Workbook answer key

Workbook answer key

Are you going to do anything else on your vacation? Elena: I ll probably catch up on my studying. I have a lot of work to do before school starts. Scott

2017/18 Part 2 Test Correct Responses and Explanations 1. Using

2017/18 Part 2 Test Correct Responses and Explanations 1. Using

Answer: Customs Tariff. Heading 34.02 specifically covers preparations put up for retain sale. Looking further 3402.20.90.11 is the correct classification

Powers of Attorney - Questions and Answers

Powers of Attorney - Questions and Answers

SECTION 2: CONTINUING POWER OF ATTORNEY FOR PROPERTY It's up to you. Your attorney is required to provide you with a full ...

ANSWER KEY

ANSWER KEY

Answer: 4 souvenir stands. Food stands per level: 42 ÷ 3 = 14. Use the ratio of food to souvenir stands to set up the proportion 7/2 =

Interactive Techniques (Kevin Yee)

Interactive Techniques (Kevin Yee)

Do not give the “answer” until they have explored all options first. 2. Why Do You Think That? – Follow up all student responses (not just the incorrect ones)

Answers

Answers

goes up ×2 the drag must go up ×4. 8 density. 9 melting. 10 solid. 11 expand 2 a sketch showing light going from the TV directly to eyes b sketch showing ...

Answers

Answers

3 a It has been going up since the 1980s. b More and more women aged 40–44 2 up and down. 3 a Some of it is transferred to the water and it spreads out ...

Chapter 2 Review pages 100–105

Chapter 2 Review pages 100–105

Answers may vary. Sample answer: I could try pulling forward and up on the rope attached to the crate. This reduces the normal force and reduces the upper

Savi 8240/8245 Office User Guide

Savi 8240/8245 Office User Guide

and up to 6.5 hours in narrowband mode. To determine your headset While on a call press the headset Call button for 2 seconds to answer the second call.

SAT Suite of

SAT Suite of

Choice C is incorrect because the setting is described in the beginning of the first paragraph but is never the main focus of the passage. QUESTION 2. Choice C

Fatty legs chapter questions key

Fatty legs chapter questions key

Kerry Aiken Fatty Legs Novel Study ANSWER KEY. Review and consider student answers. Page 2. 11. When did this book take place?

Path to Nazi Genocide Worksheet: ANSWER KEY

Path to Nazi Genocide Worksheet: ANSWER KEY

1) had to take sole blame for starting the war. 2) territory shrunk. 3) large reparations. 4) Hitler took advantage of the German people's anger and fear.

Headings and Subheadings Manual

Headings and Subheadings Manual

1. The formatting requirements for headings and chapters/ sections. 2. It provides step-by-step instructions on how to set up heading styles (major headings.

UNIT HEADING

UNIT HEADING

Section 2 contains 30 items that had been developed for the PISA 2012 survey The Gotemba walking trail up Mount Fuji is about 9 kilometres (km) long.

Untitled

Untitled

In 1973 martin cooper was heading up a team of engineers at motorola that was working to build the worlds first cell phone. Once it was ready to be tested

2017/18 Part 2 Test Correct Responses and Explanations 1. Using

2017/18 Part 2 Test Correct Responses and Explanations 1. Using

As per the legislation highway conveyance and cargo data can be transmitted to CBSA up to ______ days before arrival. a) 5 b) 30 c) 45 d) 60 e) 90. Answer:

“Understanding Car Crashes—Its Basics Physics” Teachers guide

“Understanding Car Crashes—Its Basics Physics” Teachers guide

2:50. 3:20. 4:00. 4:35. Teacher. Organizer. Answers. Running Time: Which would be more damaging to your car: having a head-on collision with an.

Influenza: Questions and Answers

Influenza: Questions and Answers

Questions and Answers 2. Wash your hands often with soap and water especially ... up study

Untitled

Untitled

Finals Study Guide - Day 2 of 4: The Law of Conservation of Momentum Questions ball sliding to the right at 8.0 m/s has an elastic head-on collision.

How Muscle Reading Works

How Muscle Reading Works

Your head is resting on your elbow which is resting on the equity method of fingers digging into the text to root up the answers to ... Step 2: Outline.

2017/18 Part 2 Test

Correct Responses and Explanations

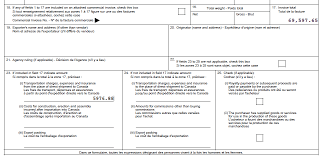

1. Using an exchange rate of 1.36 and the information shown below from the bottom portion of a

Canada Customs Invoice, what is the value for currency conversion? Both the invoice total and field 23

are in USD. a) 86524.25 b) 69597.65 c)63620.77

d) 94652.80 e) 75574.53 Answer: https://cscb.ca/repository/topic-1-canada-customs-invoice-fields-21-25-0Amounts found in 23 (i) can be deducted from the amount in field 17. In this question, we asked for the

value of currency conversion, that is, the value before any applicable exchange rate is applied. $69,597.65 - $5,976.88 = $63,620.772. A bill of lading may be used to support a claim against the carrier for loss or damage to goods.

a) True b) False Answer: https://cscb.ca/repository/topic-1-bill-lading-33. The ____________________ is

ultimately responsible for transmitting conveyance and cargo data for goods that are not accompanied by their owner, are not being imported by a courier, or are not imported through the mail. a) carrier b) exporter c) vendor d) importer e) foreign custom's office Answer: https://cscb.ca/repository/topic-1-advance-commercial-information-14. Which of the following is

not considered bulk cargo? a) oil b) light bulbs c) grain d) coal e) oreAnswer:

reporting-0Bulk cargo is

cargo that is loose or in mass. Fragile items like light bulbs cannot be shipped loose or in mass, and must be packaged in a manner that ensures they remain intact.5. Marine conveyances with containerized cargo that are loaded in China must transmit their

conveyance data to CBSA a minimum of _________ before arrival. a) 4 hours b) 24 hours c)48 hours

d) 60 hours e) 96 hours Answer: https://cscb.ca/repository/topic-2-advance-commercial-information-pre-arrival-time-frames- marine-conveyance-data-06. The bay plan is

a document used to indicate the location of marine vessels at the port of arrival. a) True b) False Answer: https://cscb.ca/repository/topic-2-advance-commercial-information-bay-plan-07. Cargo and conveyance data for a flight that is destined to leave Paris, France at 9:00 am (Paris time)

and arrive in Toronto, Canada at 3:00 pm (Toronto time) must be transmitted by _________. a) 12:00 pm Toronto time b) 1:00 pm Paris time c)2:00 pm Paris time

d) 10:00 am Toronto time e) 11:00 am Toronto time Answer: https://cscb.ca/repository/topic-3-advance-commercial-information-air-08. As per the legislation, highway conveyance and cargo data can be transmitted to CBSA up to _______

days before arrival. a) 5 b) 30 c) 45d) 60 e) 90 Answer: https://cscb.ca/repository/topic-4-advance-commercial-information-highway-0

9. Shipments that qualify for CSA clearance are exempt from the requirement to provide ACI.

a) True b) False Answer: https://cscb.ca/repository/topic-4-advance-commercial-information-highway-010. As per the legislation, a marine conveyance arrival certification message (CACM) may be transmitted

inside a _______ window prior to arrival at a Canadian port on the condition that the vessel is _________________. a) 30 minute/outside Canadian waters b) one hour/outside Canadian waters c) one hour/within Canadian waters d) two hour/outside Canadian waters e) two hour/within Canadian waters Answer: https://cscb.ca/repository/topic-1-conveyance-arrival-certification-messages-marine-011. What is the tariff classification for live elephants in a travelling menagerie?

a) 0106.19.00.90 b) 0106.90.00.90 c)9508.10.00.11

d) 9508.10.00.12 e) 9508.90.00.11Chapter 1

covers live animals and Chapter 95 cover toys, games and sports requisites, parts and accessories thereof.Remember - according to GIR 1, chapter titles are for reference only. In order to classify goods you must

look at the heading, subheadings, and notes.Note 1(c) of Chapter 1 states:

1. This Chapter covers all live animals except:

(c) Animals of heading 95.08.Now you must look at what heading 95.08 says,

since if the animals are classified in heading 95.08, they are excluded from Chapter 1.9508.10.00.00 - Travelling circuses and travelling menageries

----- Travelling menageries; Parts and accessories thereof:11 ------ Travelling menageries

12 ------ Parts and accessories for travelling menageries

20 ------ Travelling circuses

A menagerie is a collection of wild animals kept in captivity for exhibition, which means the correct

response is 9508.10.00.00.11.12. What is the tariff classification for broken rice?

a) 1904.90.69.10 b) 1006.40.00.00 c)1006.20.00.40

d) 1006.30.00.94 e) 1008.90.00.90For this question, we need to look at Chapters 10 and 19. The titles of these chapters are reproduced

below:Chapter 10 - Cereals

Chapter 19

- Preparations of cereals, flour, starch or milk; pastrycook's productsSince we can't make a decision based on the chapter title, we need to read the notes. Let's start with

Chapter 10.

1. (B) This Chapter does not cover grains which have been hulled or otherwise worked. However, r

ice, husked, milled, polished, glazed, parboiled or broken remains classified in heading 10.06.The note

specifically states that broken rice is included in Chapter 10. Looking at the headings and subheadings of Chapter 10, we see the following:10.06 Rice.

1006.10.00.00 - Rice in the husk (paddy or rough)

1006.20.00 - Husked (brown) rice

1006.30.00 - Semi-milled or wholly milled rice, whether or not polished or glazed

1006.40.00 00 - Broken Rice

The answer to the question is 1006.40.00.00, broken rice is specifically named as a tariff classification.

Keep in mind that even if it appears you found the correct response, Chapter 19 should still be reviewed.

13. What is the tariff classification for wheat germ that is over access?

a) 1104.30.12.00 b) 1108.11.20.00 c)1109.00.20.00

d) 1001.19.20.00 e) 1001.99.20.00 For this question, Chapter 10 and Chapter 11 need to be considered.The titles of these chapters are

reproduced below.Chapter 10 - Cereals

Chapter 11 - Products of the milling industry; malt; starches; inulin; wheat germSince we can't make a decision based on the chapter title, we need to read the notes. Let's start with

Chapter 10.

Start by reading the notes of Chapter 10. Is there anything about wheat germ in the notes? There is not.

Does heading 10.01 specifically name wheat germ? No.Now read the notes to Chapter 11.

Note 2 (A) states:

2. (A) Products from the milling of cereals listed in the table below fall in this Chapter if they have, by

weight on the dry Product: (a) a start content (determined by the modified Ewers polarimetric method) exceeding that indicated inColumn (2); and

(b) an ash content (after deduction of any added minerals) not exceeding that indicated in Column (3).

Otherwise, they fall in heading 23.02. However, germ of cereals, whole, rolled, flaked or ground, is always classified in heading 11.04.Turning to heading 11.04, we see:

11.04 Cereals grains otherwise worked (for example, hulled, rolled, flaked, pearled, sliced or kibbled),

except of rice of heading 10.06; germ of cereals, whole, rolled, flaked or ground.1104.30 - Germs of cereals, whole, rolled, flaked or ground

---Of wheat:1104.30.11 00 ---- Within access commitment

1104.30.12 00

---- Over access commitment The answer to the question is 1004.30.12.00, where over access wheat germ is specifically named.14. What is the tariff classification for linseed oil for further processing?

a) 1204.00.00.00 b) 1515.11.00.00 c)1515.19.10.00

d) 2306.20.00.00 e) 1515.19.90.00For this

question, we need to look at Chapters 12, 15, and 23. These chapter headings are reproduced below:Chapter 12

- Oil seeds and oleaginous fruits; miscellaneous grains, seeds and fruit; industrial or medicinal plants; straw and fodderChapter 15

- Animal or vegetable fats and oils and their cleavage products; prepared edible fats; animal or vegetable waxes Chapter 23 - Residues and waste from the food industries; prepared animal fodder Which chapter best describes the goods? Both Chapters 12 and 15 look like they could apply.Start by rea

ding the notes of Chapter 12. Is there anything about linseed oil? There is not.1204.00.00 00

Linseed, whether or not broken.

1204.00.00.00 is for linseed, not linseed oil.

Read the notes of Chapter 15.

Is there anything

about linseed oil? There is not. Now let's turn to the heading of Chapter 15.15.15 Other fixed vegetable fats and oils (including jojoba oil) and their fractions, whether or not

refined, but not chemically modified. - Linseed oil and its fractions:1515.11.00 00 -- Crude oil

1515.19 -- Other

1515.19.10 00 --- For processing

1515.19.90 00

--- OtherThe answer to the question is 1515.19.10.00,

where linseed oil for further processing is specifically named.15. What is the tariff classification for ravioli stuffed with 30% of meat, by weight, and in an airtight

container? a) 1605.69.00.00 b) 1902.30.31.10 c)1902.30.50.10

d) 1601.00.19.00 e) 1902.20.00.10 For this question, we need to look at Chapters 16 and 19. These chapter titles are shown below:Chapter 16 of the

Customs Tariff

covers: Preparations of meat, of fish or of crustaceans, molluscs or other aquatic invertebrates.Chapter 19 of the

Customs Tariff

covers: Preparations of cereals, flour, starch or milk; patrycook's products.In comparing the chapters, which one best describes the goods? Ravioli is best described in Chapter 19.

Read the notes of Chapter 19. Is there anything there about ravioli?1. Except in the case of stuffed products of heading 19.02, food preparations containing more than 20%

by weight of sausage, meat offal, blood, fish or crustaceans, molluscs or other aquatic invertebrates, or

any combination thereof (Chapter 16).The ravioli is stuffed and contains 30% of meat; therefore note 1 applies and the ravioli can remain in

Chapter 19.

19.02 Pasta, whether or not cooked or stuffed (with meat or other substances) or otherwise prepared,

such as spaghetti, macaroni, noodles, lasagna, gnocchi, ravioli, cannelloni; couscous, whether or not

prepared.1902.20.00 - Stuffed pasta, whether or not cooked or otherwise prepared

10 ----- In airtight containers

90 ----- Other

The answer to the question is 1902.20.00.10. Ravioli stuffed with 30% of meat, by weight, and in an airtight container is named16. What is the tariff classification for distilled water?

a) 3303.00.00.20 b) 2201.10.00.10 c)2501.00.90.00

d) 2845.10.00.00 e) 2853.90.00.00 For this question, we need to look at Chapters 22, 25, 28 and 33. The titles of these chapters are reproduced below.Chapter 22

- Beverages, spirits and vinegarChapter 25

- Salt; sulphur; earths and stone; plastering materials, lime and cementChapter 28

- Inorganic chemicals; organic or inorganic compounds of precious metals, of rare-earth metals, of radioactive elements or of isotopesChapter 33

- Essential oils and resinoids; perfumery, cosmetic or toilet preparationsWhich of the chapters best describes distilled water? At first glance, you might assume it is Chapter 22.

Read the notes

to Chapter 22.1. This Chapter does not cover:

(c) Distilled or conductivity water or water of similar purity (heading28.53).

We now know that we

should look at heading 28.53.Read the notes of Chapter 28.

Are there any notes

about distilled water? There are not.Heading 28.53 and following says:

28.53 Phosphides, whether or not chemically defined, excluding ferrophosphorus; other inorganic

compounds (including distilled or conductivity water and water of similar purity); liquid air (whether or

not rare gases have been removed); compressed air; amalgams, other than amalgams of precious metals.2853.10.00 00 - Cyanogen chloride (chlorcyan)

2853.90.00 00

- OtherThe answer to this question is 2853.90.00.00, since distilled water is named in heading 28.53. Since it

does not fall under 2853.10, it must be classified under the "Other" break out.17. Notes 4 and 5 of Chapter 39 apply, mutatis mutandis, to all of the tariff items of Chapter 39, other

than those where the seventh and eighth digits are "00". a) True b) FalseAnswer: See the supplementary notes

to Chapter 39 of the Customs Tariff. When reading notes, you must make sure that you read all the notes. Notes 4 and 5 are mentioned twice, in the supplementary notes and the statistical notes.Supplementary Notes.

1. Notes 4 and 5 of this Chapter apply, mutatis mutundis, to all of the tariff items of this Chapter, other

than those where the seventh and eight digits are "00". and Statistical Notes. (NB Those notes do not form part of theCustoms Tariff legislation.)

1. Notes 4 and 5 of the Chapter apply, mutatis mutundis, to the classification numbers within any one

tariff i tem of this Chapter.18. Throughout the Nomenclature, the expression "composition leather" means only substances of the

kind referred to in heading ________. a) 41.15 b) 42.02 c) 42.03d) 64.03 e) 42.05 Answer: See notes of Chapter 41 of the Customs Tariff.

19. Chapter 98 of the Customs Tariff is reserved for non-commercial goods.

a) True b) False The title of Chapter 98 provides the answer to this question:Chapter 98 - Special classification

provisions - non commercial.20. The tariff treatment code for goods that originate under the Canada-Peru Free Trade Agreement

(CPFTA) is _______. a) 5 b) 7 c) 13 d) 25 e) 30 Answer: https://cscb.ca/repository/topic-2-codes-tariff-treatments-321. Goods

that are destined for Canada are shipped from Germany on a through bill of lading and travel through the United Kingdom before arriving in Canada. The goods were in the United Kingdom for a period of 4 months and remained in customs transit control during that time. The goods were not used nor were they further processed. Under these circumstances, the goods have met the requirements for direct shipment. a) True b) False Answer: https://cscb.ca/repository/topic-2-direct-shipment-and-transhipment-2 These goods meet the requirements for direct shipment. They are shipped on a through bill of lading, never leave customs transit control, remained in the UK for less than 6 months and were not used nor further processed.22. The de minimis amount is the same for all tariff treatments and applies to all goods.

a) True b) False Answer: https://cscb.ca/repository/topic-6-de-minimis-rule-223. The duty rate under the General Tariff is _______.

a) decided as per the Customs Tariff b) free c) 7% d) 35% e) 45% Answer: https://cscb.ca/repository/topic-2-general-tariff-024. CIFTA specific rules of origin include a regional value content requirement.

a) True b) False Answer: https://cscb.ca/repository/topic-6-canada-israel-free-trade-agreement-tariff25. Once an advance ruling has been issued by CBSA for country of origin, a

C ertificate ofOrigin is not

required. a) True b) False Answer: https://cscb.ca/repository/topic-1-advance-rulings-326. The NAFTA tariff treatment code for goods that originate in the United States is ______.

a) 3 b) 10 c) 11 d) 12 e) 21 Answer: https://cscb.ca/repository/topic-2-nafta-tariff-treatments-227. Criterion ____ requires that the goods be produced entirely in the territory of one or more of the

NAFTA countries exclusively from originating materials. a) A b) B c) C d) D e) E Answer: https://cscb.ca/repository/topic-4-criterion-c-228. VFD code 25 indicates that ________________ and that the _____________________ was used.

a) the vendor and importer are related/transaction value for identical goods b) the vendor and importer are related/the deductive value c) the vendor and importer are not related/residual method d) the vendor and importer are not related/transaction value of similar goods e) the vendor and importer are related/computed value Answer: https://cscb.ca/repository/topic-1-value-duty-codes29. As per the legislation, a change to a highway conveyance report must be made if the ETA is

________ earlier or if the ETA is ________ later than what was stated on the original conveyance report.

a) 30 minutes or more/8 hours or more b) less than 30 minutes / 8 hours or less c)45 minutes or more /5 hours or more

d) less than 45 minutes /5 hours or more e) 60 minutes or more/8 hours or more Answer: https://cscb.ca/repository/topic-4-advance-commercial-information-highway-030. Calculate the GST owing on the following goods:

Description: Antique wooden bed frame

Over 100 years old

Value: $11,750.00 USD

Exchange rate: 1.1962

Country of origin: United States (no proof of origin provided) a) 643.31 b) 587.50 c)769.53

d) 1116.25 e) 702.77Answer: The classification number for antique furniture over 100 years old is 9706.00.00.10 and is duty

free. $11,750.00 USD X 1.1962 (exchange rate) = $14,055.35 CAD $14,055.35 X 5% (GST) = $702.7731. Wool" means the natural fibre grown by sheep, lambs, alpacas and llamas.

a) True b) False *** Please note the following: The correct response to this question is b. However, if you answered b, your response was shown as being incorrect. And, although the mark reflected on your test and shown in your account may not be correct, your mark has been adjusted internally and the correct mark will be used when calculating your final mark at th e end of the year.Please send an email to ayoung@cscb.ca

if you would like to verify your correct mark. ***Refer to the notes

in Chapter 51 Note.1. Throughout the Nomenclature:

(a) "Wool" means the natural fibre grown by sheep and lambs;(b) "Fine animal hair" means the hair of alpaca, llama, vicuna, camel (including dromedary), yak, Angora,

Tibetan, Kashmir or similar goats (but not common goats), rabbit (including Angora rabbit), hare, beaver,

nutria or musk-rat; (c) "Coarse animal hair" means the hair of animals not mentioned above, excluding brush-making hair and bristles (heading 05.02) and horsehair (heading 05.11). In the definition of wool, alpacas and llamas are not mentioned.32. Calculate the GST payable on the following goods:

Value: $78,294.63 USD

Exchange rate: 1.1975

Excise tax: 10%

Duty: 4.5%

a) 4919.94 b) 5388.73 c)4482.37

d) 9797.69 e) 5367.64Answer:

$78,294.63 USD X 1.1975 (exchange rate) = $93,757.82 CAD $93,757.82 X 4.5% = $4,219.10 Duty $93,757.82 + $4,219.10 = $97,976.92 $97,976.92 X 10% = $9,797.69 Excise tax $97,976.92 + $9,797.69 = $107,774.61 $107,774.61 X 5% (GST) = $5,388.7333. Calculate the GST payable on the following goods:

Value: $66,795.64 USD

Exchange rate: 1.1973

Classification: 9616.20.00.00

Country of origin: Afghanistan, with proof of origin a) 4478.57 b) 3998.72 c)4318.62

d) 4178.66 e) 3339.78Answer:

$66,795.64 USD X 1.1973 (exchange rate) = $79,974.42 CAD $79,974.42 X 5% (GST) = $3,998.7234. Items of official uniform dress or accoutrement, for use by personnel of militia regiments and

purchased with personal funds, can benefit from tariff code 9939 upon importation. a) True b) FalseAnswer: See tariff code 9939 in the

Customs Tariff.

35. Excise duty is imposed under the Excise Act, 2001 on ________________ products made in Canada.

a) spirits and wine only b) spirits, wine, beer and tobacco c) spirits, wine and beer d) wine, beer and tobacco e) spirits, wine and tobacco Answer: https://cscb.ca/repository/topic-1-about-excise-duty-236. Under the Least Developed Country Tariff treatment, a Certificate of Origin is always required,

regardless of tariff classification. a) True b) False Answer: https://cscb.ca/repository/topic-5-least-developed-country-tariff-treatment-037. Either a Certificate of Origin or an Origin Declaration can be used as proof of origin under the

Canada

-European Comprehensive Economic and Trade Agreement. a) True b) False Answer: https://cscb.ca/repository/topic-18-canada%E2%80%93european-union-comprehensive-quotesdbs_dbs1.pdfusesText_1[PDF] heart of darkness joseph conrad résumé

[PDF] heart of iron 4 forum

[PDF] heart of iron 4 guide

[PDF] heart of iron 4 jouer la france

[PDF] heart of iron 4 united kingdom

[PDF] hearts of iron 4 communist america

[PDF] hearts of iron 4 france guide

[PDF] hearts of iron 4 france strategy

[PDF] heaume

[PDF] hebergement site web gratuit avec nom domaine

[PDF] heberger son site chez soi

[PDF] hec administration

[PDF] hec anciens élèves célèbres

[PDF] hec automne 2017