Tax Information Form 1099G

Tax Information Form 1099G

What is a 1099G form? Form 1099G is a record of the total taxable income the. California Employment Development Department (EDD) issued you in a

Instructions for Form 1099-G (Rev. January 2022)

Instructions for Form 1099-G (Rev. January 2022)

You must also file Form 1099-G for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules

Form 1099-G (Rev. January 2022)

Form 1099-G (Rev. January 2022)

See IRS Publications 1141 1167

What to know about your 1099-G

What to know about your 1099-G

What does the information on the form mean? The 1099-Gs issued by Paid Leave show our agency contact and tax identification information (Employment Security

How to View Your IRS 1099-G Information

How to View Your IRS 1099-G Information

This form shows the total amount of benefits paid in the previous calendar year. 2. Unemployment benefits are taxable under federal law. Tutorial Overview. This

2021 Instructions for Form 1099-G

2021 Instructions for Form 1099-G

You must also file Form 1099-G for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules

How to obtain a duplicate 1099-G (IRS Tax Form)

How to obtain a duplicate 1099-G (IRS Tax Form)

Duplicate 1099-G for the most recent tax year: Your original 1099-G form is mailed directly to your address of record. You may obtain a duplicate.

Unemployment Fraud: - What to do if you receive a Form 1099G

Unemployment Fraud: - What to do if you receive a Form 1099G

The Form 1099G is provided to people who collected unemployment compensation from the EDD so they can report it as income on their federal tax return.

2020 Instructions for Form 1099-G

2020 Instructions for Form 1099-G

29 août 2019 File Form 1099-G Certain Government Payments

English 1099-G Infographic

English 1099-G Infographic

benefits in 2021 will receive the. 1099-G tax form. This includes claimants who received regular UI benefits and claimants who received benefits under new.

Tax Information

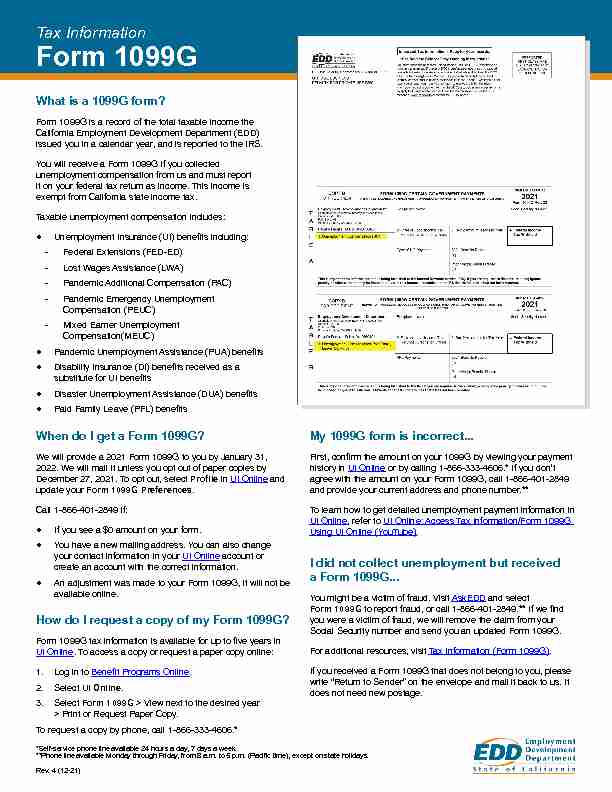

Form 1099GWhat is a 1099G form?

Form 1099G is a record of the total taxable income the California Employment Development Department (EDD) issued you in a calendar year, and is reported to the IRS.You will receive a Form 1099G if you collected

unemployment compensation from us and must report it on your federal tax return as income. This income is exempt from California state income tax.Taxable unemployment compensation includes:

-Federal Extensions (FED-ED)Compensation (PEUC)

-Mixed Earner UnemploymentCompensation(MEUC) "'LVDVWHU8QHPSOR\PHQW $VVLVWDQFH'8$EHQH¿WV "3DLG)DPLO\/HDYH3)/EHQH¿WVWhen do I get a Form 1099G? We will provide a 2021 Form 1099G to you by January 31,2022. We will mail it unless you opt out of paper copies by

December 27, 2021. To opt out, select

inUI Online and

update your Form 1099G Preferences.Call 1-866-401-2849 if:

create an account with the correct information.How do I request a copy of my Form 1099G?

UI Online

. To access a copy or request a paper copy online:1.%HQH¿W3URJUDPV2QOLQH.2.Select .

3.Select Form 1099G > View next to the desired year> Print or Request Paper Copy.

To request a copy by phone, call 1-866-333-4606.*My 1099G form is incorrect... history inUI Online

and provide your current address and phone number.**UI Online

, refer to8VLQJ8,2QOLQH a Form 1099G... $VN('' and select Form 1099G

you were a victim of fraud, we will remove the claim from your Social Security number and send you an updated Form 1099G. For additional resources, visit Tax Information (Form 1099G). Rev. 4 (12-21)

quotesdbs_dbs31.pdfusesText_37

Form 1099G

you were a victim of fraud, we will remove the claim from your Social Security number and send you an updated Form 1099G. For additional resources, visit Tax Information (Form 1099G).Rev. 4 (12-21)

quotesdbs_dbs31.pdfusesText_37[PDF] 1099 g ohio

[PDF] 1099 g turbotax

[PDF] 1099 g unemployment

[PDF] 1099 instructions 2019

[PDF] 1099 int 2018

[PDF] 1099 int form 2019 pdf

[PDF] 1099 int form definition

[PDF] 1099 int instructions 2019

[PDF] 1099 k form definition

[PDF] 1099 misc 2019

[PDF] 1099 misc box 14

[PDF] 1099 misc box 3 h&r block

[PDF] 1099 misc box 3 income

[PDF] 1099 misc box 3 or box 7