Tax Information Form 1099G

Tax Information Form 1099G

What is a 1099G form? Form 1099G is a record of the total taxable income the. California Employment Development Department (EDD) issued you in a

Instructions for Form 1099-G (Rev. January 2022)

Instructions for Form 1099-G (Rev. January 2022)

You must also file Form 1099-G for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules

Form 1099-G (Rev. January 2022)

Form 1099-G (Rev. January 2022)

See IRS Publications 1141 1167

What to know about your 1099-G

What to know about your 1099-G

What does the information on the form mean? The 1099-Gs issued by Paid Leave show our agency contact and tax identification information (Employment Security

How to View Your IRS 1099-G Information

How to View Your IRS 1099-G Information

This form shows the total amount of benefits paid in the previous calendar year. 2. Unemployment benefits are taxable under federal law. Tutorial Overview. This

2021 Instructions for Form 1099-G

2021 Instructions for Form 1099-G

You must also file Form 1099-G for each person from whom you have withheld any federal income tax (report in box 4) under the backup withholding rules

How to obtain a duplicate 1099-G (IRS Tax Form)

How to obtain a duplicate 1099-G (IRS Tax Form)

Duplicate 1099-G for the most recent tax year: Your original 1099-G form is mailed directly to your address of record. You may obtain a duplicate.

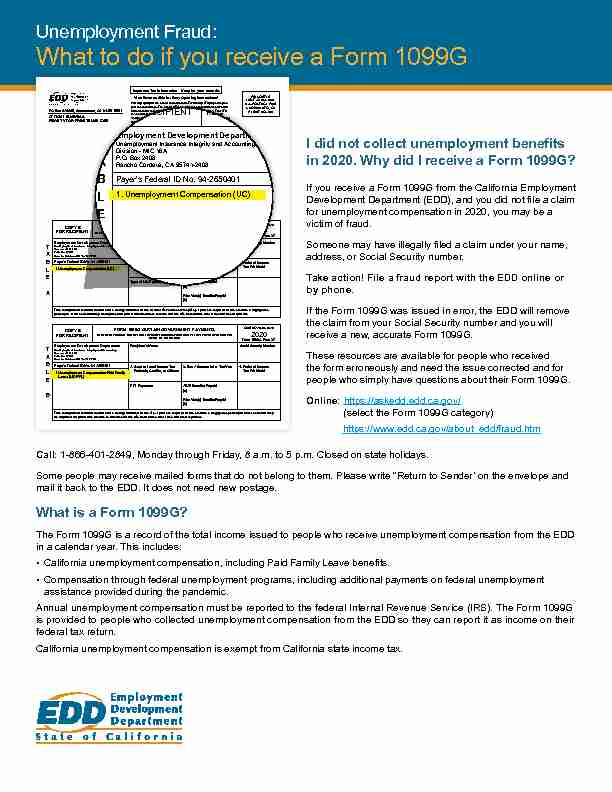

Unemployment Fraud: - What to do if you receive a Form 1099G

Unemployment Fraud: - What to do if you receive a Form 1099G

The Form 1099G is provided to people who collected unemployment compensation from the EDD so they can report it as income on their federal tax return.

2020 Instructions for Form 1099-G

2020 Instructions for Form 1099-G

29 août 2019 File Form 1099-G Certain Government Payments

English 1099-G Infographic

English 1099-G Infographic

benefits in 2021 will receive the. 1099-G tax form. This includes claimants who received regular UI benefits and claimants who received benefits under new.

in 2020. Why did I receive a Form 1099G? If you receive a Form 1099G from the California Employment for unemployment compensation in 2020, you may be a victim of fraud. address, or Social Security number. Take action! File a fraud report with the EDD online or by phone. If the Form 1099G was issued in error, the EDD will remove the claim from your Social Security number and you will receive a new, accurate Form 1099G. These resources are available for people who received the form erroneously and need the issue corrected and for people who simply have questions about their Form 1099G.

in 2020. Why did I receive a Form 1099G? If you receive a Form 1099G from the California Employment for unemployment compensation in 2020, you may be a victim of fraud. address, or Social Security number. Take action! File a fraud report with the EDD online or by phone. If the Form 1099G was issued in error, the EDD will remove the claim from your Social Security number and you will receive a new, accurate Form 1099G. These resources are available for people who received the form erroneously and need the issue corrected and for people who simply have questions about their Form 1099G. Online: https://askedd.edd.ca.gov/

(select the Form 1099G category) Call:1-866-401-2849, Monday through Friday, 8 a.m. to 5 p.m. Closed on state holidays.

Some people may receive mailed forms that do not belong to them. Please write "Return to Sender' on the envelope and mail it back to the EDD. It does not need new postage. The Form 1099G is a record of the total income issued to people who rece ive unemployment compensation from the EDD in a calendar year. This includes: Compensation through federal unemployment programs, including additional payments on federal unemployment assistance provided during the pandemic. Annual unemployment compensation must be reported to the federal Interna l Revenue Service (IRS). The Form 1099G is provided to people who collected unemployment compensation from the EDD so they can report it as income on their

federal tax return. California unemployment compensation is exempt from California state inc ome tax.What to do if you receive a Form 1099G

Unemployment Fraud: What is a 1099G form?

Form 1099G is a record of the total taxable income the California Employment Development Department (EDD) issued you in a calendar year, and is reported to the IRS.You will receive a Form 1099G if you collected

unemployment compensation (UC) from the EDD and must report it on your federal tax return as income. UC is exempt from California state income tax.Taxable UC includes:

-Federal Extensions (FED-ED) -Pandemic Additional Compensation (PAC)Compensation (PEUC)

Tax Information

Form 1099G

1. Unemployment Compensation (UC)

1. Unemployment Compensation-Paid Family

Leave (UC-PFL)

When do I get a Form 1099G?

February. If you see a $0 amount on your 2020 form in UI Online, your form is not yet processed. Check back later for updates. form in the mail. Form 1099G tax information is available for up toUI Online.

If an adjustment was made to your Form 1099G, it will not be available online. To speak to a representative, call 1-866-401-2849.*How do I request a copy of my

Form 1099G?

To access a copy or request a paper copy online:

1..2.Select UI Online.

3.Select Form 1099G > View next to the desired year

>Print or Request Paper Copy. To request a copy by phone, call 1-866-333-4606.**My 1099G form is incorrect...

call 1-866-401-2849 and provide your current address and phone number.* information in UI Online, refer to UI Online: Access TaxInformation/Form 1099G Using UI Online (YouTube).

I did not collect UC but received a

Form 1099G...

Fraud and Penalties:

What You Need to Know to learn how to report fraud, or call1-866-401-2849.*

For additional resources, visit .

state holidays. **Self-service phone line available 24 hours a day, 7 days a week.Rev. 1 (1-21)

What is a 1099G form?

Form 1099G is a record of the total taxable income the California Employment Development Department (EDD) issued you in a calendar year, and is reported to the IRS.You will receive a Form 1099G if you collected

unemployment compensation (UC) from the EDD and must report it on your federal tax return as income. UC is exempt from California state income tax.Taxable UC includes:

-Federal Extensions (FED-ED) -Pandemic Additional Compensation (PAC)Compensation (PEUC)

Tax Information

Form 1099G

1. Unemployment Compensation (UC)

1. Unemployment Compensation-Paid Family

Leave (UC-PFL)

When do I get a Form 1099G?

February. If you see a $0 amount on your 2020 form in UI Online, your form is not yet processed. Check back later for updates. form in the mail. Form 1099G tax information is available for up toUI Online.

If an adjustment was made to your Form 1099G, it will not be available online. To speak to a representative, call 1-866-401-2849.*How do I request a copy of my

Form 1099G?

To access a copy or request a paper copy online:

1..2.Select UI Online.

3.Select Form 1099G > View next to the desired year

>Print or Request Paper Copy. To request a copy by phone, call 1-866-333-4606.**My 1099G form is incorrect...

call 1-866-401-2849 and provide your current address and phone number.* information in UI Online, refer to UI Online: Access TaxInformation/Form 1099G Using UI Online (YouTube).

I did not collect UC but received a

Form 1099G...

Fraud and Penalties:

What You Need to Know to learn how to report fraud, or call1-866-401-2849.*

For additional resources, visit .

state holidays. **Self-service phone line available 24 hours a day, 7 days a week.Rev. 1 (1-21)

1099G from the EDD.

purposes. The Form 1099G is sent electronically or by postal mail to people who di d not opt-in for an electronic copy only.The Form 1099G is also posted to recipients' California EDD Unemployment Insurance (UI) online accounts.

To view or create an account, visit https://edd.ca.gov/Unemployment/UI_Online.htm This year the EDD has through February to issue the Form 1099G, which is one month longer than typical years.The IRS

Visit EDD"

s Tax Information webpage for more information https://www.edd.ca.gov/unemployment/Get_Tax_Information_

(Form_1099G).htmRead a one-page guide for what you need to know about the Form 1099G https://edd.ca.gov/unemployment/pdf/1099G-

info-sheet.pdfView a helpful EDD how-to video on our

YouTube channel

If you have a new mailing address, please change your contact informatio n in your UI online account or create an account with the correct information. https://edd.ca.gov/unemployment/UI_Online.htm1-866-401-2849, Monday through Friday, 8 a.m. to 5 p.m. (Closed on state holidays.)

For more information, visit

What to do if you haven't received a Form 1099G

Posted February 2021

quotesdbs_dbs31.pdfusesText_37[PDF] 1099 g ohio

[PDF] 1099 g turbotax

[PDF] 1099 g unemployment

[PDF] 1099 instructions 2019

[PDF] 1099 int 2018

[PDF] 1099 int form 2019 pdf

[PDF] 1099 int form definition

[PDF] 1099 int instructions 2019

[PDF] 1099 k form definition

[PDF] 1099 misc 2019

[PDF] 1099 misc box 14

[PDF] 1099 misc box 3 h&r block

[PDF] 1099 misc box 3 income

[PDF] 1099 misc box 3 or box 7