How Apple Is Organized for Innovation

How Apple Is Organized for Innovation

(See the exhibit “Apple's Functional Organization.”) The adoption of a functional structure may have been un surprising for a company of Apple's size at the

ics organizational structure and elements.pdf

ics organizational structure and elements.pdf

Section: The organizational level having responsibility for a major functional area of incident management (e.g. Operations

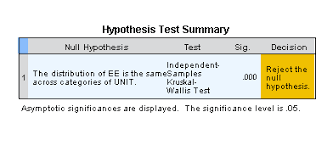

Functional Organizational Structure And Employee Engagement In

Functional Organizational Structure And Employee Engagement In

The functional structure is an organizational design that groups position into unit based on similar skill expertise and resources Department in organization

Functional Organization Manual

Functional Organization Manual

10/04/2020 The Functional Organization Manual (FOM) is the authoritative source that documents the current organization structure missions

Functional Organization Chart (as of 30 - Asian Development Bank

Functional Organization Chart (as of 30 - Asian Development Bank

Page 1. PUBLIC. This information is being disclosed to the public in accordance with ADB's Access to Information Policy.

Organizational Structure Cross-functional Integration and

Organizational Structure Cross-functional Integration and

When building a cross-functional team in a mechanical organization the organizational structure is distinct hierarchy and strictly follows the unified command

Functionally Organized Tax Administration; by Maureen Kiddك IMF

Functionally Organized Tax Administration; by Maureen Kiddك IMF

function-based organization structure with a headquarters that includes branches for: • Taxpayer service and debt management. • Compliance. • Assessment and

Leadership Style and Organizational Structure Alignment: Impact on

Leadership Style and Organizational Structure Alignment: Impact on

The leadership styles evaluated are transactional and transformational leadership and the organizational structures reviewed are functional

VA Functional Organization Manual v.7 Volume 1

VA Functional Organization Manual v.7 Volume 1

• Validates and maintains VHA organizational structure and position inventory to ensure effective span of control organizational hierarchy and compliance

organizational structures. focus on the airline sector; the air-‐france

organizational structures. focus on the airline sector; the air-‐france

Organizational structure functional structure

How Apple Is Organized for Innovation

How Apple Is Organized for Innovation

(See the exhibit “Apple's Functional Organization.”) The adoption of a functional structure may have been un surprising for a company of Apple's size at the

Functional Organization Manual

Functional Organization Manual

10?/04?/2020 Department of Veterans Affairs. Functional Organization Manual Version 6.0 ix. Table of Figures. Figure 1 - VA Organization Chart.

ics organizational structure and elements.pdf

ics organizational structure and elements.pdf

Section: The organizational level having responsibility for a major functional area of incident management (e.g. Operations

Functional structure and operational issues: An examination of core

Functional structure and operational issues: An examination of core

organisation wanted and paid us to do. Functional organizational structure also referred to as centralised structure is one of several reporting structures a

Detailed Guidelines for Improved Tax Administration in Latin

Detailed Guidelines for Improved Tax Administration in Latin

31?/08?/2013 functional organizational structures for national tax administrations. The functional structure has proven again and again that it:.

Functionally Organized Tax Administration; by Maureen Kidd? IMF

Functionally Organized Tax Administration; by Maureen Kidd? IMF

The organization structure of the tax administration is a key component of A function-based organization is one structured on the basis of the type of ...

Chap 3 : Organizational Structure

Chap 3 : Organizational Structure

Types of organizational structures. • functional organization (U-form) Accounting. An organizational chart showing a functional structure ...

ToS-Functional-Organization-Chart-April-2021.pdf

ToS-Functional-Organization-Chart-April-2021.pdf

Town of Strathmore - Functional Organizational Structure. • Recreation and Culture. • Family & Community Support. Services (FCSS). • Municipal Enforcement.

Functional Organizational Structure And Employee Engagement In

Functional Organizational Structure And Employee Engagement In

Functional Organizational Structure And Employee. Engagement In Malaysian Hotel Sector. Irza Hanie Abu Samah Abdul Shukor Shamsuddin

ADB Functional Organization Chart

ADB Functional Organization Chart

FUNCTIONAL ORGANIZATIONAL CHART. (as of July 2022) a. The Independent Evaluation Department reports to the Board of Directors through the Development

(PDF) Organizational Structure - ResearchGate

(PDF) Organizational Structure - ResearchGate

The structures diagrammed and described are functional product customer geographic divisional or M-form matrix amorphous and hybrids The note also

[PDF] Functional structure and operational issues: An examination of core

[PDF] Functional structure and operational issues: An examination of core

An organisational structure defines the reporting relationships in a company; in other words who works for whom In fact there cannot be any one optimal

(DOC) FUNCTIONAL STRUCTURE - Academiaedu

(DOC) FUNCTIONAL STRUCTURE - Academiaedu

An organizational structure activities such as task allocation coordination and supervision which are directed towards the achievement of organizational

[PDF] types of organization

[PDF] types of organization

There are three main types of organizational structure: functional divisional and matrix structure FUNCTIONAL STRUCTURE : Functional structure is set

[PDF] Chap 3 : Organizational Structure

[PDF] Chap 3 : Organizational Structure

Types of organizational structures • functional organization (U-form) • divisional organization (M-form H-form) • matrix organization (matrix-form)

[PDF] ORGANIZATIONAL STRUCTURES: CONCEPTS AND F0RMATS

[PDF] ORGANIZATIONAL STRUCTURES: CONCEPTS AND F0RMATS

It is an activity of the organizing function scalar principle (chain of command) a clear definition of authority in the organization This authority flows down

[PDF] ORGANIZATIONAL STRUCTURE - pvkketcho

[PDF] ORGANIZATIONAL STRUCTURE - pvkketcho

Without an appropri- ate organizational structure a business will not succeed • organizational chart • line function • staff function • matrix structure •

[PDF] Organizational Structure

[PDF] Organizational Structure

In such structures authority is delegated to various functional levels/individuals Decentralised decision making is practised that allows people to make their

[PDF] illustrated-guide-to-org-structurespdf - HubSpot

[PDF] illustrated-guide-to-org-structurespdf - HubSpot

For example an organization that departmentalizes by function (i e marketing sales services) is said to have a functional organizational structure

Understanding Functional and Divisional Organizational Structure

Understanding Functional and Divisional Organizational Structure

Some of these challenges are best handled by a functional organizational structure while others are much more taxing if organized that way Conversely a

What is a functional organizational structure?

What is a functional organisational structure? In this type of organisational structure, businesses are organised according to their roles and skills into smaller groups or departments. This may include, for example: sales. marketing.What is functional organizational structure in OB?

A functional organizational structure is a structure used to organize workers. They are grouped based on their specific skills and knowledge. It vertically structures each department with roles from the president to finance and sales departments, to customer service, to employees assigned to one product or service.What are the 4 types of organizational structure PDF?

The four types of organizational structures are functional, multi-divisional, flat, and matrix structures.- Examples of organizations with a functional structure include: Amazon, Starbucks. A functional structure groups employees into different departments by work specialization. Each department has a designated leader highly experienced in the job functions of each employee supervised by them.

Jamaica Tax Benchmarking Study

N PUBLIC FINANCIAL MANAGEMENT

Detailed Guidelines for Improved Tax Administration inLatin America and the Caribbean

Chapter 4. Organizational Structure and ManagementPrepared by: Arturo Jacobs

August 2013

Contract Number: EEM-I-00-07-00005-00

This publication was produced for review by the United States Agency for International Development. It was prepared by

Deloitte Consulting LLP.

Detailed Guidelines for Improved Tax Administration Page ii in Latin America and the CaribbeanDetailed Guidelines for Improved Tax

Administration in Latin America and the

Caribbean

Chapter 4. Organizational Structure and

Management

Program Name: USAID Leadership in Public Financial Management (LPFM)Sponsoring USAID Office: USAID/LAC

Contract Number: EEM-I-00-07-00005-00 Task Order: 11Contractor: Deloitte Consulting LLP

Date of Publication: August 31, 2013

Authors

Arturo Jacobs

Subject Matter Expert

USAID/LPFM

e-mail: arturoaj@aol.comDisclaimer

United States Government.

Detailed Guidelines for Improved Tax Administration Page iii in Latin America and the CaribbeanTable of Contents

List of Acronyms and Abbreviations ______________________________________________ 4 ACKNOWLEDGMENTS: ____________________________________________________________ 5 Chapter 4. Organizational Structure and Management _______________________________ 64.1. Leading Practice _______________________________________________________________ 6

4.1.1. Disadvantages of the Type-of-Tax Organizational Structure ___________________________________ 7

4.1.2. Superiority of the Functional Organizational Structure _______________________________________ 7

4.1.3. Pros and Cons of the Type-of-Taxpayer Organizational Structure _______________________________ 9

4.1.4. Core and Support Functions ___________________________________________________________ 10

4.1.5. Taxpayer Segmentation _______________________________________________________________ 11

4.1.6. Integrated Administration of Withholding Taxes and Contributions ____________________________ 13

4.1.7. Roles of Headquarters, Regional, and Local Offices and Staff _________________________________ 14

4.1.8. Centralized Staffing __________________________________________________________________ 15

4.1.9. Adequate Budget to Support Operations _________________________________________________ 15

4.1.10. Internal Audit and Integrity Functions __________________________________________________ 16

4.1.11. Typical Functional Structure for Medium and Small Tax Administrations ______________________ 16

4.1.12. Typical Functional Structure for Large Tax Administrations _________________________________ 17

4.1.13. Successful Management Practices _____________________________________________________ 18

4.1.14. Legal Services ______________________________________________________________________ 21

4.1.15. Computerization and Data Networking _________________________________________________ 22

4.2. Common Trends ______________________________________________________________ 23

4.2.1. Organizational Structure Trends ________________________________________________________ 23

4.2.2. Creative Organizational Structures ______________________________________________________ 23

4.2.3. Outsourcing ________________________________________________________________________ 26

4.2.4. Customs and Tax Administration - to Merge or Not ________________________________________ 27

4.3. Tax Administration Maturity ___________________________________________________ 27

4.4. Latin America and the Caribbean _______________________________________________ 34

4.5. Key Benchmarks and Guidelines ________________________________________________ 35

REFERENCES: _________________________________________________________________ 36 Appendix 4.A. Medium or Small Tax Administrations _______________________________ 37 Appendix 4.B. Large Tax Administrations _________________________________________ 40 Appendix 4.C. Fiscal Compliance Division _________________________________________ 43 Detailed Guidelines for Improved Tax Administration Page 4 in Latin America and the CaribbeanList of Acronyms and Abbreviations

Acronym Definition

CIAT Inter-American Center of Tax Administrations

EDTAX Education Tax (Jamaica)

HEART Human Employment and Resource Training Trust (Jamaica)IMF International Monetary Fund

IRS Internal Revenue Service (United States)

IT Information technology

JMD Jamaican dollar

LAC Latin America and the Caribbean

LTC Large taxpayer center

LTO Large taxpayer office

MCTC Model Customs and Tax Center (Egypt)

ITIS Integrated tax information system

MTO Medium Taxpayer Office

NIS National Insurance Scheme (Jamaica)

NTH National Housing Trust (Jamaica)

OECD Organisation for Economic Co-operation and DevelopmentPAYE Pay as you earn

SARA Semi-autonomous revenue authority

TIN Taxpayer identification number

VAT Value added tax

Detailed Guidelines for Improved Tax Administration Page 5 in Latin America and the CaribbeanACKNOWLEDGMENTS:

A number of persons contributed to drafts of this document. Doug Pulse and Anton Kamenov providedan outline for the chapter and, with Rajul Awasthi of the World Bank Group, commented on drafts. This

assistance is greatly appreciated. Errors and omissions should, of course, be attributed to the authors.

Detailed Guidelines for Improved Tax Administration Page 6 in Latin America and the CaribbeanChapter 4. Organizational Structure and

Management

The purpose of this chapter is to discuss the organizational and management structures and approaches

to tax administration. Specific focus is given to functional organizational structures, with segmentation

for certain types of taxpayers, as this has proven to be the most effective and efficient model. Typical

functional organizational structures for headquarters, regional, and district/field offices are presented

graphically. Several selected best practices by tax administrations are also discussed, such as those

relating to categories of staffing, centralization of staffing, and delegations of authority.4.1. Leading Practice

To collect the national tax revenues, tax administrations around the world have organized the bulk of

their staff and other resources and executed their programs around one of four traditional types of organizational structures: Type of tax (e.g., with departments responsible for income tax, value added tax, excise taxes, and other taxes); Functions performed (e.g., with departments responsible for taxpayer audits, collection of tax arrears, and other functions); Type of taxpayer/client (e.g., with departments responsible for large enterprises, small/medium enterprises, wage and salary earners, and other taxpayers); or Combinations of two or more of the types of organizational structures above. The type-of-tax organizational structure was the favored structure early on and for many years. TheBritish Empire has structured its tax administration - the Board of Taxes and the Board of Stamps, later

to become the Board of Inland Revenue - by type of tax since the 1690s. The United States alsostructured its tax administration by type of tax for decades, then operated according to functions

performed from the early 1950s to the late 1990s, when it changed to a type-of-taxpayer structure mandated by Congress' 1998 IRS Restructuring and Reform Act, with 4 major divisions - Wage and Investment Income, Small Business and Self-Employed, Large & Mid-Size Business; and Tax Exempt &Government Entities. Other countries, like New Zealand and Australia originally structured their tax

administrations by type of tax, changed to functional structures for many years, and then restructured

according to the type of taxpayer/client in the early 1990s. Particularly in developed countries more

recently, combinations of two or more of the structures listed above have been designed and

implemented. Each of the four types of structures has advantages and disadvantages. Detailed Guidelines for Improved Tax Administration Page 7 in Latin America and the Caribbean4.1.1. Disadvantages of the Type-of-Tax Organizational Structure

The following are among the longstanding problems of prolonged operations by separate type-of-taxdepartments, as cited by World Bank experts after in-depth studies of one LAC country during 1993-94,1

but typical in many other countries as well: Duplication of effort was persistent among six front-line tax departments, because each department had been conducting the same functions for its own tax, including taxpayer registration, taxpayer audits, and compliance, separately and routinely for years. Fragmentation of resources for enforcement was widespread among the departments. Inefficiencies in operations, caused by this fragmentation, impacted on organizational performance, resources, procedures, and staff development. Shortcomings in management and staff performance of all tax departments were persistent. Weaknesses in collections and poor control of tax evasion lessened the goǀernment's reǀenue for economic development. A widespread lack of voluntary compliance by taxpayers was evident. Coordination and data sharing among tax departments led to advantages for those taxpayers who were evading or avoiding taxes.Structuring by type of tax creates significant burdens for taxpayers, including increased time and

expense when they are subjected to multiple registrations, audits, and other interactions with the

separate tax departments.4.1.2. Superiority of the Functional Organizational Structure

The most prevalent and successful organizational structure for many years has been the functionalorganizational structure; that is, a tax administration structured on the basis of the type of work

performed, rather than the type of tax, business, product, or customer. The functional organizational

structure is based on the theory that, by grouping together activities that require similar skills or

specialties, real gains are achieved through an increased depth of knowledge in core areas of business

expertise.2Most international experts, including from the International Monetary Fund (IMF), the World Bank, and

the Inter-American Development Bank, who have conducted countless tax reform missions all over theworld over a span of several decades, have strongly and consistently favored and recommended

functional organizational structures for national tax administrations. The functional structure has

proven again and again that it: Permits standardization of similar processes across all taxes, which enables easier and simpler interactions by taxpayers, e.g., only one access point for registration, service and payment;1 KPMG Peat Marwick (1995), p. 1.

2 Kidd (2008), p. 2.

Detailed Guidelines for Improved Tax Administration Page 8 in Latin America and the Caribbean Facilitates simplification of procedures which taxpayers are required to follow to comply with their tax obligations; Permits greater uniformity across the organization enables grouping of all core functions together geographically for better management oversight and control, and for design of the same operating procedures for each core function in all field offices; Facilitates computerization of all work processes; Allows greater specialization, training and career development of staff; Promotes greater efficiency and higher productivity of the overall tax administration, as it avoids the duplication of processes across types of taxes; With a complete view of taxpayer behavior across all tax types and early detection of non- compliance trends, yields improved compliance results; and Decreases the incidence of intrusion on taxpayers common in organization by type of tax as it avoids, for example, separate audits at different times by different tax officials focused solely on income tax, value added tax, or other types of taxes. Other benefits of functional organizations include:3 Functional organizations enable units to focus on primary activities, which promotes efficiency - auditors, for example, are able to audit tax returns for all types of taxes; Functional organizations allow an integrated look at the taxpayer during registration, audit, and collections, as well as at the taxpayer base for planning purposes; Functional organizations enhance control and accountability, because no single tax official is responsible for all administrative elements related to a single taxpayer; and Functional organizations can accommodate major legislative changes, such as the introduction of a new tax, with minimal changes to the organizational structure.It is not surprising, therefore, that functional structures are in extensive use in most developed countries

and in developing countries as well. A recent study by the Organisation for Economic Cooperation and

Development's Forum on Tax Administration4 confirms that, despite some significant variations in theorganizational structures of revenue bodies from country to country, "there appears to be a substantial

that the functional model has been adopted as the primary criterion for structuring their tax

administration operations, while 30 revenue bodies reported that a broad mix of criteria, includingfunction, are applied in practice." In other words, 43 out of 49 tax administrations count on functional

structures. It should also be noted that those few countries that rely exclusively on taxpayer

segmentation (type of taxpayer) invariably organize the taxpayer segments, like Large Taxpayer Offices,

under a functional structure, with components for audit, collection, and taxpayer service.3 Murdoch et al. (2012), p. 3.

4 OECD (March 2011), p. 43.

Detailed Guidelines for Improved Tax Administration Page 9 in Latin America and the Caribbean4.1.3. Pros and Cons of the Type-of-Taxpayer Organizational Structure

The main rationale for organizing tax administration by type-of-taxpayer, or taxpayer segments, is that

the various taxpayer groups have different characteristics, tax-compliance behavior, and levels of risk for

loss of tax revenue, and should each be handled differently. Advantages of this organization model include: Ability to appoint and dedicate a fixed management team to oversee all compliance and service operations of each unique taxpayer segment, which strengthens responsibility and accountability for achieving organizational objectives; Ability to better research and understand compliance issues of each taxpayer segment; Ability to develop and implement compliance strategies unique to each segment, such as more targeted audits; Facility to provide better service and taxpayer education to targeted groups; Better management of various risk levels unique to each group; Ability to allocate resources of the tax administration commensurate with the risk level of each taxpayer segment; and Greater ability to closely monitor those taxpayers who account for the largest proportion of tax revenue.Functional organization structures, with partial segmentation for large taxpayers is most common, but

some countries have begun to establish Medium Taxpayer Offices (MTOs) as well to segment thosetaxpayers who account for 10-15 percent of the tax revenue. The IRS "Large and Medium-Size Business"

established in 1999 is another example of segmentation based on this model.Like with other organizational structures, there are disadvantages with the type-of-taxpayer structure:

Administrative costs are likely to increase by duplicating common core and even some support functions, like IT, across the taxpayer segments;Duplication and fragmentation of staffing limits the ability to apply the best practice of

centralized staffing, whereby adequate personnel is assigned to a limited number of centrally located tax offices to carry out all of the core functions of tax administration efficiently and effectively; Inconsistent application of tax laws, policies and procedures across different taxpayer segments is more likely; and There is too much dependence on a limited and scarce number of highly skilled managers and technical staff to design and administer the respective enforcement and educational programs for each group.quotesdbs_dbs12.pdfusesText_18[PDF] functional requirements examples for web application

[PDF] functional testing tools

[PDF] functional writing activities special education

[PDF] functionalism

[PDF] functionalism sociology

[PDF] functionalist and conflict perspective on religion

[PDF] functionalist perspective on gender and society

[PDF] functionalist theory of education pdf

[PDF] functionalist theory pdf

[PDF] functionality and degree of polymerization

[PDF] functions and features of computer applications that can be used to design business documents.

[PDF] functions and graphs pdf

[PDF] functions and mappings in mathematics pdf

[PDF] functions and processes related to sanctuary cities