Who gets the interest on 401k loans?

401(k) Loan Basics

Any interest charged on the outstanding loan balance is repaid by the participant into the participant's own 401(k) account, so technically, this also is a transfer from one of your pockets to another, not a borrowing expense or loss.Can a 401k loan be forgiven?

If you don't pay your 401(k) loan, it will go into default.

But unfortunately, it won't be forgiven.If you have a high-interest debt, such as from a credit card with a big balance, you may get a much lower interest rate on a 401(k) loan.

If you have upcoming debt payments and no other alternatives for paying them, borrowing from your 401(k) can reduce fees and penalties.

Loan Basics

Technically, 401(k) loans are not true loans, because they do not involve either a lender or an evaluation of your credit history. They are more accurately described as the ability to access a portion of your own retirement plan money—usually up to $50,000 or 50% of the assets, whichever is less—on a tax-freebasis. You then must repay the money you

When A 401(k) Loan Makes Sense

When you mustfind the cash for a serious short-term liquidity need, a loan from your 401(k) plan probably is one of the first places you should look. Let's define short-term as being roughly a year or less. Let's define "serious liquidity need" as a serious one-time demand for funds or a lump-sum cash payment. "Let’s face it, in the real world, som

Top 4 Reasons to Borrow from Your 401

1. Speed and Convenience In most 401(k) plans, requesting a loan is quick and easy, requiring no lengthy applications or credit checks. Normally, it does not generate an inquiryagainst your credit or affect your credit score. Many 401(k)s allow loan requests to be made with a few clicks on a website, and you can have funds in your hand in a few days, with total privacy. One innovation now being adopted by some plans is a debit card, through which multiple loans can be made instantly in small amounts. 2. Repayment Flexibility Although regulations specify a five-year amortizing repayment schedule, for most 401(k) loans, you can repay the plan loan faster with no prepayment penalty. Most plans allow loan repayment to be made conveniently through payroll deductions—using after-tax dollars, though, not the pretax ones funding your plan.Your plan statements show credits to your loan account and your remaining principal balance, just like a regular bank loan statement. 3. Cost Advantage There is no cost (other than perhaps a modest loan origination or administration fee) to tap your own 401(k) money for short-term liquidity needs. Here's how it usually works: You specify the investment account(s) from which you want to borrow money, and those investments are liquidated for the duration of the loan. Therefore, you lose any positive earnings that would have been produced by those investments for a short period. And if the market is down, you are selling these investments at a

Loans and Their Impact on Your Portfolio

The above discussion leads us to address another argument against 401(k) loans: By withdrawing funds, you'll drastically impede the performance of your portfolio and the building up of your retirement nest egg. That's not necessarily true. First of all, as noted above, you do repay the funds, and you start doing so fairly soon. Given the long-term

Debunking 401(k) Loan Myths with Facts

There are two other common arguments against 401(k) loans: The loans are not tax-efficientand they create enormous headaches when participants can't pay them off before leaving work or retiring. Let's confront these myths with facts: investopedia.com

Loans to Purchase A Home

Regulations require 401(k) plan loans to be repaid on an amortizing basis (that is, with a fixed repayment schedule in regular installments) over not more than five years unless the loan is used to purchase a primary residence. Longer payback periodsare allowed for these particular loans. The IRS doesn't specify how long, though, so it's something

The Bottom Line

Arguments that 401(k) loans are bad for retirement accounts often include two flaws: They assume constantly strong stock market returns in the 401(k) portfolio, and they fail to consider the interest costof borrowing similar amounts via a bank or other consumer loans (such as racking up credit card balances). Don't be scared away from a valuable li

|

Guidance for Coronavirus-Related Distributions and Loans from

loan offsets is extended to the federal income tax return deadline for the year of the distribution. Section 401(k)(2)(B)(i) generally provides that amounts |

|

Ventura County 401(k) Shared Savings Plan Loan Rules and

Loan Rules and Procedures. (Revised August 6 2019). General Information and Rules. 1. Active 401(k) Shared Savings Plan participants |

|

Section B. Acceptable Sources of Borrower Funds Overview

31-01-2011 Loans and Grants as Acceptable Sources of. Funds. 5-B-24 ... IRAs thrift savings plans |

|

Chapter 12(a) Other topics-Modifications to Section 72(p) Regulations

Under IRC Section 72(p)(2) however |

|

VA Pamphlet 26-7 Revised: Chapter 4

VA's underwriting standards are incorporated into VA regulations at 38 CFR value life insurance policies 401K loans |

|

Chapter 4 Credit Underwriting Overview

26-09-2019 VA's underwriting standards are incorporated into VA regulations at ... value life insurance policies 401(k) loans |

|

171309 Deloitte Retirement Plan Loan Leakage POV

01-07-2022 from 401(k) loan defaults not only impairs employee ... The Inconvenient Truth of Fiduciary Loan Regulation. Retrieved from. |

|

Loan Policy for the NC 401(k) and NC 457 Plans and the NC 403(b

Loan Policy for the NC 401(k) and NC 457 Plans and the NC This Loan Policy is incorporated into the plan documents for the NC ... Rules for Offset. |

|

Borrowing from the Future: 401(k) Plan Loans and Loan Defaults

We show that employers' loan rules have a strong endorsement effect on borrowing patterns; that is in plans allowing multiple loans |

|

2022 Instructions for Forms 1099-R and 5498

plan loan offset amounts see Regulations sections. 1.402(c)-2 and 1.403(b)-7(b). See Rev. For a direct rollover of a distribution from a section 401(k). |

|

401(k) Plan Loans and Loan Defaults - Pension Research Council

401(K) LOAN RULES Borrowing from tax-qualified 401(k) plans is permitted under U S Treasury regulation governing loans, repayment, interest rates, and |

|

Eight Key Requirements for 401(k) Loans - Henry+Horne

A typical plan may permit employees to make hardship withdrawals However, IRS regulations allow hardship withdrawals only if a participant has an immediate |

|

PHI 401(k) Retirement Plan Loan Rules

The repayment period for a loan may not exceed 60 months, unless the loan request is for the purchase of a primary residence thereby extending the loan term to |

|

Plan Loan Rules for Qualified Retirement Plans - LexisNexis

2 avr 2020 · 1 401(k)-1(d)(3) for 401(k) plan hardship distribution rules Note that a plan loan program that provides for hardship loans does not need to |

|

Loan Policy - The McClatchy Company

The McClatchy Company 401(k) Plan PARTICIPANT LOAN POLICY (Plan # 098630) This participant loan policy has been established by the Plan Administrator Per IRS regulations, the maximum amount you may borrow, when added to |

|

Participant Loans Phone Forum - Internal Revenue Service

from his or her plan is 50 of his or her vested account balance or $50,000, whichever is less An exception to this limit is if 50 of the vested account balance is less than $10,000 In such case, the participant may borrow up to $10,000 Plans are not required to include this exception |

|

Guidance for Coronavirus-Related Distributions and Loans from

Section 401(k)(2)(B)(i) generally provides that amounts attributable to 5-year repayment rule applies for loans used to acquire any dwelling unit that will |

|

Keeping Abreast of Plan Loan Rules - Dyatech

Plan Loan Rules If you have a 401(k) plan, you've likely had participants ask about taking loans from their accounts If you haven't yet, it is only a matter of time |

|

Loan Guidelines - Prudential Retirement - Prudential Financial

You may borrow up to: $50,000 or 50 of your account balance, whichever is less 1 Your plan allows you to take: One loan every 12 months; up to two loans |

|

[PDF] 401(k) Plan Loans and Loan Defaults - Pension Research Council

401(K) LOAN RULES Borrowing from tax qualified 401(k) plans is permitted under US Treasury regulation governing loans, repayment, interest rates, and |

|

[PDF] The Inconvenient Truth of Fiduciary Loan Regulation - K&L Gates

Section 401(k) loans form an ever growing asset in America's corporate retirement plans Although these loans are typically secured by the participant's indi |

|

[PDF] Borrowing from the Future: 401(k) Plan Loans and Loan Defaults

6 See GAO (2009) for additional background on regulations and laws for 401(k) loans Page 7 5 sponsors permit participants to take out multiple loans in |

|

[PDF] Loan Policy - The McClatchy Company

No more than one (1) loan may be granted in any one calendar year No more than two (2) loans may be outstanding at any time The minimum amount of each loan is $50000 All loans are available from your before tax rollover and before tax contribution accounts |

|

[PDF] Qualified Plan Loan Regulations - MassMutual Funds

circumstances for refinancing an existing loan • provisions for new loans in situations where there is a deemed distribution Loans to participants on military leaves |

|

[PDF] Participant Loans Phone Forum - Internal Revenue Service

loans and the rest, Safe Harbor 401(k), 401(k), Profit Sharing, Defined Benefit, 403(b), I had to reacquaint myself with a lot of the rules for Employee Plan loans |

|

[PDF] A Primer on 401(k) Loans - Harvard University

Sep 22, 2008 · The terms of a 401(k) loan are set by individual savings plans, within certain regulatory bounds When a loan is made to a 401(k) participant, |

|

[PDF] 401(k) Loan Policy 091809 - Northwest Plan Services

A deemed distribution occurs if repayment is not made in accordance with federal laws and regulations, as explained in more detail below REASONS FOR |

|

[PDF] The Availability and Utilization of 401(k) Loans

May 31, 2011 · finds that 401(k) loan utilization is correlated with the types of loan rules adopted by firms Loans are more likely to be used in plans that charge |

|

[PDF] Loans from Tax Qualified Retirement Plans

Oct 13, 2015 · DEPARTMENT OF LABOR REGULATIONS ON PLAN LOANS 29 CFR 42 • Pension and 401(k) Plan Overview and Update |

- erisa 401k loan regulations

- dol 401k loan regulations

- irs 401k loan regulations

- 401k plan loan regulations

- new 401k loan regulations

What You Need to Know About 401(k) Loans Before You Take One

Source:https://www.signnow.com/preview/403/514/403514382.png

Wells Fargo 401K Loan Payoff Form - Fill Out and Sign Printable

Source:https://www.kitces.com/wp-content/uploads/2017/08/Graphics_3-1.png

Why Paying 401(k) Loan Interest To Yourself Is A Bad Investment

Source:https://www.kitces.com/wp-content/uploads/2017/08/Featured_08232017.png

Why Paying 401(k) Loan Interest To Yourself Is A Bad Investment

Source:https://www.mysolo401k.net/wp-content/uploads/2018/08/attribution.jpg

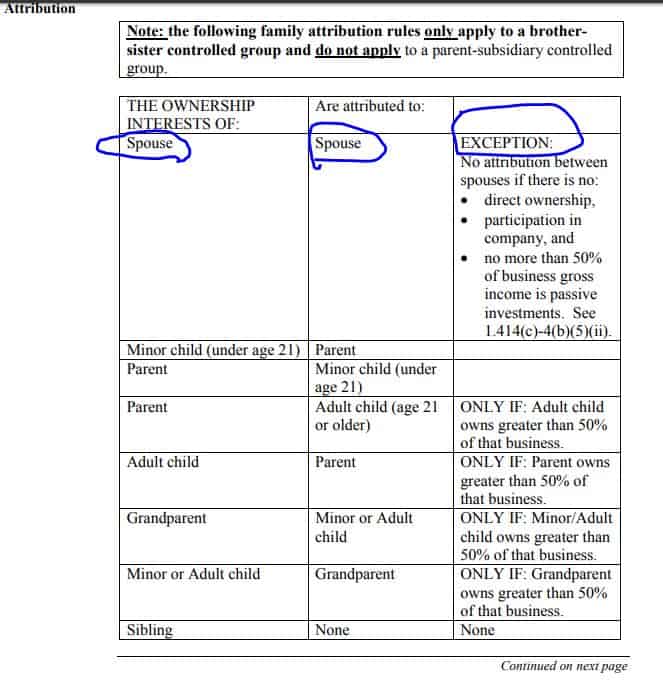

Solo 401k Controlled Group Rules - My Solo 401k Financial

Source:https://www.mysolo401k.net/wp-content/uploads/2020/04/Making-Solo-401k-Contribution-for-a-Partnership.png

401k loan repayment calculator

[PDF] Loan Guidelines - Prudential Retirement - Prudential Financial

- loan calculator

- merrill lynch 401k loan early payoff

- merrill lynch 401k loan payoff

- 401k loan repayment rules

- merrill lynch 401k loan processing time

- merrill lynch 401k loan calculator

- icma loan repayment

- icma-rc loan interest rate

- 401k loan repayment calculator t rowe price

- 401k loan repayment calculator fidelity

- 401k loan repayment calculator prudential

- 401k loan repayment calculator biweekly

- 401k loan repayment calculator weekly

- 401k loan repayment calculator wells fargo

- 401k loan payment calculator

- 401k loan payment calculator weekly

401k market size

[PDF] media kit - 401K Specialist

- 401k market value

- 401k plan size

- 401k market share

- defined contribution market size

- 401 k plan statistics

- 401k participation rates by industry

- retirement industry statistics

- how many employees to have a 401k

401k max 2020 after tax

[PDF] How High Earners Can Maximize Their Retirement - Hartford Funds

- 401k contribution limits 2020

- vanguard after-tax 401k

- retirement before or after-tax

- mega backdoor roth

- after-tax 401k contribution limit

- 401k after-tax contribution limits 2020

- contributions are made in after-tax dollars to quizlet

- after-tax to roth

- 401k max 2020 after tax

- 401k limits 2020 after tax

- 401k max contribution 2020 after tax

- 401k contribution limits 2020 after tax

- irs 401k limits 2020 after tax

- maximum 401k contribution 2020 after tax

401k max 2020 calculator

[PDF] Retirement plan catch-up contributions - Lincoln Financial Group

- Solo 401k calculator

- SEP IRA calculator

- Solo 401k contribution limits 2019

- Solo 401k contribution limits 2020

- [PDF] pre-retirement catch-up form - ICMA-RChttps://www.icmarc.org › ...

- 457 Plan Contribution Limit. 2020. 2019. Annual Deferrals. $19

- 500. $19

- 000 ... each year to calculate your total unused deferral amount. Unused Deferral ... contribution amount must include any 401(k) contributions made during the year.[PDF] Example Calculation for PPP Loans - McGill & Hill Grouphttps://www.mcgillhillgroup.com › 2020-04-07-Example-Calculation-...

- Apr 7

- 2020 · ($100

- 000 Limit) ... 3) Total employer paid retirement benefits (including 401(k) profit sharing plans ... Sample Loan/Grant Amount Calculation.[PDF] Retirement plan catch-up contributions - Lincoln Financial Grouphttps://www.lfg.com › wcs-static › pdf

- The annual 402(g) limit is an individual limit that applies to 401(k) and 403(b) plans. ... disadvantages of offering this provision are the calculation and the need to ... If a participant reaches normal retirement age (NRA) in 2020

- the catch-up is.[PDF] Your Smart Target Member Kit Midcareer - CalSTRS.comhttps://www.calstrs.com › publication › your-smart-target-member-kit

- 2020. For your security

- when you update your mailing or email address

- ... Here are three examples for her Member-Only retirement benefit calculation

- not including any unused sick ... If she continues working until her 62nd birthday

- she would be eligible for the maximum ... Roth 403(b)

- Roth 457(b)

- Roth 401(k)

- Roth IRA.Related searchesSolo 401k growth calculator

- Fidelity 401k calculator

- Where to deduct solo 401k contribution

- Fidelity se 401k calculator

- Solo 401k calculator S corp

- IRS Publication 560 for 2019

- Fidelity Solo 401k

- Fidelity self-employed 401(k) contribution Remittance Form

- 401k limits 2020 calculator

- 401k max contribution 2020 calculator

- 401k contribution limits 2020 calculator

- maximum 401k contribution 2020 calculator