|

The cares act: 401k loan expansion and student loan relief

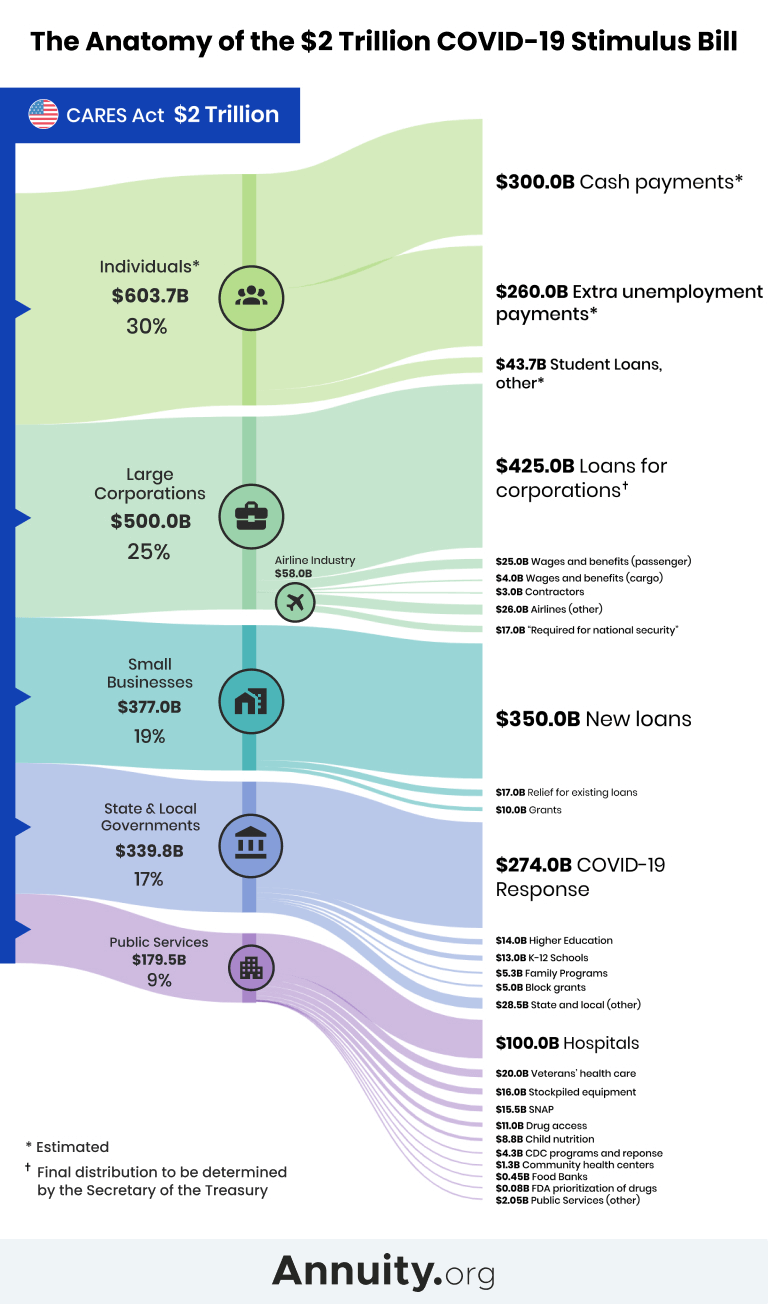

Legally Brief: COVID-19 UPDATE THE CARES ACT: 401K LOAN EXPANSION AND STUDENT LOAN RELIEF The $2 trillion CARES Act the economic stimulus package recently |

|

Guidance for Coronavirus-Related Distributions and Loans from

A Distributions Under § 402(c)(8) an eligible retirement plan includes an individual retirement arrangement (IRA) under § 408(a) or (b) a qualified plan under 401(a) an annuity plan under § 403(a) a § 403(b) plan and a governmental deferred compensation plan under § 457(b) |

Once the distribution is reviewed and approved, the payment will be processed.

Payments are generally received within 7-10 business days for a check; 5-7 business days for direct deposit (if available).

Can I withdraw from my IRA in 2023 without penalty?

Age 59½ and over: No Traditional IRA withdrawal restrictions

Once you reach age 59½, you can withdraw funds from your Traditional IRA without restrictions or penalties.

|

Notice 2020-50 PDF - Internal Revenue Service

The participant's employer takes action to suspend payroll withholding repayments, for the period from July 1, 2020, through December 31, 2020, for loans to qualified individuals that are outstanding on or after March 27, 2020 |

|

COVID-19 - ADP

and loans The Coronavirus Aid, Relief and Economic Security (CARES) Act passed on March 27 Review the definition of compensation for your 401(k) plan |

|

COVID-19, the CARES Act and your retirement plan - ADP

COVID-19 distributions, will be able to suspend any active loan payments for the remainder of 2020 be sent to ADP 401k with the next payroll file transmission |

|

401(k)

If you have not been financially impacted by COVID-19, you still have access to loans up to $50,000 and hardship distributions for significant medical needs, |

|

COVID-19 Related Early Withdrawals from Retirement Accounts

considerations for investors thinking of using 401(k) withdrawals or loans to purchase securities As a member of NASAA, the DC Department of Insurance, |

|

401(k) Withdrawal and Loan FAQs - Walmart One

To help workers whose incomes are affected by the COVID-19 pandemic, the government has loosened the rules for withdrawals and loans from 401(k) plans |

|

COVID-19 RETIREMENT PLAN UPDATE - Slavic401k

of your 401(k) plan, the loan policy in effect prior to the CARES Act will dictate the terms of your loan How will my coronavirus-related distribution be taxed? |

|

Wells Fargo & Company 401(k) Plan - Wells Fargo - Teamworks

22 sept 2020 · to and modifies the June 1, 2017, Wells Fargo Company 401(k) Plan Summary Plan Description (SPD) and To qualify for the special distribution and loan options COVID-19 by a test approved by the Centers for |

|

COVID-19 401k withdrawal option (also known as coronavirus

31, 2020 401k Loan provision What does the new loan provision in the CARES Act allow? The same eligibility qualifications for |

|

[PDF] COVID-19 401K Loan Expansion and Student Loan Relief

Legally Brief COVID 19 UPDATE THE CARES ACT 401K LOAN EXPANSION AND STUDENT LOAN RELIEF The $2 trillion CARES Act, the economic |

|

[PDF] Notice 2020-50 (PDF) - Internal Revenue Service

Guidance for Coronavirus Related Distributions and Loans from Retirement Section 401(k)(2)(B)(i) generally provides that amounts attributable to elective |

|

[PDF] 401(k) Withdrawal and Loan FAQs - Walmart One

To help workers whose incomes are affected by the COVID 19 pandemic, the government has loosened the rules for withdrawals and loans from 401(k) plans |

|

COVID-19 401k withdrawal option (also known as coronavirus

COVID 19 401k withdrawal option (also known as coronavirus related IRS plan loan limits for eligible participants requesting new loans have been increased |

|

[PDF] The Coronavirus Aid, Relief and Economic Security - Slavic401k

Have 401(k) loan limits been adjusted? Yes If allowed by the plan, the loan limit can be increased to the lesser of $100,000 or 90 of the participant's vested |

|

[PDF] How the CARES Act impacts retirement plan account access - BNSF

The Coronavirus Aid, Relief, and Economic Security (CARES) Act is a Loan When you take a loan from your 401(k) account, the money you borrow loses its |

|

[PDF] COVID-19-Related Relief for 401(k) Plans Serviced by Insperity

Mar 27, 2020 · Loan FAQs Q I would like to borrow money from my 401(k) account to cover expenses because of the COVID 19 pandemic Am I eligible? |

|

[PDF] COVID-19 FAQs for Participants and Beneficiaries - United States

Apr 28, 2020 · employers, impacted by the COVID 19 outbreak understand their you wish to take money out of your retirement plan in the form of a loan or a hardship If you cash out your 401(k) or other employer sponsored retirement |

- 401k loan covid vanguard

- 401k covid loan requirements

- 401k covid loan fidelity

- 401k loan coronavirus rules

- 401k loan during covid

- 401k loan withdrawal covid

- 401k loan payback covid

- irs 401k loan covid

Taking a 401k loan or withdrawal

Source: What you should know

Employee Benefits in the Age of COVID-19 – Part Two: 401(k

Source:https://www.varnumlaw.com/assets/htmlimages/Images_Blogs/2020_03_401k_350_x_183.jpg

COVID-19 (Coronavirus) Response: 401(k) Questions Part I

Source: Varnum LLP

CARES Act – Important Changes to 401k or other Retirement Plans

Source:https://www.annuity.org/wp-content/uploads/CARES-Act-2-Trillion-COVID-an.png

COVID-19 and Your Finances

Source: What You Need to Know

Below is a collection of vital COVID-19 resources that we have

Source:https://si-interactive.s3.amazonaws.com/prod/plansponsor-com/wp-content/uploads/2021/03/04174439/PS-030421-Added-challenges-to-COVID-19-retirement-challenges-WOTM-art-web-1.jpg

401k loan regulations

[PDF] Loans from Tax Qualified Retirement Plans

- erisa 401k loan regulations

- dol 401k loan regulations

- irs 401k loan regulations

- 401k plan loan regulations

- new 401k loan regulations

401k loan repayment calculator

[PDF] Loan Guidelines - Prudential Retirement - Prudential Financial

- loan calculator

- merrill lynch 401k loan early payoff

- merrill lynch 401k loan payoff

- 401k loan repayment rules

- merrill lynch 401k loan processing time

- merrill lynch 401k loan calculator

- icma loan repayment

- icma-rc loan interest rate

- 401k loan repayment calculator t rowe price

- 401k loan repayment calculator fidelity

- 401k loan repayment calculator prudential

- 401k loan repayment calculator biweekly

- 401k loan repayment calculator weekly

- 401k loan repayment calculator wells fargo

- 401k loan payment calculator

- 401k loan payment calculator weekly

401k market size

[PDF] media kit - 401K Specialist

- 401k market value

- 401k plan size

- 401k market share

- defined contribution market size

- 401 k plan statistics

- 401k participation rates by industry

- retirement industry statistics

- how many employees to have a 401k

401k max 2020 after tax

[PDF] How High Earners Can Maximize Their Retirement - Hartford Funds

- 401k contribution limits 2020

- vanguard after-tax 401k

- retirement before or after-tax

- mega backdoor roth

- after-tax 401k contribution limit

- 401k after-tax contribution limits 2020

- contributions are made in after-tax dollars to quizlet

- after-tax to roth

- 401k max 2020 after tax

- 401k limits 2020 after tax

- 401k max contribution 2020 after tax

- 401k contribution limits 2020 after tax

- irs 401k limits 2020 after tax

- maximum 401k contribution 2020 after tax