What are the reporting and disclosure requirements for a retirement plan?

Retirement plans must file certain forms and reports with the IRS and the Department of Labor and send out notices to plan participants and certain others. Different reporting and disclosure requirements apply depending on the type of plan and the plan’s circumstances. These PDF charts summarize the reporting and disclosure requirements:

When should a 401(k) plan be disclosed?

Additional disclosure is required to be provided 30 to 90 days before any change is adopted that will affect the information or amount of expenses required to be disclosed. “Safe Harbor” Notice (See “ 401 (k) Notice: Safe Harbor “) for details) “Safe Harbor” plans only. Must be provided “within a reasonable period” before eligibility.

What is a 401(k) safe harbor notice?

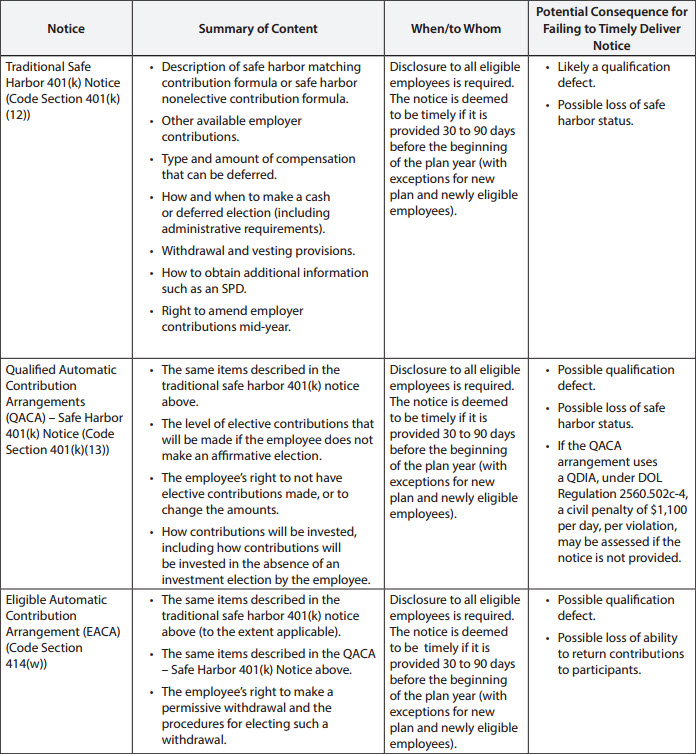

When the plan is intended to be an IRC section 401 (k) or (m) safe harbor plan, an annual notice must be provided to all employees eligible to participate in the plan. The notice must contain the following: the safe harbor matching or non-elective formula used in the plan;

When should a 401(k) plan sponsor provide a notice?

A plan sponsor must provide each plan participant with a notice explaining his or her right to diversify employer stock fund investments by no less than 30 days before the first day that the participant is eligible to exercise this diversification right. Notice of Discontinuance of Safe Harbor (see “ 401 (k) Safe Harbor Plans ” for details)

|

Participant Notices Cheat Sheet (00593159).DOCX

Notice Type. Timing Requirement. Content Requirement. 401(k) Safe Harbor Notice. Provided to participants a reasonable period before the beginning of the plan |

|

Reporting-and-disclosure-guide-for-employee-benefit-plans.pdf

For more information on IRS notice and disclosure requirements please visit average participant and be sufficiently ... 401(k)-type plans. |

|

The Participant Disclosure Regulation

Although not required Fidelity's Participant Disclosure Service combines the plan- and investment-related information into one notice (the “Participant. |

|

US

The notice for EACAs and QACAs is similar to that discussed under Notifying Employees but does contain some additional required information. The participant |

|

Administrative Procedural and Miscellaneous Automatic Rollover

This notice provides guidance relating to automatic rollover provisions Regulations provide that a distributee of any eligible rollover distribution as. |

|

DOL and SEC Rules on Blackout Notices

“black-out periods” in participant-directed retirement plans. out notice requirement or the insider trading prohibition under Sarbanes-Oxley. |

|

Guidance for Coronavirus-Related Distributions and Loans from

This notice provides guidance relating to the application of section 2202 of these requirements are satisfied an amount received by a participant as a ... |

|

Fact Sheet

to Workers in 401(k)-Type Retirement Plans A “participant-directed plan” is a plan that provides for the allocation of investment responsibilities to. |

|

FAQs about Retirement Plans and ERISA

ERISA does not require any employer to establish a retirement plan. such as 401(k) plans generally are required to provide advance notice to. |

|

Special Tax Notice Regarding Retirement Plan Payments — Your

However if the participant had started taking required minimum distributions |

|

Participant Notices Cheat Sheet (00593159)DOCX - Ferenczy

Notice Type Timing Requirement Content Requirement 401(k) Safe Harbor Notice Provided to participants a reasonable period before the beginning of the plan |

|

Glossary of Required Participant Notices & Participant Documents

Notice Description Requirements Distribution Deadline Automatic Enrollment defined contribution plans such as profit sharing, 401(k), 403(b), money |

|

Reporting and Disclosure Guide for Employee Benefit Plans

and disclosure requirements under the Employee Retirement Income administrators of employee benefit plans are required to furnish 401(k)-type plans |

|

A GUIDE TO ELECTRONIC DELIVERY OF PARTICIPANT

PARTICIPANT DISCLOSURE MATERIALS The U S Department of guide is intended to: • Provide an overview of relevant electronic delivery rules and interpretations such as the 401(k) Safe Harbor and Auto Enrollment Notices The DOL |

|

DOL and SEC Rules on Blackout Notices - Groom Law Group

The DOL rules clarify that the 30-day minimum notice period applies with participants after notices are provided to other participants must be provided with 401(k), profit-sharing, stock bonus and money purchase pension plans – and also |

|

Notice - Plan Sponsors Prudential Financial

applicable to newly eligible participants for Traditional ADP/ACP Safe Harbors, This publication provides a summary of the annual notice requirements for those The Traditional ADP/ACP Safe Harbor Notice is required for 401(k) and |

|

Sample notices - Internal Revenue Service

8 nov 2007 · (“QACAs”) under section 401(k)(13) of the Internal Revenue Code (“Code”) and on eligible automatic The DOL's regulation sets forth these notice requirements eligible participants, or may provide employer nonelective |

|

INSTRUCTIONS TO EMPLOYER What to do when a participant

Please see special rules regarding direct rollover of Roth 401(k) deferrals in the Special Tax Notice Regarding Plan Payments III You may choose to rollover your |

|

Electronic notice delivery to retirement plan participants - Qualified

which rules are applicable to which notices The chart below describes the most significant types of participant notices: (QACA) • Safe Harbor 401(k) |

|

SAFE HARBOR 401(K) PLAN NOTICE TO EMPLOYEES

This annual Safe Harbor Notice is required by the Internal Revenue Service providing a specified level of contributions and meeting certain other requirements If you are an eligible Participant, your 401(k) Plan account will be credited in |

|

[PDF] Retirement Plan Reporting and Disclosure Requirements - Internal

Mar 31, 2020 · For new participants, generally no earlier than 90 days before the employee becomes eligible and no later than the eligibility date For plan years beginning after 2019, the safe harbor notice is not required for nonelective contributions to employees as amended by SECURE Act, PL |

|

[PDF] Reporting and Disclosure Guide for Employee Benefit Plans

Disclosure Requirements for Welfare Benefit Plans That Are Group Health to provide health coverage to a participant's noncustodial 401(k) type plans |

|

[PDF] Glossary of Required Participant Notices & Participant Documents

A Summary Annual Report (SAR) notice must be distributed to all plan participants within nine months after the close of the plan year If your plan has been granted an extension of time to file the form 5500, you have until the end of two months after the filing date to distribute the SAR |

|

[PDF] a guide to electronic delivery of participant disclosure materials

steps required in the Safe Harbor, a notice or other electronic means will be considered to have participant's rights and obligations under a Safe Harbor 401(k) |

|

[PDF] safe harbor 401(k) plan notice to employees - ABA Retirement Funds

Eligible Employee who is soon to become a Participant This annual Safe Harbor Notice is required by the Internal Revenue Service (IRS) to provide important |

|

[PDF] Participant Notices Cheat Sheet (00593159)DOCX - Ferenczy

Notice Type Timing Requirement Content Requirement 401(k) Safe Harbor Notice Provided to participants a reasonable period before the beginning of the plan |

|

[PDF] DOL and SEC Rules on Blackout Notices - Groom Law Group

“black out periods” in participant directed retirement plans Black out The DOL rules clarify that the 30 day minimum notice period applies with respect 401(k), profit sharing, stock bonus and money purchase pension plans – and also |

|

[PDF] QDIA Q&A Brochure (PDF) - Invesco

in participant directed 401(k) plans Introduced If the plan complies with the requirements of the regulation, the fiduciary will not be liable for losses A notice must be furnished to participants and beneficiaries 30 days in advance of the first |

|

[PDF] Do You Need to Send an Annual Notice to Plan - Alston & Bird

Oct 25, 2017 · issue the annual 401(k) safe harbor notice, the plan could lose its Annual participant fee disclosures * This deadline applies to calendar year plans Non calendar year plans have similar requirements, though their |

|

[PDF] Notice - Prudential Retirement - Prudential Financial

The Traditional ADP ACP Safe Harbor Notice is required for 401(k) and 403(b) Alternative) Notice is required for participant directed defined contribution |

- retirement plan participant notices"

- reporting and disclosure guide for employee benefit plans 2019

- 401(k eligibility notice to employees)

- erisa requirement to provide plan documents

- erisa 104(d notice)

- form 5500 instructions

- notice to participants of plan merger

- late quarterly contributions participant notice

Do You Need to Send an Annual Notice to Plan Participants? If So

Source:https://jdsupra-html-images.s3-us-west-1.amazonaws.com/d26f56af-109e-4238-aa12-88c7e76b1706-deadlines-for-plan-sponsors1.jpg

Do You Need to Send an Annual Notice to Plan Participants? If So

Source:https://www.principal.com/sites/default/files/articlehero_stock_84471735_bynder.jpg

Do you understand 401(k) participant notice requirements?

Source: Principal

401(k) Amendment Rules – Strict but (Mostly) Straightforward

Source:https://www.julyservices.com/wp-content/uploads/2018/02/404a5_FAQ.pdf.jpg

July Business ServicesReference and Learning - July Business Services

Source:https://www.alston.com/files/Uploads/Images/Advisories/EBEC/EBEC-1.jpg

Employee Benefits \u0026 Executive Compensation: Do You Need to Send an

Source:https://www.julyservices.com/wp-content/uploads/2018/02/401kDepositTimingRules_TechDoc.pdf.jpg

401k percentage by age

[PDF] Maximum 401k contributions - Urban Institute

- 401k withdrawal age 65

- age limit for 401k

- can i cash out my 401k at age 65

- at what age can you withdraw from 401k without paying taxes

- 401k withdrawal age 62

- how to withdraw from 401k after age 60

- what age do you have to withdraw from 401k

- what age can you withdraw from 401k without penalty?

- 401k savings by age

- 401k savings by age and income

- 401k contributions by age

- 401k savings by age chart

- 401k statistics by age

- 401k savings by age 35

- 401k savings by age group

- 401k savings by age 40

401k regulations 2018

[PDF] What Employers Need To Know About H-2A Workers & 401(k) Plans

- maximum profit sharing contribution 2019

- 401k guidelines

- how to contribute $55

- 000 to 401k

- 401k handbook

- simple 401(k) contribution limits 2019

- 401k resources

- 401(k) administration guide

- 401k contribution age limit

- 401(k) regulations

- irs 401 k regulations

401k regulations 2019

[PDF] Proposed Hardship Withdrawal Regulations - Groom Law Group

- 2019 publication 560

- solo 401k

- solo 401k 5500 filing requirements

- publication 560 calculator

- owner-only 401k

- solo 401k rules

- irs 401k calculator

- self-employed 401k

- 401k guidelines 2019

401k regulations withdrawal

[PDF] US Bank 401(k) Savings Plan Summary Plan Description

- fidelity 401k terms of withdrawal pdf

- cares act 401k withdrawal

- charles schwab 401k withdrawal covid

- charles schwab 401k terms of withdrawal pdf

- does michigan tax 401k contributions

- fidelity 401k loan withdrawal terms and conditions

- state of michigan 401(k withdrawal)

- michigan tax early withdrawal 401k

- 401k requirements withdrawal

- 401k guidelines withdrawal

- 401k withdrawal requirements at age 70.5

- 401k withdrawal rule

- 401k withdrawal requirements at age 70

- 401k withdrawal rule changes

- 401k withdrawal rule of 55

- 401k withdrawal rule of thumb