Do I pay taxes on 401k withdrawal after age 60?

What Are Rules for Withdrawing From a 401k After Age 60? Owners of 401 (k) accounts can make penalty-free withdrawals any time after age 59 1/2, although they must pay income taxes on the distributions unless they roll the money into other retirement accounts within 60 days.

What is the tax rate on a 401k withdrawal?

401(k) withdrawals are taxed like ordinary income Tax rate Single filers Tax rate: 10% Single filers: Up to $9,325 Tax rate: 15% Single filers: $9,326 to $37,950 Tax rate: 25% Single filers: $37,951 to $91,900

Should I cash out my 401k?

In some instances, people may want to have more stashed away in these cash reserves – such as at least nine months or a years’ worth of expenses. Most Americans must be 59 ½ years old to withdraw freely from their 401(k) plans and traditional IRAs ...

When Can You Withdraw from A 401(k)?

Retirement plans are designed so that you can use the money when you reach retirement. For this reason, rules restrict you from taking distributions before age 59½. You can take money out before you reach that age. However, that generally means you’ll have a 10% additional tax penalty unless you meet one of the exceptions such as taking a 401(k) wi

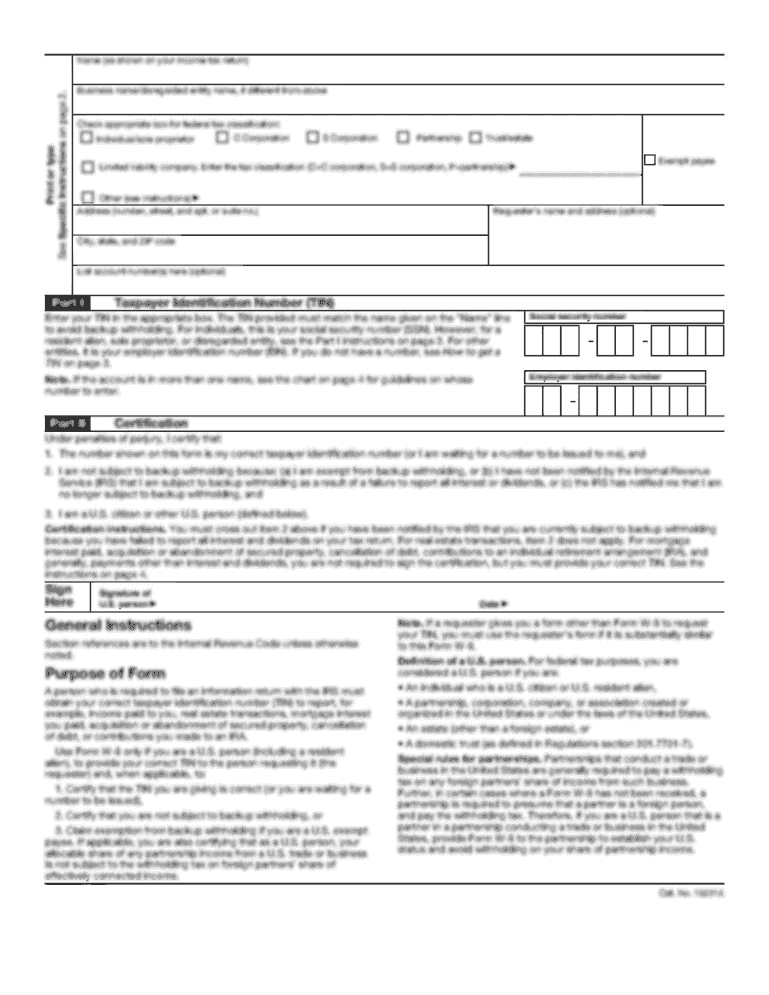

Distribution Tax Form

When you take a distribution from your 401(k), your retirement plan will send you a Form 1099-R. This tax form shows how much you withdrew overall and the 20% in federal taxes withheld from the distribution. This tax form for 401(k) distribution is sent when you’ve made a distribution of $10 or more. hrblock.com

How Does A 401(k) Withdrawal Affect Your Tax Return?

Once you start withdrawing from your 401(k) or traditional IRA, your withdrawals are taxed as ordinary income. You’ll report the taxable part of your distribution directly on your Form 1040. Keep in mind, the tax considerations for a Roth 401(k) or Roth IRA are different. To find see the difference side-by-side, check out this tablefrom the IRS. hrblock.com

Do You Pay Taxes Twice on 401(k) Withdrawals?

We see this question on occasion and understand why it may seem this way. But, no, you don’t pay taxes twice on 401(k) withdrawals. With the 20% withholding on your distribution, you’re essentially paying part of your taxes upfront. Depending on your tax situation, the amount withheld might not be enough to cover your full tax liability. In that ca

|

Guidance for Coronavirus-Related Distributions and Loans from

loan offsets is extended to the federal income tax return deadline for the year of the distribution. Section 401(k)(2)(B)(i) generally provides that amounts |

|

2021 Instructions for Form 5329

1 sept. 2021 additional tax on early distributions doesn't apply to qualified disaster ... stock bonus plan (including a 401(k) plan);. • A tax-sheltered ... |

|

UTAH RETIREMENT SYSTEMS 401(K) WITHDRAWAL

11 déc. 2015 Review both sides of this form and the enclosed Special Tax Notice Regarding Plan Payments before completing. 3. Unvested funds cannot be ... |

|

Strategies for Canadians with U.S. retirement plans

1 mars 2015 Like RRSPs IRA balances grow tax deferred |

|

401(k) Withdrawal Request

1 janv. 2022 Utah state taxes are withheld based on information provided on the Request for Income Tax Withholding for URS. Savings Plans regardless of the ... |

|

Retiring in New Jersey - Tax Guide

401(k) distributions including contributions made on or after January 1 |

|

Pub 126 How Your Retirement Benefits Are Taxed -- January 2022

11 janv. 2022 optional methods of figuring the tax on the distribution. ... plan (such as IRC sections 401(k) 403(b) |

|

The NC 401(k) Plan

* Amounts withdrawn before age 59½ may be subject to a 10% federal income tax penalty applicable taxes and plan restrictions. Withdrawals are taxed at ordinary. |

|

UTAH RETIREMENT SYSTEMS 401(K) WITHDRAWAL

7 avr. 2015 Taxes may be deferred by leaving the funds in the plan or by rolling them into another tax-deferred plan such as a traditional IRA or another ... |

|

Teamster-UPS National 401(k) Tax Deferred Savings Plan Updates

401(k) contributions and earnings can be withdrawn federal-income-tax free if the withdrawal is qualified. Roth 401(k) contributions are not available to |

|

IRA and 401(k) Overview - State of Michigan

Roth IRA: Ability to withdraw contributions (not earnings) without incurring a 10 early withdrawal penalty Tax Rates and Traditional vs Roth IRAs If tax rates |

|

Non US Citizen 401(k) Distributions - Marvell Benefits

typically look like this: Age 401(k) Type Federal Tax Withheld State Tax Withheld Early Withdrawal Penalty*** 59 ½ years old + Pretax 20 9 5 (CA) 0 |

|

Rules and Taxation of 401(k) Plan Distributions - Retirement LLC

This newsletter will examine the rules and tax consequences associated with the various types of distributions from a 401(k) plan Rollover vs Cash Distribution |

|

Common Tax Questions on CARES Act Withdrawals - Fidelity

The CARES Act allows “qualified individuals” to withdraw money from an eligible workplace retirement plans [such as a 401(k) or 403(b)] Nonqualified and |

|

401(k) - NYCgov

15 oct 2020 · The withdrawal will be deducted from your Pre-tax and/or Roth account, based on your request If your hardship is met by utilizing only one |

|

50 55 59½ 62 65 66 70 70½ Ready, Set, Retire—8 - Merrill Edge

Withdrawals from 401(k)s or an IRA are no longer subject to the 10 early withdrawal tax once you reach age 59 1/2, though you'll still owe income tax on |

|

Distribution options - Maryland Teachers & State Employees

Minimum withdrawals at age 70½: Federal Tax Law requires withdrawals In- service distribution at age 59½: The 401(k), Roth 401(k) and 403(b) plans allow |

|

Know the facts about loans and withdrawals - Merrill Lynch

Unlike loans, withdrawals do not have to be paid back, but if you withdraw from your 401(k) account before age 59½, a 10 early withdrawal additional tax may |

|

Making sense of tax withholding for your retirement plan distributions

Twice a year Vanguard Fiduciary Trust Company reminds you of your right to change the amount of federal income tax withheld, if any, from your Individual 401(k) |

|

[PDF] IRA and 401(k) Overview - State of Michigan

Roth IRA or 401(k) □ Roth IRA Ability to withdraw contributions (not earnings) without incurring a 10 early withdrawal penalty Tax Rates and Traditional vsTaxes 2016 Retirement Pension InformationTaxes 2018 Retirement Pension InformationMore results from michigangov |

|

[PDF] Strategies for Canadians with US retirement plans - Sun Life of

11 As a result, any IRA or 401(k) plan withdrawal will qualify for the 15 withholding tax rate Before making a withdrawal, the plan owner should confirm with the |

|

[PDF] Rules and Taxation of 401(k) Plan Distributions - Retirement LLC

This newsletter will examine the rules and tax consequences associated with the various types of distributions from a 401(k) plan Rollover vs Cash Distribution |

|

[PDF] Early Retirement Distributions, Social Security Benefits and Federal

Benefits and Federal Income Taxes South Carolina Legal Services Low Income Taxpayer you withdraw money from your IRA, 401(k) or any other qualified |

|

[PDF] 50 55 59½ 62 65 66 70 70½ Ready, Set, Retire—8 - Merrill Edge

Withdrawals from 401(k)s or an IRA are no longer subject to the 10 early withdrawal tax once you reach age 59 1 2, though you'll still owe income tax on |

|

[PDF] 401(k) Withdrawals: Beware the Penalty Tax - DaVinci Financial

You've probably heard that if you withdraw taxable amounts from your 401(k) or 403(b) plan before age 59½, you may be socked with a 10 early distribution |

|

[PDF] 0 Early Withdrawals from Retirement Accounts During the Great

withdrawal, but a ten percent penalty in addition to the regular income tax liability Most contributions to self directed accounts occur through 401(k) and other |

|

[PDF] Roth 401(k) - MassMutual Funds

earnings can generally be withdrawn tax free To avoid paying taxes on your Roth 401(k) withdrawals, your account must be held for at least five years and you |

|

[PDF] Traditional after-tax contributions - Vanguard - Retirement Plans

Your traditional after tax contributions will be held in your Adobe 401(k) Plan account taxes will also be due on traditional after tax earnings upon withdrawal |

- 401k withdrawal penalty calculator

- early 401k withdrawal tax form

- tax refund calculator with 401k withdrawal

- does michigan tax 401k contributions

- when do you pay the 10% penalty on early 401k withdrawal

- withholding tax on 401k withdrawal

- does michigan tax 401k distributions

- 401k early withdrawal penalty michigan

- 401k withdrawal tax rate

- 401k withdrawal tax calculator

- 401k withdrawal tax form

- 401k withdrawal tax rate 2020

- 401k withdrawal tax covid

- 401k withdrawal tax withholding

- 401k withdrawal tax free

- 401k withdrawal taxable

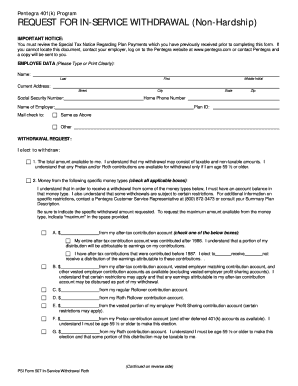

Principal Financial Group 401k Terms And Conditions Of Withdrawal

Source:https://www.pdffiller.com/preview/0/155/155108/large.png

Massmutual 401k Terms Of Withdrawal Pdf - Fill Online Printable

Source:https://www.pdffiller.com/preview/0/158/158243.png

How To Withdraw Ups 401k With Prudential And Rolling Over - Fill

Source:https://www.signnow.com/preview/388/519/388519550.png

Pentegra 401K - Fill Out and Sign Printable PDF Template

Source: signNow

Fillable Online transamerica 401k withdrawal form Fax Email Print

Source:https://www.pdffiller.com/preview/412/192/412192713/large.png

:max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png</figure>)

Sentry 401k Withdrawal Form - Fill Online Printable Fillable

Source:https://www.thebalance.com/thmb/Dx0k70zrsqrS6y8r5nza3eExcM0\u003d/1500x1000/filters:no_upscale():max_bytes(150000):strip_icc()/how-to-take-money-out-of-a-401k-plan-2388270-v6-5b575ead4cedfd0036bbfb6f.png

402 information technology class 9 pdf

[PDF] CLASS IX (INFORMATION TECHNOLOGY - 402) HOLIDAYS

- Information Technology book for Class 9 PDF

- Information Technology (Code 402 Book pdf)

- Information Technology Vocational Class 9 solutions

- Information Technology Code 402 Sample Papers Class 9

- [PDF] (class ix) it - dav public school

- cantt.area

- gayadavcanttgaya.com › HighlightNewsDoc › 21d6e35f-4528-40f8-b294-...

- The student workbook on “Information Technology (IT)” is a part of the qualification package ... IT/ITes sector for NVEQF levels 1 to 4 ; level 1 is equivalent to class IX. ... JPG

- Excercise1.odt

- Expenses.ods

- Class9Lesson1.odp

- RESUME.pdf”.[PDF] NVEQ SWB IT L1 U2 Funda of Computer.pdf - Information Technologywww.gsssmunishbahali.org › syllabus › 9th › NVEQ-SWB-IT-L1-U2-...

- package in IT/ITes sector for NVEQ levels 1 to 4; level 1 is equivalent to Class. IX. Based on NOS

- occupation related core competencies (knowledge

- skills

- and.[PDF] of 5 INFORMATION TECHNOLOGY 402 SPREADSHEET ... - laps.inhttps://laps.in › H.WRK_2019_WINTER › IX_SPREADSHEET

- 9. MAX. MARKS. PRACTICAL. 10. THEORY. 10 a. Find the total of each student. b. Calculate the total percentage of each student. c. Find the grade of each ...[PDF] CLASS IX (INFORMATION TECHNOLOGY - 402) HOLIDAYS ...https://laps.in › HHWRK_CLASS_IX_X_XI2019-20 › CLASS IX_IT

- CLASS IX (INFORMATION TECHNOLOGY - 402). HOLIDAYS HOMEWORK ( 2019-2020). PRACTICAL FILE WORK. WORD PROCESSOR a. Create your class ...Related searchesInformation Technology Code 402 book solutions

- Information Technology Code 402 Sample Papers Class 10 with solutions

- Information Technology (Code 402 Class 10 book PDF Solutions)

- Information Technology Sumita Arora Class 9 code 402 Pdf

- Information Technology NSQF level 2 class 10 solutions

- Class 9 Information Technology Notes

- Kips Class 10 Book Pdf

- information technology code 402 class 10 book pdf 2020-21

- 402 information technology class 10

- 402 information technology class 9 pdf

- 402 information technology class 9

- 402 information technology class 10 book

- 402 information technology class 10 syllabus

- 402 information technology class 9 solutions

- 402 information technology class 10 practical file

- 402 information technology class 10 sample paper

402g limit 2019

[PDF] Retirement plan catch-up contributions - Lincoln Financial Group

- 402g limit 2020 catch-up

- hce limit 2019

- hce limit 2020

- defined benefit plan contribution limits 2019

- 401(a)(17) limit 2019

- hce limit 2018

- key employee 2020

- irs notice 2019-59

- 402g limit 2019 catch up

- 402g limit 2019 irs

- 402g limit 2019 after tax

- 401k 402g limit 2019

- irs 402(g) limit 2019

- 402g contribution limits 2019

- 402(g) limit 2019

40k 3rd edition box set

[PDF] To whom it may concern, I am writing because it is my sad duty to

- 40k 3rd edition box set

- warhammer 40k 3rd edition box set

- warhammer 40k 3rd edition box

410 17 euros en lettre

[PDF] Lettre de demande d'autorisation unique pour un parc de production

- lettre administrative exemple

- le grand livre des modèles de lettres pdf

- unités

- dizaines

- centaines

- milliers

- tableau unité dizaine centaine dixième centième millième

- lettre de motivation

- tableau des unités

- demande d'emploi

- 410 17 euros en lettre