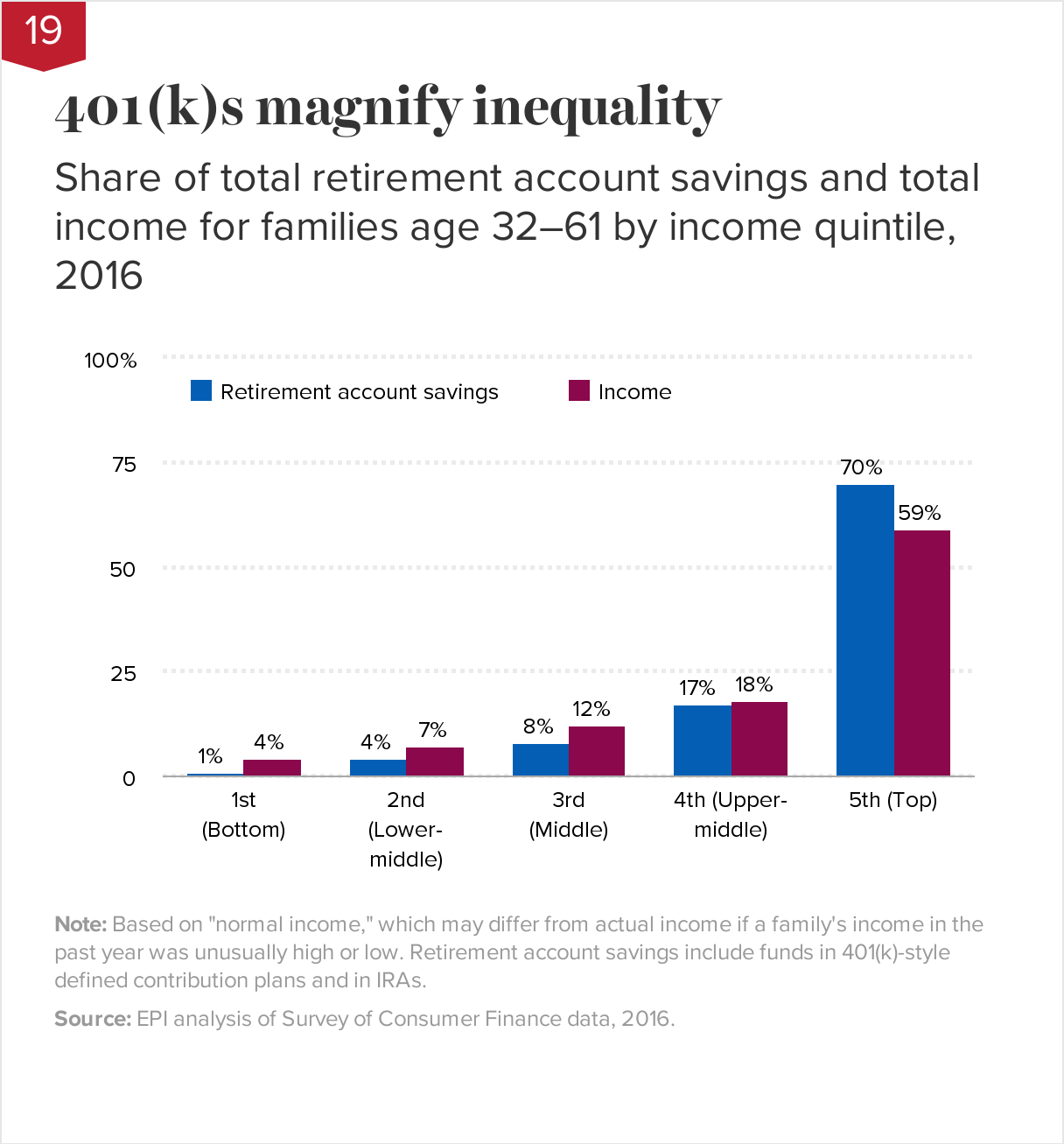

401k Savings By Age: How Much Should You Save For Retirement

Source:https://files.epi.org/charts/img/135981-22715.png

The State of American Retirement Savings: How the shift to 401(k)s

Source:https://www.mysolo401k.net/wp-content/uploads/2020/04/Making-Solo-401k-Contribution-for-a-Partnership.png

Solo 401k contribution for partnership and compensation

Source:https://www.mysolo401k.net/wp-content/uploads/2019/10/Solo-401k.png

401k regulations 2018

[PDF] What Employers Need To Know About H-2A Workers & 401(k) Plans

- maximum profit sharing contribution 2019

- 401k guidelines

- how to contribute $55

- 000 to 401k

- 401k handbook

- simple 401(k) contribution limits 2019

- 401k resources

- 401(k) administration guide

- 401k contribution age limit

- 401(k) regulations

- irs 401 k regulations

401k regulations 2019

[PDF] Proposed Hardship Withdrawal Regulations - Groom Law Group

- 2019 publication 560

- solo 401k

- solo 401k 5500 filing requirements

- publication 560 calculator

- owner-only 401k

- solo 401k rules

- irs 401k calculator

- self-employed 401k

- 401k guidelines 2019

401k regulations withdrawal

[PDF] US Bank 401(k) Savings Plan Summary Plan Description

- fidelity 401k terms of withdrawal pdf

- cares act 401k withdrawal

- charles schwab 401k withdrawal covid

- charles schwab 401k terms of withdrawal pdf

- does michigan tax 401k contributions

- fidelity 401k loan withdrawal terms and conditions

- state of michigan 401(k withdrawal)

- michigan tax early withdrawal 401k

- 401k requirements withdrawal

- 401k guidelines withdrawal

- 401k withdrawal requirements at age 70.5

- 401k withdrawal rule

- 401k withdrawal requirements at age 70

- 401k withdrawal rule changes

- 401k withdrawal rule of 55

- 401k withdrawal rule of thumb

401k rules

[PDF] Understanding the Roth 401(k) - Benefits

- solo 401k rules

- 401k rules for employers

- department of labor 401(k rules)

- self-directed 401k rules irs

- 401k law

- safe harbor 401k rules

- 401k regulations

- solo 401k eligibility

- 401k rules 2020

- 401k rules covid

- 401k rules for withdrawal

- 401k rules cares act

- 401k rules coronavirus

- 401k rules for employers

- 401k rules change

- 401k rules and regulations