How much money can I withdraw a year without paying a penalty?

In addition, starting in January 2024, a provision in the SECURE 2.0 Act of 2022 will allow you to to withdraw up to $1,000 a year for emergency personal or family expenses without paying the 10% early withdrawal penalty.

How much can a 401(k) be withdrawn from a Roth IRA?

The same annual contribution limits of $22,500, or $30,000 for individuals who are 50 or older still apply. However, unlike the Roth IRA, contributions can't be withdrawn from a Roth 401 (k) without penalty until five years after the plan starts, while a Roth IRA's contributions (not earnings) can be withdrawn at any time.

Standard Withdrawal Regulations

Under normal circumstances, participants in a traditional 401(k) planare not allowed to withdraw funds until they reach age 59½ or become permanently unable to work due to disability, without paying a 10% penalty on the amount distributed. Exceptions to this rule include certain hardship distributions and major life events, like tuition payments or

Calculating The Basic Penalty

Assume you have a 401(k) plan worth $25,000 through your current employer. If you suddenly need that money for an unforeseen expense, there is no legal reason why you cannot simply liquidatethe whole account. However, you are required to pay an additional $2,500 (10%) at tax time for the privilege of early access. This effectively reduces your with

Vesting Schedules

Though the only penalty imposed by the IRS on early withdrawals is the additional 10% tax, you may still be required to forfeit a portion of your account balanceif you withdraw too soon. The term “vesting” refers to the degree of ownership that an employee has in a 401(k) account. If an employee is 100% vested, it means they are entitled to the ful

Calculating The Total Penalty

In the $25,000 example above, assume your employer-sponsored 401(k) includes a vesting schedule that assigns 10% vesting for each year of service after the first full year. If you worked for just four full years, you are only entitled to 30% of your employer’s contributions. If your 401(k) balance is composed of equal parts employee and employer fu

Income Tax

Another factor to consider when making early withdrawals from a 401(k) is the impact of income tax. Contributions to a Roth 401(k) are made with after-tax money. No income tax is due when contributions are withdrawn. However, contributions to traditional 401(k) accounts are made with pretax dollars. This means that any withdrawn funds must be inclu

Avoiding 401(k) Withdrawal Penalties

To avoid having to make 401(k) withdrawals, investors should consider taking a loan from their 401(k). This avoids the 10% penalty and taxes that would be charged on a withdrawal. Another possible option is to make sure your withdrawal meets one of the hardship withdrawal requirements. Instead of tapping into your 401(k), you may also be able to us

Roth 401(k) Withdrawal Penalties

Because contributions are made with after-tax dollars, if you have a Roth 401(k), you can withdraw contributions penalty free at any time. Earnings can be withdrawn without paying taxes and penalties if you are at least 59½ years old and your account has been open for at least five years. In general, if withdrawals don’t meet this criteria, they wi

The Bottom Line

As you can see from the above example, it makes sense to consider all of your options before dipping into your 401(k) before you can make qualified withdrawals. At the very least, understand what you will come away with after paying the early withdrawal penalty and other taxes that you will owe. investopedia.com

|

CHAPTER 5. DETERMINING INCOME AND CALCULATING RENT

Internal Revenue Service (IRS) the tax rules are different from the HUD program Example – Withdrawals from IRAs or 401K Accounts. |

|

Hybrid Retirement Plan for State Employees and Teachers

In addition to being subject to regular income tax hardship withdrawals from the 401(k) plan may be subject to the 10% early distribution tax penalty. |

|

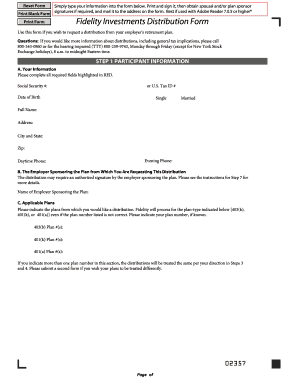

IRA and nonqualified only - Withdrawal request

If the contract is a SIMPLE IRA the penalty tax is 25% for withdrawals taken during the Calculate and distribute my free withdrawal amount (default). |

|

UTAH RETIREMENT SYSTEMS 401(K) WITHDRAWAL

11 déc. 2015 If you take a distribution before you reach age 59 1/2 you may be subject to a 10% tax penalty in addition to income taxes unless you meet one ... |

|

If I terminate employment with the state what retirement benefits can

NOTE: 401(k) withdrawals made prior to age 59 ½ are generally subject to an early withdrawal penalty. If your new employer accepts rollovers you can roll |

|

401(k) Savings Plan Summary Plan Description

6 juil. 2022 Fund Information and Calculators . ... Withdrawing Funds from Your Account. ... 401(k) account and thereby keep the money tax-. |

|

Office of Labor Relations Deferred Compensation Plan & NYCE IRA

Generally you may not withdraw funds from the Deferred to take distributions |

|

Pension lump-sum payouts and your retirement security

In addition you don't have to worry about calculating how Some 401(k) ... money from the 10 percent early withdrawal penalty and defer. |

|

Tax Rules about TSP Payments

Life Expectancy Installments and the Early Withdrawal Tax Penalty. Uniform Lifetime Table for Calculating Minimum Distributions. |

|

Exhibit 5-2: Assets

Individual retirement 401K |

|

IRA and 401(k) Overview - State of Michigan

Investment Knowledge IRA and 401(k) Overview 10 Early Withdrawal Penalty Exemptions Tax diversify: Percentage of retirement assets in a Traditional IRA or 401k and a percentage in a Three methods of calculating distribution: |

|

Non US Citizen 401(k) Distributions - Marvell Benefits

distributions allowed from any 401(k) plan are limited If you would Withheld State Tax Withheld Early Withdrawal Penalty*** 59 ½ years old + Pretax 20 |

|

FIVE STEPS TO PLANNING A HEALTHY RETIREMENT - Log In to

Once you are ready to turn your TVA 401(k) Plan assets into to a 10 early withdrawal penalty if you are under the and Social Security Benefit Calculators |

|

Withdrawing Your PERSI Funds - Public Employee Retirement

you may withdraw your funds from either or both accounts The two accounts Taking a PERSI Choice 401(k) Plan Withdrawal by using the Purchase of Service Calculator on the PERSI website at taxes and penalties as described above |

|

Think twice before “cashing out” your retirement - T Rowe Price

withdrawal could have on your savings—in this example, a difference of any tax penalties or (ii) promoting, marketing, or recommending to any other party any |

|

Retirement plans guide: Facts at a glance (PDF) - Invesco

Withdrawal Penalties: – 10 penalty on taxable portion of distribution unless a penalty exception applies With a SIMPLE IRA, the penalty for early withdrawal is |

|

Retirement Plan Required Minimum Distributions - Money Tree

The RMD rules also apply to Roth 401(k), Roth 403(b), and and penalty calculation, as well as a section where owners can explain their error, their corrective |

|

[PDF] IRA and 401(k) Overview - State of Michigan

Whether your IRA contribution is tax deductible depends on three factors 1 Your income tax Funds withdrawn prior to 59½ are generally subject to a 10 early withdrawal penalty and income tax Three methods of calculating distribution |

|

[PDF] Withdrawal request - John Hancock Annuities

If the contract is a SIMPLE IRA, the penalty tax is 25 for withdrawals taken during the first two Calculate and distribute my free withdrawal amount (default) |

|

[PDF] Early Retirement Distributions, Social Security Benefits and Federal

tax return Are any of my Social Security Benefits taxable? The IRS uses a formula to determine if any of you withdraw money from your IRA, 401(k) or any |

|

[PDF] Distributions and Withdrawals - Valic

Are there any penalties or special tax withholdings? A Yes The money you receive is income and will be taxed along with all other income If you take a |

|

[PDF] Strategies for Canadians with US retirement plans - Sun Life of

any IRA or 401(k) plan withdrawal will qualify for the 15 withholding tax rate Before The taxpayer must calculate the penalty tax on their tax return, file the |

|

[PDF] five steps to planning a healthy retirement - Fidelity NetBenefits

Once you are ready to turn your TVA 401(k) Plan assets into to a 10 early withdrawal penalty if you are under the and Social Security Benefit Calculators |

|

[PDF] Payout Guide - Voya Financial

Before you make your payout decisions, you'll want to consider the tax consequences of In service distributions are allowed from the 401(k) Plan after you reach You can repeat this calculation each year as you grow older Life Expectancy |

|

[PDF] Roth IRA - AARP

work based plan, like a 401(k) Penalty for early withdrawal Penalty for late withdrawal 401(k) rollover Use Morningstar's IRA comparison calculator at |

- 401k early withdrawal penalty Michigan

- When do you pay the 10% penalty on early 401k withdrawal

- John Hancock 401k loan terms and conditions of withdrawal

- Roth 401k withdrawal calculator

- John Hancock 401k withdrawal how long

- South Carolina state tax on 401k withdrawal

- John Hancock withdrawal form 401k

- Does Michigan tax 401k distributions

- 401k withdrawal penalty calculator florida

- 401k early withdrawal penalty calculator

- roth 401k withdrawal penalty calculator

- 401k hardship withdrawal penalty calculator

- 401k withdrawal tax penalty calculator

- 401k early withdrawal penalty calculator fidelity

- fidelity 401k withdrawal penalty calculator

- 401k withdrawal no penalty calculator

Taking a 401k loan or withdrawal

Source: What you should know

Retirement Withdrawal Calculator

Source:https://www.kitces.com/wp-content/uploads/2017/10/Graphics_3-1.png

2018 Rules To Calculate Required Minimum Distributions (RMDs)

Source:https://www.signnow.com/preview/0/12/12678.png

401K Withdrawal Form - Fill Out and Sign Printable PDF Template

Source:https://www.kitces.com/wp-content/uploads/2017/10/Graphics_2-2.png

2018 Rules To Calculate Required Minimum Distributions (RMDs)

Source:https://images.sampletemplates.com/wp-content/uploads/2016/03/18102153/401k-Calculator-Template-PDF.jpg

FREE 6+ Sample 401k Calculator Templates in PDF

Source:https://images.sampletemplates.com/wp-content/uploads/2016/11/19180956/401k-Retirement-Withdrawal-Calculator.jpg

401k withdrawal rules

[PDF] 0 Early Withdrawals from Retirement Accounts During the Great

- new 401k withdrawal rules 2019

- 401k involuntary cash-out rules

- 401k withdrawal rules after 70

- 401k withdrawal rules after 59

- 401k rules

- 401k withdrawal penalty calculator

- 401k distribution options

- ira vs 401k withdrawal rules

- 401k withdrawal rules 2020

- 401k withdrawal rules covid

- 401k withdrawal rules coronavirus

- 401k withdrawal rules after 65

- 401k withdrawal rules after 55

- 401k withdrawal rules fidelity

- 401k withdrawal rules at age 70.5

- 401k withdrawal rules irs

401k withdrawal rules 2019

[PDF] Hardship Withdrawals - Fidelity Investments

- form 5329

- simplified method worksheet 2019

- irs publication 575 for 2019

- massmutual 401k terms of withdrawal pdf

- massmutual 401k withdrawal rules

- form 5329 reasonable cause

- pso exclusion 2019

- massmutual 401k terms and conditions of withdrawal

- 401k hardship withdrawal rules 2019

- new 401k withdrawal rules 2019

401k withdrawal tax

[PDF] Traditional after-tax contributions - Vanguard - Retirement Plans

- 401k withdrawal penalty calculator

- early 401k withdrawal tax form

- tax refund calculator with 401k withdrawal

- does michigan tax 401k contributions

- when do you pay the 10% penalty on early 401k withdrawal

- withholding tax on 401k withdrawal

- does michigan tax 401k distributions

- 401k early withdrawal penalty michigan

- 401k withdrawal tax rate

- 401k withdrawal tax calculator

- 401k withdrawal tax form

- 401k withdrawal tax rate 2020

- 401k withdrawal tax covid

- 401k withdrawal tax withholding

- 401k withdrawal tax free

- 401k withdrawal taxable

402 information technology class 9 pdf

[PDF] CLASS IX (INFORMATION TECHNOLOGY - 402) HOLIDAYS

- Information Technology book for Class 9 PDF

- Information Technology (Code 402 Book pdf)

- Information Technology Vocational Class 9 solutions

- Information Technology Code 402 Sample Papers Class 9

- [PDF] (class ix) it - dav public school

- cantt.area

- gayadavcanttgaya.com › HighlightNewsDoc › 21d6e35f-4528-40f8-b294-...

- The student workbook on “Information Technology (IT)” is a part of the qualification package ... IT/ITes sector for NVEQF levels 1 to 4 ; level 1 is equivalent to class IX. ... JPG

- Excercise1.odt

- Expenses.ods

- Class9Lesson1.odp

- RESUME.pdf”.[PDF] NVEQ SWB IT L1 U2 Funda of Computer.pdf - Information Technologywww.gsssmunishbahali.org › syllabus › 9th › NVEQ-SWB-IT-L1-U2-...

- package in IT/ITes sector for NVEQ levels 1 to 4; level 1 is equivalent to Class. IX. Based on NOS

- occupation related core competencies (knowledge

- skills

- and.[PDF] of 5 INFORMATION TECHNOLOGY 402 SPREADSHEET ... - laps.inhttps://laps.in › H.WRK_2019_WINTER › IX_SPREADSHEET

- 9. MAX. MARKS. PRACTICAL. 10. THEORY. 10 a. Find the total of each student. b. Calculate the total percentage of each student. c. Find the grade of each ...[PDF] CLASS IX (INFORMATION TECHNOLOGY - 402) HOLIDAYS ...https://laps.in › HHWRK_CLASS_IX_X_XI2019-20 › CLASS IX_IT

- CLASS IX (INFORMATION TECHNOLOGY - 402). HOLIDAYS HOMEWORK ( 2019-2020). PRACTICAL FILE WORK. WORD PROCESSOR a. Create your class ...Related searchesInformation Technology Code 402 book solutions

- Information Technology Code 402 Sample Papers Class 10 with solutions

- Information Technology (Code 402 Class 10 book PDF Solutions)

- Information Technology Sumita Arora Class 9 code 402 Pdf

- Information Technology NSQF level 2 class 10 solutions

- Class 9 Information Technology Notes

- Kips Class 10 Book Pdf

- information technology code 402 class 10 book pdf 2020-21

- 402 information technology class 10

- 402 information technology class 9 pdf

- 402 information technology class 9

- 402 information technology class 10 book

- 402 information technology class 10 syllabus

- 402 information technology class 9 solutions

- 402 information technology class 10 practical file

- 402 information technology class 10 sample paper